Special Circumstances Review Application - South Piedmont ...

Special Circumstances Review Application - South Piedmont ...

Special Circumstances Review Application - South Piedmont ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

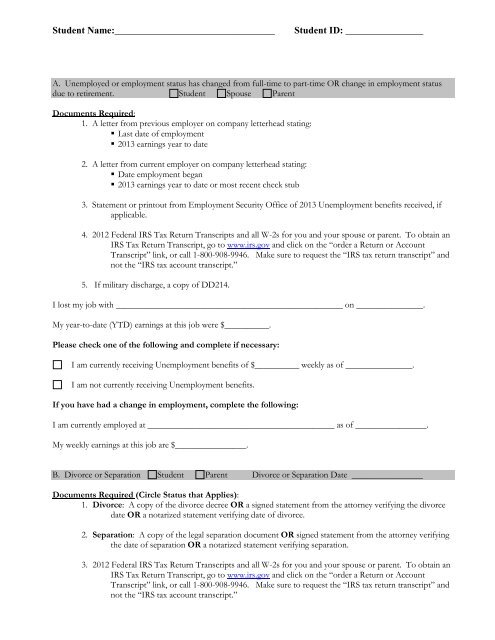

Student Name:_________________________________Student ID: ________________A. Unemployed or employment status has changed from full-time to part-time OR change in employment statusdue to retirement. Student Spouse ParentDocuments Required:1. A letter from previous employer on company letterhead stating:• Last date of employment• 2013 earnings year to date2. A letter from current employer on company letterhead stating:• Date employment began• 2013 earnings year to date or most recent check stub3. Statement or printout from Employment Security Office of 2013 Unemployment benefits received, ifapplicable.4. 2012 Federal IRS Tax Return Transcripts and all W-2s for you and your spouse or parent. To obtain anIRS Tax Return Transcript, go to www.irs.gov and click on the “order a Return or AccountTranscript” link, or call 1-800-908-9946. Make sure to request the “IRS tax return transcript” andnot the “IRS tax account transcript.”5. If military discharge, a copy of DD214.I lost my job with ___________________________________________________ on _______________.My year-to-date (YTD) earnings at this job were $__________.Please check one of the following and complete if necessary:I am currently receiving Unemployment benefits of $__________ weekly as of _______________.I am not currently receiving Unemployment benefits.If you have had a change in employment, complete the following:I am currently employed at __________________________________________ as of ________________.My weekly earnings at this job are $________________.B. Divorce or Separation Student Parent Divorce or Separation Date ________________Documents Required (Circle Status that Applies):1. Divorce: A copy of the divorce decree OR a signed statement from the attorney verifying the divorcedate OR a notarized statement verifying date of divorce.2. Separation: A copy of the legal separation document OR signed statement from the attorney verifyingthe date of separation OR a notarized statement verifying separation.3. 2012 Federal IRS Tax Return Transcripts and all W-2s for you and your spouse or parent. To obtain anIRS Tax Return Transcript, go to www.irs.gov and click on the “order a Return or AccountTranscript” link, or call 1-800-908-9946. Make sure to request the “IRS tax return transcript” andnot the “IRS tax account transcript.”