PT INDOCEMENT TUNGGAL PRAKARSA Tbk

PT INDOCEMENT TUNGGAL PRAKARSA Tbk

PT INDOCEMENT TUNGGAL PRAKARSA Tbk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

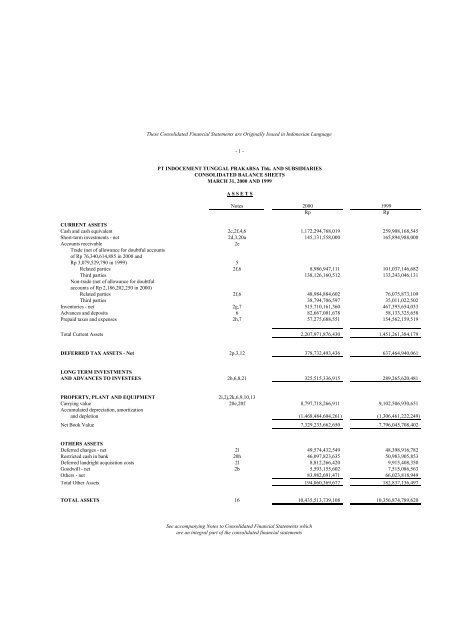

These Consolidated Financial Statements are Originally Issued in Indonesian Language- 1 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESCONSOLIDATED BALANCE SHEETSMARCH 31, 2000 AND 1999A S S E T SNotes 2000 1999RpRpCURRENT ASSETSCash and cash equivalent 2c,2f,4,6 1,172,294,768,019 259,908,168,545Short-term investments - net 2d,3,20a 145,131,558,000 165,894,988,000Accounts receivable2eTrade (net of allowance for doubtful accountsof Rp 76,340,614,885 in 2000 andRp 3,079,529,790 in 1999) 5Related parties 2f,6 8,986,947,111 101,037,146,682Third parties 138,126,160,512 133,243,046,131Non-trade (net of allowance for doubtfulaccounts of Rp 2,186,202,250 in 2000)Related parties 2f,6 48,984,884,602 76,075,873,109Third parties 38,794,706,597 35,011,022,502Inventories - net 2g,7 515,710,161,360 467,395,654,033Advances and deposits 6 82,667,001,678 58,133,325,658Prepaid taxes and expenses 2h,7 57,275,688,551 154,562,159,519Total Current Assets 2,207,971,876,430 1,451,261,384,179DEFERRED TAX ASSETS - Net 2p,3,12 378,732,493,436 637,464,940,061LONG TERM INVESTMENTSAND ADVANCES TO INVESTEES 2b,6,8,21 325,515,336,915 289,265,620,481PROPERTY, PLANT AND EQUIPMENT2i,2j,2k,6,9,10,13Carrying value 20e,20f 8,797,718,266,911 9,102,506,930,651Accumulated depreciation, amortizationand depletion (1,468,484,604,261) (1,306,461,222,249)Net Book Value 7,329,233,662,650 7,796,045,708,402OTHERS ASSETSDeferred charges - net 2l 49,574,432,549 48,398,916,782Restricted cash in bank 20h 46,097,823,635 50,983,905,853Deferred landright acquisition costs 2l 8,812,266,420 9,915,408,350Goodwill - net 2b 5,593,155,602 7,515,086,563Others - net 83,982,691,471 66,023,818,949Total Other Assets 194,060,369,677 182,837,136,497TOTAL ASSETS 16 10,435,513,739,108 10,356,874,789,620See accompanying Notes to Consolidated Financial Statements whichare an integral part of the consolidated financial statements

These Consolidated Financial Statements are Originally Issued in Indonesian Language- 3 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESCONSOLIDATED STATEMENTS OF INCOMEFOR THE THREE MONTHS ENDED MARCH 31, 2000 AND 1999Notes 2000 1999RpRpNET REVENUES 2m,6,16,21 538,752,136,113 386,644,682,710COST OF REVENUES 2m,16,17 331,592,548,307 276,322,937,437GROSS PROFIT 207,159,587,806 110,321,745,273OPERATING EXPENSES 2m,18Delivery and selling 21,282,077,700 21,605,024,060General and administrative 19,522,760,659 22,619,098,792Total Operating Expenses 40,804,838,359 44,224,122,852INCOME FROM OPERATIONS 16 166,354,749,447 66,097,622,421OTHER INCOME (CHARGES)Interest income 4 25,704,310,921 11,851,671,267Equity share in net earnings of investees - net 2b,8 5,884,557,985 20,618,155,308Foreign exchange losses - net 2k,2o,9,21 (302,514,517,394) (317,668,109,467)Interest expense 2k,9,21 (128,662,365,655) (106,258,363,512)Others - net 2b,2d,2i,2j,2l,3 (4,871,191,246) 18,895,099,380Other Charges - net (404,459,205,389) (372,561,547,024)LOSS BEFORE PROVISION FORINCOME TAX (238,104,455,942) (306,463,924,603)PROVISION FOR INCOME TAX2p,3,12Current 107,782,184 -Deferred (78,968,354,743) (105,416,316,641)Net Provision for Income Tax (78,860,572,559) (105,416,316,641)LOSS BEFORE MINORITY INTERESTSIN NET LOSSES (INCOME) OF SUBSIDIARIES (159,243,883,383) (201,047,607,962)MINORITY INTERESTS IN NET LOSSES(INCOME) OF SUBSIDIARIES (4,500,149,088) 274,822,427NET LOSS (163,744,032,471) (200,772,785,535)NET LOSS PER SHARE 2q (67.82) (83.15)See accompanying Notes to Consolited Financial Statementswhich are an integral part of the consolidated financial statements

These Consolidated Financial Statements are Originally Issued in Indonesian Language- 4 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESCONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITYFOR THE THREE MONTHS ENDED MARCH 31, 2000 AND 1999Differences Arisingfrom RestructuringUnrealized GainsForeign Currency Differences Arising Transactions Among (Losses) onCapital Additional Translation from Changes in Entities Under Available-for-Sale Retained EarningsNotes Stock Paid-in-Capital Adjustments Subsidiary's Equity Common Control Securities Appropriated Unappropriated TotalRp Rp Rp Rp Rp Rp Rp RpBalance, January 1, 1999 (as previously reported) 1,207,226,660,000 172,329,476,497 562,570,781,248 - (1,496,514,575,077) - 50,000,000,000 (355,913,407,003) 139,698,935,665Retroactive effects of changes in accounting principles 2b,2d,2p,3 - - 4,564,541,456 (13,579,469,792) - 4,595,125,960 - 530,067,676,328 525,647,873,952Balance, January 1, 1999 (as restated) 1,207,226,660,000 172,329,476,497 567,135,322,704 (13,579,469,792) (1,496,514,575,077) 4,595,125,960 50,000,000,000 174,154,269,325 665,346,809,617As previously reportedNet loss - - - - - - - (306,335,349,791) (306,335,349,791)Foreign currency translation adjustments 2b - - 60,430,891,819 - - - - - 60,430,891,819Retroactive effects of changes in accounting principles 2b,2d,2p,3 - - 1,200,333,119 24,698,321,646 - 84,764,815 - 105,562,564,256 131,545,983,836Balance, March 31, 1999 (as restated) 1,207,226,660,000 172,329,476,497 628,766,547,642 11,118,851,854 (1,496,514,575,077) 4,679,890,775 50,000,000,000 (26,618,516,210) 550,988,335,481Balance, January 1, 2000 (as restated) 1,207,226,660,000 172,329,476,497 477,577,930,779 19,310,551,854 (1,496,514,575,077) (1,891,104,470) 50,000,000,000 697,577,607,517 1,125,616,547,100Net loss - - - - - - - (163,744,032,471) (163,744,032,471)Depreciation in market value of investments in marketable securities 2d - - - - - (124,590,000) - - (124,590,000)Changes in Subsidiary's equity arising from the depreciation inmarket value of its investments in marketable securities 2b,2d - - - (8,894,550,000) - - - - (8,894,550,000)Foreign currency translation adjustments 2b - - 46,938,633,675 - - - - - 46,938,633,675Balance, March 31, 2000 (as restated) 1,207,226,660,000 172,329,476,497 524,516,564,454 10,416,001,854 (1,496,514,575,077) (2,015,694,470) 50,000,000,000 533,833,575,046 999,792,008,304-See accompanying Notes to Consolidated Financial Statements whichare an integral part of the consolidated financial statements

These Consolidated Financial Statements are Originally Issued in Indonesian Language- 5 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH FLOWSFOR THE THREE MONTHS ENDED MARCH 31, 2000 AND 19992000 1999RpRpCASH FLOWS FROM OPERATING ACTIVITIESReceipts from customers 611,407,346,296 434,306,939,563Payments to supplier (247,638,310,931) (209,401,863,278)Payments of labor costs, operating expenses and others (131,167,426,917) (124,026,065,623)Cash inflow from operations 232,601,608,448 100,879,010,662Receipts (payments) of interest 26,048,406,646 7,435,519,376Receipts (payments) of taxes 51,976,769,024 51,858,841,915Other receipts (payments) 9,956,941,438 18,593,062,610Net Cash Provided by Operating Activities 320,583,725,556 178,766,434,563CASH FLOWS FROM INVESTING ACTIVITIESProceeds from disposal of property, plant and equipment 302,000,000 100,180,028Additions to property, plant and equipment (15,627,602,490) (27,619,600,003)Proceeds from sales of short-term investments - 47,465,998,008Additions to short-term investments - (19,119,086,135)Deductions (additions) to long-term investments in sharesof stock and advances to investees (120,000,000) 300,000,000Net Cash Used in Investing Activities (15,445,602,490) 1,127,491,898CASH FLOWS FROM FINANCING ACTIVITIESPayments of long term debts - -Net increase in long term debts - -Net decrease in short term loans - -Net Cash Provided by Financing Activities - -NET EFFECT OF CHANGES IN EXCHANGE RATES ONCASH AND CASH EQUIVALENT (2,823,957,971) (4,080,541,283)NET INCREASE (DECREASE) IN CASH AND 302,314,165,095 175,813,385,178CASH EQUIVALENTCASH AND CASH EQUIVALENT AT BEGINNING OF PERIOD 869,980,602,924 84,094,783,367CASH AND CASH EQUIVALENT AT END OF PERIOD 1,172,294,768,019 259,908,168,545See accompanying Notes to Consolidated Financial Statements whichare an integral part of the consolidated financial statements

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 6 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS1. GENERAL<strong>PT</strong> Indocement Tunggal Prakarsa <strong>Tbk</strong>. (the Company) was incorporated in Indonesia onJanuary 16, 1985 and its deed of incorporation was approved by the Ministry of Justice onMay 17, 1985. The Company’s articles of association has been amended from time to time, the latestof which was covered by notarial deed No. 42 of Amrul Partomuan Pohan, S.H., datedAugust 21, 1997. The amendments made are primarily intended to align the Company’s articles ofassociation with the new Corporate Law No. 1, Year 1995. Such amendments were approved by theMinistry of Justice in its decision letters No. C2-11.426.HT.01.04.TH.97 andNo. C2-HT.01.04.A.23746 both dated November 4, 1997, and were published in State Gazette of theRepublic of Indonesia No. 24, Supplement No. 1689 dated March 24, 1998.The Company started its commercial operations in 1985.As stated in Article 3 of the Company’s article of association, the scope of its activities comprises of,among others, manufacture of cement and building materials, food and beverages, textile, constructionand trading.The Company is domiciled in Jakarta, while its factories are located in Citeureup and Cirebon, WestJava. The Company and its Subsidiaries (the “Group”) were a multibusiness group divided intoCement Business, as the Group core business, and Other Business.The Cement Business mainly includes the operations of the nine integrated cements plants at itsCiteureup – Bogor site, two integrated cements plants at its Palimanan – Cirebon site with a combinedannual capacity of 13.35 million tons, consisting of 13.15 million tons of portland cement and 0.2million tons of specialty (white and oil well) cements, and its ready mix concrete manufacturingsubsidiary.Other Business includes, among others, the operations of the Company-owned property, WismaIndosemen, a 23 storey office tower building with over 19,000 square meters of rentable space and twobasement car parks and <strong>PT</strong> Wisma Nusantara International, an equitized subsidiary which owns andoperates a 30 storey office building with 26,108 square meters of rentable space and President Hotel, afour star hotel with 315 rooms. The above mentioned buildings are located in Jakarta’s centralcommercial district.As of March 31, 2000, the members of the Company’s boards of commissioners and directors are asfollows:CommissionerDirectorSoedono Salim - President Commissioner Sudwikatmono - President DirectorDjuhar Sutanto - Commissioner Anthony Salim - Vice President DirectorJohny Djuhar - Commissioner Ibrahim Risjad - DirectorKuntara - Commissioner Tedy Djuhar - DirectorAndree Halim - Commissioner Iwa Kartiwa - DirectorTanto Koeswanto - Commissioner Soepardjo - DirectorI. Ketut Mardjana - Commissioner Daddy Hariadi - DirectorFranciscus Welirang - DirectorBenny S. Santoso - DirectorAs of March 31, 2000, the Company and its Subsidiaries have a total of 7,096 permanent employees(unaudited).

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 7 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIESa. Basis of Consolidated Financial StatementsThe consolidated financial statements have been prepared on the historical cost basis ofaccounting, except for inventories which are valued at the lower of cost or net realizable value(market), certain short-term investments which are stated at market value, certain investments inshares of stock which are accounted for under the equity method, and certain property, plant andequipment which are stated at revalued amounts.The consolidated statements of cash flows present cash receipts and payments classified intooperating, investing and financing activities, using the direct method.b. Principles of ConsolidationThe consolidated financial statements include the accounts of the Company and the followingSubsidiaries, in which the Company owns, either directly or indirectly, more than 50% equityownership:EffectivePercentage of OwnershipCountryPrincipal Activity of Domicile 2000 1999Direct SubsidiariesIndocement (Cayman Island)Limited Investment Cayman Island 100.00% 100.00%Leamaat Omikron BV Financing Netherlands 100.00 100.00<strong>PT</strong> Indomix PerkasaReady mixed(Indomix) concrete Indonesia 99.99 99.99<strong>PT</strong> Indocement Investama(Investama) Investment Indonesia 93.03% 93.03<strong>PT</strong> Dian Abadi Perkasa Cement distributor Indonesia 51.00 -Indirect Subsidiary (throughInvestama)<strong>PT</strong> Indo Kodeco Cement (IKC) Cement Indonesia 72.09 71.43<strong>PT</strong> Dian Abadi Perkasa was established in 1999 and primarily acts as the Company’s maindomestic distributor of bagged cement (see Note 6).The integrated cement plant of IKC has an installed capacity of 2.45 million tons of portlandcement per annum. As of March 31, 2000, IKC is already in its trial production stage.Since 1997, IKC changed its functional currency for recording and reporting purposes fromRupiah to US Dollar currency. The management of IKC believes that such change is appropriatesince its transactions are primarily US Dollar denominated.For consolidation purposes, the accounts of foreign Subsidiaries and IKC are translated intoRupiah amounts on the following basis:Balance sheet accounts - Middle rates of exchange as of balance sheet date (US$ 1 toRp 7,590 and Rp 8,685 as of March 31, 2000 and 1999,respectively; and NLG 1 to Rp 3,301.28 and Rp 4,218.96 as ofMarch 31, 2000 and 1999, respectively).

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 8 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)Profit and loss accounts - Average rates of exchange during the year (US$ 1 toRp 7,343.33 and Rp 8,752.17 for the periods ended March 31,2000 and 1999, respectively; and NLG 1 to Rp 3,300.94 andRp 4,409.38 for the periods ended March 31, 2000 and 1999,respectively).The statements of cash flows of foreign Subsidiaries and IKC are translated using averageexchange rates during the period. The resulting net difference arising from the translations ofbalance sheet and profit and loss accounts is presented as “Foreign Currency TranslationAdjustments” under the Shareholders’ Equity section of the consolidated balance sheets.The difference of the purchase price over the underlying fair value of the net assets of theacquired subsidiaries is booked as “Goodwill” and amortized using the straight-line method overtwenty (20) years, in view of the good future business prospect of the investees.All significant intercompany accounts and transactions have been eliminated.Investments in which the Company or its Subsidiaries have ownership interests of at least 20%but not exceeding 50% are accounted for under the equity method, whereby the costs of suchinvestments are increased or decreased by the Company’s or Subsidiaries’ equity shares in thenet earnings (losses) of the investees since date of acquisition, and are reduced by dividendsreceived by the Company or Subsidiaries from the investees. The equity shares in net earnings(losses) of the investees are being adjusted for the straight-line amortization, over a twenty-yearperiod (in view of the good future business propects of the investees), of the difference betweenthe cost of such investments and the Company’s or Subsidiaries’ proportionate shares in theunderlying fair value of the net assets of investees at date of acquisition (goodwill).All other investments are carried at cost (cost method).In compliance with Statement of Financial Accounting Standards (PSAK) No. 38, “Accountingfor Restructuring Transactions Among Entities under Common Control”, the differences betweenthe costs / proceeds of net assets acquired / disposed in connection with restructuring transactionsamong entities under common control compared to their net book values are recorded andpresented as “Differences Arising from Restructuring Transactions Among Entities underCommon Control” under the Shareholders’ Equity section of the consolidated balance sheets.In compliance with PSAK No. 40, “Accounting for Changes in Subsidiary’s / Investee’s Equity”,the difference between the carrying amount of the Company’s investment in, and the value of theunderlying net assets of the subsidiary / investee due to changes in the latter’s equity which arenot resulting from transactions between the Company and the related subsidiary / investee isrecorded and presented as “Differences Arising from Changes in Subsidiary’s Equity” under theshareholders’ equity section of the consolidated balance sheets.c. Cash EquivalentsTime deposits and other short-term investments with maturities of three months or less at thetime of placement or purchase and not pledged as collateral for loans are considered as “CashEquivalents”.

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 9 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)d. Short-Term InvestmentsInvestments in equity securities listed in the stock exchanges, bonds and other investments withmaturities of more than three months but not exceeding one year are classified as “Short-termInvestments”.The bonds, which are held-to-maturity, are stated at cost adjusted for amortization of premiumsor accretion of discounts to maturity.Prior to 1999, investments in equity securities held available-for-sale were stated at the lower ofaggregate cost or market value determined at balance sheet date. Any unrealized loss on declinein market value was charged to current operations.In accordance with PSAK No. 50, “Accounting for Investments in Certain Securities”, startingJanuary 1, 1999, equity securities held available-for-sale are stated at market value. Anyunrealized gains or losses on appreciation/decline in market value of the equity securities arerecorded and presented as “Unrealized Gains (Losses) on Available-for-Sale Securities” underthe Shareholders’ Equity section of the consolidated balance sheets, which are credited orcharged to operations upon realization.e. Allowance for Doubtful AccountsThe Company and Subsidiaries provide allowance for doubtful accounts based on a review ofthe status of the individual receivable accounts at the end of year.f. Transactions with Related PartiesThe Company and Subsidiaries have transactions with related parties. Related party relationshipis defined under PSAK No. 7, “Related Party Disclosures”, as follows:(1) enterprises that, through one or more intermediaries, control, or are controlled by, or areunder common control with, the reporting enterprise (including holding companies,subsidiaries and fellow subsidiaries);(2) associated enterprises;(3) individuals owning, directly or indirectly, an interest in the voting power of the reportingenterprise that gives them significant influence over the enterprise, and close members of thefamily of any such individuals (close members of a family are defined as those members whoare able to exercise influence or can be influenced by such individuals, in conjunction withtheir transactions with the reporting enterprise);(4) key management personnel, that is, those persons having authority and responsibility forplanning, directing and controlling the activities of the reporting enterprise, includingcommissioners, directors and managers of the enterprise and close members of the familiesof such individuals; and(5) enterprises in which a substantial interest in the voting power is owned, directly or indirectly,by any person described in (3) or (4), or over which such a person is able to exercisesignificant influence. This definition includes enterprises owned by the commissioners,directors or major shareholders of the reporting enterprise and enterprises that have amember of key management in common with the reporting enterprise.

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 10 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)All significant transactions with related parties, whether or not performed under normal pricesand conditions similar to those with non-related parties, are disclosed herein.g. InventoriesInventories are stated at the lower of cost or market value. Cost is determined using the averagemethod. The Company and its Subsidiaries provide allowance for inventory obsolescence basedon a periodic review of the physical condition of the inventories.h. Prepaid ExpensesPrepaid expenses are amortized over the periods benefited. Prepaid expenses which benefitsextend beyond one year are presented under “Other Non-current Assets” in the consolidatedbalance sheets.i. Property, Plant and EquipmentProperty, plant and equipment are stated at cost, except for certain assets revalued in accordancewith government regulations, less accumulated depreciation, amortization and depletion. Mainmachinery and equipment related to the production of cement are depreciated using the unit-ofproductionmethod while all the other property, plant and equipment items are depreciated usingthe straight-line method based on their estimated useful lives as follows:YearsLand improvements; quarry; buildings and structures 8 - 30Machinery and equipment 3 - 10Leasehold improvements; furniture, fixtures and officeequipment; and tools and other equipment 2 - 5Transportation equipment 5 - 8Land are stated at cost and not depreciated (see item l).Construction in progress is stated at cost. The accumulated costs will be reclassified to theappropriate property, plant and equipment accounts when the construction is substantiallycompleted and the asset is ready for its intended use.The cost of maintenance and repairs is charged to operations as incurred; significant renewalsand betterments as defined under PSAK No. 16, “Property, Plant and Equipment”, arecapitalized. When assets are retired or otherwise disposed of, their carrying values and the relatedaccumulated depreciation, amortization or depletion are removed from the accounts and theresulting gains or losses are credited or charged to current operations.j. LeasesLease transactions are accounted for under the capital lease method when the requiredcapitalization criteria under PSAK No. 30, “Accounting for Leases” are met. Otherwise, leasetransactions are accounted for under the operating lease method. Assets under capital lease(presented under “Property, Plant and Equipment” account in the consolidated balance sheets)are recorded based on the present value of the lease payments at the beginning of the lease termplus residual value (option price) to be paid at the end of the lease period. Depreciation of leasedassets is computed based on methods and estimated useful lives that are in line with those of thesimilar property, plant and equipment acquired under direct ownership.Gain on sale-and-leaseback transactions is deferred and amortized using the same basis andmethods as referred to above.

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 11 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)k. Capitalization of Borrowing Costs and Foreign Exchange LossesIn accordance with the revised PSAK No. 26, “Borrowing Costs”, interest charges, foreignexchange differences on borrowings and other costs incurred to finance the constructions orinstallations of the property, plant and equipment are capitalized. Capitalization of theseborrowing costs ceases when the construction or installation is substantially completed and theasset is ready for its intended use.l. Deferred ChargesExpenditures which benefits extend over one year are deferred and amortized over the periodsbenefited using the straight-line method.In accordance with PSAK No. 47, “Accounting for Land”, starting January 1, 1999, costsincurred in connection with the acquisitions/renewal of landrights, such as legal fees, landremeasurement fees, notarial fees, taxes and other expenses, are deferred and amortized using thestraight-line method over the legal term of the related landrights. The net book value of suchcosts are presented as “Deferred Landright Acquisition Costs” in the consolidated balance sheets.m. Revenue and Expense RecognitionRevenues are recognized as earned when the products are delivered and/or when services arerendered to customers. Cost and expenses are generally recognized and charged to operationswhen these are incurred (accrual basis).n. Retirement BenefitsThe Company has a defined contribution retirement plan covering substantially all of its full timeemployees. Contributions are funded and consist of the Company’s and the employees’contributions computed at 10% and 5%, respectively, of the employees’ pensionable earnings.On the other hand, the Subsidiaries still operate the “pay-as-you-go” retirement benefits scheme.Retirement benefits are accrued and/or charged to operations.o. Foreign Currency Transactions and BalancesTransactions involving foreign currencies are recorded in Rupiah amounts at the middle rates ofexchange prevailing at transaction date. At balance sheet date, monetary assets and liabilitiesdenominated in foreign currencies are adjusted to reflect the rates of exchange prevailing at thelast banking transaction date of the period, as published by Bank Indonesia, and any resultinggains or losses are credited or charged to current operations, except for those capitalized underPSAK No. 26 (see item k).For March 31, 2000 and 1999, the rates of exchange used, are as follows:2000 1999US Dollar (US$1) Rp 7,590.00 Rp 8,685.00Japanese Yen (¥ 100) 7,188.19 7,204.50Deutsche Mark (DEM 1) 3,719.73 4,753.72Denmark Kroner (DKK 1) 977.06 1,250.62Italian Lira (ITL 100) 375.73 482.17

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 12 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)Transactions in other foreign currencies are considered insignificant.p. Provision for Income TaxPrior to 1999, the Company and Subsidiaries applied the taxes payable method in computingtheir provision for income tax. Under this method, provision for income tax was computed on thebasis of estimated taxable income for the year.Starting January 1, 1999, the Company and a Subsidiary applied PSAK No. 46, “Accounting forIncome Taxes”, which requires for the accounting of tax effects of the recovery of assets andsettlement of liabilities at their carrying amounts, and the recognition and measurement ofdeferred tax assets and tax liabilities for the expected future tax consequences of eventsrecognized in the financial statements, including tax loss carryforwards.q. Net Income (Loss) per ShareNet income (loss) per share is computed by dividing net income (loss) by the weighted averagenumber of shares outstanding during the period (2,414,453,320 shares).3. CHANGES IN ACCOUNTING PRINCIPLESAs explained in Notes 2d and 2p, effective January 1, 1999, the Company and certain Subsidiariesretroactively applied PSAK No. 46, “Accounting for Income Taxes”, and PSAK No. 50, “Accountingfor Investments in Certain Securities”.4. CASH AND CASH EQUIVALENTThe details of cash and cash equivalent are as follows:2000 1999Rp RpCash on hand 369,925,690 341,675,813Cash in banksRelated Parties (See Note 6)Rupiah accounts<strong>PT</strong> Bank Central Asia - 45,632,224,992<strong>PT</strong> Bank Risjad Salim Internasional - 3,597,623,664US Dollar accounts<strong>PT</strong> Bank Central Asia - 13,664,959,898Third PartiesRupiah accounts<strong>PT</strong> Bank Central Asia 107,030,425,182 -<strong>PT</strong> Bank Risjad Salim Internasional 1,455,691,122 -<strong>PT</strong> Bank Mandiri (formerly underthe name of Bank dagang Negara) 31,626,907,349 27,137,307,299Bank BNP-Lippo Indonesia 108,017,236 -<strong>PT</strong> Bank Mandiri (formerly under the nameof <strong>PT</strong> Bank Pembangunan Indonesia) 38,428,105 222,274,990

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 13 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)2000 1999Rp Rp<strong>PT</strong> Bank Danamon 25,296,324 84,007,486<strong>PT</strong> Bank Lippo - 73,363,788Citibank, N.A. - 19,278,430US Dollar accounts<strong>PT</strong> Bank Central Asia 26,841,681,934 -<strong>PT</strong> Bank Mandiri (formerly underthe name of <strong>PT</strong> Bank dagang Negara) 15,267,236,899 13,903,149,490Bank of America 8,384,462,285 -Fuji Bank 54,542,879 61,886,010Bank BNP 2,106,549,928 15,540,934,050Other 214,229,963 45,614,287Yen AccountsFuji Bank 271,686,339 272,180,101Cash equivalentTime depositsRelated Parties (see Note 6)Rupiah accounts<strong>PT</strong> Bank Central Asia - 2,895,334,747<strong>PT</strong> Bank Risjad Salim Internasional - 80,000,000,000Third PartiesRupiah accounts<strong>PT</strong> Bank Mandiri (formerly underthe name of <strong>PT</strong> Bank dagang Negara) 635,600,000,000 56,268,000,000<strong>PT</strong> Bank Central Asia 2,704,333,284 -<strong>PT</strong> Bank Risjad Salim Internasional 315,000,000,000 -<strong>PT</strong> Bank Jabar 148,353,500 148,353,500US Dollar accounts<strong>PT</strong> Bank Internasional Indonesia 22,770,000,000 -<strong>PT</strong> Bank Mandiri (formerly underthe name of <strong>PT</strong> Bank dagang Negara) 2,277,000,000 -Total 1,172,294,768,019 259,908,168,545Interest rates per annum range from 10.5 to 13.08% in 2000 and 38 to 48% in 1999 for the Rupiahtime deposits, and 5.5% in 2000 for the US Dollar time deposits.

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 14 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)5. ACCOUNTS RECEIVABLE – TRADEThe details of trade receivables are as follows:2000OverdueTotal Current 1 month 2 month 3 monthRp Rp Rp Rp RpRelated Parties (see Note 6)Rupiah<strong>PT</strong> Semen Tiga Roda Prasetya 69,868,180,772 - - - 69,868,180,772<strong>PT</strong> Pioneer Beton Industri 6,736,392,127 1,894,182,135 544,984,632 835,266,605 3,461,958,755Others (each below Rp. 1,000,000,000) 993,335,695 371,612,672 46,532,450 9,902,000 565,288,573Sub-total 77,597,908,594 2,265,794,807 591,517,082 845,168,605 73,895,428,100US DollarIndocement Singapore Pte. Ltd., 1,176,765,289 1,176,765,289 - - -Others (each below Rp. 1,000,000,000) 80,454,000 - - - 80,454,000Sub-total 1,257,219,289 1,176,765,289 - - 80,454,000Total 78,855,127,883 3,442,560,096 591,517,082 845,168,605 73,975,882,100Less allowance for doubtful accounts (69,868,180,772) - - - (69,868,180,772)Net 8,986,947,111 3,442,560,096 591,517,082 845,168,605 4,107,701,328Third PartiesRupiah<strong>PT</strong> Royal Inti Mega Utama 12,736,744,141 12,736,744,141 - - -<strong>PT</strong> Trio Bhakti Perkasa 10,764,315,862 10,764,315,862 - - -PD Sinar Jaya 7,819,468,576 7,819,468,576 - - -<strong>PT</strong> Saka Agung Abadi 6,610,630,409 6,610,630,409 - - -<strong>PT</strong> Semen Kupang 6,549,345,178 - - 2,079,855,144 4,469,490,034<strong>PT</strong> Gunungbatu Airhidup 6,257,292,755 6,257,292,755 - - -<strong>PT</strong> Sumber Kencana Ekspresindo 4,434,421,308 4,434,421,308 - - -<strong>PT</strong> Semen Andalas Indonesia 4,274,661,849 2,314,817,346 1,959,844,503 - -PD Binangun Jaya 4,011,372,404 4,011,372,404 - - -CV Prima Utama 3,440,529,757 3,440,529,757 - - -<strong>PT</strong> Putra Sekawan Bersatuabadi 3,243,224,226 3,243,224,226 - - -<strong>PT</strong> Cipta Niaga 3,170,405,846 3,168,719,019 - 1,686,827 -<strong>PT</strong> Bina Surya Abadi 2,580,406,421 2,580,406,421 - - -PD Sumber Tepat 2,097,268,333 2,097,268,333 - - -<strong>PT</strong> Adhi Karya Premix 2,041,268,696 1,354,515,430 531,037,736 40,527,658 115,187,872<strong>PT</strong> Niaga Manunggal Perkasa 1,757,762,883 1,757,762,883 - - -PD Baseta 1,576,823,071 1,072,135,300 504,485,371 - 202,400<strong>PT</strong> Fauna Inti Kencana 1,555,590,955 - - - 1,555,590,955<strong>PT</strong> Pancar Pelangi Sakti 1,544,060,351 1,544,060,351 - - -<strong>PT</strong> Dharma Niaga 1,393,192,629 1,393,192,629 - - -<strong>PT</strong> Panca Sehati Sentosa 1,060,545,805 1,060,545,805 - - -UD Sahabat 1,024,762,005 1,024,762,005 - - -Others (each below Rp. 1,000,000,000) 22,675,956,561 17,197,313,802 1,580,224,214 400,307,390 3,498,111,155Sub-total 112,620,050,021 95,883,498,762 4,575,591,824 2,522,377,019 9,638,582,416US DollarS.E.M.T. Pielstick 12,354,138,258 9,850,007,508 - - 2,504,130,750Shun Shing Trading 11,331,384,240 11,331,384,240 - - -Commodity International 2,443,980,000 - - - 2,443,980,000Starlink Navigation 2,407,286,904 - - - 2,407,286,904Others (each below Rp. 1,000,000,000) 3,441,755,202 1,100,878,494 1,028,693,648 5,203,932 1,306,979,128Sub-total 31,978,544,604 22,282,270,242 1,028,693,648 5,203,932 8,662,376,782Total 144,598,594,625 118,165,769,004 5,604,285,472 2,527,580,951 18,300,959,198Less allowance for doubtful accounts (6,472,434,113) - - - (6,472,434,113)Net 138,126,160,512 118,165,769,004 5,604,285,472 2,527,580,951 11,828,525,085

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 15 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)1999OverdueTotal Current 1 month 2 month 3 monthRp Rp Rp Rp RpRelated Parties (see Note 6)Rupiah<strong>PT</strong> Semen Tiga Roda Prasetya 86,614,209,057 86,614,209,057 - - -<strong>PT</strong> Pioneer Beton Industri 11,062,186,640 975,502,156 409,131,045 590,968,965 9,086,584,474Others (each below Rp. 1,000,000,000) 721,992,785 161,373,436 69,364,112 79,585,890 411,669,347Sub-total 98,398,388,482 87,751,084,649 478,495,157 670,554,855 9,498,253,821US DollarIndocement Singapore Pte. Ltd., 2,638,758,200 2,638,758,200 - - -Others (each below Rp. 1,000,000,000) - - - - -Sub-total 2,638,758,200 2,638,758,200 - - -Total 101,037,146,682 90,389,842,849 478,495,157 670,554,855 9,498,253,821Less allowance for doubtful accounts - - - - -Net 101,037,146,682 90,389,842,849 478,495,157 670,554,855 9,498,253,821Third PartiesRupiah<strong>PT</strong> Trio Bhakti Perkasa 7,923,144,266 7,923,144,266 - - -<strong>PT</strong> Saka Agung Abadi 8,531,890,594 8,531,890,594 - - -<strong>PT</strong> Semen Kupang 2,010,788,472 930,165,614 979,775,658 100,847,200 -<strong>PT</strong> Gunungbatu Airhidup 6,613,200,675 6,613,200,675 - - -<strong>PT</strong> Total Galaxy 2,601,838,493 2,564,959,485 36,879,008 - -<strong>PT</strong> Jaya Readymix 1,932,242,539 191,188,487 - - 1,741,054,052<strong>PT</strong> Sumber Kencana Ekspresindo 1,027,290,067 1,027,290,067 - - -PD Binangun Jaya 2,598,029,189 2,598,029,189 - - -<strong>PT</strong> Putra Sekawan Bersatuabadi 2,258,223,100 2,258,223,100 - - -<strong>PT</strong> Makmur Perkasa Sukses Perkasa 2,022,241,953 2,022,241,953 - - -PD Sumber Tepat 1,764,168,783 1,764,168,783 - - -<strong>PT</strong> Adhi Karya Premix 2,975,553,242 19,008,951 3,825,000 3,900,000 2,948,819,291PD Baseta 2,328,273,303 1,870,797,666 329,199,079 128,276,558 -<strong>PT</strong> Fauna Inti Kencana 1,671,485,320 - - - 1,671,485,320<strong>PT</strong> Megaindo Pertala 1,574,643,928 1,574,643,928 - - -<strong>PT</strong> Tiara Rasecitra Griya 1,535,118,338 1,535,118,338 - - -<strong>PT</strong> Betaconcrete Mixerindo 1,510,425,606 - - - 1,510,425,606<strong>PT</strong> Pancar Pelangi Sakti 1,437,208,120 1,437,208,120 - - -<strong>PT</strong> Unggul Beton Remikon 1,381,512,708 - - - 1,381,512,708PD kalimas 1,321,316,213 1,321,316,213 - - -UD Sinar Agung 1,320,302,504 1,320,302,504 - - -<strong>PT</strong> Pasific Prestress Indonesia 1,228,711,740 - - - 1,228,711,740<strong>PT</strong> Istana Triusaha 1,115,810,951 1,115,810,951 - - -Others (each below Rp. 1,000,000,000) 30,512,518,434 22,259,867,508 2,092,753,330 1,430,964,561 4,728,933,035Sub-total 89,195,938,538 68,878,576,392 3,442,432,075 1,663,988,319 15,210,941,752US DollarHaivant Cement 13,492,411,958 13,492,411,958 - - -Shun Shing Trading 9,530,861,679 9,530,861,679 - - -Asian Industrial 4,725,002,251 4,725,002,251 - - -Kassabgui Trading 4,342,500,000 4,342,500,000 - - -Indo Energy 3,966,873,750 3,966,873,750 - - -Starlink Navigation 2,754,583,236 - - - 2,754,583,236G Premjee Trading 2,618,527,500 2,618,527,500 - - -Karsa Bhakti Nusa 2,341,263,993 45,509,400 - - 2,295,754,593Others (each below Rp. 1,000,000,000) 3,354,613,016 2,650,215,938 - - 704,397,078Sub-total 47,126,637,383 41,371,902,476 - - 5,754,734,907Total 136,322,575,921 110,250,478,868 3,442,432,075 1,663,988,319 20,965,676,659Less allowance for doubtful accounts (3,079,529,790) - - - (3,079,529,790)Net 133,243,046,131 110,250,478,868 3,442,432,075 1,663,988,319 17,886,146,869

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 16 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)An analysis of the changes in the balance of allowance for doubtful accounts follows:2000 1999Rp RpBalance at beginning of period 74,348,679,217 3,079,529,790Provisions during the period 1,991,935,668 -Receivables written-off during the period - -Balance at end of period 76,340,614,885 3,079,529,790Based on the review of the status of the individual receivable accounts at the end of the period,management is of the opinion that the above allowance for doubtful accounts is sufficient to coverany possible losses from uncollectible accounts.6. TRANSACTIONS AND ACCOUNTS WITH RELATED PARTIESIn the normal course of their business, the Company and its Subsidiaries engage in transactions andhave contracts/agreements with related parties. The significant transactions, contracts/agreements andrelated account balances with related parties are as follows:a. The Company sells a substantial portion of its product to related parties. Net revenues derivedfrom sales to related parties accounted for 4.58% and 53.98% of the consolidated net revenuesfor the period ended March 31, 2000 and 1999, respectively, with details as follows:2000 1999<strong>PT</strong> Semen Tiga Roda Prasetya (STRP) Rp - Rp 142,606,055,837<strong>PT</strong> Indosahid Perdana - 54,652,970,757Indocement Singapore Pte. Ltd., 22,306,620,476 9,737,415,668<strong>PT</strong> Pioneer Beton Industri 2,372,497,930 1,701,250,608<strong>PT</strong> Indo Clean Set Cement - 24,388,424Total Rp 24,679,118,406 Rp 208,722,081,294The related trade receivables arising from the above-mentioned sales transactions are shown aspart of “Accounts Receivable – Trade” in the consolidated balance sheets (see Note 5).In mid 1999, STRP ceased to become the Company’s main distributor.On April 26, 1999, <strong>PT</strong> Dian Abadi Perkasa (DAP), a subsidiary, entered into a distributorshipagreement with Company whereby DAP acts as the Company’s main distributor of baggedcement for domestic market, replacing STRP.b. The Company and Subsidiaries have loans and time deposits placements. The Company andSubsidiaries also maintain current accounts with BCA and <strong>PT</strong> Bank Risjad Salim Internasional(see Notes 4, 10, 13 and 20h).Until mid-December 1999, BCA is still considered as a related party.

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 17 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)c. The Company insures a major portion of its assets with <strong>PT</strong> Asuransi Central Asia (see Note 9).d. The Company has lease transactions with <strong>PT</strong> Swadharma Indotama Finance (see Note 13).e. The loan obtained by the Company from Marubeni Corporation is guaranteed by<strong>PT</strong> Mekar Perkasa (see Note 13).f. The Company extended non-interest bearing advances to certain affiliated companies with nofixed repayment dates. These advances are presented under “Accounts Receivable – Non trade(Related Parties)” account in the consolidated balance sheets.g. In 1999, the Company purchased non-interest bearing convertible bonds issued by <strong>PT</strong> CibinongCenter Industrial Estate, an investee, amounting to Rp 40,064,000,000, which have no fixedmaturity date. As of March 31, 2000, the carrying value of this investment in bonds is presentedas part of “Long-term Investments and Advances to Investees” account in the consolidatedbalance sheets (see Note 8).h. IKC entered into a mining agreement with <strong>PT</strong> Pama Indo Kodeco (PIK) whereby PIK agreed todevelop and operate a limestone, clay and laterite mine, and to supply the limestone, clay andlaterite requirements of IKC for the operations of its plant. As compensation, IKC pays PIKservice fees based on its tonnage consumption of limestone, clay and laterite. Service feesincurred amounted to US$ 511,349 and US$ 428,490.19 for the periods ended March 31, 2000and 1999, respectively. A portion of the said service fees incurred was capitalized to“Construction in Progress” since the raw materials were used for trial production runs. The totaloutstanding payables as of March 31, 2000 and 1999 arising from these transactions amounted toUS$ 430,212 and US$ 391,800.64, respectively, and is shown under “Accrued Expenses” in theconsolidated balance sheets.i. IKC entered into an agreement with <strong>PT</strong> Indotek Engico whereby the latter agreed to provide andundertake the construction of a 20 km long pipe line at Tarjun, South Kalimantan, Indonesia.IKC has accepted the tender for the execution of such works in the sum of US$ 3,770,000 (net ofwitholding tax). As of March 31, 2000 and 1999, the total project related expenditures amountedto US$ 3,843,091 and US$ 3,843,091, respectively, which are recorded as part of “Constructionin Progress”.The balances of accounts with related parties arising from non-trade transactions are as follows:2000 1999Rp RpAccounts receivable<strong>PT</strong> Semen Tiga Roda Prasetya (See Note 13c) 17,972,651,983 -<strong>PT</strong> Mekar Perkasa 8,706,250,000 8,706,250,000<strong>PT</strong> Indofood Sukses Makmur <strong>Tbk</strong> 5,733,207,115 5,785,284,320Joint Operations Indomix-Indosipa 3,933,837,139 67,428,029<strong>PT</strong> Indolampung Perkasa 3,600,000,000 2,200,000,000<strong>PT</strong> Mandara Medika Utama 3,285,500,000 5,000,000,000Employees 2,898,193,383 5,555,545,136<strong>PT</strong> Polymax International 2,008,082,488 10,572,082,488<strong>PT</strong> Indomulti Intisukses Industri 1,284,967,103 2,246,645,640<strong>PT</strong> Gula Putih Mataram 1,001,070,285 2,200,000,000

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 18 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)2000 1999Rp Rp<strong>PT</strong> Besland Pertiwi - 31,500,000,000<strong>PT</strong> Sweet Indolampung - 2,200,000,000Others (each below Rp. 1,000,000,000) 747,327,356 42,637,496Total 51,171,086,852 76,075,873,109Less allowance for doubtful accounts (2,186,202,250) -Net 48,984,884,602 76,075,873,109Accounts payableVarious (each below Rp 1,000,000,000) 3,902,184,305 365,058,755An analysis of the changes in the balance of allowance for doubtful accounts follows:2000 1999Rp RpBalance at beginning of period 2,186,202,250 -Provisions during the period - -Paid during the period - -Balance at end of period 2,186,202,250 -7. INVENTORIESInventories consist of:2000 1999Rp RpFinished goods 61,917,074,466 17,375,158,118Work in process 62,136,117,544 53,739,699,359Raw materials 17,242,543,172 24,106,683,160Fuel and lubricants 63,150,983,723 82,848,918,817Spare parts 317,120,502,178 293,247,128,940Materials in transit and others 5,564,465,160 7,499,590,522Total 527,131,686,243 478,817,178,916Less allowance for inventory obsolescence (11,421,524,883) (11,421,524,883)Net 515,710,161,360 467,395,654,033

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 19 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)Inventories are insured against fire and other risks based on a certain policy package (see Note 9).The inventories in the Company‘s Plant-9 are used as collateral to the loans it obtained from <strong>PT</strong> BankMandiri (see Notes 10 and 13).Finished goods and work in process inventories of IKC valued at Rp 5,775,202,269 andRp 5,312,186,124 as of March 31, 2000, and Rp 2,020,114,238 and Rp 3,113,197,916 as of March31, 1999, respectively, represent the outputs from its trial production runs.8. LONG-TERM INVESTMENTS AND ADVANCES TO INVESTEESThis account consists of long-term investments and advances to certain investees. The details of thisaccount are as follows:2000AccumulatedPercentageEquity in Netof Earning CarryingOwnership Cost (Losses) - Net Value% Rp Rp RpInvestments in Shares of Stock<strong>PT</strong> Pioneer Beton Industri 50.00 18,445,157,441 (1,303,634,642) 17,141,522,799<strong>PT</strong> Indotek Engico 50.00 500,000,000 8,037,259,104 8,537,259,104Stillwater Shipping Corporation 50.00 105,500,000 5,760,968,322 5,866,468,322<strong>PT</strong> Cibinong Center Industrial estate 50.00 60,000,000 (60,000,000) -<strong>PT</strong> Indominco Mandiri 35.00 38,493,328,526 (38,493,328,526) -<strong>PT</strong> Wisma Nusantara International 33.98 93,750,000,000 66,208,764,924 159,958,764,924<strong>PT</strong> Citra Marga Nusaphala Persada <strong>Tbk</strong>. 8.80 66,023,100,000 - 66,023,100,000Other investees various 4,979,284,580 (464,787,500) 4,514,497,080Sub-total 222,356,370,547 39,685,241,682 262,041,612,229Advances<strong>PT</strong> Pioneer Beton Industri 10,010,403,435<strong>PT</strong> Indo Clean Set Cement 8,077,107,163<strong>PT</strong> Cibinong Center Industrial Estate 2,637,459,085<strong>PT</strong> Indotek Engico 47,255,003Stillwater Shipping Corporation 2,637,500,000Sub-total 23,409,724,686Convertible Bonds (see Note 6)<strong>PT</strong> Cibinong Center Industrial estate 40,064,000,000Total 325,515,336,9151999AccumulatedPercentageEquity in Netof Earning CarryingOwnership Cost (Losses) - Net Value% Rp Rp RpInvestments in Shares of Stock<strong>PT</strong> Pioneer Beton Industri 50.00 18,445,157,441 443,928,328 18,889,085,769<strong>PT</strong> Indotek Engico 50.00 500,000,000 7,643,572,761 8,143,572,761

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 20 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)1999AccumulatedPercentageEquity in Netof Earning CarryingOwnership Cost (Losses) - Net Value% Rp Rp RpStillwater Shipping Corporation 50.00 105,500,000 4,768,269,766 4,873,769,766<strong>PT</strong> Cibinong Center Industrial Estate 50.00 60,000,000 (60,000,000) -<strong>PT</strong> Indominco Mandiri 35.00 38,493,328,526 (38,493,328,526) -<strong>PT</strong> Wisma Nusantara International 33.98 93,750,000,000 78,973,998,984 172,723,998,984<strong>PT</strong> Citra Marga Nusaphala Persada <strong>Tbk</strong>. 8.80 66,023,100,000 - 66,023,100,000Other investees various 4,783,233,080 (464,787,500) 4,318,445,580Sub-total 222,160,319,047 52,811,653,813 274,971,972,860Advances<strong>PT</strong> Indo Clean Set Cement 7,868,985,102<strong>PT</strong> Cibinong Center Industrial Estate 3,640,326,243<strong>PT</strong> Indotek Engico 146,836,276Stillwater Shipping Corporation 2,637,500,000Sub-total 14,293,647,621Total 289,265,620,481The principal activities of the above investees are as follows:Investee Country of Domicile Principal Business Activity<strong>PT</strong> Pioneer Beton Industri Indonesia Production of ready mixed concrete<strong>PT</strong> Indotek Engico Indonesia Construction engineering consultancyStillwater Shipping Corporation Liberia Shipping<strong>PT</strong> Cibinong Center Industrial Estate Indonesia Development of industrial estates<strong>PT</strong> Indominco Mandiri Indonesia Coal mining<strong>PT</strong> Wisma Nusantara International Indonesia Hotel operations and office space rental<strong>PT</strong> Citra Marga Nusaphala Persada <strong>Tbk</strong>. Indonesia Operations of toll highway<strong>PT</strong> Indo Clean Set Cement Indonesia Production of special cementThe details of equity in net earnings (losses) of investees, net of goodwill amortization, for theperiods ended March 31, 2000 and 1999 are as follows:2000 1999Rp Rp<strong>PT</strong> Wisma Nusantara International 5,311,124,788 20,514,867,458<strong>PT</strong> Indotek Engico 170,363,854 516,109,522Stillwater Shipping Corporation 754,453,724 -<strong>PT</strong> Pioneer Beton Industri (351,384,381) (412,821,672)Total 5,884,557,985 20,618,155,308

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 21 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)9. PROPERTY, PLANT AND EQUIPMENTProperty, plant and equipment consist of:2000Additions/Disposals/Beginning Balance Reclassifications Reclassification Ending BalanceRp Rp Rp RpCarrying ValueLandrights and land improvements 200,866,692,458 28,031,512,943 - 228,898,205,401Leasehold improvements 1,904,449,250 30,581,570 - 1,935,030,820Quarry 55,833,081,247 1,132,461,050 - 56,965,542,297Buildings and structures 724,541,209,945 478,516,885,080 5,934,720,122 1,197,123,374,903Machinery and equipment 2,093,711,834,506 1,119,545,012,413 85,145,547 3,213,171,701,372Transportation equipment 218,065,881,242 4,406,155,671 1,796,115,032 220,675,921,881Furniture, fixtures and office equipment 80,014,148,752 6,181,593,705 992,707,159 85,203,035,298Tools and other equipment 28,917,315,038 678,946,722 6,249,143 29,590,012,617Assets under capital lease 42,019,726,200 - - 42,019,726,200Construction in progress 5,071,240,032,501 273,875,788,529 1,622,980,104,908 3,722,135,716,122Total Carrying Value 8,517,114,371,139 1,912,398,937,683 1,631,795,041,911 8,797,718,266,911Accumulated Depreciation, Amortizationand DepletionLand improvements 13,029,348,954 267,887,605 - 13,297,236,559Leasehold improvements 1,784,070,290 52,436,313 - 1,836,506,603Quarry 6,825,278,941 262,157,980 - 7,087,436,921Building and structures 230,527,425,858 10,800,480,226 16,468,848.00 241,311,437,236Machinery and equipment 887,967,340,472 30,851,539,996 11,688,594 918,807,191,874Transportation equipment 164,919,059,139 7,664,606,529 1,190,836,260 171,392,829,408Furniture, fixtures and office equipment 61,988,451,141 1,563,960,668 297,258,543 63,255,153,266Tools and others equipment 22,228,418,612 601,807,514 5,478,953 22,824,747,173Assets under capital lease 28,449,604,206 222,461,015 - 28,672,065,221Total Accumulated Depreciation,Amortization and Depletion 1,417,718,997,613 52,287,337,846 1,521,731,198 1,468,484,604,261Net Book Value 7,099,395,373,526 7,329,233,662,6501999Additions/Disposals/Beginning Balance Reclassifications Reclassification Ending BalanceRp Rp Rp RpCarrying ValueLandrights and land improvements 160,140,000,401 58,006,915,683 - 218,146,916,084Leasehold improvements 1,962,180,836 41,193,128 - 2,003,373,964Quarry 45,250,525,922 1,925,471,961 23,642,011 47,152,355,872Buildings and structures 718,989,389,603 2,936,029,094 51,447,084 721,873,971,613Machinery and equipment 2,006,685,886,124 2,089,023,531 1,450,232,365 2,007,324,677,290Transportation equipment 218,456,180,944 2,812,482,406 195,666,492 221,072,996,858Furniture, fixtures and office equipment 75,100,039,443 1,123,000,675 17,528,496 76,205,511,622Tools and other equipment 25,966,362,778 1,306,194,771 8,220,131 27,264,337,418Assets under capital lease 42,019,726,200 - - 42,019,726,200Construction in progress 5,270,249,954,248 469,193,109,482 - 5,739,443,063,730Total Carrying Value 8,564,820,246,499 539,433,420,731 1,746,736,579 9,102,506,930,651

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 22 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)1999Additions/Disposals/Beginning Balance Reclassifications Reclassification Ending BalanceRp Rp Rp RpAccumulated Depreciation, Amortizationand DepletionLand improvements 11,944,897,316 287,224,253 - 12,232,121,569Leasehold improvements 1,690,942,975 63,784,271 - 1,754,727,246Quarry 5,903,028,234 216,683,332 - 6,119,711,566Building and structures 205,398,172,927 6,408,860,917 - 211,807,033,844Machinery and equipment 811,106,575,593 18,520,269,105 - 829,626,844,698Transportation equipment 143,029,163,631 8,177,733,272 52,750,120 151,154,146,783Furniture, fixtures and office equipment 53,389,095,475 2,612,262,440 9,943,715 55,991,414,200Tools and others equipment 20,130,826,886 558,541,360 7,927,681 20,681,440,565Assets under capital lease 16,565,506,455 528,275,323 - 17,093,781,778Total Accumulated Depreciation,Amortization and Depletion 1,269,158,209,492 37,373,634,273 70,621,516 1,306,461,222,249Net Book Value 7,295,662,037,007 7,796,045,708,402Foreign currency translation adjustments amounting to Rp 241,491,340,973 and Rp 307,141,580,883as of March 31, 2000 and 1999, respectively, which mainly arise from the translation of IKC’sUS Dollar financial statements into Rupiah, are presented as part of “Additions/Reclassifications” inthe above analysis of property, plant and equipment account.Construction in progress consists of:2000 1999Land under development Rp 626,370,117 Rp 626,370,117Buildings under construction 111,628,715,242 2,318,501,474,441Machinery under installation 3,589,000,887,331 2,709,946,539,116Others 20,879,743,432 720,368,680,056Total Rp 3,722,135,716,122 Rp 5,739,443,063,730A significant portion of the above construction in progress represents the accumulated costs of IKC’scement plant and related facilities and infrastructure under construction (see Note 20f). As ofMarch 31, 2000, the full completion and/or final commissioning of the said cement plant is still onhold due to certain major technical problems noted during the cement plant’s trial production runs.IKC is currently negotiating with its project suppliers and main contractors for the resolution of suchproblems.Property, plant and equipment are used as collateral to secure short-term loans and long-term debts(see Notes 10 and 13).Depreciation, amortization and depletion charges totalled to Rp 52,287,337,846 andRp 36,462,487,599 for periods ended March 31, 2000 and 1999, respectively.The Company and Subsidiaries insure their property, plant and equipment and inventories againstlosses by fire and other insurable risks under several policies with insurance coverage totallingRp 153,628,446,530 and US$ 1,615,153,770 as of March 31, 2000. In management’s opinion, the

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 23 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)said amount of insurance coverage is adequate to cover any possible losses that may arise from theinsured risks.The Company and Subsidiaries owned HGB (Hak Guna Bangunan) and HP (Hak Pakai) coveringapproximately 7,343 hectares of land at several locations in Indonesia, with legal terms ranging from8 to 30 years. Management is of the opinion that these titles of landright ownership can be extendedupon their expiration.As of March 31, 2000, the title of ownership on the Company‘s land located at Citeureup, West Java,with a carrying value of Rp 49,840,721,490 and covering approximately 1,349 hectares, is still inprocess. Total costs incurred in connection with the processing of the said title of ownershipamounted to Rp 8,812,266,420 and is presented as “Deferred Landrights Acquisition Costs” in theconsolidated balance sheets.10. SHORT-TERM LOANSShort-term loan represents working capital loan from <strong>PT</strong> Bank Mandiri (formerly under the name of<strong>PT</strong> Bank Pembangunan Indonesia), which bears interest at annual rates of 34% in 2000 and 34% in1999. This loan is collateralized by inventories, and property, plant, and equipment (see Notes 7and 9).11. ACCOUNTS PAYABLE - TRADEThis account consists of the following:2000 1999Rp RpRelated Parties (see Note 6)RupiahOthers (each below Rp. 1,000,000,000) 103,182,247 386,087,719Third PartiesRupiahParna Raya 7,480,631,291 -Indoporlen Kitadin 2,628,509,140 131,100,000Bahari Cakrawala Sebuku 1,996,963,072 -Pelitama Pakindo 1,952,438,000 -Sumber Kencana 1,597,385,497 1,227,198,342Kitadin 1,559,476,141 -Multi Harapan Utama 1,515,678,365 -Dahana (Persero) 1,002,217,993 823,503,788Petro Kimia Gresik 469,701,180 2,188,669,400Fajar Mas Murni 16,242,800 4,528,955,013Others (each below Rp. 1,000,000,000) 17,392,382,826 19,515,651,115Sub-total 37,611,626,305 28,415,077,658

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 24 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)2000 1999Foreign CurrenciesPertamina 11,521,964,979 4,604,127,809Didier Werke 10,385,726,529 20,826,792,322Refratechnik 6,622,165,760 9,793,905,632Vietcher Magnesit 3,471,799,655 5,451,252,065United Engineering 1,423,125,000 -ABB Industri 359,974,118 4,900,684,950SEMT Pielstick 343,477,526 1,475,478,930Others (each below Rp. 1,000,000,000) 1,172,211,795 1,685,896,892Sub-total 35,300,445,362 48,738,138,600Total 72,912,071,667 77,153,216,258Trade payables mostly arise from purchases of raw materials and other supporting materials. Themain suppliers of the Company are as follows:SupplierTopnicheAnker Far EastVeitscher Magnesitwerke V.C.M.H.HRefratechnik GmbHDidier Werke<strong>PT</strong> Fajar Mas MurniPertambangan Minyak dan Gas Negara<strong>PT</strong> Sumberkencana EkspressindoMagotteaux Co. LtdProductGypsumCoalFirebricksFirebricksFirebricksPaper BagFuelIron Sand, Silica Sand and Pyrate CynderSteel Ball

These Consolidated Financial Statements are Originally Issued in Indonesian Language.12. TAXES PAYABLE- 25 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)Taxes payable consists of:2000 1999Rp RpIncome taxesArticle 21 986,004,542 1,082,400,299Article 22 509,250,256 203,495,050Article 23 399,248,370 405,577,912Article 26 288,216,241 3,748,860,103Corporate income tax 250,557,248 153,101,880Value Added Tax 10,281,782,147 2,373,040,058Others 9,288 -Total 12,715,068,092 7,966,475,302A reconciliation between income (loss) before provision for income tax, as shown in the consolidatedstatements of income, and estimated taxable income (fiscal loss) for the periods ended March 31,2000 and 1999 is as follows:2000 1999Rp RpLoss before provision for income taxper consolidated statements of income (238,104,455,942) (306,463,924,603)Add (deduct) :Income of subsidiaries beforeprovision for income tax - net (8,159,690,188) (1,283,282,702)Net income of Other Businesses alreadysubjected to final tax (5,735,767,050) (5,178,539,038)Loss before provision for income taxattributable to the company (251,999,913,180) (312,925,746,343)Add (deduct) :Timing differences (22,485,854,426) 4,779,568,749Non-deductible expenses (mainly consist ofemployees' benefits, donations and publicrelations expenses) 3,225,638,778 2,531,574,693Equity in net earnings of investees (5,884,557,985) (20,618,155,308)Income already subjected to final tax (21,751,145,316) (9,790,344,418)Loss (gain) on short-term investments 99,750,000 (12,669,517,193)Estimated tax loss of the company - current period (298,796,082,129) (348,692,619,820)Tax loss carry forward from prior year (1,735,194,852,588) (2,459,706,693,774)Total tax loss carry forward - end of period (2,033,990,934,717) (2,808,399,313,594)

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 26 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)Under existing tax regulations, the prescription period for tax loss carry forward is five years fromthe date the tax loss occurred.The computation of the provision for income tax is as follows:2000 1999Rp RpTotal tax loss carry forward (2,033,990,934,717) (2,808,399,313,594)Provision for income tax - currentCompany - -Subsidiaries 107,782,184 -Total provision for income tax - current 107,782,184 -Provision for income tax - deferredCompanyFiscal losses (89,638,824,639) (104,607,785,946)Depreciation of fixed assets 7,024,761,159 (1,260,216,390)Sale and leaseback transactions 19,006,769 7,703,865Sub-total(82,595,056,711) (105,860,298,471)Subsidiary 3,626,701,968 443,981,830Total provision for income tax - deferred (78,968,354,743) (105,416,316,641)Provision for Income Tax perConsolidated Statements of IncomeCurrent 107,782,184 -Deferred (78,968,354,743) (105,416,316,641)Net (78,860,572,559) (105,416,316,641)In 1998, the Tax Office approved to refund a substantial portion of the Company’s 1997 claims fortax refund amounting to Rp 88,693,535,771. In addition, the Company has also received severalwitholding tax assessments for 1997 and for the first six months of 1998, which require the Companyto pay additional tax and penalty totalling Rp 12,097,798,062. Out of the said total amount ofassessment , Rp 10,717,374,690 is contested by the Company.The above-mentioned approved tax refund is paid in cash and received by the Company in 1999 inthe amount of Rp 33,381,140,741 (after offsetting the Company’s additional tax and penaltymentioned above and the Company’s outstanding income tax payable Article 25 and penalty forfiscal year 1998).In January 2000, the Tax Office approved to refund the Company’s 1998 claims for tax refundamounting to Rp 83,591,401,846. During 1999 and the period from January 1, 2000 up to theindependent auditors’ report date, the Company has also received several witholding tax assessmentsfor the second semester of 1998, whereby according to the Tax Office, the Company has to payadditional tax and penalty totalling Rp 6,967,452,371. Out of the said total amount of assessment,Rp 5,698,564,853 will be contested by the Company.

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 27 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)Furthermore, the Company’s corporate income tax for 1998 and 1997 had been examined by TaxOffice. On February 3, 1999, the Company contested the results of the Tax Office’s income taxexamination for fiscal year 1997 amounting to Rp 318.5 billion.The deferred tax effects of the significant timing differences between commercial and fiscal reportingare as follows:2000 1999Rp RpDeferred tax assetsCompanyFiscal loss carried forward 610,197,280,416 842,519,794,079Allowances for doubtful accounts andinventory obsolescence 1,245,115,062 1,245,115,062Sub-total 611,442,395,478 843,764,909,141Subsidiary 3,999,026,790 23,919,784,065Total 615,441,422,268 867,684,693,206Deferred tax liabilitiesCompanyProperty, plant and equipment 235,760,920,211 228,886,017,566Sales and leaseback transaction 167,453,021 482,509,176Sub-total 235,928,373,232 229,368,526,742Subsidiary 780,555,600 851,226,403Total 236,708,928,832 230,219,753,145Deferred Tax Assets - Net 378,732,493,436 637,464,940,061Management is of the opinion that the above deferred tax assets can be fully recovered through futuretaxable income.13. LONG-TERM DEBTSa. Bank LoansBank loans consist of the following:2000 1999Rp RpRupiah :<strong>PT</strong> Bank Central Asia (BCA) 95,241,057,709 95,241,057,709<strong>PT</strong> Bank Mandiri (formerly under the name<strong>PT</strong> Bank Pembangunan Indonesia) 40,430,345,466 40,430,345,466<strong>PT</strong> Bank Mitsubishi Buana (BMB) 20,000,000,000 20,000,000,000

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 28 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)2000 1999Rp RpForeign currencies :Syndicated offshore loan 2,325,576,000,000 2,661,084,000,000The Export - Import Bank of Japan (Japan 896,795,242,107 966,300,356,714Exim Bank)Marubeni General Leasing Corporation (MGLC) 788,971,012,500 902,794,893,750The Chase Manhattan Bank, New York (CMB) 759,000,000,000 868,500,000,000Bank of America NT and SA, Taipei (BOA) 759,000,000,000 868,500,000,000The Chase Manhattan South East Ltd.,Singapore (CMSE) 324,852,000,000 371,718,000,000Fuji Bank Limited, Singapore (Fuji) 303,600,000,000 347,400,000,000Yasuda Trust and Banking Co., Ltd.,Singapore (Yasuda) 265,650,000,000 303,975,000,000Chase Investment Bank Limited (CIBL) 197,186,619,066 251,997,708,134Bank of Tokyo - Mitsubishi Ltd., Singapore 189,750,000,000 217,125,000,000(BOTM)The Tokai Bank Ltd., Singapore (Tokai) 189,750,000,000 217,125,000,000Marubeni Corporation (Marubeni) 97,065,611,683 111,069,148,546Export Finance and Insurance Corporation68,525,252,400 78,411,306,600(EFIC)Marubeni Corporation (Marubeni) 67,317,543,114 -Total 7,388,710,684,045 8,321,671,816,919Less Portions Currently DueRupiah loans 155,671,403,175 155,671,403,175Foreign currencies 7,233,039,280,870 8,166,000,413,744Total 7,388,710,684,045 8,321,671,816,919Long-term Portion - -The balances of the above foreign currency denominated loans in their original currencies are asfollows:2000 1999Syndicated offshore loan US$ 306,400,000 US$ 306,400,000Japan Exim Bank Yen 12,475,953,503 Yen 13,412,455,503MGLC US$ 103,948,750 US$ 103,948,750CMB US$ 100,000,000 US$ 100,000,000BOA US$ 100,000,000 US$ 100,000,000CMSE US$ 42,800,000 US$ 42,800,000Fuji US$ 40,000,000 US$ 40,000,000Yasuda US$ 35,000,000 US$ 35,000,000CIBL ITL 52,480,935,530 ITL 52,480,935,530

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 29 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)2000 1999BOTM US$ 25,000,000 US$ 25,000,000Tokai US$ 25,000,000 US$ 25,000,000Marubeni US$ 12,788,618 US$ 12,788,618EFIC US$ 9,028,360 US$ 9,028,360Marubeni Yen 936,502,000 Yen -The above indebtedness bear interest at the following annual rates:2000 1999Rupiah 17.87% to 41.00% 17.87% to 41.00%US Dollar 6.6% to 10.48% 6.6% to 11.11%Italian Lira 8.8% 7.35%Japanese Yen 2.3% 2.3%The loans from MGLC and Marubeni are used to finance the construction of the Company’scement plant facility (Plant 10).The Company obtained a loan facility from the Japan Exim Bank with maximum credit limitamounting to ¥ 14,984,029,840. This facility is used to finance about 85% of the total cost ofimported machinery and equipment relating to the construction of the Company’s cement plantfacility (Plant 11), as discussed in Note 20e.IKC obtained US$ 345,000,000 syndicated offshore loan facilities arranged by Banque Nationalede Paris, The Fuji Bank Limited, Korea Exchange Bank, and The Mitsubishi Bank Limited,which also act as the security agent, facility agent, insurance agent, and technical agent,respectively. The said credit facilities are divided into four (4) tranches (A, B, C, and D) with thefollowing terms:• Tranches A and B amounting to US$ 117,240,000 and US$ 78,160,000, respectively, whichwill be repaid in fifteen (15) semi-annual installments of US$ 7,816,000 and US$ 5,211,000,respectively, starting from January 20, 1999 until January 20, 2006.• Tranches C and D amounting to US$ 72,477,194 and US$ 38,522,806, respectively. Thesetranches will be repaid in fifteen (15) semi-annual installments; the first two of suchinstallments being an aggregate of US$ 5,000,000 each prorated between the two tranches,and the remaining thirteen (13) installments being an aggregate of US$ 7,769,231 eachprorated between the two tranches.These loan facilities, which bear interest at LIBOR (London Inter-bank Offered Rate) plusbank’s margin, shall only be used specifically to finance the project construction costs,equipment and start-up costs, import duties and initial working capital of IKC.The loans obtained by the Company from Fuji, CMB, BOA, Yasuda and BOTM also representsyndicated loans from various financial institutions.All the other loans, as enumerated below, are mostly obtained to finance the general fundrequirements of the Company

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 30 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)Name of Banks Security Date of Maturity<strong>PT</strong> Bank Mandiri Plant 1, 2 and 9; and inventories December 25, 2000of Plant 9BCA (Rp 27.5 billion) Plant 1 – 5 March 25, 2001BCA (+/- Rp 67.7 billion) Plant 1 – 5 December 12, 1998BMB Negative pledge March 12, 2001Fuji Negative pledge July 20, 1998Syndicated off-shore loan Property, plant and equipment January 20, 2006of IKCJapan Exim Bank Plant 11 June 26, 2007MGLC Plant 10 July 1, 2005CMB Negative pledge May 19, 2002BOA Negative pledge May 19, 2002CMSE Negative pledge October 6, 2002Yasuda Negative pledge September 12, 2001CIBL Property, plant and equipment March 31, 2002BOTM Negative pledge July 1, 2005Tokai Negative pledge September 25, 2001Marubeni Plant 10, corporate guarantee by July 1, 1999<strong>PT</strong> Mekar PerkasaEFIC Property, plant and equipment October 15, 2006Certain loan agreements contain terms and conditions requiring the Company and the concernedSubsidiaries to obtain prior written consent from the lenders with respect to changes in theCompany’s and the concerned Subsidiaries’ legal status, the composition of their board ofdirectors and their capital structure; and incurrence of significant capital expenditures in excessof certain specified amounts. In addition, the following financial ratios are required to bemaintained:- Ratio of consolidated total liabilities to consolidated tangible net worth should not be morethan 3 : 1- Ratio of consolidated total current assets to consolidated current liabilities should be at least0.8 : 1- Interest coverage ratio should be at least 2 : 1- Consolidated tangible net worth will not at any time be less than Rp 1,500,000,000,000As a result of the extraordinary Rupiah depreciation discussed in Note 21, as of March 31, 2000and 1999, certain of the above required financial ratios are not maintained. Starting July 1998,the Company and Subsidiaries have taken a standstill position and ceased all of their loanprincipal and interest payments. Up to March 31, 2000, no formal waivers for such noncompliancehave been obtained from the creditors. As provided for in the covering loanagreements, such non-compliance with the loan covenants render all of the subject loansimmediately due and payable, and therefore, were reclassed and presented in the consolidatedbalance sheets as part of current liabilities as of March 31, 2000 and 1999 in accordance withgenerally accepted accounting principles.Unpaid interest expenses amounted to Rp 934,956,461,080 and Rp 478,074,815,139 as ofMarch 31, 2000 and 1999, respectively, which are presented as part of “Accrued Expenses” inthe consolidated balance sheets.The Company and a Steering Committee representing the creditors are currently in the process ofnegotiating for the debt restructuring (see Note 21).

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 31 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)b. Obligation Under Capital LeaseThe Company has lease commitments covering certain buildings expiring in 1999. Obligationunder capital lease are collateralized by the related assets.c. OthersOn October 1, 1999, DAP entered into a “Transfer and Assignment of Contract Agreement” withCMB, whereby CMB agreed to irrevocably sell, transfer, assign, grant and convey to DAP,without recourse, all of CMB’s rights on its loan receivables from STRP for a total considerationof US$ 3.0 million, which shall be settled through an initial payment of US$ 800,000 and five (5)equal semi-annual installments for the remaining balance. The agreement further provides thatany collections made by DAP from the aforesaid loan receivables transferred in excess ofUS$ 3.0 million shall be shared by DAP and CMB on a 50:50 basis. As of March 31, 2000, thebalance of the long-term payable to CMB in connection with the said transaction amounted toUS$ 2.2 million, which is scheduled to be paid as follows:YearInstallment Amount2000 US$ 880,0002001 880,0002002 440,000US$ 2,200,00014. CAPITAL STOCKThe details of share ownership list based on share registrar are as follows:2000Number Precentageof Shares of AmountShareholders Issued Ownership% Rp<strong>PT</strong> Mekar Perkasa 1,390,953,604 57.60% 695,476,802,000Government of the Republic of Indonesia 621,128,380 25.73% 310,564,190,000<strong>PT</strong> Kaolin Indah Utama 106,600,820 4.42% 53,300,410,000Public and cooperatives 295,770,516 12.25% 147,885,258,000Total 2,414,453,320 100.00% 1,207,226,660,000

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 32 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)1999Number Precentageof Shares of AmountShareholders Issued Ownership% Rp<strong>PT</strong> Mekar Perkasa 1,396,298,604 57.83 698,149,302,000Government of the Republic of Indonesia 621,128,380 25.73 310,564,190,000<strong>PT</strong> Kaolin Indah Utama 106,600,820 4.42 53,300,410,000Public and cooperatives 290,425,516 12.02 145,212,758,000Total 2,414,453,320 100.00 1,207,226,660,000The Company’s shares are listed in Jakarta and Surabaya Stock Exchanges.15. ADDITIONAL PAID-IN CAPITALThis account represents the excess of the amounts received or the carrying value of converteddebentures and bonds over the par value of the shares issued.16. SEGMENT INFORMATIONThe information concerning the Company and Subsidiaries’ business segments are as follows:2000 1999Rp RpNet RevenuesCement BusinessCementDomestic 1,004,454,807,228 315,084,121,033Export 55,223,896,326 66,571,683,649Ready Mix Concrete 3,766,270,597 3,091,568,824Other Businesses 7,768,485,198 7,631,274,732Total 1,071,213,459,349 392,378,648,238Eliminations (532,461,323,236) (5,733,965,528)Net 538,752,136,113 386,644,682,710Cost of RevenuesCement BusinessCement 852,734,088,524 272,118,283,142Ready Mixed Concrete 4,473,316,344 3,188,415,216Other Businesses 2,722,098,551 2,793,991,357Total 859,929,503,419 278,100,689,715

These Consolidated Financial Statements are Originally Issued in Indonesian Language.- 33 -<strong>PT</strong> <strong>INDOCEMENT</strong> <strong>TUNGGAL</strong> <strong>PRAKARSA</strong> <strong>Tbk</strong>. AND SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)2000 1999Rp RpEliminations (528,336,955,112) (1,777,752,278)Net 331,592,548,307 276,322,937,437Income (loss) from OperationsCement BusinessCement 162,710,359,223 62,709,899,819Ready Mixed Concrete (1,364,745,748) (636,057,205)Other Businesses 4,472,015,996 4,023,779,807Total 165,817,629,471 66,097,622,421Eliminations 537,119,976 -Net 166,354,749,447 66,097,622,421Identifiable AssetsCement BusinessCement 10,623,024,410,750 10,001,494,156,578Ready Mixed Concrete 124,151,839,566 143,215,452,667Other Businesses 1,638,821,668,973 1,711,160,269,748Total 12,385,997,919,289 11,855,869,878,993Eliminations (1,950,484,180,181) (1,498,995,089,373)Net 10,435,513,739,108 10,356,874,789,62017. COST OF REVENUESThe details of cost of revenues are as follows:2000 1999Rp RpRaw materials used 82,313,711,182 35,346,969,232Direct labor 17,436,851,329 23,833,519,302Fuel and power 121,103,986,285 109,851,871,213Manufacturing overhead 84,393,746,838 57,840,661,297Total Manufacturing Cost 305,248,295,634 226,873,021,044Work in Process InventoryAt beginning of period 56,396,396,078 44,749,275,187At end of period (56,823,931,420) (50,626,501,443)Cost of Goods Manufactured 304,820,760,292 220,995,794,788