Resource-based African Development Strategy - Partnership to Cut ...

Resource-based African Development Strategy - Partnership to Cut ...

Resource-based African Development Strategy - Partnership to Cut ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A <strong>Resource</strong>-<strong>based</strong><strong>African</strong> <strong>Development</strong><strong>Strategy</strong>RADSRADSDr Paul JourdanAfDB, March, 2008<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADS OutlineRADSIntroduction- Africa’s natural resourcesGlobal demand/consumptionMineral resourcesEnergy resources<strong>Resource</strong> rents<strong>Resource</strong> linkagesAgricultural & Water resourcesConstraints <strong>to</strong> agri-developmentRADS-4 sub-strategiesstrategies<strong>Resource</strong>-<strong>based</strong> DCs (SDP)Potential SDPs in 4 regionsThe Curse of <strong>Resource</strong>s-GovernanceRADS recap-new global ac<strong>to</strong>rs-PRCWay forward<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

“Africa will never be able <strong>to</strong> tradecompetitively – it needs <strong>to</strong> be moreintegrated, with larger economic spaces.Goods and services must move moreeasily; infrastructure must facilitate, notfrustrate trade; institutions must besupportive and effective. Withoutintegration, the continent will remaindisjointed with many small, shallowmarkets that are uncompetitive on theirown and unattractive ti <strong>to</strong> inves<strong>to</strong>rs”RADSReport of the High Level Panel“Investing in Africa’s Future: The ADB in the 21 st Century”<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADS 4.Africa:Start from what we are!1. <strong>Resource</strong>-<strong>based</strong> exporter ofminerals/metals (oil & gas, gold, coal, ironore & ferro-alloys, bauxite/aluminium,copper, diamonds, etc.);2. <strong>Resource</strong>-<strong>based</strong>exporter of agri & agri-<strong>based</strong> commodities (cocoa, cot<strong>to</strong>n, fruit &juices, sugar, grains, wood & paper/pulp,wool, meat, fish, etc.);3. Insignificant exporter of manufacturedgoods; and4. Very weak HR base (skills) except for a fewniche competencies.<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSAfrica’s Natural <strong>Resource</strong>s• Agriculture– Contributes 40% of <strong>African</strong> GDP % provides livelihood for 60% ofpopulation, but largest user of scarce water– Enormous unrealised potential (low yields & only x% undercultivation)– But, agri-commodities exported without processing(beneficiation)i i • Minerals– World’s <strong>to</strong>p producer of numerous mineral commodities;– Has world’s greatest resources of many more;– Africa lacks systematic geo-survey: could be > resources;– But exported as ores, concs, metals: Need > beneficiation.• Energy– Significant fossil fuels (oil, gas and coal)– Large biomass and bio-fuels potential (ethanol, bio-diesel)– Massive hydro-electric potential (Inga 45GW, Congo River200GW)• Forestry– 22% of <strong>African</strong> land is forested (650m hectares= 17% of world<strong>to</strong>tal);– Deforestation: Africa’s net change highest globally = -0.78% p.a;– Huge silviculture potential, but exported as logs/chips: need >bene.• Fishing– Decline in catch rate (international poaching! over-harvesting);– 68% of marine protected areas under threat;<strong>Resource</strong>-<strong>based</strong> – Aquaculture/mariculture <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong> still nascent (large potential)Tourism

Thus, Africa’s short <strong>to</strong> medium term potentiallies in our natural comparative advantage:Namely, resource & resource-<strong>based</strong> industries (provide acompetitive platform for finished products in the longer term,and immediate market for resource inputs industries)capitalSkills/HRD•Agricultural•Mineral•Forestry•Tourismm•Fishing/Aquaculture•Energy (coal/gas & HEP)technologyR&DmarketingFinishedHigh-ValueProductsRaw Mat. - Int. Product - Semi-Manufacture- Fabricatedenergy logistics services etc…RADSHowever, with >value-addition other fac<strong>to</strong>rs determine competitiveness!<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

t?$1 million GDPAsian Boom:New “scramble for resources”?Global Steel Consumption t/$1 million GDP(proxy for all metals)30High intensity,25High intensity,20sellersmarket:Colonial15systemSteeel Consumption t10Africa’s newopportunity?Majority World takes offFailure of global growthDeflated GDP <strong>to</strong> 2004 $ terms(Minority World hegemony)RADS5Source: IISI0Post WWII Minority World Growth<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>Low intensity,buyers market:stagnation &instability1940 1950 1960 1970 1980 1990 2000 2010Year

How long will boom last?However, prices will fall with increasing supply over themedium-long term, but at a higher level (lower grades)SteelIntensity(all metals proxy) ?PRCRADSIndia~$16k/capita<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>China + India > 2Xpop’n pof First World!Data Source: BHPB 2006

Energy intensity follows a similar path,but appears <strong>to</strong> peak at ~ $20 - $25k/cap?RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

<strong>Resource</strong>s Sustainability?<strong>Resource</strong> Industry Linkages(beyond resource rents)1. INFRASTRUCTURE:3. DOWNSTREAMPuts in critical infraUse wasting assetValue-additionaddition(transport, energy) forBeneficiationother non-minerals<strong>to</strong> underpin growth inExport of resource-economic potentialsustainable sec<strong>to</strong>rs<strong>based</strong> articles2. UPSTREAM 4. TECHNOLOGICALInputs:Linkages:Plant, machinery,equipment, consumables,HRD, R&D“Nursery” for new techclusters, adaptable <strong>to</strong>services, (export)other sec<strong>to</strong>rsRADS The direct potential linkage is the provision of infrastructure thatcould be used <strong>to</strong> realise other resources potential (e.g. agriculture)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Oil & Gas Value Chain<strong>Resource</strong>s provide 2 industrial opportunities forvalue-addition: addition: Beneficiation & Inputse.g. Mineral down- & up-stream beneficiation.i <strong>Resource</strong>s inputs sec<strong>to</strong>r has a comparativeadvantage in: (a) relatively large local market &(b) development of tech solutions for locallconditions(applies equally <strong>to</strong> other resource sec<strong>to</strong>rs)expl. capital goodsextract. capital goodsprocessing cap. goodsRefining Cap. GoodsFabrication Cap.goods• geophysical• drilling• crushers/mills •Smelters•Rolling• drilling• cutting• hydromet plant• survey• hauling• materials handling •Furnaces•Moulding• etc.• hoisting, etc.• furnaces, etc. • refineries•Machining• etc.•assemblingExplorationExtractionProcessingSmelting &RefiningFabricationexploration services• GIS• analytical• data processing• financing• etcextraction services• mine planning•consumables/spares• sub-contracting• financing• analytical, etcprocessing services• comminution• grinding media• chem/reagects• process control• analytical, etcRefining services•Reductants•Chemicals•Assaying•Gas & elec supplyValue adding services•Design•Marketing•Distribution•ServicesRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

<strong>Resource</strong>s provide 2 industrialopportunities for value-addition:Beneficiation & Inputse.g. Mineral down-& side-stream beneficiation chainexpl. capital goodsmining capital goodsprocessing cap. goods• geophysical• drilling• crushers/mills• drilling• cutting• hydromet plant• survey• hauling• materials handling• etc.• hoisting, etc.• furnaces, etc.Refining Cap. Goods•Smelters•Furnaces•Electro winning cells•CastersFabrication Cap.goods pg•Rolling•Moulding•Machining•assemblingExplorationMiningMineralProcessingSmelting &RefiningFabricationexploration services• GIS• analytical• data processing• financing• etcmining services• mine planning•consumables/spares• sub-contracting• financing• analytical, etcprocessing services• comminution• grinding media• chem/reagects• process control• analytical, etcRefining services•Reductants•Chemicals•Assaying•Gas & elec supplyValue adding services•Design•Marketing•Distribution•ServicesRADS<strong>Resource</strong>s inputs sec<strong>to</strong>r has a comparativeadvantage in (a) relatively l large local l market & (b)development of tech inputs for local conditions(applies equally <strong>to</strong> other resource sec<strong>to</strong>rs)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

The resource curse can be avoided!“Deepening” the resource sec<strong>to</strong>r linkages: development ofthe resource inputs & outputs industries is criticalFinland: 1970 on primarycommodities (pc- mining & forestry)inverted U-curve, Finland: but e.g. shifts Forestrygrewcapital curve goods (mf-resources (machinery) inputs exports &andoutputs/beneficiation).value-added exports<strong>to</strong> 1998manufacturing(wood manufactures,Chile: 1970 on manufacturingpulp/paper)p/pape U-curve (ISI), but shifts <strong>to</strong> 1998primary commodities (mining &agriculture) curve, after opening upits economy (coup) in the 70’s.RADSFinland managed <strong>to</strong> shift from a 1970 resources (pc) trajec<strong>to</strong>ry <strong>to</strong> a 1998manufactures (mf) trajec<strong>to</strong>ry, through the development of its resources inputs(machinery) and outputs (value-addition) sec<strong>to</strong>rs (source Palma, G. 2004)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSAfrica’sNatural<strong>Resource</strong>sRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Africa is well-endowed endowed with mineral resourcesMineral Production & Known <strong>Resource</strong>s (‘04)(however, much of Africa is still un-surveyed)MineralProductionRankReservesRankPGMs* 54% 1 60+% 1Phosphate 27% 1 66% 1Gold 20% 1 42% 1Chromium 40% 1 44% 1Manganese 28% 2 82% 1Vanadium 51% 1 95% 1Cobalt 18% 1 55+% 1Diamonds 78% 1 88% 1RADSAluminium 4% 7 45% 1Also Ti (20%), U (20%), Fe (17%), Cu (13%), etc.<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>*PGMs: Platinum Group Minerals

However, many of thegaps correspond <strong>to</strong>zones of low geo-dataSS <strong>African</strong> Mineral DepositsKalahari sandcoverRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

<strong>African</strong> GeologyAreas covered withrecent overburden(unknownunderlying geology)RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Africa also has significant energy resources:fossil fuels (oil, gas, coal), HEP & geothermalGoethermalPotential:Great <strong>African</strong>Rift ValleyGulf of Guineaconsidered <strong>to</strong> be one ofthe world’s mostprospective oil & gasterrainsRADSAnd Africa has huge HEP (Congo R: 200GW)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

e.g. INGA (DRC): 45 GW of HEP at onelocation (><strong>to</strong>tal SA consumption)!Grand Ingadam tributaryRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

e.g. INGA (DRC): 45 GW of HEP at onelocation (><strong>to</strong>tal SA consumption)!Grand Ingadam tributaryRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Yet most <strong>African</strong>s don’t have access <strong>to</strong>electricity and rely on biomass for energy!RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Although private exploration spend isincreasing, this isn’t an alternative <strong>to</strong>systematic geo-survey!World exploration spending (non-ferrous), 2006(Africa 16%)RADS11%16%8% 4%Latin America24%CanadaRest of World*Africa19% Australia18% USAPacific/SE Asia<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

<strong>African</strong> FDI inflowsRADSDominated by investmentin natural resources!<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> (WIR <strong>Strategy</strong> 2007)

Africa’s Undiscovered <strong>Resource</strong>sAfrica requires massive investment t in<strong>to</strong> basicgeological mapping in order <strong>to</strong> assess & valorise itsmineral assets. FDI for blue-sky exploration will onlycome in on an unacceptably high risk-reward reward basis!RADSSource: USGS; USGS Mineral <strong>Resource</strong>s Program. TheGlobal Mineral <strong>Resource</strong> Assessment Project<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Inappropriate Mineral RegimesAfrica is not capturing mineral rents!Global Steel Consumption t/$1 million GDPRADSt?$1 million GDPSteeel Consumption t30High Prices: WBregimes- rentsexit (Zambia ’06:252%!) Need <strong>to</strong>High prices:urgently update!colonial 20mineralregimes: Pro-colonisers/TNC15sDeflated GDP <strong>to</strong> 2004 $ terms105Source: IISI0Post WWII Minority World Growth<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>High prices:Post-colonialregimes:Strongly YearnationalFailure of global growth(Minority World hegemony)Majority World takes offLow prices:WB revisions:Overly pro-TNC!1940 1950 1960 1970 1980 1990 2000 2010

Extracting Greater Benefits?Conditions of LicensingLow(high risk terrains)Exploration licenceApplicationConditionalityHigh(low risk terrains)ExplorationTerrainExploration LicenseAu<strong>to</strong>maticityRoR*-<strong>based</strong> taxMining Chartertype conditionsDelineationTerrainAuction, <strong>based</strong> on:• Infra development• Up/downstream invest• equity (“mining charter”)• rent share• licence termRADSMining Licence*ROR: <strong>Resource</strong>-<strong>based</strong> Rate-of-Return <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Investment in Geo-knowledgeRADS• Numerous studies (USGS, W.Australia) havedefinitively showed the extremely high return <strong>to</strong> thestate from investment in geo-survey (~1:10investment <strong>to</strong> return ratio <strong>to</strong> the fiscus)• In general, the lower the geo-info base, the higherthe risk, the lower the share of resource rents <strong>to</strong>the state: The less a state knows about the value ofits mineral assets, the worse the deal it’s likely <strong>to</strong> beable <strong>to</strong> negotiate with foreign inves<strong>to</strong>rs.• This will inevitably compromise the longer termsustainability of the investment: An unequalextractive deal serves neither the inves<strong>to</strong>r nor thehost state over the longer term• Investment in<strong>to</strong> <strong>African</strong> infrastructure shouldnot only target t physical infrastructure t but alsoknowledge infrastructure (geo-survey)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

The foreign resource capital “trade-off”In order <strong>to</strong> rapidly acquire the requisite capital and skills,<strong>African</strong> states have generally opted <strong>to</strong> realise their resourceendowments through attracting foreign resource companies(TNCs & JRCs), rather than mainly relying on domestic capital.However, this “trade-off” comes with several possible “threats”:1.TNCs often have global purchasing departments which are lesslikely <strong>to</strong> develop local suppliers (linkages), than would be thecase with domestic resource companies;2.TNCs tend <strong>to</strong> optimise their global processing g( (beneficiation)facilities which often denies the resource state theirdownstream opportunities;3.TNCs generally tend <strong>to</strong> locate the tech development (R&D) inOECD countries, with the requisite skills and incentives, therebydenying Africa the development of this critical side-stream streamcapacity;4.TNCs also tend <strong>to</strong> locate their high level HRD in OECD countries(often linked <strong>to</strong> their R&D university it partners), which h could deny<strong>African</strong> states the development of this seminal capacity;5.In the longer term there are clearly political downsides <strong>to</strong> aresource sec<strong>to</strong>r dominated by foreign capital;6.Finally RADSthere is the TNC “core competence” conundrum.7.However, all of these threats can be overcome or amelioratedthrough <strong>Resource</strong>-<strong>based</strong> appropriate <strong>African</strong> actions, <strong>Development</strong> policies <strong>Strategy</strong>and interventions!

RADSFacilitation of up- and down-stream linkages1. Access <strong>to</strong> competitively priced feeds<strong>to</strong>cks: Downstream: restric<strong>to</strong>re & concentrate exports? Upstream: Capital goods- steel andspecial steels (poss. for regional iron/steel production facilities);2. Access <strong>to</strong> concessionary capital: DFIs: local, regional &continental (AfDB). Venture capital funds (PPPs with TNCs?);3. Competitive currency (forex rate): Ameliorate the Dutch Diseaseby keeping windfall rents offshore and committing <strong>to</strong> long termphysical & social infrastructure (drip-feed back in<strong>to</strong> economy)?4. Access <strong>to</strong> requisite skills: HRD- dedicated institutions, JV’sbetween local and foreign Universities. Short-term skills import,but with men<strong>to</strong>rships. TNC HR “indigenisation” programmes,<strong>Strategy</strong> <strong>to</strong> repatriate the huge <strong>African</strong> skills “diaspora”?5. Access <strong>to</strong> supply contracts: t <strong>Partnership</strong> with TNCs onadjudication of all tenders (ensure that equitable access for localsuppliers). Judicious use of tariffs for infant industries. Ensureforeign supplier localisation (JVs with local capital?) & techtransfer. Local content miles<strong>to</strong>nes?6. Access <strong>to</strong> technology: Establish resources up- and down-streamresearch facilities with TNCs (R&D PPPs) and use of resourcerents for R&D;7. Infrastructure: Establish world-class infrastructure (transport,energy, water, telecoms, etc.) for upstream and downstreamindustrial clusters (specialised “industrial development zones”).<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Growing <strong>African</strong> JRCs• The bulk of JRCs (Junior <strong>Resource</strong> Companies) operatingin Africa are from Europe and its settler colonies (Canada,US, Oz) which poses problems of political sustainability;• Need <strong>to</strong> facilitate the growth of indigenous explorationcompanies (JRCs) <strong>to</strong> build local buy-in & legitimacy;• Possible PRC-<strong>African</strong> JRC exploration partnerships?• Soquem (mineral DFI) in Canada successfully facilitatedthe growth of French-speaking JRCs in Quebec from1965, by identifying potential targets and taking up <strong>to</strong> 49%of the risk/equity- AfDB could establish an <strong>African</strong> Soquem<strong>to</strong> share risk and nurture local l participation i in mineraldevelopment?• Possible first sight (3 months?) on all new geo-surveydata?• National DFIs should also target indigenous investmentin<strong>to</strong> the mining inputs (supplier) sec<strong>to</strong>r;RADS Predominantly foreign mineral DFI isultimately politically unsustainable!<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Africa also has significantAgri-potentialRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

And water potential…(except for North Africa)Withdrawals by sec<strong>to</strong>rRegion Agriculture Communities Industries Total As % of% of internal<strong>to</strong>tal resourcesx 10 6 m³/yr x 10 6 m³/yr x 10 6 x 10 6 m³/yr % %m³/yrNorthern 65 000 5 500 5 800 76 300 50.9 152.6(85%) (7%) 18%) (100 %)Sudano-Sahelian22 600 1 200 300 24 100 16.1 14.2(94%) (5%) (1%) (100%)Gulf of Guinea 3 800 1 600 700 6 100 4.1 0.6(62%) (26%) (12%) (100%)Central 600 600 200 1 400 09 0.9 01 0.1(43%) (43%) (14%) (100%)Eastern 5 400 900 200 6 500 4.3 2.5(83%) (14%) (3%) (100%)RADSSouthern 14 100 3 000 1 800 18 900 12.6 6.9(75%) (16%) (9%) (100%)Total <strong>Resource</strong>-<strong>based</strong> <strong>African</strong> 127 900<strong>Development</strong> 13 000<strong>Strategy</strong>9 020 149 920 100 0 3.8(85%) (9%) (6%) (100%) Source: FAO

Major River Major BasinsRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

However, much of Africa’s waterresources are difficult <strong>to</strong> access!Water ScarcityRADSRealisation of water potential will require largeinvestments in water infrastructure<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Although waterresources arelarge, by 2025availability/cap.will be understress in most<strong>African</strong> states!RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Current and potential arable land use in AfricaRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Land utilisation in Africa(percentage of <strong>to</strong>tal land area)Less than 50% inthe well-wateredtropics!RADSSource: <strong>Resource</strong>-<strong>based</strong> UNEP- compiled <strong>African</strong> <strong>Development</strong> from FAOSTAT <strong>Strategy</strong> 2001

Agri-potential: Possible repeat ofBrazil's soya success?Brazil Soy Boom replicable?(similar soils & climate)RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

However, the <strong>African</strong> “GreenRevolution” failed <strong>to</strong> happen?RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

<strong>African</strong> agricultural growth is still <strong>based</strong>on area expansion (deforestation)…Rather than intensification!SS AfricaAsia?RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

And, <strong>African</strong> food output/capitahas been falling…FAO Index of Net Food Output per Capita, 1961-200016015014013012011010090RADS80<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> World <strong>Development</strong> E SE <strong>Strategy</strong> Asia South Asia Sub-Sahara

Causing Africa <strong>to</strong> become a netagri-importer!importer!RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Although some agri-exportshave grown:RADSCommodity <strong>African</strong> % World % GrowthExports 2005 Exports 1995-2005(kt) 2005maize 2308 3% -1%sorghum 80 1% -77%sugar 6 6% -3%cacao 2073 71% 52%coffee 642 12% -6%tea 430 26% 35%cot<strong>to</strong>n 306 23% 45%<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

But, nutrients are being rapidly depleted…Average annual nutrienttdepletion (NPK) 1993-95Fertilizer applicationrates (1997)kg NPK per hectareRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>0 10 20 50 100no dataSource: FAOSTAT 1999.Compiled by Stan Wood, IFPRI

Due <strong>to</strong> the lowest fertiliseruse in the world!Regional Fertiliser Use (kg/ha)RADSAfrica

Yet Africa has abundant knownfertiliser minerals!Agri-mineraldeposits (ex-gas/coal & K)Nitrogen sources(oil/gas & coal) &K resourcesRADSBut, generally undeveloped for the <strong>African</strong> market,mainly due <strong>to</strong> severe logistics constraints.<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Resulting in the the lowestGlobal Value of Agricultural Crops/Ha1989-9191 US$/Ha0 150 250 350 450 600 1000No dataRADSSource: FAOSTAT 1999.<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Africa also has important forestryproduction, and large potential.But much of its logging is unsustainable…RegionIndustrial roundProduct productionProduct consumptionwood production (million m 3 EQ) (million m 3 EQ)(million m 3 )1996 2010 Annual 1996 2010 Annual 1996 2010 Annualgrowth growth growthAfrica 68 84 1.5% 61 74 1.4% 35 37 0.6%Asia 280 421 3.0% 334 479 2.6% 510 653 2.1%Oceania 41 54 19% 1.9% 23 39 38% 3.8% 18 28 33% 3.3%Europe 370 502 2.2% 368 509 2.4% 347 469 2.4%NorthAmericaSouthAmericaWorld<strong>to</strong>tal600 658 0.7% 585 639 0.7% 499 589 0.8%130 153 1.2% 120 131 0.7% 80 97 1.4%1490 1872 1.7% 1490 1872 1.7% 1490 1872 1.7%RADSNotes: Product production and consumption have been converted <strong>to</strong> their roundwood equivalents (m 3 EQ) <strong>to</strong> be compatible with roundwoodproduction and potential figures. Growth rates shown are growth over the period 1996 - 2010. (source: FAO)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Africa also has large biofuelsproduction potential.RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

But, desertification isspreading…RADSGlobal warming, >climatevariability & over-usage posefrightening threats <strong>to</strong> <strong>African</strong>agriculture: Alternativelivelihoods are needed!<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Africa: Human ImpactRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Agriculture should be the principaldriver of <strong>African</strong> developmentWhy is agriculture struggling?RADS–Prices/subsidies/Doha…–Access <strong>to</strong> finance (collateral/title)–Access <strong>to</strong> inputs ((Infrastructure)–Access <strong>to</strong> markets (Infrastructure)–Information (extension services)Infrastructure is a necessary, butnot exclusive, enabling fac<strong>to</strong>r!<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Subsidies <strong>to</strong> Agriculturedepress agri-commodity ypricesRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Thus the demand boom hasdisproportionately p increased mineral prices!(also lower mineral supply elasticity)The prices of metals haveincreased spectacularly, whilstagri-commodities havelanguished…Due <strong>to</strong>:• Market dis<strong>to</strong>rtions (agri-subsidies)• High mineral supply inelasticity (windfall rents)RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSBut this huge commodities potential is criticallyconstrained by poor infrastructure•Africa is the highest continent (few navigablerivers), > infra cost and O&M cost;•93% of Africa in the tropics (ITCZ, high ppt):>cost of infrastructure provision and O&M;•Incoherent European balkanisation resulted inmany <strong>African</strong> states t being landlocked;d•Africa has only 10% of land within 100km ofcoast (cf. 18% OECD & 27% Latin America) and•Only 21% of its people live within 100km of coast(cf. 69% OECD & 42% Latin America);‣ Resulting in Africa having the world’s highestrelative logistics costs (poor infrastructure)Africa’s potential could be realised throughintegrated <strong>Development</strong> Corridors (not a neocolonial“scramble for resources”)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Insurance and freight import valuesfor selected groups of countriesRADSFreight &insuranceas a%ofcost 19851990 1995 1997World ldt <strong>to</strong>tal t 4.6 5.55 4.44 4.1Developed market economy countries 3.8 4.2 3.5 3.4Developing countries <strong>to</strong>tal: of which: 7.7 11.2 7.4 6.5Africa 11.3 10.6 11.3 10America 6.7 12.8 6.4 5.6Asia 7.77 11.2 7.4 6.5Table 6Freight and insurance as a percentage of cost, insurance and freight import values for selected groups of countries [1]Landlocked Africa: 14.8 15.8 10.7 ..East Africa 17.9 20.2 16.7 14.6Southern Africa 12.5 11.5 9.9 ..West Africa 30 30.2 24.6 ..Least developed countries 13.8 14.6 12.5Source:UNCTADAfrica’s logistics costs ~250% global average!<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>:4 sub-strategiesstrategiesMinerals,Agric,Forestry<strong>Resource</strong>ProcessingRefiningIntermediateproductsFabrication<strong>Resource</strong> Capital Goods &Services (generic tech)Enhance resource-tech(HRD, R&D) capacityLateral Migration in<strong>to</strong>Unrelated knowledge-<strong>based</strong> IndustriesRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>eg: process controlconstruction equipment,atmospheric control,pumping, materialshandling, etc, etc….

<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>:Minerals,Agric,Forestry<strong>Resource</strong>Processing4 sub-strategiesstrategiesIntermediateproductsFabrication<strong>Strategy</strong> t 1: Beneficiation Refiningi (RBI)<strong>Resource</strong> Capital Goods &Services (generic tech)<strong>Strategy</strong> 2: <strong>Resource</strong> InputsLateral Migration in<strong>to</strong>Unrelated knowledge-<strong>based</strong> IndustriesRADSEnhance resource-tech(HRD, R&D) capacityeg: process controlconstruction equipment,atmospheric control,pumping, materialshandling, etc, etc….<strong>Strategy</strong> 3: Lateral Migration<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Maghreb Coastal<strong>Strategy</strong> t 4:Red Sea - NilePort HarcourtNiger: Dakar –ConakryBuchananSekondiOugadougouGulf of GuineaCoastal<strong>Resource</strong>-Based <strong>Development</strong>Corridors (Nepad SDPs)DjiboutiDoualaLibreville LomieBas CongoMombasaIntegrated <strong>Resource</strong>-BasedMadagascarspatial development initiativesRADSCurrent SDIsRSDIP<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>NEPAD SDP: 1 st Pass

NEPADSpatial <strong>Development</strong>Programme(SDP)RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Sharing of Best in Practices in SouthernAfrica SDIs/Dev.Corridors (RSDIP)Based on UNREALISEDeconomic potentialRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

BASIC DC METHODOLOGY: KEY ASPECTSRADS• Inherent economic potential: Naturalresources (agri & mineral);• Configuration of investments <strong>to</strong> ensureinfrastructure viability through sustainablerevenue streams;• Crowding-in i of private sec<strong>to</strong>r investment;t• Promotes PPPs where feasible;• Secure political commitment (HoS) andprovide the requisite conduciveenvironment;• Ensure rapid planning and deliveryprojects and programmes (momentum).• Ensure densification: open-access,linkages and value-addition<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

SDP methodology:SynchronousINVESTMENT CONFIGURATIONinfrastructure needsIDViableresourceinvestmentprojectsAddresses 4market failures:1)Infra econ-of-scale2)Sync users (time)3)Political borders4)Information/dataDimensionrequisiteiiinfrastruct-ureRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>revenue streams

RADSTHE DC APPROACH:What value does it add?• Addresses the urgent need for effectiveinvestment & capacity prioritisation <strong>based</strong>on sound economic rationale;• Links and synchronises private sec<strong>to</strong>reconomic investment project opportunitieswith key infrastructure t projects;• Promotes the realisation of widerdevelopment potential (densification)catalysed by infrastructure provision andanchor investments;• Provides spatial focus for strategies <strong>to</strong>promote regional economic integration &development.• However, it is only one component of anintegrated growth & development strategy!(focus on “low-hanginghanging-fruit” <strong>to</strong> catalysed l )<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Underlying DC DriversRADSDue <strong>to</strong> the global market dis<strong>to</strong>rtion of FirstWorld agri-subsidies (Doha), mineral-<strong>based</strong>opportunities are generally the only ones withrequisite rents <strong>to</strong> pay for the provision ofcostly infrastructure (transport & energy).For this reason the indicative DCs (SDP)“anchor” projects tend <strong>to</strong> be minerals/energy<strong>based</strong> which establish infrastructure <strong>to</strong>underpin the viability of projects in other,sustainable, sec<strong>to</strong>rs: “densification”).However, the DC methodology goes beyondthe “colonial” paradigm (resources <strong>to</strong> coast)<strong>to</strong> integrated growth & development usingresources <strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>to</strong> <strong>Development</strong> catalyze <strong>Strategy</strong>the process

APPLICATION OFTHE SDI METHODOLOGY:SOME EXAMPLESRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Mature SDP Example:The Mapu<strong>to</strong> <strong>Development</strong> CorridorCoal-<strong>based</strong> Power Station2 transmission lines <strong>to</strong> Ma<strong>to</strong>lacompletedJoburg-Mapu<strong>to</strong> HighwayPPP- BOT completedPort of Ma<strong>to</strong>la/Mapu<strong>to</strong>Upgrades, PPPGAAUTENGMAPUTOJoburg <strong>to</strong> Mapu<strong>to</strong>Railway line: UpgradeRADSLiquid Fuels & Petrochemicals:<strong>Resource</strong>-<strong>based</strong> Sasol <strong>African</strong> <strong>Development</strong> PPP <strong>Strategy</strong> SasolPande-Secunda Gas line.completedAl smelter 500ktpaBHPB completed

Mature SDP Example:The Mapu<strong>to</strong> <strong>Development</strong> CorridorMajor investments <strong>to</strong> date:Port >$5bnof Ma<strong>to</strong>la/Mapu<strong>to</strong>Upgrades, PPPCoal-<strong>based</strong> Power Station2 transmission lines <strong>to</strong> Ma<strong>to</strong>lacompletedAUTENGGAJoburg-Mapu<strong>to</strong> HighwayPPP- BOT completedNew MDC Potential Projects:• Greater Limpopo Trans-frontier Park (underway)Mozal III (Al: $1bn)• Corridor Sands (Ti & Fe: >$0.3bn)• MMC: Mapu<strong>to</strong> Metallurgical Complex (Fe & Steel:>$1bn)• MMC (Ti & Fe: $0.3mn)Joburg <strong>to</strong> Mapu<strong>to</strong>• Fertiliser complex (Phos & Nitrogen)Railway line: Upgrade• Chlor-alkali complex (Cl, TiO 2 , NaOH)• Numerous mega-project inputs industriesLiquid Fuels & Petrochemicals:<strong>Resource</strong>-<strong>based</strong> SasolInvestments <strong>African</strong> <strong>Development</strong> PPP (Cluster: <strong>Strategy</strong> Sasol completedPande-Secunda Gas line.• Tourism >$0.3bn)RADSMAPUTOAl smelter 500ktpaBHPB completed

MDC phase II:Mapu<strong>to</strong> Metallurgical Complex(Ti/V) MagnetiteSep. & conc. plant• magnetite• ilmeniteHigh Cu Magnetitedumps > 300 MTMagnetite (>Cu)dump upgradingplantRailPossible Ti/FeFrom Chibu<strong>to</strong>Slurry pipelineElec transmissionGas Connec<strong>to</strong>rPande Gas PipelineFe pelletising plantRADSOther Potential:Ilmenite smelter Ti/FeFertiliser plant N/PChlor-alkali plant Na/Cl<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>MMC:Iron (DRI) &Steel PlantRailwayMajor RoadDuvhaPower LinesPande GasPipeline

Under implementation-The Zambezi Valley <strong>Development</strong>Possible BOFMuambe Fe ore& coking coalMoatize coking andsteam coal (CVRD):CaboraBassaHEPMpandeUncuaHEPMt Muambe FeMt Mulanje bauxiteAlternativebulk (coal)rail routeMoatize ThermalPower StationRehab ofpeasantcot<strong>to</strong>n (exprazos)RADSElec transmissionSena RailRehabPotential Al<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> Smelter <strong>Strategy</strong>Sena SugarBeira PortRehab

Schematic <strong>Development</strong>Corridor ApproachConceptualWorkshopsAppraisalApp doc &Inves<strong>to</strong>rCONCEPTUALISATION(scan)Conf prep “fiesta”DC investprom agencyID 3-4 ind. clusters Cluster inv. projectsDE-BOTTLENECKING ID DebotsPROJECTSDebotsAlready underwayCluster orgsProject scoping & dimensioningKEY ANCHOR PROJECTSNew anchor infra PPP’sPPP’s, BOT, ROTRADSCLUSTER INITIATIVESHitch-hike existing investmentsDebots = debottlenecking projects (infrastructure)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>Other infraIndustrialNumerousinvestments

DC Time-Line1) ID Requisite “trunk” Infrastructure:Conceptualisation:Transport: road/rail/ports/pipelinesSec<strong>to</strong>ral scans of Investment Energy: electricity/gas/oil/biomasspotential: Agriculture,Water; other (telecoms), <strong>to</strong> realiseMinerals, Energy,the investment potential.Forestry, Tourism, etc.2) Dimension i resource (& resource<strong>based</strong>)and other investment ProjectsAssessment of infrastructureneeds& linkages (up- & downstream)opportunities•Strengthening the investmentregime and institutions.•Feeder Infrastructure(<strong>to</strong> facilitate densification)Identification and facilitationof appropriate inves<strong>to</strong>rs andfinanciers (DFIs et al) <strong>to</strong>realise the investment targets<strong>Development</strong> of local & regionalDeepening of the resource sec<strong>to</strong>r:(RECs) capacity: Financial,Up-, down- & side-stream linkagesRADS Governance & Regula<strong>to</strong>ry,<strong>Resource</strong>s R&D, & tech development.HRD/Skills, R&D, SMMESustainable resource-<strong>based</strong> G&Dsupport, <strong>Resource</strong>-<strong>based</strong> ongoing DC <strong>African</strong> capacity <strong>Development</strong> <strong>Strategy</strong>

Idealised DC ConfigurationAnchor &“cluster”Agri-node &“cluster”StrandedinvestmentDC logistics“catchment”RADSProblemfeeder“DENSIFICATION”Feeders oftenneed <strong>to</strong> be fundedthru’ fiscus/grantStrandedinvestment<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>Anchor &“cluster”Problemfeeder

DC Virtuous circleViable resource-<strong>based</strong> anchorInvestmentsRequisiteInfrastructureRADSCatalysedinvestments<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

AU CommissionPossible DC OrganogrammeDC ID, validation,buy-n (HoS,RECs)DC Proj ManagersSec<strong>to</strong>r potentialscans by RISDIFacilityNEPADSecretariatRECsHoSMulti-lateral1HoSMulti-lateral2SDPCapacityHoSMulti-lateral3Sec<strong>to</strong>ralCommissionersHoSMulti-lateralnInternational“Partners”AfDB(DFIs)SDP capacitysupportDC 1PM1PM 1Sec<strong>to</strong>ralScansDC 2PM2PM 1Sec<strong>to</strong>ralScansDC 3PM3PM 1Sec<strong>to</strong>ralScansDC nPMPM 1Sec<strong>to</strong>ralScansDC SupportNetworkingCentre, DCbest-practiceProjectpackaging &developmentby AfDB, et alP1P2P3P1PnP2P3P1Pn P2P3Pn P1P2P3PnPublic Projectconfiguration,regulation,transparency,impactDensification Densification Densification P1 Densification P2 Densification P3P1 Densification PnP2 Densification P3 P1Densification Pn P2P3 Densification P1PnDensification P2 P3 PnRADSProjectDensification:inputs &infrastructureSocial <strong>Resource</strong>-<strong>based</strong> Impacts, <strong>African</strong> Market <strong>Development</strong> Access, Regional <strong>Strategy</strong> integrationCoordination of Int’lPartners:linkages, skills,SME facilitation,Coordination ofNGO/stateintervention,Int’l trade advocacy

SDP DESK-TOP ANALYSIS:“An indicative assessment <strong>to</strong>determine the prospects for aNEPAD Spatial <strong>Development</strong>Programme”On Nepad websiteRADSWWW.NEPAD.ORG(Mr Godwin Punungwe)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

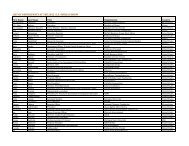

NEPAD SD PROGRAMMEPortfolio of Possible SDPsRegion No. SDP CountriesNorth Africa 1 Maghreb Coastal Morroco, Algeria, Tunisia, Libya, Egypt2 Red Sea-Nile Egypt, SudanWest Africa 3 Niger (Dakar-PortHarcourt)Senegal, Gambia, Mali, Niger, Nigeria4 Conakry-Buchanan Guinea, Liberia, i Cote D’ivoirei5 Sekondi/Takoradi-OuagadougouGhana, Burkina Faso6 Gulf of Guinea Nigeria, Benin, Togo, Ghana, Cote D’Ivoire,LiberiaCentral Africa 7 Douala-N’djamena Cameroon, Chad8 Libreville-Lomie Gabon, Republic of Congo, Cameroon9 Bas-Congo DRC, Republic of Congo, AngolaEast Africa 10 Mombasa Kenya, Uganda, DRC, SudanRADS11 Djibouti Djibouti, Ethiopia, (Kenya)SouthernAf i<strong>Resource</strong>-<strong>based</strong> 12 Madagascar <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong> Madagascar

SELECTION CRITERIA & RANKINGCorridorSolidMineralPotentialAgriculturalPotentialProjects Logistics PowerClusteringPotentialRegionalIntegrationDataAvailability ScoreBas Congo SDI (current) 30 5 20 15 20 30 20 10 150Maghreb Coastal 15 5 15 15 20 30 30 10 140Niger (Dakar - Pt Harcourt) 15 15 23 15 13 20 30 5 136Conakry-Buchanan 30 10 23 13 13 10 20 5 124Gulf of Guinea- coastal 0 5 25 15 18 20 30 5 118Mombasa 15 10 20 8 13 10 30 5 111Madagascar 30 10 23 13 15 10 0 10 111But selection but more likely be throughbuy-in by DC footprint states!Libreville-Lome 15 5 18 15 13 20 10 5 101Douala- N'djamena 30 5 18 8 13 10 10 5 99Red Sea-Nile 0 5 5 15 13 10 10 10 68RADSDjibouti 0 10 3 15 8 0 20 5 61<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>Sekondi-Takoradi 0 10 3 15 13 0 0 10 51

Maghreb CoastalNiger: Dakar –Port HarcourtNEPAD indicative Spatial<strong>Development</strong> ProgramFirst Pass!Red Sea - NileDjiboutiConakryBuchananSekondiOugadougouGulf of GuineaCoastalDoualaLibreville LomieMombasaBas CongoMadagascarRADSCurrent SDIsRSDIP<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>NEPAD SDP: 1 st Pass

POTENTIAL SDPs INTHE 4 REGIONSRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSMaghreb Coastal SDPCountries: Morocco, Algeria, Tunisia, Libya, EgyptAnchors: Oil/gas & PC industry, iron & steel (gas),<strong>to</strong>urism (coastal & heritage), phos & fertilisers, agric,fishing & aquaculture, gen. industry (HCs)Infra: HC grid, elec grid, coastal highway, cabotage<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Niger SDP:Countries: Senegal/Gambia, Mali, Niger, NigeriaAnchors: <strong>Resource</strong>: Fe (Faleme) & iron/steel, Au(Loulou), U (Niger), Oil/gas (Delta), GTL (Escravos),Al (Alscon), Ti (Dakar), Phos (Tiaba), agriculture(cot<strong>to</strong>n), etc.RADSInfra: riverine transport , rail <strong>to</strong> Dakar (??), Oreterminal <strong>Resource</strong>-<strong>based</strong> (~Dakar), <strong>African</strong> power <strong>Development</strong> (elec grid), <strong>Strategy</strong>roads upgrade

Conakry-BuchananCountries: Guinea-Liberia (Cote d’Ivoire)Anchors: Fe (Nimba) & iron/steel (gas line?), Al(Conakry, Friguia), Au (Siguiri), Ni (Man) & FeNi(gas?), agricultureInfra: gas line, rail (ore), elec grid, port upgradeRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Gulf of Guinea Coastal SDPCountries: Nigeria, Benin, Togo, Ghana, Cote d’Ivoire,LiberiaiAnchors: Oil/gas (Delta & pipeline), GTL, Al (Delta),Iron/steel (Sekondi/Takoradi, Buchanan), Mn (Nsuta)& FeMn (Sekondi- gas?); <strong>to</strong>urism (coast, heritage),gen. industry (gas), agriculture (palm oil/carbon),fishing & maricultureInfra: gas line,, elec grid, ports, cabotage, coastalhighwayRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Gulf of Guinea: Geology & Oil ProvincesGulf of GuineaOil ProvincePart of the much largerWest <strong>African</strong> HCProvince!Source: USGS, 2006RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Gulf of Guinea: Geology & Oil ProvincesRADSSource: USGS,2006<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Gulf of Guinea DC: Hydro carbon linkages• Downstream:• Oil Refining: Liquid fuels, bitumen, Chemical feeds<strong>to</strong>cks (polymersplastics,synfibres, etc.)• Gas processing: GTL, fertilisers (urea), methanol, etc.• Reductant- metallurgy (iron, steel, ferro-alloys, etc.)• Heat: agri-processing, min-processing, general industry,power/elec, etc.• Upstream (HC inputs):• Capital goods (plant & equipment)• Services (exploration, engineering, HRD, R&D, finance)• Consumables (pipes, drilling rods, valves, etc.)WAGPExtend?WAGPRADSFe/Steel?Petro Chem<strong>Resource</strong>-<strong>based</strong> Ni, <strong>African</strong> FeNi? <strong>Development</strong> complex? <strong>Strategy</strong>FeMn,Fe/steel?HCServiceindustriesGeneric HC ?usage:polymer

<strong>African</strong> oil resourcesFuture arena of super-powercontestation?10yConflict points over lastRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

2 Indicative SDPs: Douala-N’djamena& Libreville-LomieLomieCountries: Cameroon, Chad, Gabon, (CAR)Anchors: Oil & Gas, elec/Al, Fe/Steel, Fe-alloys(Mn) agric (coffee, et al), fertilisers (NPK), generalindustry (agri-processing) processing), <strong>to</strong>urism,Infra: rail upgrades& ext., gas pipelines, elec grid,port upgrade, road network, power plantsRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Bas CongoCountries: Congo Braz, DRC, AngolaAnchors: Electricity (Inga), oil/gas & PC industry, Mg (P. Noire),Al (Matadi), phos & fertilisers, base metals, construction(lmst/cement), agric (cane et al), fishing & aquaculture, gen.industry (HCs), <strong>to</strong>urismInfrastructure: HC grid, elec grid, ports (Banana et al), Congo R.bridge, cabotage, road net.RADSDRC request <strong>to</strong> fast-track trackthis SDI (SA-DRCBilateral, l Aug 2007)Angola & Congo-Brazneed <strong>to</strong> join<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Kodo Fe &Sudan gas?Mombasa SDPCountries: DRC, Sudan, Uganda, Kenya,Anchors: Fe & iron/steel (Kodo), agric(coffee et al), soda ash, phos & fertiliser(NPK), gen. industry (agri-proc), <strong>to</strong>urism,aquaculture (L.Vic)Infra: rail upgrade & ext., gas pipeline,elec grid, port upgrade, road net.NCTTCA request <strong>to</strong> NEPADSDP & RSDIP <strong>to</strong> assist intransforming in<strong>to</strong> a SDI/DCRADS (Aug 2007)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Current RSDIP <strong>Development</strong> Corridor (SDI)Extend <strong>to</strong>Kisangani?Central SDI: Dar <strong>to</strong> Kigali (Kisangani?) RSDIPCountries: Tanzania, DRC,Rwanda, BurundiAnchors: Nickel (Kabanga), Gold (Mwanza Au Belt), Ta/Nb (DRC),RADSagriculture & agri-industries, industries, fishing/aquaculture, <strong>to</strong>urismInfra: rail <strong>Resource</strong>-<strong>based</strong> upgrade & <strong>African</strong> ext., <strong>Development</strong> port upgrade, <strong>Strategy</strong>road net., elec gen & grid

TAZARA SDPCountries: Tanzania, Zambia (DRC, Malawi)Anchors: Cu/Co (Copper-belt), Fe/steel (Liganga), Coal (Ruhuhu-Ketawaka),Ta/Nb (Mbeya) Fe/C (Njombe); Forestry P&P (Mbeya),argic & RADSagri-proc (Iringa, Mbeya & Mkushi highlands), <strong>to</strong>urism(Selous, Ruaha, Luangwa), mineral & agri-processing & inputsInfra: rail, <strong>Resource</strong>-<strong>based</strong> road network, <strong>African</strong> <strong>Development</strong> energy grid, <strong>Strategy</strong>rail & pipelines rehab,

East-West SDPs: Critical for <strong>African</strong> integration!GMRAHigh minpotential?WB TradeStudy(Buys et al)RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>USGSGMRAHigh MineralPotentialZones

RADSNoteThis was NOT assessed in theindicative SDP scoping study<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>Inter-<strong>African</strong>SDP?Great LakesSDP?Countries: Zambia,Mozambique Malawi,Tanzania, DRC, Burundi,Rwanda, Uganda,S.SudanAnchors: Genericdevelopment potential,particularly inter-<strong>African</strong>trade.Tourism (Gt Lakes)Infra: waterways,road,rail, port upgrades.

Madagascar SDPCountries: MadagascarAnchors: FeNi, Cr (FeCr?) & stainless steel?, Ti/Zr(Ti slag & Fe, pigment?), Al (alumina?), Forestry(P&P?), agric (vanilla et al), gems<strong>to</strong>nes(jewellery?), <strong>to</strong>urism,Infra: RADSrail upgrade & ext., elec grid, port upgrades,road net (S.coastal).<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSNEPAD SD PROGRAMME• Key findings of the Study– Confirmed scope for application of the SDPmethodology as a means <strong>to</strong> fast-trackingt regional economic development continentally;– Methodology provides a focus for infrastructureinvestment;– Programme does highlight opportunities forregional economic integration ti and intra-Africaitrade and investment;– Emphasises role of minerals as a major rationalefor viable large-scale infrastructure investment;and– Has identified a portfolio of <strong>Development</strong>Corridors with best prospects for success.<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

<strong>Resource</strong>-<strong>based</strong><strong>Development</strong>?Overcoming the<strong>Resource</strong>s Curse:<strong>Resource</strong>s GovernanceRADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSThe “<strong>Resource</strong>s Curse”Improving Governance in the Natural<strong>Resource</strong> Sec<strong>to</strong>rNew developments• <strong>African</strong> Peer Review Mechanism(APRM)• EITI- Extractive IndustriesTransparency Initiative• Equa<strong>to</strong>r Banks Principles• Governance of “Conflict Minerals”• SHE standards/moni<strong>to</strong>ring• Windfall Rent Management• Regional authorities: power pools;river catchment bodies, DCs,cus<strong>to</strong>ms/currency unions, etc.<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

APRMRADS• The <strong>African</strong> Peer Review Mechanism (APRM) is amutually agreed instrument t voluntarily acceded d <strong>to</strong>by the member states of the <strong>African</strong> Union (AU) asa self-moni<strong>to</strong>ring mechanism.• The mandate of the APRM is <strong>to</strong> encourageconformity in regard <strong>to</strong> political, economic andcorporate governance values, codes andstandards, among <strong>African</strong> countries and theobjectives in socio-economic development withinNepad.• 25 countries have acceded (APRM MOU):– Algeria, Angola, Cameroon, Republic of Congo, Egypt,Ethiopia, Gabon, Benin, Burkina Faso, Mali, Mauritius,Senegal, Tanzania, Lesotho, Sierra Leone, Malawi, Ghana,Kenya, Mozambique, Nigeria, Rwanda, South Africa,Sudan, Uganda and Zambia.• The APRM is not meant <strong>to</strong> exclude or punishcountries. There is no conditionality attached <strong>to</strong><strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>the mechanism

RADS• EITI creates transparency over the flow of moneyfrom oil, gas and mining companies <strong>to</strong> thegovernments of the countries in which they operate(Launched at WSSD Joburg in 2002)• The objective is <strong>to</strong> increase accountability over theuse of natural resource wealth <strong>to</strong> ensure it is ablessing and not a curse.• Country led: Brings <strong>to</strong>gether th governments,companies, NGOs, inves<strong>to</strong>rs, international institutions• > 25 countries implementing• However, perceived as “rehab” facility- Needssupport from low-risk extractive states like SA,Botswana, Oz, Norway, Canada, etc.• Needs <strong>to</strong> also cover upstream (contracts/licenses)• <strong>Resource</strong>-<strong>based</strong> COST- construction/infra <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>“EITI” launched ’07 (UK)

RADS• The "Equa<strong>to</strong>r Principles“: A financial industry benchmarkfor determining, assessing and managing social &environmental risk in project financing• The Equa<strong>to</strong>r Principles Financial Institutions (EPFIs) haveadopted the Principles in order <strong>to</strong> ensure that the projectsthey finance are developed in a manner that is sociallyresponsible and reflect sound environmental managementpractices.• Over 50 Banks have joined (mainly 1 st World).• These Principles are intended <strong>to</strong> serve as a commonbaseline and framework for the implementation by each EPFIof its own internal social and environmental policies• Disadvantages: Mainly 1 st World driven (WB/IFC & NGOs)and 1 st World concerns (don’t look at the developmentalimpact)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Governance of “Conflict Minerals”RADS– Minerals used <strong>to</strong> finance civil wars &crime need governance systems,particularly precious & semi-preciousminerals targeting the “fashion” market.– Diamonds:• The Kimberley Process Certification Scheme(KPCS) is a PPP process designed <strong>to</strong> certifythe origin of diamonds from sources whichare free of conflict. The certification schemeaims at preventing "conflict diamonds" (alsoknown as "blood diamonds") from enteringthe mainstream rough diamond market.– Other Minerals: Regulate gold (fashionmarket), coltan, etc. in a similar way?<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSSHE: Safety, Health & Environment• Need a continuous method of independent SHEmoni<strong>to</strong>ring of all extractive plants (as per EITIsystem);• Need commonly accepted <strong>African</strong> SHEstandards, <strong>to</strong> be objectively moni<strong>to</strong>red on aregular basis (e.g. Cyanide Code). Suchstandards need <strong>to</strong> be reconciled withinternational (e.g. ISO) standards;• Need <strong>to</strong> ensure that the post-mining rehabcosts are amortised through annual transfersduring life of mine and periodically reassessed(5 yearly?): Any surpluses <strong>to</strong> accrue <strong>to</strong> centralfund for rehab of “ownerless” mine sites.• Kyo<strong>to</strong>: CDM useful, but needs <strong>to</strong> be <strong>based</strong> oncarbon footprint (consumption) and <strong>to</strong> valorise<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>conservation (forests) as well as forestation.

Managing Windfall RentsRADS• Windfall mineral rents need <strong>to</strong> beequitably appropriated (rate of returntax regime, as per oil & gas sec<strong>to</strong>r).• However, large forex inflows coulddis<strong>to</strong>rt the economy y( (Dutch Disease).Need a method of inflowsmanagement:• “Stabilisation” or “Future” Funds forinvestment in long-term <strong>African</strong>infrastructure t (c.f. Pan-<strong>African</strong> InfraFund: PAIDF)?<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

e.g. Norwegian Global Fund• Oil & gas taxes are invested in a global l portfolio and earningsare used by government for current expenditure.RADSSource: Fridjof Barents, UNCTAD 2006For <strong>African</strong> countries, the windfall earnings could beinvested in an offshore <strong>African</strong> investment fund(PAIDF?) & committed <strong>to</strong> long-term infrastructuretinvestment, <strong>to</strong> ameliorate currency appreciation(Dutch <strong>Resource</strong>-<strong>based</strong> Disease) <strong>African</strong> <strong>Development</strong> & improve <strong>Strategy</strong>national competitiveness.

National Capacity for Minerals GovernanceLocal govt:CommunitydevelopmentMineralRegulationLicencesInfra:TransportPoweretcMineralsInputs:(supplierindustries)Geo-dataexpl. licenses(GSD)MineralProjectMineralHRD,R&DEnviro:SEA, EIAsTrust FundsMineralbeneficiationMineralTaxation:FutureFundsLabourRegulation,Health &SafetyRADSEach requires capacitation/support!Tall order? But achievable collectively<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

Multi-layered MineralsGovernance?National:Govt, MPs, pvt.sec<strong>to</strong>r, civil soc.DC HoS Bilateral:X-border infragovernance?Min ofLabourMin ofMinesMins ofInfrastructureREC Institutions:power pools, waterbodies, FTA, CU,CMA, chambers,etcRADSMin ofFinanceMineralProjectMin ofEnviro<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>Min ofIndustry<strong>African</strong>:AU/ARPM,NEPAD, AfDB,UNECA, PAIDF,geo-data etcInternational:UN, WTO, WB,EITI, ICMM,Kimberly, Kyo<strong>to</strong>,Equa<strong>to</strong>r, SHE, etc.

IIIIIIIVVSchematic RADS Phasing (relative economic importance)Phase 1 Phase 2 Phase 3 Phase 4<strong>Resource</strong> Infrastructure<strong>Resource</strong> ExploitationUnskilled resource labour<strong>Resource</strong> rentsImport of <strong>Resource</strong> Inputs<strong>Resource</strong> Beneficiation (value-addition)Densification InfrastructureSkill intensity (HRD)Rents from <strong>Resource</strong> diversification industr& catalysed industr<strong>Resource</strong> Inputs production & Lateral migration(diversification)VIImport of <strong>Resource</strong> Tecnologies<strong>Resource</strong> R&D. high level skills and tech developmComplex regulation, M&E, arbitration, governanceVIIContract/license resource & infra (PPP) governanceRADS<strong>Resource</strong> Exploitation& infrastructure phase<strong>Resource</strong> Consumables &HRD phase<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong><strong>Resource</strong> R&D, capitalgoods & services phaseLateral migration &diversification phase

Emerging global ac<strong>to</strong>rsRADS• Need flexibility <strong>to</strong> trade resourcesaccess for infrastructure, HRD,beneficiation & investment (offsets:develop local capital)• What is the appropriate fiscal regime forresource management? Look <strong>to</strong> oil/gasfiscal regimes eg. auction resourceblocks for investment in “DC”;• New Asian (China & India) players haveshown a willingness <strong>to</strong> look at integratedwin-win approaches <strong>to</strong> <strong>African</strong>development<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSWay Forward• Use resource boom <strong>to</strong> leverage high rent resources(e.g. minerals) <strong>to</strong> establish infrastructure t for higherhimpact agriculture, <strong>to</strong>urism, manufacturing, etc.;•Invest in <strong>African</strong> resource-knowledge infrastructure(e.g. geosurvey) & facilitate the development <strong>African</strong>resources companies (AfDB: JRC DFI?);• Ensure equitable state share of resource and windfallrents and management (UNECA ISG project, WBprojects);• Establish DC capability: NEPAD, AfDB/WB, REC?• Finalise AfDB, WB, REC?, ADCP DC pilot partnership;• Launch 1 or 2 pilot, high impact, DCs as learningprogrammes (RECs?, AfDB, NEPAD, ADCP);•Link requisite infrastructure financing <strong>to</strong> user(resources) investment (“use or pay”)- PPPs;•Ensure “densification” (donor agencies- ADCP?) andrealisation of collateral opportunities <strong>to</strong> avoid enclavedevelopment;<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSWay Forward (governance)• Use concrete DC projects <strong>to</strong> develop “bot<strong>to</strong>m-up”x-border trade & regula<strong>to</strong>ry harmonisation (easierif already in place- RECs);• Use DCs <strong>to</strong> build X-bordergovernance &institutional capacity (REC?) for areas with higheconomic potential (power pools, water catchmentauthorities, transport authorities, etc.): AfDB/WBet al support;• Support from WB/AfDB on negotiating large DCinvestments t & building ongoing (REC/state?)t negotiating, moni<strong>to</strong>ring, auditing, regulatingcapacity;• Deepen and widen continental and internationalresource exploitation pro<strong>to</strong>cols (Equa<strong>to</strong>r BankingPrinciples, APRM, SHE, EITI, COST, KimberleyProcess, Africa-PRC “Compact”?, etc.)<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADSe.g. an Africa-PRC “Compact”for Growth & <strong>Development</strong>?• Configure a mutual benefit “compact” of intentbetween the AU/AfDB and PRC that “balances”access <strong>to</strong> resources and markets with:– Infrastructure not only for resource extraction, butalso for integrated development (Nepad SDP concept)– HRD in all the FDI areas– <strong>Resource</strong> beneficiation before export– <strong>Resource</strong> inputs (supplier) industries– JVs <strong>to</strong> develop local capital– Investment t in geo-survey (joint “Afro-Sino” JRC DFI?)– Location of consumer products industries for productsdestined for <strong>African</strong> markets (where viable) – (AGOA,EPAs, MGOA?)– Adherence <strong>to</strong> codes of conduct (EITI, Equa<strong>to</strong>r Banks,SHE codes)• Establish a joint Africa-PRC investmentfacilitation & moni<strong>to</strong>ring commission?ACHIEVABLE??<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

e.g. Iron/SteelSome SS <strong>African</strong> Opportunities(Fe ore, coal/gas deposits)Nouakchott:Tiris Fe,Chinguetti gasDakar:Faleme Fe,Diam gasBuchanan:Nimba Fe,delta gasAjaokuta:Itakpe Fe,delta gas<strong>Resource</strong> Scarcity:Link resource access <strong>to</strong>:local processing,infra estab/rehab,inputs industries, HRD,etc.Kodo: Kodo Fe;S.Sudan gasLiganga:Liganga Fe;Ruhuhu coalTete: Muande Fe;Moatize cokeRADSLuanda: KissalaFe, Soyo gasS.Bay: Kathu Fe;Offshore gas?Coega: Kathu Fe,<strong>Resource</strong>-<strong>based</strong> Molteno <strong>African</strong> <strong>Development</strong> coal? <strong>Strategy</strong>Source: MINTEK - CDC PresentationGauteng: BCFe, coal finesMa<strong>to</strong>la: PhalaFe, Pande gasR.Bay: P.Retief FeKZN coal/gasgas line

Thanks <strong>to</strong>:• AU Commission• NEPAD• UNECA• AfDB• RECsRADS• RSDIP & Mintek<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>

RADS<strong>Resource</strong>-<strong>based</strong> <strong>African</strong> <strong>Development</strong> <strong>Strategy</strong>