Annual Report 2006 - Munters

Annual Report 2006 - Munters

Annual Report 2006 - Munters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

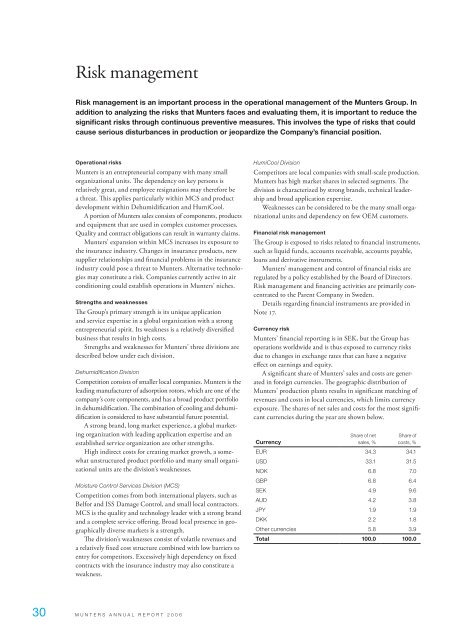

Risk managementRisk management is an important process in the operational management of the <strong>Munters</strong> Group. Inaddition to analyzing the risks that <strong>Munters</strong> faces and evaluating them, it is important to reduce thesignificant risks through continuous preventive measures. This involves the type of risks that couldcause serious disturbances in production or jeopardize the Company’s financial position.Operational risks<strong>Munters</strong> is an entrepreneurial company with many smallorganizational units. The dependency on key persons isrelatively great, and employee resignations may therefore bea threat. This applies particularly within MCS and productdevelopment within Dehumidification and HumiCool.A portion of <strong>Munters</strong> sales consists of components, productsand equipment that are used in complex customer processes.Quality and contract obligations can result in warranty claims.<strong>Munters</strong>’ expansion within MCS increases its exposure tothe insurance industry. Changes in insurance products, newsupplier relationships and financial problems in the insuranceindustry could pose a threat to <strong>Munters</strong>. Alternative technologiesmay constitute a risk. Companies currently active in airconditioning could establish operations in <strong>Munters</strong>’ niches.Strengths and weaknessesThe Group’s primary strength is its unique applicationand service expertise in a global organization with a strongentrepreneurial spirit. Its weakness is a relatively diversifiedbusiness that results in high costs.Strengths and weaknesses for <strong>Munters</strong>’ three divisions aredescribed below under each division.Dehumidification DivisionCompetition consists of smaller local companies. <strong>Munters</strong> is theleading manufacturer of adsorption rotors, which are one of thecompany’s core components, and has a broad product portfolioin dehumidification. The combination of cooling and dehumidificationis considered to have substantial future potential.A strong brand, long market experience, a global marketingorganization with leading application expertise and anestablished service organization are other strengths.High indirect costs for creating market growth, a somewhatunstructured product portfolio and many small organizationalunits are the division’s weaknesses.Moisture Control Services Division (MCS)Competition comes from both international players, such asBelfor and ISS Damage Control, and small local contractors.MCS is the quality and technology leader with a strong brandand a complete service offering. Broad local presence in geographicallydiverse markets is a strength.The division’s weaknesses consist of volatile revenues anda relatively fixed cost structure combined with low barriers toentry for competitors. Excessively high dependency on fixedcontracts with the insurance industry may also constitute aweakness.HumiCool DivisionCompetitors are local companies with small-scale production.<strong>Munters</strong> has high market shares in selected segments. Thedivision is characterized by strong brands, technical leadershipand broad application expertise.Weaknesses can be considered to be the many small organizationalunits and dependency on few OEM customers.Financial risk managementThe Group is exposed to risks related to financial instruments,such as liquid funds, accounts receivable, accounts payable,loans and derivative instruments.<strong>Munters</strong>’ management and control of financial risks areregulated by a policy established by the Board of Directors.Risk management and financing activities are primarily concentratedto the Parent Company in Sweden.Details regarding financial instruments are provided inNote 17.Currency risk<strong>Munters</strong>’ financial reporting is in SEK, but the Group hasoperations worldwide and is thus exposed to currency risksdue to changes in exchange rates that can have a negativeeffect on earnings and equity.A significant share of <strong>Munters</strong>’ sales and costs are generatedin foreign currencies. The geographic distribution of<strong>Munters</strong>’ production plants results in significant matching ofrevenues and costs in local currencies, which limits currencyexposure. The shares of net sales and costs for the most significantcurrencies during the year are shown below.CurrencyShare of netsales, %Share ofcosts, %EUR 34.3 34.1USD 33.1 31.5NOK 6.8 7.0GBP 6.8 6.4SEK 4.9 9.6AUD 4.2 3.8JPY 1.9 1.9DKK 2.2 1.8Other currencies 5.8 3.9Total 100.0 100.030 M U N T E R S A N N U A L R E P O R T 2 0 0 6