You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

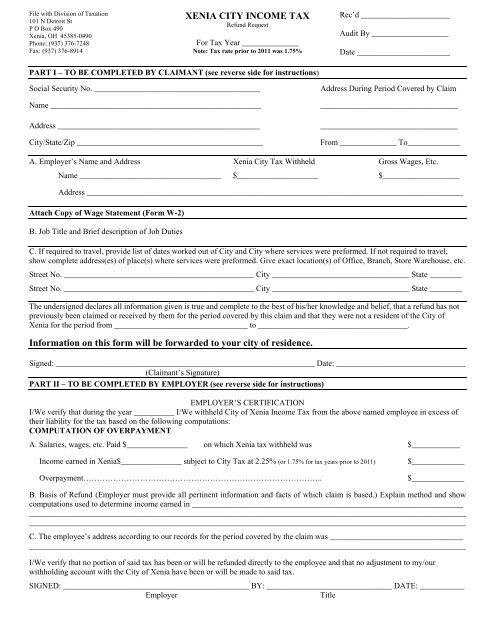

File with Division <strong>of</strong> Taxation101 N Detroit StP O Box 490<strong>Xenia</strong>, OH 45385-0490Phone: (937) 376-7248Fax: (937) 376-8914XENIA CITY INCOME TAX<strong>Refund</strong> <strong>Request</strong>For Tax Year ______________Note: Tax rate prior to 2011 was 1.75%Rec’d ______________________Audit By ___________________Date _______________________PART I – TO BE COMPLETED BY CLAIMANT (see reverse side for instructions)Social Security No. _________________________________________Name ____________________________________________________Address __________________________________________________<strong>City</strong>/State/Zip ______________________________________________Address During Period Covered by Claim____________________________________________________________________From ______________ To_____________A. Employer’s Name and Address <strong>Xenia</strong> <strong>City</strong> Tax Withheld Gross Wages, Etc.Name ___________________________________ $____________________ $___________________Address _____________________________________________________________________________________________Attach Copy <strong>of</strong> Wage Statement (<strong>Form</strong> W-2)B. Job Title and Brief description <strong>of</strong> Job DutiesC. If required to travel, provide list <strong>of</strong> dates worked out <strong>of</strong> <strong>City</strong> and <strong>City</strong> where services were preformed. If not required to travel,show complete address(es) <strong>of</strong> place(s) where services were preformed. Give exact location(s) <strong>of</strong> Office, Branch, Store Warehouse, etc.Street No. _______________________________________________ <strong>City</strong> __________________________________ State ________Street No. _______________________________________________ <strong>City</strong> __________________________________ State ________The undersigned declares all information given is true and complete to the best <strong>of</strong> his/her knowledge and belief, that a refund has notpreviously been claimed or received by them for the period covered by this claim and that they were not a resident <strong>of</strong> the <strong>City</strong> <strong>of</strong><strong>Xenia</strong> for the period from _________________________________ to _____________________________________.Information on this form will be forwarded to your city <strong>of</strong> residence.Signed: ________________________________________________________________ Date: ________________________________(Claimant’s Signature)PART II – TO BE COMPLETED BY EMPLOYER (see reverse side for instructions)EMPLOYER’S CERTIFICATIONI/We verify that during the year __________ I/We withheld <strong>City</strong> <strong>of</strong> <strong>Xenia</strong> Income Tax from the above named employee in excess <strong>of</strong>their liability for the tax based on the following computations:COMPUTATION OF OVERPAYMENTA. Salaries, wages, etc. Paid $_______________ on which <strong>Xenia</strong> tax withheld was $____________Income earned in <strong>Xenia</strong>$_______________ subject to <strong>City</strong> Tax at 2.25% (or 1.75% for tax years prior to 2011)Overpayment……………………………………………………………………………..$_____________$_____________B. Basis <strong>of</strong> <strong>Refund</strong> (Employer must provide all pertinent information and facts <strong>of</strong> which claim is based.) Explain method and showcomputations used to determine income earned in ___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________C. The employee’s address according to our records for the period covered by the claim was _____________________________________________________________________________________________________________________________________________I/We verify that no portion <strong>of</strong> said tax has been or will be refunded directly to the employee and that no adjustment to my/ourwithholding account with the <strong>City</strong> <strong>of</strong> <strong>Xenia</strong> have been or will be made to said tax.SIGNED: ______________________________________________ BY: _______________________________ DATE: ___________EmployerTitle

REFUND REQUESTGENERAL INSTRUCTIONSThis form is to be used only by non-resident individuals claiming a refund <strong>of</strong> <strong>Xenia</strong> <strong>City</strong> tax withheld in excess <strong>of</strong> theiractual liability. Designate the calendar year for which refund is claimed. If the individual has other taxable income, thestandard <strong>City</strong> Income Tax Return (<strong>Form</strong> R) must be used. If a refund is claimed for tax withheld by more than oneemployer, a separate <strong>Refund</strong> <strong>Request</strong> form must be completed for each employer.INSTRUCTIONS FOR PART I(TO BE COMPLETED BY CLAIMANT)Fill in Social Security Number, name and current address and address during period covered by claim.LINE A. List employer’s name, address <strong>Xenia</strong> <strong>City</strong> tax withheld, total salary, wages, commissions andother compensation.Attach a copy <strong>of</strong> Wage Statement (<strong>Form</strong> W-2) showing the <strong>Xenia</strong> tax withheld.LINE B. List job title and provide a brief description <strong>of</strong> required duties.LINE C. If duties require travel, provide a list <strong>of</strong> dates worked out <strong>of</strong> the <strong>City</strong> and city or cities where serviceswere performed. If traveling is not required, show where duties were performed.INSTRUCTIONS FOR PART II(TO BE COMPLETED BY EMPLOYER)A. List total compensation paid and full amount <strong>of</strong> <strong>Xenia</strong> city tax withheld. NOTE: The current <strong>Xenia</strong> tax rate is 2.25%.The tax rate prior to 1/1/2011 was 1.75%.Compute the amount to be entered in “Income Earned in the <strong>City</strong>” by multiplying the total compensation by the ratio <strong>of</strong>actual days worked in the <strong>City</strong> to total days worked. Days worked only refers to the actual number <strong>of</strong> days on the job. Anemployee is not on the job when there is a holiday, or when he is sick or on vacation.EXAMPLE:NOTE:An employee worked 160 days in the <strong>City</strong> and 80 days out <strong>of</strong> the <strong>City</strong>, or a total <strong>of</strong> 240 workingdays. Report as wages earned in the <strong>City</strong>, 160/240 or 2/3rds <strong>of</strong> his wages (which would includevacation pay, holiday pay and sick pay), since all pay has the same relative tax location as thelocation where the employee performs his services.For employees paid on a commission basis, the ratio <strong>of</strong> commissions earned in the <strong>City</strong> to totalcommissions should be used instead <strong>of</strong> using days worked.B. Basis for <strong>Refund</strong>: A brief but complete explanation by employer is required concerning the reason for the overpaymentto be refunded. Explain method and show computations used to determine amount entered in “Income Earned in the<strong>City</strong>.”C. Show the employee’s address as listed on the employer’s records.The “Employer’s Certification” must be signed by the employer’s supervisor or other responsible representative <strong>of</strong> theemployer who has knowledge that the information given is true and correct.NOTE: Separate requests are required if more than one employer is involved.LIMITATIONS ON REFUNDS:Taxes erroneously paid shall not be refunded unless a claim for refund is made within three (3) years from thedate on which such payment was made. For erroneously withholdings this is 3 years from the date the employerpaid the withholding to the <strong>City</strong> <strong>of</strong> <strong>Xenia</strong>.Updated 11/2011