Personal Property Declaration Forms - Town of South Windsor

Personal Property Declaration Forms - Town of South Windsor

Personal Property Declaration Forms - Town of South Windsor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Assessor’s Office«Service_Type», Connecticut201 <strong>Declaration</strong> <strong>of</strong> <strong>Personal</strong> <strong>Property</strong>Filing Requirement – This declaration must be filed with the Assessor <strong>of</strong> the town where the personal property is located. <strong>Declaration</strong>s <strong>of</strong>personal property shall be made annually.If you no lo nger own the a bove noted business or pers onal property assessed in your name last year, you do n ot need to com plete thisdeclaration. You must, however, return this declaration to the Assessor and provide information related to the name <strong>of</strong> the new owner <strong>of</strong> theproperty or the date your business ceased or to where you moved the business (see Affidavit below). Otherwise, the Assessor must assumethat you are still operating the business and still own and have failed to declare your taxable personal property.AFFIDAVIT OF BUSINESS TERMINATION OR MOVE OR SALE OF BUSINESS OR PROPERTYI <strong>of</strong> atBusiness or property owners name Business Name (if applicable) Street location in «<strong>Town</strong>»With regards to said business or property I do so certify that onSaid business or property was (indicate which one by circling):DateSOLD TO:NameAddressMOVED TO:City/<strong>Town</strong> and State to where business or property was movedAddressTERMINATED:Attach Bill <strong>of</strong> Sale or Letter <strong>of</strong> dissolution to this form and return it with this affidavit to the Assessor’s <strong>of</strong>ficeThe signer is made aware that the penalty for making a false affidavit is a $500.00 fine or imprisonment for one year or both.SignaturePrint namePenalty for late filing – Failure to file timely will result i n a penalty equal to 25% o f the assessment <strong>of</strong> the personal property. Thisdeclaration must be filed or postmarked (as defined in C.G.S. Sec 1-2a & as referenced in Sec. 12-41(d)) no later than:day, November , 201 Assessor’s Office

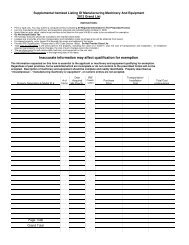

List or Account#:Owner’s Name:Assessment date October 1, 201Required return date November , 201LESSEE’S LISTING REPORT Pursuant to Connecticut General Statutes §12-57a all leased, borrowed, consigned, loaned, rented, or stored personalproperty not owned by you but in your possession as <strong>of</strong> the assessment date must be included on this form. Failure to declare, in the form and manner asherein prescribed, shall result in the presumption <strong>of</strong> ownership and subsequent tax liability plus penalties. <strong>Property</strong> you do not lease that may be in yourpossession and must be reported includes (but is not limited to) dumpsters, gas/propane tanks, vending machines, water coolers, c<strong>of</strong>fee machines.YesNoDid you dispose <strong>of</strong> any leased items that were in your possession on October 1, 201? Ifyes, enter a description <strong>of</strong> the property and the date <strong>of</strong> disposition in the space to the right. Did you acquire any <strong>of</strong> the leased items that were in your possession on October 1, 201?If yes, indicate previous lessor, item(s) and date(s) acquired in the space to the right.Is the cost <strong>of</strong> any <strong>of</strong> the equipment listed below declared anywhere else on this declaration? If yes, note year in the ‘Year Included’ row and listcost in the ‘Acquisition Cost’ row.Lease #1 Lease #2 Lease #3Name <strong>of</strong> LessorLessor’s addressPhone NumberLease NumberItem description /Model #Serial #Year <strong>of</strong>manufactureCapital Lease Yes No Yes No Yes No Lease Term –Beginning/EndMonthly rentAcquisition CostYear IncludedDISPOSAL, SALE OR TRANSFER OF PROPERTY REPORTDisposal, sale or transfer <strong>of</strong> property – If you disposed <strong>of</strong>, sold, or transferred a portion <strong>of</strong> the property included in last year’s filing, complete the DetailedListing Of Disposed Assets Report And Reconciliation Of Fixed Assets on page 6. If you no longer own the business noted on the cover sheet you do not needto complete this declaration. You must, however, return to the Assessor this declaration along with the complete AFFIDAVIT OF BUSINESS CLOSING OR MOVE OFBUSINESS OR SALE OF BUSINESS found in this return. DO NOT INCLUDE DISPOSALS IN TAXABLE PROPERTY REPORTING SECTION.DETAILED LISTING OF DISPOSED ASSETS COPY AND ATTACH ADDITIONAL SHEETS IF NEEDEDDate Removed Code # Description <strong>of</strong> Item Date Acquired Acquisition CostTAXABLE PROPERTY INFORMATION1) All data reported should be:a) Actual acquisition costs including any additional charges fortransportation and installation by year for each type <strong>of</strong> propertydescribed. These costs, less the standard depreciation asshown on the form will determine the net depreciated value.2) Include all assets that may have been fully depreciated, written <strong>of</strong>f, orcharged to expense but are still owned. Do not include disposedassets. All data reported should be:a) Actual acquisition costs including any additional charges fortransportation and installation by year for each type <strong>of</strong> propertydescribed. These costs, less the standard depreciation asshown on the form will determine the net depreciated value.3) Reports are to be filed on an assessment year basis <strong>of</strong> October 1.Acquisitions between October 2 and December 31 apply to the newyear. (i.e. acquisition made October 30, 201 is reported in the yearending October 1, 201).4) Computerized filings are acceptable as long as all information isreported in prescribed format.5) Do not include disposed assets. Disposals are used to reconcile lastyear’s reporting with this year’s reporting.Page 4

List or Account#:Owner’s Name:# 9 – Motor Vehicles Unregistered motor vehicles & vehiclesgaraged in Connecticut but registered in another stateVEHICLE 1 VEHICLE 2 VEHICLE 3 YearEnding#10 – Manufacturing machinery & equipment not eligibleunder CGS 12-81 (76) for exemptionOriginal cost, transportation& installation%GoodYearMake 10-1-13 95%Model 10-1-12 90%VIN 10-1-11 80%Length 10-1-10 70%Weight 10-1-09 60%Purchase $ 10-1-08 50%Date 10-1-07 40%Assessment date October 1, 201Required return date November , 201Depreciated ValuePrior Yrs 30% # 9Value Total Total #10#11 – Horses and Ponies #12 – Commercial Fishing Apparatus#1 #2 #3 YearEndingOriginal cost, transportation& installation%GoodBreedRegistered 10-1-13 95%Age 10-1-12 90%Sex 10-1-11 80%Quality 10-1-10 70%Breeding 10-1-09 60%Show 10-1-08 50%Pleasure 10-1-07 40%Depreciated ValueRacing Prior Yrs 30% #11Value Total Total #12#13 – Manufacturing machinery & equipment eligible underCGS 12-81(76) for exemption - must complete exempt claim.#14 – Mobile Manufactured Homes if not currently assessed asreal estateYear Original cost, transportation%#1 #2 #3Ending& installation Good Depreciated Value Year10-1-13 95% Make10-1-12 90% Model10-1-11 80% ID Number10-1-10 70% Length10-1-09 60% Width10-1-08 50% Bedrooms10-1-07 40% BathsPrior Yrs 30% #13Total Total Value #14#16 - Furniture, fixtures and equipment #16b – Equipment - technologically advancedYearEndingOriginal cost, transportation& installation%GoodYearEndingOriginal cost, transportation& installationDepreciated ValueDepreciated Value10-1-13 95% 10-1-13 95%10-1-12 90% 10-1-12 80%10-1-11 80% 10-1-11 60%10-1-10 70% 10-1-10 40%10-1-09 60% Prior Yrs 20%10-1-08 50% Total Total10-1-07 40%Prior Yrs 30%Total Total #16#17 – Farm Machinery #18 – Farm ToolsYear Original cost, transportation& installation Good Depreciated Value Ending portation & installation Good Depreciated Value%Year Original cost, trans- %Ending10-1-13 95% 10-1-13 95%10-1-12 90% 10-1-12 90%10-1-11 80% 10-1-11 80%10-1-10 70% 10-1-10 70%10-1-09 60% 10-1-09 60%10-1-08 50% 10-1-08 50%10-1-07 40% 10-1-07 40%Prior Yrs 30% Prior Yrs 30% #17Total Total Total Total #18%GoodAssessor’sUse OnlyPage 5

List or Account#:Owner’s Name:#19 – Mechanics Tools # 20 -- Electronic data processing equipmentYearEndingOriginal cost, transportation& installation%GoodIn accordance with Section 168 IRS CodesComputers OnlyAssessment date October 1, 201Required return date November , 201Depreciated Value10-1-13 95%10-1-12 90% Year Original cost, trans- %10-1-11 80%Ending portation & installation Good Depreciated Value10-1-10 70% 10-1-13 95%10-1-09 60% 10-1-12 80%10-1-08 50% 10-1-11 60%10-1-07 40% 10-1-10 40%Prior Yrs 30% Prior Yrs 20% #19Total Total Total Total #20#21a Telecommunication company equipment not technologicallyadvanced –include previously coded #21c propertywith #21aYearEndingOriginal cost, transportation& installation%Good#21b Telecommunication company equipment technologicallyadvanced–include previously coded #21d property with #21bYearEndingOriginal cost, transportation& installationDepreciated ValueDepreciated Value10-1-13 95% 10-1-13 95%10-1-12 90% 10-1-12 80%10-1-11 80% 10-1-11 60%10-1-10 70% 10-1-10 40%10-1-09 60% Prior Yrs 20%10-1-08 50% Total Total10-1-07 40%Prior Yrs 30%Total Total 21a and 21b Total #21#22 – Cables, conduits, pipes, etc # 23 - Expensed SuppliesYearEnding10-1-13Original cost, transportation& installation%GoodDepreciated Value10-1-12 Year10-1-11Ending10-1-10 10-1-1310-1-0910-1-0810-1-07Prior Yrs%GoodThe average is the total amount expended on supplies sinceOctober 1, 2012 divided by the number <strong>of</strong> months in businesssince October 1, 2012.Total Expended# <strong>of</strong>MonthsAverage MonthlyTotal Total #22Check here if a DPUC regulated utility #23#24a – Other Goods - including leasehold improvements #24b -- Rental Entertainment MediumYearEndingOriginal cost, transportation& installation%GoodYearEndingOriginal cost, transportation& installation%GoodDepreciated Value10-1-13 95% 10-1-13 95%10-1-12 90% 10-1-12 80%10-1-11 80% 10-1-11 60%10-1-10 70% 10-1-10 40%10-1-09 60% Prior Yrs 20%10-1-08 50% Total Total10-1-07 40% # <strong>of</strong> video tapes # <strong>of</strong> DVD moviesDepreciated ValuePrior Yrs 30% # <strong>of</strong> music CD’s # <strong>of</strong> video gamesTotal Total 24a and 24b Total #24RECONCILIATION OF FIXED ASSETS*Complete Detailed Listing <strong>of</strong> Disposed Assets –page 4Assets declared 10/1/1* Assets disposed since 10/1/1Assets added since 10/1/1Assets declared 10/1/1Expensed equipment last yearCapitalization ThresholdPage 6

List or Account#:Owner’s Name:Assessment date October 1, 201Required return date November 3, 201DECLARATION OF PERSONAL PROPERTY AFFIDAVITTHIS FORM MUST BE SIGNED (AND IN SOME CASES WITNESSED) BEFORE IT MAY BE FILED WITH THE ASSESSOR.AVOID PENALTY – IMPROPERLY SIGNED DECLARATIONS REQUIRE A 25% PENALTYCOMPLETE SECTION A OR SECTION BSection AOWNER I DO HE REBY declare under penalty <strong>of</strong> false statem ent that all sections <strong>of</strong> thi s declaration have beencompleted according to th e best <strong>of</strong> my knowledge, remembrance, and belief; that it is a true statement <strong>of</strong> all m ypersonal property liable to taxation; and that I have not c onveyed or tempo rarily disposed <strong>of</strong> any estate for thepurpose <strong>of</strong> evading the laws relating to the assessment and collection <strong>of</strong> taxes as per Connecticut General Statutes§12-49.SEE PAGE TWO (2) FOR SIGNATURE REQUIREMENTS.CHECK ONE OWNER PARTNER CORPORATE OFFICER MEMBERSignatureSignature/TitleDatedPrint or type nameSection BAGENT I DO HEREBY declare under oath that I have been duly appointed agent for the o wner <strong>of</strong> the property listed herein and that Ihave full authority and knowledge sufficient to file a proper declaration for him in accord with the provisions <strong>of</strong> §12-50 C.G.S.Agent’sSignatureAgent’s Signature /TitleDatedWitness <strong>of</strong> agent’s sworn statementSubscribed and sworn to before me -Print or type agent’s nameAGENT SIGNATURE MUST BE WITNESSEDCircle one: Assessor or staff member, <strong>Town</strong> Clerk, Justice <strong>of</strong> the Peace, Notary or Commissioner <strong>of</strong> SuperiorCourtDatedDirect questions concerning declaration to the Assessor’s Office at:Check Off List:Phone «AC»– «Phone» Fax «AC»– «Fax» Read instructions on page 2Hand deliver declaration to: Mail declaration to: Complete appropriate sections«TC» <strong>of</strong> «<strong>Town</strong>» «TC» <strong>of</strong> «<strong>Town</strong>» Complete exemption applicationsAssessor’s Office Assessor’s Office Sign & date as required on page 8«Location» «Mailing_Address» Make a copy for your records«City_<strong>Town</strong>» «CSZ» Return by November , 201Notes:This <strong>Personal</strong> <strong>Property</strong> <strong>Declaration</strong> must be signed above and delivered to the <strong>South</strong> <strong>Windsor</strong> Assessor or postmarked(as defined in C.G.S. Sec 1-2a(as defined in C.G.S. Sec 1-2a & as referenced in Sec. 12-41(d)) by day, November , 201– a 25% Penalty required for failure to file as required.Page 8