Fema Forms CA. Anshuman Chaturvedi 23June 12

Fema Forms CA. Anshuman Chaturvedi 23June 12

Fema Forms CA. Anshuman Chaturvedi 23June 12

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

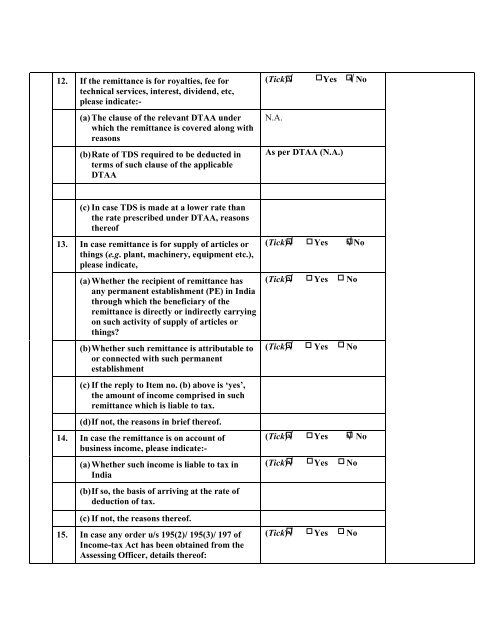

<strong>12</strong>. If the remittance is for royalties, fee fortechnical services, interest, dividend, etc,please indicate:-(a) The clause of the relevant DTAA underwhich the remittance is covered along withreasons(b) Rate of TDS required to be deducted interms of such clause of the applicableDTAA(Tick) Yes NoN.A.As per DTAA (N.A.)(c) In case TDS is made at a lower rate thanthe rate prescribed under DTAA, reasonsthereof13. In case remittance is for supply of articles orthings (e.g. plant, machinery, equipment etc.),please indicate,(a) Whether the recipient of remittance hasany permanent establishment (PE) in Indiathrough which the beneficiary of theremittance is directly or indirectly carryingon such activity of supply of articles orthings?(b) Whether such remittance is attributable toor connected with such permanentestablishment(c) If the reply to Item no. (b) above is ‘yes’,the amount of income comprised in suchremittance which is liable to tax.(d) If not, the reasons in brief thereof.14. In case the remittance is on account ofbusiness income, please indicate:-(a) Whether such income is liable to tax inIndia(b) If so, the basis of arriving at the rate ofdeduction of tax.(c) If not, the reasons thereof.15. In case any order u/s 195(2)/ 195(3)/ 197 ofIncome-tax Act has been obtained from theAssessing Officer, details thereof:(Tick) Yes No(Tick) Yes No(Tick) Yes No(Tick) Yes No(Tick) Yes No(Tick) Yes No