IFTA Quarterly Fuel Use Tax Return - Kentucky Transportation Cabinet

IFTA Quarterly Fuel Use Tax Return - Kentucky Transportation Cabinet

IFTA Quarterly Fuel Use Tax Return - Kentucky Transportation Cabinet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

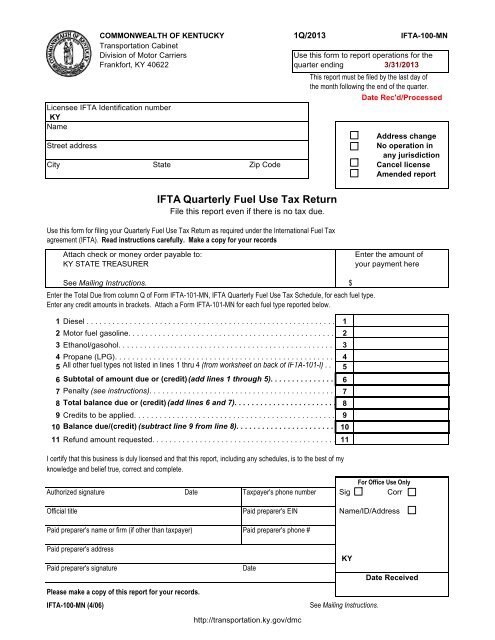

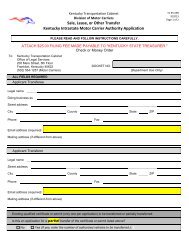

COMMONWEALTH OF KENTUCKY 1Q/2013 <strong>IFTA</strong>-100-MN<strong>Transportation</strong> <strong>Cabinet</strong>Division of Motor Carriers<strong>Use</strong> this form to report operations for theFrankfort, KY 40622 quarter ending 3/31/2013This report must be filed by the last day ofthe month following the end of the quarter.Date Rec'd/ProcessedLicensee <strong>IFTA</strong> Identification numberKYNameAddress changeStreet addressNo operation inany jurisdictionCity State Zip Code Cancel licenseAmended report<strong>IFTA</strong> <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> <strong>Return</strong>File this report even if there is no tax due.<strong>Use</strong> this form for filing your <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> <strong>Return</strong> as required under the International <strong>Fuel</strong> <strong>Tax</strong>agreement (<strong>IFTA</strong>). Read instructions carefully. Make a copy for your records.Attach check or money order payable to:KY STATE TREASUREREnter the amount ofyour payment hereSee Mailing Instructions. $Enter the Total Due from column Q of Form <strong>IFTA</strong>-101-MN, <strong>IFTA</strong> <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> Schedule, for each fuel type.Enter any credit amounts in brackets. Attach a Form <strong>IFTA</strong>-101-MN for each fuel type reported below.1 Diesel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. . . . . . . . . . . .2 Motor fuel gasoline. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . . . . . . . . . . . . . . . . .3 Ethanol/gasohol. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . . . . . . . . . . . .4 Propane (LPG). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. . . . . . . . . . . . .5 All other fuel types not listed in lines 1 thru 4 (from worksheet on back of <strong>IFTA</strong>-101-I) . . 56 Subtotal of amount due or (credit) (add lines 1 through 5). . . . . . . . . . . . . . . 67 Penalty (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. . . . . . . . . . . . . . .8 Total balance due or (credit) (add lines 6 and 7). . . . . . . . . . . . . . . . . . . . . . . . 89 Credits to be applied. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. . . . . . . . . . . . . ")10 Balance due/(credit) (subtract line 9 from line 8). . . . . . . . . . . . . . . . . . . . . . . 1011 Refund amount requested. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 . . . . . . . . . . . . . . .I certify that this business is duly licensed and that this report, including any schedules, is to the best of myknowledge and belief true, correct and complete.For Office <strong>Use</strong> OnlyAuthorized signature Date <strong>Tax</strong>payer's phone number Sig CorrOfficial title Paid preparer's EIN Name/ID/AddressPaid preparer's name or firm (if other than taxpayer) Paid preparer's phone #Paid preparer's addressPaid preparer's signatureDatePlease make a copy of this report for your records.<strong>IFTA</strong>-100-MN (4/06)http://transportation.ky.gov/dmcKYSee Mailing Instructions.Date Received

<strong>Kentucky</strong> <strong>Transportation</strong> <strong>Cabinet</strong> 1Q/2013<strong>IFTA</strong> <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> Schedule<strong>IFTA</strong>-101<strong>Tax</strong> on <strong>Fuel</strong> Type: D (Diesel) Attach this schedule to Form <strong>IFTA</strong>-100, <strong>Use</strong> this form to report operations<strong>IFTA</strong> <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> <strong>Return</strong>. for the quarter ending 3/31/2013Prepare a separate schedule for each fuel type. <strong>Use</strong> Date due 4/30/2013additional sheets if necessary. Make a copy for your records.Date ProcessedLicensee <strong>IFTA</strong> Identification numberNameKYRound to the nearest whole gallon or mile. Read instructions (<strong>IFTA</strong>-101-I) carefully.Total Total Average(A) <strong>IFTA</strong> Miles + (B) Non-<strong>IFTA</strong> Miles = (C) Total Miles / (D) Total Gallons = (E) Fleet MPG(all <strong>IFTA</strong> and Non-<strong>IFTA</strong> jurisdictions)(2 decimal places)(A) (B) = (C) / (D) = (E)Enter credits in brackets([ ]).F G H I J K L M N O P QRate <strong>Tax</strong>able MPG <strong>Tax</strong>able <strong>Tax</strong> Paid Net <strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong> (Credit) Due InterestJurisdiction Code <strong>IFTA</strong> Miles Miles from E Gallons Gallons Gallons Rate (col. M x N (<strong>Tax</strong>)) Due Total Dueabove (col. I / J) (col. K - L) (col. K x N (Surch)) (col. O + P)SubtotalsSubtotals from continuationTotals

Licensee <strong>IFTA</strong> Identification numberKY<strong>IFTA</strong> <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> Schedule<strong>Use</strong> this form to report operationsfor the quarter ending 3/31/2013DIESEL - Continuation-2 Date due 4/30/2013Date ProcessedNameTotal Total Average(A) <strong>IFTA</strong> Miles + (B) Non-<strong>IFTA</strong> Miles = (C) Total Miles / (D) Total Gallons = (E) Fleet MPG(all <strong>IFTA</strong> and Non-<strong>IFTA</strong> jurisdictions)(2 decimal places)(A) + (B) = (C) / (D) = (E)Enter credits in brackets([ ]).F G H I J K L M N O P QRate <strong>Tax</strong>able MPG <strong>Tax</strong>able <strong>Tax</strong> Paid Net <strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong> (Credit) Due InterestJurisdiction Code <strong>IFTA</strong> Miles Miles from E Gallons Gallons Gallons Rate (col. M x N (<strong>Tax</strong>)) Due Total Dueabove (col. I / J) (col. K - L) (col. K x N (Surch)) (col. O + P)Totals

Licensee <strong>IFTA</strong> Identification numberKY<strong>IFTA</strong> <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> Schedule<strong>Use</strong> this form to report operationsfor the quarter ending 3/31/2013DIESEL - Continuation-3 Date due 4/30/2013Date ProcessedNameTotal Total Average(A) <strong>IFTA</strong> Miles + (B) Non-<strong>IFTA</strong> Miles = (C) Total Miles / (D) Total Gallons = (E) Fleet MPG(all <strong>IFTA</strong> and Non-<strong>IFTA</strong> jurisdictions)(2 decimal places)(A) + (B) = (C) / (D) = (E)Enter credits in brackets([ ]).F G H I J K L M N O P QRate <strong>Tax</strong>able MPG <strong>Tax</strong>able <strong>Tax</strong> Paid Net <strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong> (Credit) Due InterestJurisdiction Code <strong>IFTA</strong> Miles Miles from E Gallons Gallons Gallons Rate (col. M x N (<strong>Tax</strong>)) Due Total Dueabove (col. I / J) (col. K - L) (col. K x N (Surch)) (col. O + P)Total

<strong>Kentucky</strong> <strong>Transportation</strong> <strong>Cabinet</strong> 1Q/2013<strong>IFTA</strong> <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> Schedule<strong>IFTA</strong>-101<strong>Tax</strong> on <strong>Fuel</strong> Type: G (Gasoline) Attach this schedule to Form <strong>IFTA</strong>-100, <strong>Use</strong> this form to report operations<strong>IFTA</strong> <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> <strong>Return</strong>. for the quarter ending 3/31/2013Prepare a separate schedule for each fuel type. <strong>Use</strong> Date due 4/30/2013additional sheets if necessary. Make a copy for your records.Date ProcessedLicensee <strong>IFTA</strong> Identification numberNameKYRound to the nearest whole gallon or mile. Read instructions (<strong>IFTA</strong>-101-I) carefully.Total Total Average(A) <strong>IFTA</strong> Miles + (B) Non-<strong>IFTA</strong> Miles = (C) Total Miles / (D) Total Gallons = (E) Fleet MPG(all <strong>IFTA</strong> and Non-<strong>IFTA</strong> jurisdictions)(2 decimal places)(A) + (B) = (C) / (D) = (E)Enter credits in brackets([ ]).F G H I J K L M N O P QRate <strong>Tax</strong>able MPG <strong>Tax</strong>able <strong>Tax</strong> Paid Net <strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong> (Credit) Due InterestJurisdiction Code <strong>IFTA</strong> Miles Miles from E Gallons Gallons Gallons Rate (col. M x N (<strong>Tax</strong>)) Due Total Dueabove (col. I / J) (col. K - L) (col. K x N (Surch)) (col. O + P)Sub totalsSubtotals from continuationTotals

Licensee <strong>IFTA</strong> Identification numberKY<strong>IFTA</strong> <strong>Quarterly</strong> <strong>Fuel</strong> <strong>Use</strong> <strong>Tax</strong> Schedule<strong>Use</strong> this form to report operationsfor the quarter ending 3/31/2013GASOLINE - Continuation-2 Date due 4/30/2013Date ProcessedNameTotal Total Average(A) <strong>IFTA</strong> Miles + (B) Non-<strong>IFTA</strong> Miles = (C) Total Miles / (D) Total Gallons = (E) Fleet MPG(all <strong>IFTA</strong> and Non-<strong>IFTA</strong> jurisdictions)(2 decimal places)(A) + (B) = (C) / (D) = (E)Enter credits in brackets([ ]).F G H I J K L M N O P QRate <strong>Tax</strong>able MPG <strong>Tax</strong>able <strong>Tax</strong> Paid Net <strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong> (Credit) Due InterestJurisdiction Code <strong>IFTA</strong> Miles Miles from E Gallons Gallons Gallons Rate (col. M x N (<strong>Tax</strong>)) Due Total Dueabove (col. I / J) (col. K - L) (col. K x N (Surch)) (col. O + P)Totals

JD Jurisdiction FUEL_TYPE G-Gasoline-Rate G-Gasoline-US Code <strong>Tax</strong> Rate SurchargeAB Alberta GASOLINE 0071 0.3462 NAL Alabama GASOLINE 0069 0.16 NAR Arkansas GASOLINE 0071 0.215 NAZ Arizona GASOLINE 0071 0.18 NBC British Columbia GASOLINE 0070 0.8142 NCA California GASOLINE 0069 0 NCO Colorado GASOLINE 0071 0.22 NCT Connecticut GASOLINE 0069 0.25 NDE Delaware GASOLINE 0067 0.23 NFL Florida GASOLINE 0071 0.3087 NGA Georgia GASOLINE 0075 0.165 NIA Iowa GASOLINE 0071 0.21 NID Idaho GASOLINE 0069 0 NIL Illinois GASOLINE 0071 0.391 NIN Indiana GASOLINE 0141 0.18 NIN* SURCHARGE GASOLINE 0142 0.11 YKS Kansas GASOLINE 0071 0.24 NKY <strong>Kentucky</strong> GASOLINE 0133 0.285 NKY* SURCHARGE GASOLINE 0134 0.052 YLA Louisiana GASOLINE 0071 0.2 NMA Massachusetts GASOLINE 0069 0.21 NMB Manitoba GASOLINE 0072 0.5385 NMD Maryland GASOLINE 0069 0.235 NME Maine GASOLINE 0065 0 NMI Michigan GASOLINE 0070 0 NMN Minnesota GASOLINE 0072 0.285 NMO Missouri GASOLINE 0070 0.17 NMS Mississippi GASOLINE 0071 0.18 NMT Montana GASOLINE 0071 0 NNB New Brunswick GASOLINE 0069 0.5231 NNC North Carolina GASOLINE 0071 0.375 NND North Dakota GASOLINE 0071 0.23 NNE Nebraska GASOLINE 0071 0.246 NNH New Hampshire GASOLINE 0065 0 NNJ New Jersey GASOLINE 0067 0.145 NNL Newfoundland GASOLINE 0069 0.6346 NNM New Mexico GASOLINE 0069 0 NNS Nova Scotia GASOLINE 0070 0.5962 NNV Neveda GASOLINE 0069 0.23 NNY New York GASOLINE 0069 0.426 NOH Ohio GASOLINE 0111 0.28 NOK Oklahoma GASOLINE 0071 0.16 NON Ontario GASOLINE 0065 0.5654 NOR Oregon GASOLINE 0069 0 NPA Pennsylvania GASOLINE 0076 0.312 NPE Prince Edward Island GASOLINE 0070 0.6077 NQC Quebec GASOLINE 0069 0.7 NRI Rhode Island GASOLINE 0067 0.32 NSC South Carolina GASOLINE 0069 0.16 NSD South Dakota GASOLINE 0069 0 NSK Saskatchewan GASOLINE 0071 0.577 N

TN Tennessee GASOLINE 0071 0.2 NTX Texas GASOLINE 0071 0.2 NUT Utah GASOLINE 0071 0.245 NVA* SURCHARGE GASOLINE 0138 0.035 YVA Virginia GASOLINE 0137 0.175 NVT Vermont GASOLINE 0066 0 NWA Washington GASOLINE 0071 0.375 NWI Wisconsin GASOLINE 0071 0.329 NWV West Virginia GASOLINE 0069 0.347 NWY Wyoming GASOLINE 0071 0.14 N0 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 0

JD Jurisdiction FUEL_TYPE D-Diesel-Rate D-Diesel-US Code <strong>Tax</strong> Rate SurchargeAB Alberta DIESEL 0071 0.3462 NAL Alabama DIESEL 0069 0.19 NAR Arkansas DIESEL 0071 0.225 NAZ Arizona DIESEL 0080 0.26 NBC British Columbia DIESEL 0070 0.872 NCA California DIESEL 0069 0.445 NCO Colorado DIESEL 0071 0.205 NCT Connecticut DIESEL 0070 0.512 NDE Delaware DIESEL 0067 0.22 NFL Florida DIESEL 0071 0.3307 NGA Georgia DIESEL 0071 0.184 NIA Iowa DIESEL 0071 0.225 NID Idaho DIESEL 0071 0.25 NIL Illinois DIESEL 0071 0.43 NIN Indiana DIESEL 0141 0.16 NIN* SURCHARGE DIESEL 0142 0.11 YKS Kansas DIESEL 0071 0.26 NKY <strong>Kentucky</strong> DIESEL 0133 0.255 NKY* SURCHARGE DIESEL 0134 0.123 YLA Louisiana DIESEL 0071 0.2 NMA Massachusetts DIESEL 0069 0.21 NMB Manitoba DIESEL 0073 0.5385 NMD Maryland DIESEL 0069 0.2425 NME Maine DIESEL 0066 0.312 NMI Michigan DIESEL 0093 0.368 NMN Minnesota DIESEL 0072 0.285 NMO Missouri DIESEL 0071 0.17 NMS Mississippi DIESEL 0071 0.18 NMT Montana DIESEL 0071 0.2775 NNB New Brunswick DIESEL 0069 0.7384 NNC North Carolina DIESEL 0071 0.375 NND North Dakota DIESEL 0071 0.23 NNE Nebraska DIESEL 0071 0.246 NNH New Hampshire DIESEL 0065 0.18 NNJ New Jersey DIESEL 0067 0.175 NNL Newfoundland DIESEL 0069 0.6346 NNM New Mexico DIESEL 0071 0.21 NNS Nova Scotia DIESEL 0069 0.5923 NNV Neveda DIESEL 0071 0.27 NNY New York DIESEL 0069 0.4085 NOH Ohio DIESEL 0111 0.28 NOK Oklahoma DIESEL 0071 0.13 NON Ontario DIESEL 0065 0.55 NOR Oregon DIESEL 0069 0 NPA Pennsylvania DIESEL 0076 0.381 NPE Prince Edward Island DIESEL 0070 0.777 NQC Quebec DIESEL 0071 0.7384 NRI Rhode Island DIESEL 0067 0.32 NSC South Carolina DIESEL 0069 0.16 NSD South Dakota DIESEL 0071 0.22 NSK Saskatchewan DIESEL 0071 0.577 N

TN Tennessee DIESEL 0071 0.17 NTX Texas DIESEL 0071 0.2 NUT Utah DIESEL 0071 0.245 NVA* SURCHARGE DIESEL 0138 0.035 YVA Virginia DIESEL 0137 0.175 NVT Vermont DIESEL 0079 0.29 NWA Washington DIESEL 0071 0.375 NWI Wisconsin DIESEL 0071 0.329 NWV West Virginia DIESEL 0069 0.347 NWY Wyoming DIESEL 0071 0.14 N0 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00 0 0 0 0 0