SIFMA Comments on Regulatory Notice 08-55 - finra

SIFMA Comments on Regulatory Notice 08-55 - finra

SIFMA Comments on Regulatory Notice 08-55 - finra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

November 14, 20<strong>08</strong>Via e-mail to pubcom@<strong>finra</strong>.orgMs. Marcia E. AsquithOffice of Corporate SecretaryFINRA1735 K Street, N.W.Washingt<strong>on</strong>, D.C. 20006-1506Re:<str<strong>on</strong>g>Comments</str<strong>on</strong>g> Regarding Proposed Research Registrati<strong>on</strong> andC<strong>on</strong>flicts of Interest Rules (FINRA <strong>Regulatory</strong> <strong>Notice</strong> <strong>08</strong>-<strong>55</strong>)Dear Ms. Asquith:The Securities Industry and Financial Markets Associati<strong>on</strong> 1 is submitting thisletter to the Financial Industry <strong>Regulatory</strong> Authority, Inc. (“FINRA”) in resp<strong>on</strong>se toFINRA’s request for comments regarding proposed changes to its research analystc<strong>on</strong>flicts of interest and registrati<strong>on</strong> rules, set forth in FINRA <strong>Regulatory</strong> <strong>Notice</strong> <strong>08</strong>-<strong>55</strong>.FINRA proposes to establish new FINRA Rule 1223 (Registrati<strong>on</strong> of Research Analysts)and new FINRA Rule 2240 (Research Analysts and Research Reports), the latterincluding new Supplementary Material (collectively, the “Proposed Rules”).I. Introducti<strong>on</strong>First and foremost, we commend FINRA’s diligent efforts to create acomprehensive, c<strong>on</strong>solidated approach to the registrati<strong>on</strong> of research analysts and themanagement of potential c<strong>on</strong>flicts of interest related to research. In particular, weapplaud FINRA’s adopti<strong>on</strong> of many of the recommendati<strong>on</strong>s set forth in the 2005 JointReport <strong>on</strong> Research by the Nati<strong>on</strong>al Associati<strong>on</strong> of Securities Dealers (“NASD”) andNew York Stock Exchange (“NYSE”). 2 As a general matter, we agree with FINRA thatthe Proposed Rules will help ensure that investors receive objective research, whilepermitting the flow of informati<strong>on</strong> to investors and minimizing burdens <strong>on</strong> members. In1Securities Industry and Financial Markets Associati<strong>on</strong> (“<str<strong>on</strong>g>SIFMA</str<strong>on</strong>g>” or the “Associati<strong>on</strong>”) brings togetherthe shared interests of more than 650 securities firms, banks and asset managers. <str<strong>on</strong>g>SIFMA</str<strong>on</strong>g>’s missi<strong>on</strong> is topromote policies and practices that work to expand and perfect markets, foster the development of newproducts and services and create efficiencies for member firms, while preserving and enhancing thepublic’s trust and c<strong>on</strong>fidence in the markets and the industry. <str<strong>on</strong>g>SIFMA</str<strong>on</strong>g> works to represent its members’interests locally and globally. It has offices in New York, Washingt<strong>on</strong> D.C., and L<strong>on</strong>d<strong>on</strong> and its associatedfirm, the Asia Securities Industry and Financial Markets Associati<strong>on</strong>, is based in H<strong>on</strong>g K<strong>on</strong>g.2 See Joint Report by the NASD and the NYSE On the Operati<strong>on</strong> and Effectiveness of the Research AnalystC<strong>on</strong>flict of Interest Rules (December 2005), available at http://www.<strong>finra</strong>.org/web/groups/industry/@ip/@issues/@rar/documents/industry/p015803.pdf

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 2 of 14particular, we str<strong>on</strong>gly support FINRA’s proposals to eliminate quiet period surroundinglock-ups and reduce the quiet periods for initial public offerings to 10 days. We alsosupport the proposed, more flexible supervisory approach with respect to research analystaccount trading and encourage the proposed eliminati<strong>on</strong> of the chaper<strong>on</strong>ing mandatewhen reports are reviewed by n<strong>on</strong>-research, n<strong>on</strong>-investment banking pers<strong>on</strong>nel. Wefurther support the expansi<strong>on</strong> of the exempti<strong>on</strong> for members with limited investmentbanking activities. Finally, we appreciate the guidance provided to members regardingthe ways in which a member may distribute and differentiate research, includingguidance regarding permissible ways for distributing different research products andservices to certain classes of customers.While we commend FINRA’s efforts to produce a coherent and c<strong>on</strong>solidated setof research rules, we believe there are certain critical modificati<strong>on</strong>s that FINRA shouldmake to the Proposed Rules. We discuss these provisi<strong>on</strong>s and the modificati<strong>on</strong>s below.II. <str<strong>on</strong>g>SIFMA</str<strong>on</strong>g> Urges FINRA to Make Certain Critical Modificati<strong>on</strong>s to the ProposedRulesA. Proposed Rule 2240(b): Identifying and Managing C<strong>on</strong>flicts of Interest1. Proposed Rule 2240(b)(2) (Preamble)As a general matter, we endorse the overarching principle in Proposed Rule2240(b)(1) that requires members to implement policies and procedures reas<strong>on</strong>ablydesigned to identify and effectively manage c<strong>on</strong>flicts of interest. We believe thisprinciple appropriately captures the purpose of this rule, NASD Rule 2711, NYSE Rule472, and Regulati<strong>on</strong> AC. We also understand and support the need to set out certainspecific minimum policies and procedures.We are troubled, however, by the breadth and ambiguity of the language in theintroductory sentence of Proposed Rule 2240(b)(2), “[a] member’s policies andprocedures must be reas<strong>on</strong>ably designed to promote objective and reliable research thatreflects the truly held opini<strong>on</strong>s of the research analysts and to prevent the use of researchreports or research analysts to manipulate or c<strong>on</strong>diti<strong>on</strong> the market or favor the interests ofthe member or certain current or prospective clients” (emphasis added). That sentence isproblematic in three key respects. First, it purports to require members to designprocedures to promote “reliable” research. The c<strong>on</strong>cept of “reliable” research is new andundefined. In that regard, “reliable” is not a term used in NASD Rule 2711 or 2210 orNYSE Rule 472, and it is not clear whether and how it differs from the noti<strong>on</strong>s ofobjectivity and independence, which are embodied in those rules and in the Sarbanes-Oxley Act of 2002 (“SOX”). It is also not clear whether and how this new standarddiffers from the requirements in NASD Rule 2210 that communicati<strong>on</strong>s be “fair andbalanced” and “provide a sound basis for evaluating the facts” and in NASD IM-2210that recommendati<strong>on</strong>s have a “reas<strong>on</strong>able basis.”

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 3 of 14Sec<strong>on</strong>d, the introductory sentence in Proposed Rule 2240(b)(2) is problematicbecause it uses the phrase “truly held” opini<strong>on</strong>s. Again, the phrase “truly held” is a newand undefined c<strong>on</strong>cept. It is not clear what difference, if any, exists between (i) therequirement in Regulati<strong>on</strong> AC that research accurately reflect the analyst's “pers<strong>on</strong>alviews” about any and all of the subject securities or issuers, and (ii) the “truly held”opini<strong>on</strong>s of research analysts referenced in the Proposed Rules.Third, the introductory sentence of Proposed Rule 2240(b)(2) is problematicbecause it broadly prohibits the use of research to “manipulate or c<strong>on</strong>diti<strong>on</strong> the market”or “favor the interests of the member or certain current or prospective clients.” Whilewe support the general principle that members should implement policies and proceduresreas<strong>on</strong>ably designed to prevent market manipulati<strong>on</strong> or fr<strong>on</strong>t running of research, webelieve this principle is already codified in Securities and Exchange Commissi<strong>on</strong>(“SEC”) and FINRA rules (in particular, Regulati<strong>on</strong> M and Rule 10b-5 under theSecurities Exchange Act of 1934, as amended (“Exchange Act”), and FINRA fr<strong>on</strong>trunning prohibiti<strong>on</strong>s in NASD-IM-2110-4. As such, it is not clear why this language isnecessary or what types of activities Proposed Rule 2240(b)(2) is designed to address.For the above reas<strong>on</strong>s, we urge FINRA to delete the introductory sentence of2240(b)(2) so the secti<strong>on</strong> would simply state: “Such policies and procedures must at aminimum:” Alternatively, we ask FINRA to revise the introductory sentence to state: “Amember's policies and procedures must be reas<strong>on</strong>ably designed to promote independentand objective research that reflects the pers<strong>on</strong>al views of the analyst.”2. Proposed Rule 2240(b)(2) (Specific Policies and Procedures ToIdentify and Manage C<strong>on</strong>flicts)With respect to the provisi<strong>on</strong> setting forth the specific types of policies andprocedures that members are required to have, we urge FINRA to c<strong>on</strong>sider the followingmodificati<strong>on</strong>s:a) Proposed Rule 2240(b)(2)(C) (Analyst Compensati<strong>on</strong>)Proposed Rule 2240(b)(2)(C) prohibits not <strong>on</strong>ly payments “based up<strong>on</strong> specificinvestment banking services transacti<strong>on</strong>s” but also those based up<strong>on</strong> “c<strong>on</strong>tributi<strong>on</strong>s to amember’s investment banking services activities.” We ask FINRA to c<strong>on</strong>firm that –c<strong>on</strong>sistent with current rules – this prohibiti<strong>on</strong> does not prevent a member fromcompensating analysts for engaging in permissible vetting, commitment committeeparticipati<strong>on</strong>, due diligence, teach-ins, investor educati<strong>on</strong>, and other permissible bankingrelatedactivities. Indeed, in resp<strong>on</strong>se to comments <strong>on</strong> an earlier set of revisi<strong>on</strong>s to theresearch analyst rules, NASD staff recognized that analysts’ participati<strong>on</strong> in certain typesof banking activities could be c<strong>on</strong>sidered in compensati<strong>on</strong> decisi<strong>on</strong>s. Specifically, in itsresp<strong>on</strong>se letter regarding these revisi<strong>on</strong>s, the NASD staff said that “NASD believesscreening potential investment banking clients is <strong>on</strong>e of many factors to measure thequality of an analyst’s research. As such, it may be c<strong>on</strong>sidered in determining an

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 4 of 14analyst’s compensati<strong>on</strong>; [as l<strong>on</strong>g as] it may not be given undue weight relative toevaluating the quality of other research work product.” 3 The SEC also has providedinterpretive guidance in the c<strong>on</strong>text of the Global Research Settlement 4 that permitssettling firms to compensate analysts for vetting investment banking transacti<strong>on</strong>s subjectto certain requirements and that also permits analysts to be compensated for providingtheir views regarding proposed transacti<strong>on</strong>s or candidates for transacti<strong>on</strong>s, commitmentcommittee participati<strong>on</strong>, and c<strong>on</strong>firming disclosures in offering or other disclosuredocuments. 5b) Proposed Rule 2240(b)(2)(D) (Analyst Compensati<strong>on</strong>)Proposed Rule 2240(b)(2)(D) should be revised so that compensati<strong>on</strong> committeesare required to c<strong>on</strong>sider the enumerated factors <strong>on</strong>ly to the extent they are applicable. Byway of comparis<strong>on</strong>, NASD Rule 2711(d)(2) provides that compensati<strong>on</strong> committees“must c<strong>on</strong>sider the following factors when reviewing a research analyst’s compensati<strong>on</strong>,if applicable” (emphasis added).We also request that FINRA include in the Proposed Rules the followingadditi<strong>on</strong>al factors that are permissible for members to c<strong>on</strong>sider in determining analystcompensati<strong>on</strong>: (i) the analyst’s seniority and experience, and (ii) the market for the hiringand retenti<strong>on</strong> of analysts. These factors are critical to the proper determinati<strong>on</strong> of analystcompensati<strong>on</strong> and, as such, are specifically identified in the Global Research Settlementand similarly should be included in the Proposed Rules. 6c) Proposed Rule 2240(b)(2)(E) (Informati<strong>on</strong> Barriers)Proposed Rule 2240(b)(2)(E) requires members “to establish informati<strong>on</strong> barriersand other instituti<strong>on</strong>al safeguards to ensure that analysts are insulated from the review,pressure or oversight of pers<strong>on</strong>s engaged in investment banking services activities orother pers<strong>on</strong>s who might be biased in their judgment or supervisi<strong>on</strong>” (emphasis added).We request that FINRA clarify that members may rely <strong>on</strong> informati<strong>on</strong> barriers “or” otherinstituti<strong>on</strong>al safeguards reas<strong>on</strong>ably designed to ensure that analysts are shielded fromsuch pressures. Informati<strong>on</strong> barriers traditi<strong>on</strong>ally are used to restrict the flow of material,n<strong>on</strong>public informati<strong>on</strong> and may not always be appropriate to manage potential researchc<strong>on</strong>flicts. In some situati<strong>on</strong>s, instituti<strong>on</strong>al safeguards that do not rise to the level of an“informati<strong>on</strong> barrier” are more fitting. Accordingly, we believe members should beaccorded the flexibility to rely <strong>on</strong> barriers or other safeguards.3 See Letter from Philip A. Shaikun, NASD, to James A. Brigagliano, SEC, at p. 8 (July 29, 2003).4 The Global Research Settlement, which was reached am<strong>on</strong>g certain investment banking firms, the SEC,NYSE, NASD, and other regulators <strong>on</strong> April 28, 2003 is available athttp://www.sec.gov/spotlight/globalsettlement.htm.5 See Letter from Dana Fleischman, Cleary Gottlieb, to James A. Brigagliano, SEC, (Nov. 2, 2004),available at http://www.sec.gov/divisi<strong>on</strong>s/marketreg/mr-noacti<strong>on</strong>/grs110204.htm6 See Secti<strong>on</strong> I.5.d of the Global Research Settlement.

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 5 of 14We also believe that the broad phrase “pers<strong>on</strong>s who might be biased” should bereplaced with “pers<strong>on</strong>s within the firm who may try to improperly influence analysts’views.” We believe our recommended wording more accurately characterizes the typesof individuals and improper c<strong>on</strong>duct the rule is intended to address. As currently worded,the Proposed Rule could have unintended c<strong>on</strong>sequences, by requiring members toinsulate an analyst from review by salespeople and investor clients because their holdingsor activities may cause them to have a bias. Further, under the language of the ProposedRules, members arguably may need to wall off an analyst from discussi<strong>on</strong>s with subjectcompanies and traders because these c<strong>on</strong>stituencies also may have biases and could try topressure the analyst. We believe FINRA did not intend to restrict analysts in this manner.As such, we urge FINRA to adopt our suggested language, which permits analysts toengage in legitimate and important activities, while requiring firms to have safeguardsreas<strong>on</strong>ably designed to protect the analysts against improper influences.d) Proposed Rule 2240(b)(2)(F) (Anti-Retaliati<strong>on</strong>)Proposed Rule 2240(b)(2)(F) requires members to "prevent direct or indirectretaliati<strong>on</strong> or threat of retaliati<strong>on</strong> against research analysts by pers<strong>on</strong>s engaged ininvestment banking services or other employees as the result of c<strong>on</strong>tent of a researchreport." This prohibiti<strong>on</strong> is broader than the current anti-retaliati<strong>on</strong> provisi<strong>on</strong>s 7 because itapplies to all employees rather than just those employees involved in the member’sinvestment banking department. Also, the proposed provisi<strong>on</strong> does not explicitly providemembers with the ability to discipline or terminate an analyst for any cause other than thewriting of an unfavorable research report as is set forth in the current rules. We believethe current anti-retaliati<strong>on</strong> provisi<strong>on</strong>s strike a reas<strong>on</strong>able balance between preventingretaliati<strong>on</strong> while preserving a member’s ability to evaluate, discipline or even terminatean analyst for causes other than the writing of an unfavorable research report such as poorquality or inaccurate written work product or careless fact checking. As such, we urgeFINRA retain the current language in the anti-retaliati<strong>on</strong> provisi<strong>on</strong> set forth in currentNASD Rule 2711(j).e) Proposed Rule 2240(b)(2)(H) (Trading by Analyst Accounts)As noted earlier, we support Proposed Rule 2240(b)(2)(H) that provides a moreflexible supervisory approach regarding research analyst account trading in securities ofcompanies covered by the analyst. To the extent members have adopted internal policiesprohibiting analysts from owning securities issued by companies the analyst covers, weask FINRA to c<strong>on</strong>firm that members may permit an analyst to divest any such holdingspursuant to a reas<strong>on</strong>able plan of liquidati<strong>on</strong> within 120 days of the effective date of themember’s policy even if the sale is inc<strong>on</strong>sistent with the analyst’s current7 See NASD Rule 2711(j) and NYSE Rule 472(g)(2).

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 6 of 14recommendati<strong>on</strong>. This approach was proposed by the NASD and NYSE in 2007 8 and webelieve it is c<strong>on</strong>sistent with the principles set forth in Proposed Rule 2240(b)(H).f) Proposed Rule 2240(b)(2)(J)(ii) (Limitati<strong>on</strong>s <strong>on</strong> Analysts’Activities)Proposed Rule 2240(b)(2)(J)(ii) would require members to prohibit analysts’participati<strong>on</strong> in road shows and other marketing <strong>on</strong> behalf of issuers. We ask that FINRAclarify that – c<strong>on</strong>sistent with its current rules – this prohibiti<strong>on</strong> does not apply to investoreducati<strong>on</strong> activities and <strong>on</strong>ly applies to road shows and marketing activities “inc<strong>on</strong>necti<strong>on</strong> with investment banking services transacti<strong>on</strong>s.” 9 Under the proposedprohibiti<strong>on</strong>, many legitimate marketing activities that occur outside of a deal c<strong>on</strong>textwould be prohibited. For example, analysts frequently facilitate meetings betweeninvestors and company management in what are often referred to as n<strong>on</strong>-deal road shows.We believe these types of interacti<strong>on</strong>s are beneficial to investors and should not beprohibited by Proposed Rule 2240(2)(J)(ii).We also ask FINRA to c<strong>on</strong>firm that, c<strong>on</strong>sistent with existing NYSE and NASDguidance, 10 analysts may listen to or view a live webcast of a transacti<strong>on</strong>-related roadshow or other widely attended presentati<strong>on</strong> by investment bankers to investors or thesales force from a remote locati<strong>on</strong> or, to the extent the event occurs at the member’soffices, from a room that is separate from investment banking pers<strong>on</strong>nel, investors or thesales force.B. Proposed Rule 2240(c): C<strong>on</strong>tent and Disclosure Requirements forResearch ReportsWe recommend that FINRA modify certain provisi<strong>on</strong>s in the c<strong>on</strong>tent anddisclosure requirements of the Proposed Rules so that they (i) are more c<strong>on</strong>sistent withexisting FINRA and SEC rules and requirements, and (ii) provide clearer guidance tomembers regarding FINRA’s expectati<strong>on</strong>s as set out below.1. Proposed Rule 2240(c)(1) (Ensuring “Purported Facts” Are Based <strong>on</strong>“Reliable Informati<strong>on</strong>”)Proposed Rule 2240(c)(1) requires members “to ensure that purported facts inreports are based <strong>on</strong> reliable informati<strong>on</strong>.” As we noted above, “reliable” is not a termused in current NASD Rule 2711 or 2210 or NYSE Rule 472. It is also unclear what“purported facts” are. We ask FINRA to modify this provisi<strong>on</strong> to require members to8 See Proposed Rule Changes of the NYSE and NASD Relating to Research Analyst C<strong>on</strong>flicts of Interests,File Nos. SR-NYSE-2006-78, SR-NASD-2006-113 at 72 Fed. Reg. 2058, 2059 (Jan. 17, 2007) (“2007 RuleProposals”).9 See NASD Rule 2711(c)(5)(A). We believe that the Proposed Rule does not prohibit teach-ins or otherinternal meetings intended to educate the sales force, but ask FINRA to c<strong>on</strong>firm our understanding.10 See NASD <strong>Notice</strong> to Members 07-04 (Jan. 2007) and NYSE Informati<strong>on</strong> Memo 07-11 (Jan. 2007).

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 8 of 14general principle regarding the purpose of the disclosures, we believe the rule shouldrecognize that compliance with the specific disclosures c<strong>on</strong>stitutes compliance with thegeneral principle.4. Proposed Rule 2240(c)(5)(F) (Disclosure of Significant FinancialInterest)Proposed Rule 2240(c)(5)(F) establishes a new requirement that membersdisclose if they or their affiliates maintain a significant financial interest in the debt of thesubject company. For a number of reas<strong>on</strong>s, we believe that disclosure of financialinterests in the debt securities of a subject company in an equity research report regardingthe subject company is an unnecessary and burdensome requirement. First, to the extentthat a member’s ownership interest in a debt security may present a c<strong>on</strong>flict of interest,the member is already required to disclose that interest under the catch-all provisi<strong>on</strong>requiring disclosures of material c<strong>on</strong>flicts of interest. Also, while it is not clear what (ifany) benefit this new disclosure requirement would have to investors, the costs to developand implement this new requirement to members are clear: this new disclosure will takea significant amount of time and resources to implement because members may need toestablish new methods to determine ownership thresholds and analyze and compile listsof instruments that qualify for inclusi<strong>on</strong> in such calculati<strong>on</strong>s. Unlike equity holdings,which members were already required to calculate and aggregate with affiliate holdingspursuant to Secti<strong>on</strong> 13 of the Exchange Act, members do not generally identify andaggregate debt holdings am<strong>on</strong>g affiliates. As such, this requirement would imposesignificant infrastructure requirements <strong>on</strong> members and should be eliminated, given thequesti<strong>on</strong>able utility to investors.5. Proposed Rule 2240(c)(5)(H) (Material C<strong>on</strong>flict of InterestDisclosure)As noted above, Proposed Rule 2240(c)(5)(H) c<strong>on</strong>tains a “catch-all” disclosurerequirement for “any other material c<strong>on</strong>flict of interest…” While this disclosure islargely c<strong>on</strong>sistent with the current “catch-all” disclosure in NASD Rule 2711(h) andNYSE Rule 472(k), it differs in two key respects, which we believe will raise verydifficult compliance issues for members. Specifically, under the current rules, membersmust disclose “any other actual, material c<strong>on</strong>flict of interest of the research analyst ormember of which the research analyst knows or has reas<strong>on</strong> to know at the time ofpublicati<strong>on</strong> of the research report or at the time of the public appearance.” Proposed Rule2240(c)(5)(H), however, goes bey<strong>on</strong>d the current requirement by mandating thatmembers disclose not just actual, material c<strong>on</strong>flicts of which the research analyst knows,but also any other material c<strong>on</strong>flict of interest (including mere potential, material c<strong>on</strong>flictof interests) that “an associated pers<strong>on</strong> of the member with the ability to influence thec<strong>on</strong>tent of a research report knows or has reas<strong>on</strong> to know.” This proposal also goesbey<strong>on</strong>d the current requirement by mandating that disclosures be made with respect tomaterial c<strong>on</strong>flicts of interest that are known not <strong>on</strong>ly at the time of publicati<strong>on</strong>, but also“at the time of the … distributi<strong>on</strong> of a research report.”

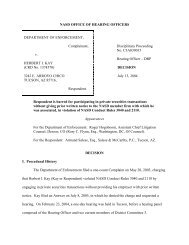

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 9 of 14We urge FINRA to revise Proposed Rule 2240(c)(5)(H) so that it is c<strong>on</strong>sistentwith the current research disclosure provisi<strong>on</strong>s. As a practical matter, it would be verydifficult – if not impossible – to comply with the two new requirements in the proposal.In that regard, members would be required to delay the distributi<strong>on</strong> of any researchreports until they have surveyed any pers<strong>on</strong>s who have the “ability to influence thec<strong>on</strong>tent of the research report” to determine whether such pers<strong>on</strong>s “know or have reas<strong>on</strong>to know of any material c<strong>on</strong>flicts.” Also, it is unclear how members could c<strong>on</strong>trol andprevent the distributi<strong>on</strong> of reports that already have been published, in order to determinewhether additi<strong>on</strong>al disclosures are required. For example, if a member publishes a report,does it need to m<strong>on</strong>itor and prevent any subsequent mailings of that report by itssalespeople or other associated pers<strong>on</strong>s and, potentially, include additi<strong>on</strong>al disclosures inthat report? We do not believe such a requirement would be practical or useful toinvestors. Indeed, to the extent any potential c<strong>on</strong>flicts of interest arise after thepublicati<strong>on</strong> of a report, such c<strong>on</strong>flicts would not have influenced the substance or c<strong>on</strong>tentof the report. For these reas<strong>on</strong>s, we ask that FINRA revise Proposed Rule 2240(c)(5)(H)so that it is c<strong>on</strong>sistent with current disclosure requirements.C. Proposed Rule 2240(h): Distributi<strong>on</strong> of Third Party Research Reports<strong>Regulatory</strong> <strong>Notice</strong> <strong>08</strong>-<strong>55</strong> describes the Proposed Rules as “incorporate[ing] intheir entirety the current provisi<strong>on</strong>s regarding distributi<strong>on</strong> and supervisi<strong>on</strong> of third partyresearch” and refers the reader to <strong>Regulatory</strong> <strong>Notice</strong> <strong>08</strong>-16, which sets out member’sdisclosure and supervisory review obligati<strong>on</strong>s. In fact, FINRA’s proposed provisi<strong>on</strong>sregarding third party research reports seem to go significantly bey<strong>on</strong>d the existingrequirements in at least two respects and, as such, should be modified.First, Proposed Rule 2240(h)(1)(A) imposes a new requirement that membersadopt policies and procedures “to ensure that any third party research,” includingindependent third party research, “is reliable and objective.” Sec<strong>on</strong>d, Proposed Rule2240(h)(2) changes the third party research report disclosure requirements fromspecifically-delineated disclosures set out in current NASD Rule 2711(h)(13)(A) andNYSE Rule 472(k)(4)(i) to a broad requirement that members disclose “any materialc<strong>on</strong>flict of interest that can reas<strong>on</strong>ably be expected to have influenced the choice of athird party research provider or the subject company of a third party research report.”In FINRA <strong>Regulatory</strong> <strong>Notice</strong> <strong>08</strong>-16 (which is referenced in <strong>Regulatory</strong> <strong>Notice</strong> <strong>08</strong>-<strong>55</strong>) FINRA recognized not <strong>on</strong>ly the value that third party research provides to investors,but also the large volume of third party research reports distributed by many members.For these reas<strong>on</strong>s, FINRA revised the third party research rules to provide that “amember firm’s approval of third party research reports shall be based <strong>on</strong> a review todetermine that the report does not c<strong>on</strong>tain any untrue statement of material fact or anyfalse or misleading informati<strong>on</strong> that (i) should be known from a reading of the report or

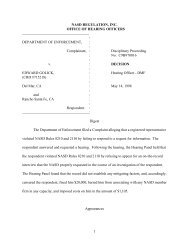

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 10 of 14(ii) is known based <strong>on</strong> the informati<strong>on</strong> otherwise possessed by the member.” 11 FINRAwent further by excluding all independent third party research reports from that review.Proposed Rule 2240(h)(1)(A), however, appears to overrule the carefully-craftedbalance established by <strong>Regulatory</strong> <strong>Notice</strong> <strong>08</strong>-16 by requiring members to ensure that anythird party research – including independent third party research – “is reliable andobjective.” It is not clear what kind of review would be necessary to comply with thisrequirement, and, as noted above, it is not clear what would make research “reliable.”For these reas<strong>on</strong>s, we urge FINRA to eliminate this new requirement in 2240(h)(1)(A) or,at a minimum, allow members to apply the same review standard and excepti<strong>on</strong> that areprovided for in 2240(h)(1)(C).In additi<strong>on</strong> to the departures from existing guidance noted above, Proposed Rule2240(h)(2) c<strong>on</strong>tains significant changes from the existing disclosure requirements forthird party research. Unlike NASD Rule 2711(h)(13)(A), which required four specificdisclosures for third party research (other than independent third party research)distributed by members, Proposed Rule 2240(h)(2) requires third party research reports todisclose “any material c<strong>on</strong>flict of interest that can be reas<strong>on</strong>ably be expected to haveinfluenced the choice of a third party research provider or the subject company of a thirdparty research report.” We believe the current disclosure requirements for third partyresearch are well-established and well-functi<strong>on</strong>ing. As such, we urge FINRA to do what<strong>Regulatory</strong> <strong>Notice</strong> <strong>08</strong>-<strong>55</strong> purports to do and adopt those existing requirements.See Appendix for a table highlighting our suggested modificati<strong>on</strong>s to Rule2240(h).D. Proposed Changes to Definiti<strong>on</strong>s1. Proposed Rule 2240(a)(4) (Revisi<strong>on</strong> to the Definiti<strong>on</strong> of “InvestmentBanking Services”)The proposed revisi<strong>on</strong>s to the definiti<strong>on</strong> of “investment banking services” areoverly broad, and might cover activities that are not investment banking services. Assuch, FINRA should retain the current definiti<strong>on</strong> of “investment banking services.” Inthat regard, the definiti<strong>on</strong> of “investment banking services” has been modified to cover“all acts in furtherance of a public or private offering <strong>on</strong> behalf of an issuer.” Thismodificati<strong>on</strong> creates an extremely broad definiti<strong>on</strong> that extends bey<strong>on</strong>d those pers<strong>on</strong>neland departments traditi<strong>on</strong>ally viewed as related to investment banking, and read literally,might apply to sales activities in c<strong>on</strong>necti<strong>on</strong> with an offering or private placement.Therefore, we ask FINRA to maintain its existing definiti<strong>on</strong> of “investment bankingservices.”11 See FINRA <strong>Regulatory</strong> <strong>Notice</strong> <strong>08</strong>-13 (April 20<strong>08</strong>) at p. 3.

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 11 of 142. Proposed Rule 2240(a)(10) (Definiti<strong>on</strong> of “Research Report”)We support FINRA’s proposal to exclude from the definiti<strong>on</strong> of “research report,”sales material analyzing open-end registered investment companies not listed or traded <strong>on</strong>an exchange and public direct participati<strong>on</strong> programs. As the self-regulatoryorganizati<strong>on</strong>s have observed in the 2007 Rule Proposals, those types of sales materialsare already subject to “a separate regulatory regime, including NASD Rule 2210 and SECRule 482, and all sales literature must be filed with the NASD Advertising Regulati<strong>on</strong>Department within ten business days of first use” with certain excepti<strong>on</strong>s. 12 Becausesales material analyzing open-end exchange traded funds (“ETFs”) are also subject to thesame regulatory regime and must be filed with FINRA within ten business days of firstuse, subject to certain excepti<strong>on</strong>s, we urge FINRA to c<strong>on</strong>sider excluding such materialfrom the definiti<strong>on</strong> of “research report.”We also recommend that FINRA modify Rule 2240(a)(10)(B)(ii) to exclude fromthe definiti<strong>on</strong> of “research report” any type of periodic report or other communicati<strong>on</strong> forany managed client account, whether such account is “discreti<strong>on</strong>ary” as the rule currentlyprovides, or n<strong>on</strong>-discreti<strong>on</strong>ary in nature. Reports distributed to “discreti<strong>on</strong>ary investmentaccounts” are excluded from the definiti<strong>on</strong> of “research report” because the member’sdiscreti<strong>on</strong> over the account presumably means the analysis provided is not for thepurpose of the client’s making an “investment decisi<strong>on</strong>” as the definiti<strong>on</strong> of “researchreport” currently requires. The client’s representative generally makes all investmentdecisi<strong>on</strong>s for the discreti<strong>on</strong>ary account. We believe this rati<strong>on</strong>ale is equally applicable toall managed accounts, whether discreti<strong>on</strong>ary or n<strong>on</strong>-discreti<strong>on</strong>ary, because clients whoutilize managed accounts generally rely <strong>on</strong> their individual m<strong>on</strong>ey manager to makeinvestment decisi<strong>on</strong>s in line with their goals and will not rely up<strong>on</strong> research reportsprovided by the member to make “investment decisi<strong>on</strong>s” as required by Rule2240(a)(10). An expansi<strong>on</strong> of the excepti<strong>on</strong> for communicati<strong>on</strong>s prepared fordiscreti<strong>on</strong>ary accounts to include all managed accounts would allow members to preparewritten communicati<strong>on</strong>s about portfolio managers and their funds and provide suchcommunicati<strong>on</strong>s to both their discreti<strong>on</strong>ary and n<strong>on</strong>-discreti<strong>on</strong>ary managed clients.Accordingly, we ask FINRA revise 2240(a)(10)(B)(ii) to permit the distributi<strong>on</strong> ofperiodic reports or other communicati<strong>on</strong>s for investment company shareholders ormanaged account clients….”E. Supplementary Material .01 Regarding Pitch Book Materials.Proposed Supplementary Material .01 interprets 2240(b)(2)(J)(i) to prohibit pitchmaterials that suggest or imply that the member might provide favorable researchcoverage. The sec<strong>on</strong>d sentence of the proposed interpretati<strong>on</strong> provides an example ofpresumably prohibited materials that reads, “[f]or example, FINRA would c<strong>on</strong>sider thepublicati<strong>on</strong> of a pitch book or related materials of an analyst’s industry ranking to implythe potential outcome of future research because of the manner in which such rankings12 See 2007 Rule Proposals at 2068-9.

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 12 of 14are compiled.” The example does not provide members with a clear understanding ofwhat is prohibited; and, further, it is not clear why the inclusi<strong>on</strong> of an analyst’s industryranking necessarily suggests or implies that the member may provide favorable researchcoverage. We request that FINRA revise the example to make it clearer regarding whatsort of materials are prohibited or provide an alternative example of prohibited pitchmaterials. We also ask that FINRA c<strong>on</strong>firm that members may disclose in pitch materialsthe fact that research coverage will be provided for a particular issuer.III. Web-Based DisclosuresWe appreciate FINRA’s efforts to pursue more web-based disclosure opti<strong>on</strong>s forresearch reports, and are disappointed that the SEC staff has chosen to interpret SOX todisallow broad use of web-based disclosures. We c<strong>on</strong>tinue to believe that web-baseddisclosure promotes efficiency, provides important informati<strong>on</strong> to investors in ameaningful and effective manner, and is c<strong>on</strong>sistent with important initiatives by the SECto promote the use of electr<strong>on</strong>ic media.In particular, price charts and ratings distributi<strong>on</strong> tables are often cumbersome anddifficult to produce in individual research reports, and it would greatly ease producti<strong>on</strong>burdens and streamline the research reports themselves if they could be provided throughwebsites. The dynamic nature of such charts and tables make them particularly wellsuited for <strong>on</strong>line disclosure where they may provide more meaningful informati<strong>on</strong> toinvestors.In the 2007 Rule Proposals, the NASD and NYSE asked whether a web-baseddisclosure regime should be permitted for public appearances. 13 We urge FINRA toc<strong>on</strong>sider permitting such a regime because we believe a web-based disclosure regime isequally, if not more, appropriate for public appearances. In particular, web-baseddisclosures would allow investors to c<strong>on</strong>sider and appreciate more fully the disclosuresrelated to public appearances. With web-based disclosures, investors would be able todownload, review, and assess the disclosures (as opposed to simply hearing them recitedbefore or after an appearance, at which time investors may not focus <strong>on</strong> the substance ofthe disclosures). 14IV. Request for an Extensi<strong>on</strong> of the Effective Date of the Proposed RulesWe believe FINRA should adopt the Proposed Rules, with the above suggestedmodificati<strong>on</strong>s, as so<strong>on</strong> as they are approved by the SEC. We request, however, thatFINRA provide a 120-day “grace period” between the adopti<strong>on</strong> of the Proposed Rules13 See 2007 Rule Proposals at 2072.14 We also ask FINRA to c<strong>on</strong>firm that to the extent a disclosure is required by both Proposed Rule 2240and Rule 2210 and is presented in a “compendium report” as defined by Proposed Rule 2240(c)(8),members may rely <strong>on</strong> the delivery mechanisms set forth in 2240(c)(8) to satisfy their disclosuresobligati<strong>on</strong>s for both rules.

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 13 of 14and the implementati<strong>on</strong> date of the Rules. Additi<strong>on</strong>al time is required because some ofthe Proposals, if adopted, such as the new disclosure regarding ownership of debtsecurities of a subject company, will require major modificati<strong>on</strong>s to informati<strong>on</strong>technology (“IT”) systems and research report templates, and policies and procedures.Modificati<strong>on</strong>s to systems near year end are particularly difficult because many ITdepartments stop accepting new requests while they focus exclusively <strong>on</strong> producing yearendfinancials and completing existing requests.* * * *<str<strong>on</strong>g>SIFMA</str<strong>on</strong>g> appreciates the opportunity to submit this letter to you. We would bepleased to discuss this matter further and to provide any additi<strong>on</strong>al informati<strong>on</strong> youbelieve would be helpful in c<strong>on</strong>necti<strong>on</strong> with your c<strong>on</strong>siderati<strong>on</strong> of this matter. Please feelfree to c<strong>on</strong>tact me with any questi<strong>on</strong>s you may have in this regard at (212) 313-1268.Very truly yours,Amal AlySIMFA Managing Director andAssociate General CounselCC:Mary Schapiro, Chief Executive OfficerMarc Menchel, Executive Vice President and General Counsel for Regulati<strong>on</strong>Grace Vogel, Vice President, Member Regulati<strong>on</strong>Stephen Luparello, Senior Executive Vice President, <strong>Regulatory</strong> Operati<strong>on</strong>s

Marcia E. AsquithNovember 14, 20<strong>08</strong>Page 14 of 14APPENDIXDisclosures bydistributingmember firmReview foruntruestatements ofmaterial factand false ormisleadinginformati<strong>on</strong>Current Rule* Proposed Rule Suggested Modificati<strong>on</strong>sThird partyresearchFourenumerateddisclosures.NASD Rule2711(h)(13)(A).*citati<strong>on</strong>s <strong>on</strong>lyto NASD rulesfor thesepurposes.Review islimited tountruestatements orfalse ormisleadinginformati<strong>on</strong> thatshould beknown fromreading thereport or isknown to themember.NASD Rule2711(h)(13)(C).Excepti<strong>on</strong> forindependentthird partyresearchNo disclosuresrequired ifindependentthird partyresearch is not“distributed” bythe member.NASD Rule2711(h)(13)(B).Reviewrequirementdoes not applyto independentthird partyresearch.NASD Rule2711(h)(13)(D).Third partyresearchDisclosure of“any materialc<strong>on</strong>flict ofinterest that canreas<strong>on</strong>ably beexpected toinfluence thechoice of a thirdparty researchprovide or thesubjectcompany.”Proposed Rule2240(h)(2).Review foruntrue or falseor misleadinginformati<strong>on</strong> thatshould beknown fromreading thereport or isknown to thememberpursuant toProposed Rule2240(h)(1)(C).Excepti<strong>on</strong> forindependentthird partyresearchNo disclosuresrequired ifindependentthird partyresearch is not“distributed” bythe member.Proposed Rule2240(h)(4)Reviewrequirementdoes not applyto independentthird partyresearch.Proposed Rule2711(h)(3).Third partyresearchMaintaincurrentdisclosurerequirements setforth in Rule2711(h)(13)(A).No modificati<strong>on</strong>suggested.Excepti<strong>on</strong> forindependentthird partyresearchNo modificati<strong>on</strong>suggested.No modificati<strong>on</strong>suggested.Review toensure thatresearch is“reliable andobjective”Not in currentrule.N/ARequires reviewto ensure thatthird partyresearchdistributed is“reliable andobjective.”Proposed Rule2240(h)(1)(A).No excepti<strong>on</strong> oraccommodati<strong>on</strong>for independentthird partyresearch.Eliminate thisnew reviewrequirement.Alternatively,apply thestandard ofreview set forthin ProposedRule2240(h)(1)(C).Eliminate thisnew reviewrequirement.Alternatively,apply theexcepti<strong>on</strong> setforth inProposed Rule2240(h)(3).