Maturity Claim - Gbic.co.in

Maturity Claim - Gbic.co.in

Maturity Claim - Gbic.co.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

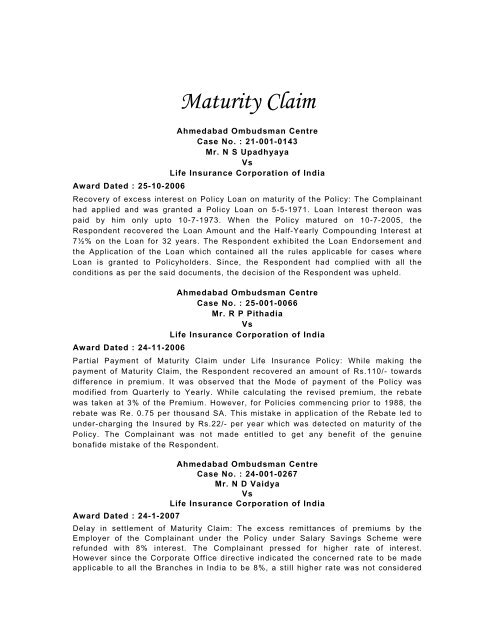

<strong>Maturity</strong> <strong>Claim</strong>Ahmedabad Ombudsman CentreCase No. : 21-001-0143Mr. N S UpadhyayaVsLife Insurance Corporation of IndiaAward Dated : 25-10-2006Re<strong>co</strong>very of excess <strong>in</strong>terest on Policy Loan on maturity of the Policy: The Compla<strong>in</strong>anthad applied and was granted a Policy Loan on 5-5-1971. Loan Interest thereon waspaid by him only upto 10-7-1973. When the Policy matured on 10-7-2005, theRespondent re<strong>co</strong>vered the Loan Amount and the Half-Yearly Compound<strong>in</strong>g Interest at7½% on the Loan for 32 years. The Respondent exhibited the Loan Endorsement andthe Application of the Loan which <strong>co</strong>nta<strong>in</strong>ed all the rules applicable for cases whereLoan is granted to Policyholders. S<strong>in</strong>ce, the Respondent had <strong>co</strong>mplied with all the<strong>co</strong>nditions as per the said documents, the decision of the Respondent was upheld.Ahmedabad Ombudsman CentreCase No. : 25-001-0066Mr. R P PithadiaVsLife Insurance Corporation of IndiaAward Dated : 24-11-2006Partial Payment of <strong>Maturity</strong> <strong>Claim</strong> under Life Insurance Policy: While mak<strong>in</strong>g thepayment of <strong>Maturity</strong> <strong>Claim</strong>, the Respondent re<strong>co</strong>vered an amount of Rs.110/- towardsdifference <strong>in</strong> premium. It was observed that the Mode of payment of the Policy wasmodified from Quarterly to Yearly. While calculat<strong>in</strong>g the revised premium, the rebatewas taken at 3% of the Premium. However, for Policies <strong>co</strong>mmenc<strong>in</strong>g prior to 1988, therebate was Re. 0.75 per thousand SA. This mistake <strong>in</strong> application of the Rebate led tounder-charg<strong>in</strong>g the Insured by Rs.22/- per year which was detected on maturity of thePolicy. The Compla<strong>in</strong>ant was not made entitled to get any benefit of the genu<strong>in</strong>ebonafide mistake of the Respondent.Ahmedabad Ombudsman CentreCase No. : 24-001-0267Mr. N D VaidyaVsLife Insurance Corporation of IndiaAward Dated : 24-1-2007Delay <strong>in</strong> settlement of <strong>Maturity</strong> <strong>Claim</strong>: The excess remittances of premiums by theEmployer of the Compla<strong>in</strong>ant under the Policy under Salary Sav<strong>in</strong>gs Scheme wererefunded with 8% <strong>in</strong>terest. The Compla<strong>in</strong>ant pressed for higher rate of <strong>in</strong>terest.However s<strong>in</strong>ce the Corporate Office directive <strong>in</strong>dicated the <strong>co</strong>ncerned rate to be madeapplicable to all the Branches <strong>in</strong> India to be 8%, a still higher rate was not <strong>co</strong>nsidered

easonable <strong>in</strong> the circumstances. As such, the Compla<strong>in</strong>t was taken to be disposedwith no further relief to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. : 21-001-0269Mr H N BuddhdevVsLife Insurance Corporation of IndiaAward Dated : 13-2-2007Short settlement of <strong>Maturity</strong> <strong>Claim</strong> under Life Insurance Policy: The Insured had a BimaSandesh Policy. The Compla<strong>in</strong>ant desired that the full Sum Assured with Bonus be paidon maturity of the Policy. As per the <strong>co</strong>nditions of the Plan, only premiums paid uptothe date of maturity less the premiums paid towards Accident Benefit <strong>co</strong>uld berefunded on <strong>Maturity</strong> without <strong>in</strong>terest. The provision be<strong>in</strong>g clearly mentioned <strong>in</strong> theContract, no <strong>in</strong>terpretative <strong>in</strong>tervention can be made. As such, the decision of theRespondent <strong>in</strong> the matter of the <strong>Claim</strong> was upheld.Ahmedabad Ombudsman CentreCase No. : 21-001-0272Mrs S D MurarkaVsLife Insurance Corporation of IndiaAward Dated : 13-2-2007Short settlement of <strong>Maturity</strong> <strong>Claim</strong> under Life Insurance Policy: The Insured had a CDAPlan 41 which vests on the Policy Anniversary subsequent to the Life Assured<strong>co</strong>mplet<strong>in</strong>g age 21. The Insured <strong>co</strong>mpleted age 21 on 15-2-1998. As such, the DeferredDate mentioned <strong>in</strong> the Policy Document should have been 28-11-1998 <strong>in</strong>stead on 28-11-1997. The Respondent admitted to the error <strong>in</strong> the date. The error is a bonafideerror <strong>in</strong> pr<strong>in</strong>t<strong>in</strong>g the Policy Document. The shortfall <strong>in</strong> payment of Vested Bonus due tothis error, though unfortunate, was expla<strong>in</strong>ed to the Compla<strong>in</strong>ant by also giv<strong>in</strong>g him a<strong>co</strong>py of all the types of Bonus Instructions of LIC. The discussions hav<strong>in</strong>g been donethreadbare, the <strong>in</strong>firmities hav<strong>in</strong>g been admitted by the Respondent, there be<strong>in</strong>g nof<strong>in</strong>ancial deficiency <strong>in</strong> the proceeds disbursed, no order to that effect was given.However the Respondent was advised to tone up its work<strong>in</strong>g.Bhopal Ombudsman CentreCase No. : LI-1073-21/10-07/BPLShri Subhash AmdekarVsLife Insurance Corporation of IndiaAward Dated : 22.12.2006Shri Subhash Amdekar, resident of Gwalior (here<strong>in</strong>after called Compla<strong>in</strong>ant) took a life<strong>in</strong>surance policy No. 200210611 under Jeevan Suraksha Policy Table/Term 122-06 on26-04-1999 from LIC of India, DO: Gwalior, Branch: P&GS Gwalior under the CentralZonal Office, Bhopal (here<strong>in</strong>after called Respondent). The Compla<strong>in</strong>ant stated that thePolicy matured on 26-06-2005 and the Pension was due as per provisions of the saidPlan w.e.f. 26-04-2005 at rate of Rs. 843=00 as mentioned on the policy bond. The<strong>co</strong>mpla<strong>in</strong>ant has <strong>in</strong>formed that there has been short-remittance of pension payment byRs 90=00 from the Respondent. The Compla<strong>in</strong>ant added that he has to pay the pension@ Rs. 843=00 but the same is be<strong>in</strong>g paid @ Rs 753=00 from 7/2005 to 8/2006. Whereas the option given by him vide letter dated 11.10.2004 was for the mode of annuity

‘monthly’ and Type of annuity “Option-(F), life pension with Return of purchase price ondeath.” The Term & Conditions of the policy can not be altered without the <strong>co</strong>nsent ofthe policy holder once decided. Aggrieved by the same, the Compla<strong>in</strong>ant has lodged a<strong>co</strong>mpla<strong>in</strong>t with this Office seek<strong>in</strong>g directions to Respondent to settle the balanceamount of pension along with <strong>in</strong>terest.Observations of Ombudsman: I have gone through the materials on re<strong>co</strong>rds andsubmissions made dur<strong>in</strong>g the hear<strong>in</strong>g and my observations are summariz<strong>in</strong>g below.There is no dispute that the Policy No. 200210611 was issued to the Compla<strong>in</strong>ant bythe Respondent on 26-04-1999 under Jeevan Suraksha Annuity Plan.Dur<strong>in</strong>g hear<strong>in</strong>g, the Respondent has stated that the amount of pension of Rs. 843shown on the policy bond is ac<strong>co</strong>rd<strong>in</strong>g to the Option ‘D’ The Respondent further<strong>in</strong>formed that usually they obta<strong>in</strong> the <strong>co</strong>nsent from the annuitant before the maturity ofpolicy for mak<strong>in</strong>g the payment of pension. In this case the Compla<strong>in</strong>ant has alsosubmitted the letter dated 13.10.2004 to opt the Option ‘F’ and ac<strong>co</strong>rd<strong>in</strong>gly the pensionamount Rs 753=00 became payable till survival with another benefit of Notional CashValue payable to the Nom<strong>in</strong>ee after the death. The Respondent also <strong>co</strong>ntented thatthey have sent a letter dated 13-10-2006 to the Compla<strong>in</strong>ant stat<strong>in</strong>g the benefits ofboth the option to take the decision to opt either of it which may be <strong>co</strong>rrectedac<strong>co</strong>rd<strong>in</strong>gly. But the Compla<strong>in</strong>ant has not submitted any reply <strong>in</strong> this regard.It is clear from re<strong>co</strong>rds that the difference <strong>in</strong> annuity amount is due to the change ofoption exercised by the Compla<strong>in</strong>ant at the time of maturity.In view of the above circumstances, I am of the <strong>co</strong>nsidered op<strong>in</strong>ion that the decision ofthe Respondent is fair and justified. I found no reason to <strong>in</strong>terfere with the decisiontaken by the Respondent. Hence the Compla<strong>in</strong>t is dismissed without any relief.Bhopal Ombudsman CentreCase No. : LI-1072-24/10-07/JBPShri R.P.SoniVsLife Insurance Corporation of IndiaAward Dated : 22.01.2007Shri R.P.Soni, Resident of Kareli Distt Nars<strong>in</strong>ghpur (M.P.) [here<strong>in</strong>after calledCompla<strong>in</strong>ant] took life <strong>in</strong>surance policy No. 341366513 & 341369904 from LIC of India,Branch Office: CAB Jabalpur DO, Jabalpur under salary sav<strong>in</strong>g scheme aga<strong>in</strong>st pay<strong>in</strong>gauthority M.P.E.B.[here<strong>in</strong>after called Respondent]. The policies became due for maturity claim. Thepremium of both the policies has been sent to The CAB Jabalpur by his employerthrough RAO MPEB Nars<strong>in</strong>ghpur regularly every month but the premium post<strong>in</strong>g wasnot up dated by the Respondent. The <strong>co</strong>mpla<strong>in</strong>ant has <strong>co</strong>mpla<strong>in</strong>ed that he has notreceived the maturity claim due <strong>in</strong> January 2006 under the policy 341366513 andpension due from May 2006, till the date of <strong>co</strong>mpla<strong>in</strong>t. Aggrieved by the delay <strong>in</strong>payment of maturity claim, the <strong>co</strong>mpla<strong>in</strong>ant has lodged a <strong>co</strong>mpla<strong>in</strong>t with this Officeseek<strong>in</strong>g directions to Respondent to settle the maturity claim amount aga<strong>in</strong>st policy.no. 341366513 and pension aga<strong>in</strong>st policy no. 341369904.The Compla<strong>in</strong>t was registered & necessary forms were issued to both the parties andreply was received from both the parties.Observations of Ombudsman : I have gone through the materials on re<strong>co</strong>rds andsubmissions made dur<strong>in</strong>g hear<strong>in</strong>g and my observations are summarized as follows:

There is no dispute that the Policies number 341366513 and 341369904 were issued toDLA by the Respondent.Dur<strong>in</strong>g hear<strong>in</strong>g, the Compla<strong>in</strong>ant <strong>in</strong>formed that he has not received the maturity claimdue <strong>in</strong> January 2006 under the policy 341366513 and pension due from May 2006under policy no. 341369904 so far where as the premiums were remitted regularly byhis employer, <strong>in</strong> spite of his several <strong>co</strong>rrespondences and visits to the office of therespondent.Dur<strong>in</strong>g hear<strong>in</strong>g, the Respondent stated that the policies were perta<strong>in</strong><strong>in</strong>g to the salarysav<strong>in</strong>g scheme and the premiums were remitted through their respective RAO’s ofMPEB where the Life Assured was posted. Ac<strong>co</strong>rd<strong>in</strong>gly the efforts have been made totrace out the gaps under the policies. Now they have settled the maturity claim underthe policy no. 341366513 vide cheque no. 153275 dated 15.01.2007 for Rs. 142562=00<strong>in</strong>clud<strong>in</strong>g the <strong>in</strong>terest for delay <strong>in</strong> settlement of the maturity claim.Regard<strong>in</strong>g another policy no. 341369904 the Respondent replied that they are underthe process of payment of pension but unable to proceed further <strong>in</strong> absence of optiondesired by the life assured which led to the amount of pension. The Respondent furtheradded that they shall proceed for the payment of pension on receipt of the option fromthe Life Assured.Dur<strong>in</strong>g Hear<strong>in</strong>g, the Respondent has handed over the maturity claim cheque no.153275dated 15.01.2007 for Rs. 142562=00 to the Compla<strong>in</strong>ant which was received by himdur<strong>in</strong>g the hear<strong>in</strong>g. In respect of the another policy no. 341369904 the Respondent hasobta<strong>in</strong>ed the letter of potion “ F ” for pension from the life assured.It is observed that the maturity claim under the policy no. 341366513 has been paid tothe Compla<strong>in</strong>ant and the Compla<strong>in</strong>ant has also submitted the option letter dated17.01.2007 for the calculation of pension amount to the Respondent.In view of the above, the Respondent is directed to settle the payment of pensionunder the policy no. 341369904 with<strong>in</strong> the 15 days from the receipt of this order.Bhubaneshwar Ombudsman CentreCase No. : 21-001-0169Sri Durga Charan BehurayVsLife Insurance Corporation of IndiaAward Dated : 11.11.06The Compla<strong>in</strong>ant had obta<strong>in</strong>ed a Bima Nivesh(S<strong>in</strong>gle Premium) Policy under Table &Term 132-05 on payment of Rs.94972/- on 12.11.99 for an assured sum of Rs.100000/-from Rourkela Branch of LIC of India vide Policy No. 591067046 on the assurance thathe will get guaranteed addition and may get loyalty addition on the maturity value. Thepolicy matured on 12.11.2004. The <strong>in</strong>surer paid maturity value of Rs.150366/- on12.11.2004 which <strong>in</strong>cludes Guaranteed Additions of Rs.50366/-. But no loyalty additionwas paid on the ground <strong>in</strong>teralia that it was not declared by the Insurer. Therepresentation for payment of loyalty addition of Rs.14246/- was rejected by theInsurer. Be<strong>in</strong>g aggrieved the Compla<strong>in</strong>ant moved this forum for redressal.The <strong>co</strong>mpla<strong>in</strong>t was taken up for hear<strong>in</strong>g on 19.6.2006. It was <strong>co</strong>ntended by theCompla<strong>in</strong>ant that before open<strong>in</strong>g the policy, a Development Officer of Rourkela Branchof the Insurer had assured him that the maturity benefit shall <strong>in</strong>clude loyalty addition.He had given him a pr<strong>in</strong>ted leaflet <strong>co</strong>nta<strong>in</strong><strong>in</strong>g emblem of the Insurer and official seal ofthe Development Officer show<strong>in</strong>g loyalty addition of Rs.14246/ . It was submitted by

the Insurer that no loyalty addition was declared on the policy hence the representationof the Compla<strong>in</strong>ant was rejected.Neither party has submitted the policy document and related papers. Therepresentative of the Insurer stated that the policy docket <strong>co</strong>nta<strong>in</strong><strong>in</strong>g the policydocument is not traceable. It appears from the special provisions <strong>co</strong>nta<strong>in</strong>ed <strong>in</strong> a sample<strong>co</strong>py of similar policy that on the life assured surviv<strong>in</strong>g the stipulated date of maturity,the policy may be eligible for payment of loyalty addition at such rate and on suchterms as may be declared by the Corporation.On a pla<strong>in</strong> read<strong>in</strong>g of the special provision it is manifest that loyalty addition may bepaid if declared by the Insurer as per their own terms. The leaflet produced by theCompla<strong>in</strong>ant bears emblem and official seal of a Dev. Officer of the Insurer. It <strong>co</strong>nta<strong>in</strong>sa chart show<strong>in</strong>g payment of loyalty addition of Rs.14246/- on the date of maturity of thepolicy. It does not bear signature of the Dev. Officer <strong>co</strong>ncerned or for that mattersignature of any other official of the Insurer. But the fact rema<strong>in</strong>s that the Compla<strong>in</strong>antwas assured of loyalty addition by circulation of such leaflet either by the Dev. Officeror any of the officials of the Insurer which needs <strong>in</strong>vestigation by C.V.O of the LIC.The representative of the Insurer have neither admitted nor disputed the leaflet. Was ita ploy by the local officers of the Insurer to rope <strong>in</strong> good bus<strong>in</strong>ess? The Compla<strong>in</strong>ant istherefore assuaged by an ex-gratia award of Rs.6000/- under Rule 16 of R.P.G.Rules’1998.Bhubaneshwar Ombudsman CentreCase No. : 24-001-0343Smt.Mart<strong>in</strong>a SorengVsLife Insurance Corporation of IndiaAward Dated : 12.12.06The Compla<strong>in</strong>ant while work<strong>in</strong>g as Asst.Teacher <strong>in</strong> Govt.Girls High School, Sundergarhhad obta<strong>in</strong>ed one Endowment Assurance with Profit Policy under Table & term 14-25for an assured sum of Rs.15000/- from Cuttack Divisional Office of LIC of India underGovt.Salary Sav<strong>in</strong>gs Scheme mode of payment of premium @ Rs.51.33 <strong>co</strong>mmenc<strong>in</strong>gfrom 28.3.69 vide policy no. 10781627. The policy matured on 28.3.94. TheCompla<strong>in</strong>ant lodged maturity claim with the Insurer <strong>in</strong> time. As the Insurer sat over theclaim the Compla<strong>in</strong>ant moved this forum for redressal.The <strong>co</strong>mpla<strong>in</strong>t was taken up for hear<strong>in</strong>g on 30.10.2006 at Jeypore camp. TheCompla<strong>in</strong>ant rema<strong>in</strong>ed absent on the ground of old age. The representative of theInsurer <strong>co</strong>ntended that the claim <strong>co</strong>uld not be settled by the servic<strong>in</strong>g branch ( at thetime of maturity ) due to non availability of policy docket and premium deductionparticulars as the life assured had worked <strong>in</strong> different places dur<strong>in</strong>g the 25 years term.However, the Branch is tak<strong>in</strong>g necessary steps to <strong>co</strong>llect the aforesaid documents andthey shall f<strong>in</strong>alise the claim with<strong>in</strong> one month.The Insurer was orally directed to settle the claim with<strong>in</strong> 15 days, but the claim has notyet been settled even more than one month time has elapsed by now. It speaks ofnegligence on the part of the Insurer <strong>in</strong> settl<strong>in</strong>g the claim of a retired teacher. TheInsurer is directed to pay the maturity claim along with bonus and penal <strong>in</strong>terestthereon to the Compla<strong>in</strong>ant with<strong>in</strong> 15 days from the date of receipt of her <strong>co</strong>nsentletter.Bhubaneshwar Ombudsman CentreCase No. : 21-001-0162

Sri Ganeswar SahooVsLife Insurance Corporation of IndiaAward Dated : 09.10.07The Compla<strong>in</strong>ant while serv<strong>in</strong>g <strong>in</strong> the F<strong>in</strong>ance w<strong>in</strong>g of OSEB Head Office, Bhubaneswarhad obta<strong>in</strong>ed an Endowment Assurance with Profit policy under Table & Term 14-15 foran assured sum of Rs.50000/- <strong>co</strong>mmenc<strong>in</strong>g from 6.12.89 vide policy no. 580252655.The policy matured on 6.12.04 and the Insurer sent D.V. for full maturity amount of Rs.96810/- but ultimately paid a cheque for Rs. 85731/- 0n the ground of excess paymentof Rs. 11698.40 ps. to him <strong>in</strong> a <strong>co</strong>nvertible whole life policy no. 60481628 under Table& Term 27-22 obta<strong>in</strong>ed from another branch of the Insurer. Be<strong>in</strong>g aggrieved theCompla<strong>in</strong>ant moved this forum for redressal.The <strong>co</strong>mpla<strong>in</strong>t was taken up for hear<strong>in</strong>g on 28.11.2006. The Compla<strong>in</strong>ant <strong>co</strong>ntendedthat after issu<strong>in</strong>g the D.V. for full maturity amount of Rs. 96810/- the Insurer arbitrarilydeducted a sum of Rs. 11698.40 ps. Therefrom with out prior notice to him. The Insureradmitted that on the basis of audit report dtd. 12.8.2004 excess payment wasre<strong>co</strong>vered from the maturity claim of policy no. 580252655.There is no dispute that maturity value of policy no. 580252655 was Rs. 96810/- and aD.V. for the like amount was issued to the <strong>co</strong>mpla<strong>in</strong>ant. The Question centers roundwhether there was excess payment of Rs. 11698.40 ps. In policy no. 60481628 to theCompla<strong>in</strong>ant and whether the said amount should not have been adjusted from thematurity value of the policy <strong>in</strong> question.The audit slip produced by the Insurer shows excess payment of Rs. 11698.40 ps. tothe Compla<strong>in</strong>ant <strong>in</strong> policy no. 60481628. The Insurer <strong>co</strong>ntended that notice of excesspayment was issued to the Compla<strong>in</strong>ant vide letter ref: BLS/<strong>Claim</strong>s/AO dtd. 8.11.2004which is disputed by the Compla<strong>in</strong>ant. The Compla<strong>in</strong>ant has expressed anguish fordeduction of the excess payment <strong>in</strong> earlier policy without notice to him. The Insurer nodoubt has <strong>co</strong>mmitted impropriety by not notic<strong>in</strong>g the <strong>co</strong>mpla<strong>in</strong>ant before deduct<strong>in</strong>g theexcess payment <strong>in</strong> previous policy.The payment of excess amount hav<strong>in</strong>g not been refuted the Compla<strong>in</strong>ant is not entitledto any relief.Delhi Ombudsman CentreCase No. : LI-DL-I/106/06Sh. Anand SharmaVsLife Insurance Corporation of IndiaAward Dated :29.12.06My office has received a <strong>co</strong>mpla<strong>in</strong>t on 23.08.2006 from Shri Anand Sharma, aga<strong>in</strong>st theLife Insurance Corporation of India, Divisional Office-I, Delhi, regard<strong>in</strong>g delayedpayment of <strong>Maturity</strong> claim under Policy No.113126031.Life Insurance Corporation of India, Delhi, Divisional Office-I, has <strong>in</strong>formed by theirletter that they have settled maturity claim with<strong>in</strong> stipulated time. The maturity was dueon 11.06.2006 and the <strong>co</strong>mpla<strong>in</strong>ant has received the cheque on 29.6.2006 i.e. with<strong>in</strong>30 days from the due date. Hence, due to this timely payment no penal <strong>in</strong>terest ispayable.In the circumstances, there is no further relief to be granted to the <strong>co</strong>mpla<strong>in</strong>ant. The<strong>co</strong>mpla<strong>in</strong>t is disposed of f<strong>in</strong>ally.

Guwahati Ombudsman CentreCase No. : 23/01/059/L/06-07/GHYSri Prabodh Ch BorahVsLife Insurance Corporation of IndiaAward Dated : 16.11.2006GrievanceThe allegation of the <strong>co</strong>mpla<strong>in</strong>ant is non-payment of the maturity-claim <strong>in</strong> <strong>co</strong>nnectionwith the policy <strong>in</strong> question.ReplyThe Insurance Company has submitted that due to mistake of the clerical staff wrongdirections were issued to the <strong>in</strong>sured with regard to maturity of the policy. That policy<strong>in</strong> question was under table and term 2 (whole life plan) and not under table and term14-15.Decisions & ReasonsThe proposal form has clearly mentioned the table and term of assurance as T-2, sumassured Rs.50,000/-, D.O.C. : 28/03/91, Mode of premium : HLY and amount ofpremium Rs.979.50. Similar facts were re<strong>co</strong>rded <strong>in</strong> this policy <strong>co</strong>py (whole life policywith profits) issued on 19th September, 1991 and it is stated there<strong>in</strong> aga<strong>in</strong>st theword<strong>in</strong>gs — “the period dur<strong>in</strong>g which premium is payable” as ® “till the death of the lifeassured”. In their <strong>co</strong>rrespondences dated 08/06/2006, the <strong>in</strong>surance <strong>co</strong>mpany hasstated that the maturity discharge voucher due for 03/2006 was wrongly issued to the<strong>in</strong>sured. It is also submitted vide letter dated 16/10/2006 addressed to InsuranceOmbudsman that the The error <strong>in</strong> the premium receipt is due to some clerical mistakeand if the policyholder produces his earlier receipts, we may detect at what stage themistake occurs.In the policy the date of maturity has not been mentioned and therefore, the matter isto be settled as per the <strong>in</strong>surance terms and <strong>co</strong>nditions and the <strong>in</strong>sured is to be<strong>in</strong>formed ac<strong>co</strong>rd<strong>in</strong>gly upto which dates he has to pay the premium, if not for the wholelife or till death.Incidentally, <strong>in</strong> case of table and term 14-15, at age 43 of the proposer, total premiumfor 15 years will be, say, Rs.979.50 (HLY) x 30=Rs.29,385.00 which will not be<strong>co</strong>nsistent with the sum assured of Rs.50,000/-. Therefore, we f<strong>in</strong>d that there wasdef<strong>in</strong>itely a mistake <strong>in</strong> issu<strong>in</strong>g the discharge voucher and appropriate action may betaken aga<strong>in</strong>st the <strong>co</strong>ncerned employee of the <strong>in</strong>surer but that cannot give rise to anyright <strong>in</strong> favour of the <strong>in</strong>sured to claim the amount mentioned <strong>in</strong> discharge voucher or to<strong>in</strong>sist upon that because there is no possibility of chang<strong>in</strong>g terms and <strong>co</strong>nditions of theorig<strong>in</strong>al policy etc.The matter stands closed with a direction to the <strong>in</strong>surer/LICI to make necessary<strong>co</strong>rrections of the mistake <strong>co</strong>mmitted by it and <strong>in</strong>form the <strong>in</strong>sured ac<strong>co</strong>rd<strong>in</strong>gly. Forclarification, <strong>co</strong>py of the terms and <strong>co</strong>nditions with <strong>in</strong>structions may be issued to the<strong>in</strong>sured afresh for his knowledge and guidance etc. at the earliest.Guwahati Ombudsman CentreCase No. : 21/01/048/L/06-07/GHYSri Prakash Ch BaruahVsLife Insurance Corporation of IndiaAward Dated : 18.12.2006

GrievanceThe grievance of the <strong>co</strong>mpla<strong>in</strong>ant/Insured is that he has not received the maturity claimaga<strong>in</strong>st the policy <strong>in</strong> question. That on his visit to the LIC Office with <strong>in</strong>tent to make anenquiry, he <strong>co</strong>uld <strong>co</strong>me to know that the policy status was ‘surrendered’ but he hasneither received any cheque nor any <strong>in</strong>timation from the LIC <strong>in</strong> this <strong>co</strong>ntext on the fateof the policy.ReplyThe LIC has <strong>co</strong>mmunicated this authority by letter dated 12/12/06 to say that the policywas surrendered <strong>in</strong> the year 1991 as per re<strong>co</strong>rds, but s<strong>in</strong>ce surrender payments weredone manually dur<strong>in</strong>g that period and s<strong>in</strong>ce it destroys old re<strong>co</strong>rds after expiry of 5years, payment details is not available either <strong>in</strong> the <strong>co</strong>mputer or <strong>in</strong> the old register.Decisions & ReasonsOn perusal of the status report of the policy, it appears that it was a policy of sumassured of Rs.25,000/- with monthly mode of premium @81.80 under Plan-Trm-PPtm:14-25-25, the D.O.C. was 20/03/1981, maturity date 03/2006 , last due 02/2006, FUP-04/1990, the last ac<strong>co</strong>unt dt:31/7/2001 (Date of <strong>co</strong>mputerization of system). So, fromthe aforesaid figures, it appears that the <strong>co</strong>mpla<strong>in</strong>ant/<strong>in</strong>sured did not take any step tokeep the policy <strong>in</strong> force after the policy status FUP 04/1990.Thus, we f<strong>in</strong>d that the <strong>co</strong>mpla<strong>in</strong>ant/<strong>in</strong>sured was not tak<strong>in</strong>g up any step towards therunn<strong>in</strong>g of the policy or claim<strong>in</strong>g the benefit for last 15 to 16 years mak<strong>in</strong>g it a ‘staleclaim’ by now and has approached this authority too belatedly for such relief. It issignificant that he has absolutely no document of any k<strong>in</strong>d <strong>in</strong> his possession <strong>in</strong>clud<strong>in</strong>gthe <strong>co</strong>py of the policy <strong>in</strong> order to substantiate his claim. LIC is also not <strong>in</strong> a position tosay def<strong>in</strong>itely, <strong>in</strong> absence of re<strong>co</strong>rds, whether the claim was settled by payment orotherwise. But then, presumption under the facts and circumstances aforesaid will bethat the claim was most desiredly settled around the year 1990-91 as there is noth<strong>in</strong>g<strong>in</strong> rebuttal from the side of the <strong>co</strong>mpla<strong>in</strong>ant. The question would have been different if<strong>co</strong>mpla<strong>in</strong>ant <strong>co</strong>uld produce any document <strong>in</strong> <strong>co</strong>nnection with the said policy. Generally,as per the Law of Limitation the claim of money due is to be made with<strong>in</strong> three yearsfrom the date it be<strong>co</strong>mes due and <strong>in</strong> this present case, no claim was submitted for along period of 15 years.Consequently <strong>co</strong>nclud<strong>in</strong>g, no s<strong>co</strong>pe to give relief to the <strong>co</strong>mpla<strong>in</strong>ant. Matter standsclosed.Guwahati Ombudsman CentreCase No. : 24/01/122/L/06-07/GHY.Sri Haripada DuttaVsLife Insurance Corporation of IndiaAward Dated : 26.02.2007GrievanceThis is a <strong>co</strong>mpla<strong>in</strong>t aga<strong>in</strong>st LICI for non-payment of maturity claim of Rs.10,000/- under‘SSS’ policy, (DOC : 15.03.91, monthly premium be<strong>in</strong>g Rs.61.30, table & term : 14-15)due on 15.03.06 as per the policy terms and <strong>co</strong>nditions. The <strong>co</strong>mpla<strong>in</strong>ant, however,admits that his employer deducted the premium @ Rs.61/- per month (<strong>in</strong>stead ofRs.61.30) aga<strong>in</strong>st wrong policy no.480309280 <strong>in</strong>stead of the <strong>co</strong>rrect policyno.480309289.Reply

The stand taken by LICI is that there is only a deposit of Rs.1,281/- aga<strong>in</strong>st the policy no.480309280 w.e.f. 07/2004 to 03/2006 and no depositswere found aga<strong>in</strong>st policy no.480309289.Decisions & ReasonsAs per the documents submitted by LICI it is seen that aga<strong>in</strong>st the policy no.480309289 the deposit has been shown upto 4th April, 1999 and thereafter the policyhas been shown as <strong>in</strong> lapsed <strong>co</strong>ndition. But <strong>in</strong> another photo-<strong>co</strong>py of ‘SSS Adj. Errors/Deposits’ submitted from LICI also reflects policy no.480309280. So, there was<strong>co</strong>nfusion and the same has still rema<strong>in</strong>ed not removed by the LICI. The LICI has notsubmitted any self-<strong>co</strong>nta<strong>in</strong>ed note to give any clear picture of the claim position, butfrom the documents submitted and <strong>in</strong>ter-Branches <strong>co</strong>rrespondences made, it appearthat the receipt of the premiums from the <strong>in</strong>sured/<strong>co</strong>mpla<strong>in</strong>ant from DOC i.e., 15.03.91,till April 2006 @ Rs,61/- is an admitted fact. The <strong>co</strong>mpla<strong>in</strong>ant has enclosed also <strong>co</strong>piesof the ‘pay sheets’ and ‘demand <strong>in</strong>voice of the employer’ where<strong>in</strong> the deduction hasbeen shown and remittance has been re<strong>co</strong>rded from DOC till April, 2006 i.e., withexcess deposits of premiums for the month of March & April, 2006. Thus, from thegiven facts we can easily <strong>co</strong>me to the <strong>co</strong>nclusion that because of the negligence ofLICI the status position of the policy <strong>in</strong> question was not rectified <strong>in</strong> spite of<strong>co</strong>rrespondences made by the <strong>co</strong>mpla<strong>in</strong>ant and his employer for which the maturitypayment <strong>co</strong>uld not be effected at appropriate time and it is due to non-action on thepart of the LICI which kept the matter pend<strong>in</strong>g without any desire to settle the claim.However, it appears that there was deduction of premium @ Rs. 61/- <strong>in</strong>stead ofRs.61.30 (as reflected from the <strong>co</strong>py of the policy) and thus, the monthly premium wasdeposited <strong>in</strong> a reduced rate by 30 paisa which was not detected earlier nor any attemptwas made for <strong>co</strong>rrection of the same by the <strong>in</strong>surer. This matter may be solved byadjustment of the same as per the LICI rules and norms for less payment of premium.In view of the discussions aforesaid, it is hereby directed that LIC will make thepayment to the <strong>in</strong>sured/<strong>co</strong>mpla<strong>in</strong>ant at once without any further delay along with penal<strong>in</strong>terest @ 6% P.A. from the date it became due till f<strong>in</strong>al payment for delay <strong>in</strong> payment,after mak<strong>in</strong>g the adjustment as described beforehand.Hyderabad Ombudsman CentreCase No. : L-21-001-0337-2006-07Sri Francis JosephVsLife Insurance Corporation of IndiaAward Dated : 22.02.2007Facts of the Case:The <strong>co</strong>mpla<strong>in</strong>ant is the LA under policy no.33836647 and his <strong>co</strong>mpla<strong>in</strong>t is about shortpayment of maturity value of the policy on ac<strong>co</strong>unt of re<strong>co</strong>very of <strong>in</strong>terest on policyloan. The LA obta<strong>in</strong>ed the policy for a sum assured of Rs.70,000 from Kolkata Divisionof LIC <strong>in</strong> the year 1981. He borrowed a loan of Rs.14,700 on 1.8.1988 from Citybranch-19, Kolkata @ 10.5% <strong>in</strong>terest and executed necessary loan papers. The LAshifted to Bangalore <strong>in</strong> 1996 and got his policy file transferred from Kolkata toBangalore. The policy matured for f<strong>in</strong>al payment on 28.3.2006 and <strong>in</strong> the <strong>in</strong>itial claim<strong>in</strong>timation letter, LIC did not show any re<strong>co</strong>very aga<strong>in</strong>st loan. The LA was asked to givea f<strong>in</strong>al discharge for Rs.205870.00 and was asked to return the orig<strong>in</strong>al policy bond forcancellation. At this po<strong>in</strong>t of time it came to light that the LA was not <strong>in</strong> possession ofthe bond and about existence of loan. The maturity payment under the policy was madeby LIC after deduct<strong>in</strong>g the outstand<strong>in</strong>g loan and a total <strong>in</strong>terest of Rs. 74,890. The

<strong>co</strong>mpla<strong>in</strong>ant raised the present <strong>co</strong>mpla<strong>in</strong>t aga<strong>in</strong>st LIC about the huge amount ofRs.74890 re<strong>co</strong>vered as <strong>in</strong>terest on <strong>co</strong>mpound basis. He claimed that LIC was at fault <strong>in</strong>not <strong>in</strong>timat<strong>in</strong>g him about the loan and <strong>in</strong>terest outstand<strong>in</strong>g aga<strong>in</strong>st the policy. He<strong>co</strong>ntended that even though there was a provision to show details of loan <strong>in</strong> thepremium notices, LIC never <strong>in</strong>dicated any loan details <strong>in</strong> the notices sent to him and heforgot about the loan. He <strong>co</strong>ntended that it is highly irregular for LIC to levy such ahuge amount as <strong>co</strong>mpound <strong>in</strong>terest without ever rem<strong>in</strong>d<strong>in</strong>g him. He requested forcharg<strong>in</strong>g of simple <strong>in</strong>terest on the loan and not <strong>co</strong>mpound <strong>in</strong>terest as LIC was at fault<strong>in</strong> not rem<strong>in</strong>d<strong>in</strong>g him about loan.The <strong>in</strong>surer <strong>co</strong>ntended that the LA executed a loan bond and he was given the loancheque under a <strong>co</strong>ver<strong>in</strong>g letter. As per the loan sanction letter dated 29.7.1988, the LAwas advised to pay half yearly <strong>in</strong>terest @ Rs.771.80 regularly and he was also advisedabout the broken period <strong>in</strong>terest of Rs.257.30 payable on 28.9.1988. They <strong>co</strong>ntendedthat the LA did not pay even the broken period <strong>in</strong>terest and they are justified <strong>in</strong>re<strong>co</strong>ver<strong>in</strong>g the total <strong>in</strong>terest as per loan agreement.DECISIONThe LA admitted that he availed the loan <strong>in</strong> 07/1988 and forgotten about the same. Hisma<strong>in</strong> <strong>co</strong>mpla<strong>in</strong>t is that he was not rem<strong>in</strong>ded by LIC till the policy matured and he neverknew that he would be asked to pay such a huge amount as <strong>in</strong>terest. Dur<strong>in</strong>g the <strong>co</strong>urseof personal hear<strong>in</strong>g held on 14.2.2007, the LA admitted that he requested for transferof his file to Bangalore and LIC acted ac<strong>co</strong>rd<strong>in</strong>gly. As per re<strong>co</strong>rd the LA stayed atKolkata for about eight years after sanction of loan and he did not pay even a s<strong>in</strong>glerupee towards the loan ac<strong>co</strong>unt. Hence, shift<strong>in</strong>g of residence is not the immediatereason for non-payment of <strong>in</strong>terest. Further, the <strong>in</strong>surer <strong>co</strong>ntended that there is nodiscretion to waive any part of <strong>in</strong>terest, even <strong>in</strong> the case of their regular employees <strong>in</strong>similar situations. In view of the clear terms of loan agreement, the <strong>co</strong>mpla<strong>in</strong>t wasdismissed.Kolkata Ombudsman CentreCase No. : 167/24/001/L/06/2006-07Shri Baban PrasadVsLife Insurance Corporation of IndiaAward Dated : 28.11.2006Facts & Submissions:The <strong>co</strong>mpla<strong>in</strong>ant, Shri Baban Prasad purchased the above LIC policy, which gotmatured on 07.11.05. He stated that even after surrender of the policy bond anddischarge form on 25.11.05, he did not receive the maturity amount till date. Hence,this <strong>co</strong>mpla<strong>in</strong>t was filed before this forum seek<strong>in</strong>g relief for the maturity amount plus<strong>in</strong>terest thereon.However, before the order <strong>co</strong>uld be passed, the <strong>co</strong>mpla<strong>in</strong>ant sent a letter dated18.11.06 stat<strong>in</strong>g that he would like to withdraw the above <strong>co</strong>mpla<strong>in</strong>t aga<strong>in</strong>st the<strong>in</strong>surance <strong>co</strong>mpany. He further stated that he would take appropriate steps aga<strong>in</strong>st the<strong>in</strong>surance <strong>co</strong>mpany and he prayed for withdrawal of the <strong>co</strong>mpla<strong>in</strong>t.As the <strong>co</strong>mpla<strong>in</strong>ant had requested for withdrawal of the <strong>co</strong>mpla<strong>in</strong>t, the same wasdismissed as per his request.Kolkata Ombudsman CentreCase No. : 429/24/001/L/09/06-07

Smt. Lalita S<strong>in</strong>ghVsLife Insurance Corporation of IndiaAward Dated : 08.03.07Facts & Submissions:This petition was filed by the <strong>co</strong>mpla<strong>in</strong>ant Smt. Lalita S<strong>in</strong>gh for non-payment ofmaturity claim by LICI.Smt. Lalita S<strong>in</strong>gh purchased an <strong>in</strong>surance policy, which was due for maturity on21.07.2006. Ac<strong>co</strong>rd<strong>in</strong>g to the petition, she requested LICI for a transfer of the policyfrom Jamshedpur but she was <strong>in</strong>formed on 24.04.06 that the policy was go<strong>in</strong>g tomature with<strong>in</strong> 3 months and that there was no provision for transfer of re<strong>co</strong>rds ofpolicies where maturity <strong>in</strong>timations were sent. They requested her to furnish hercurrent address for their needful action. S<strong>in</strong>ce the maturity claim was not settled, shehas requested this forum for relief.HEARING :A hear<strong>in</strong>g was fixed to sort out the matter. The representative of the <strong>in</strong>surance<strong>co</strong>mpany attended but the party did not attend. The representative of the <strong>in</strong>surance<strong>co</strong>mpany <strong>in</strong>formed this office that maturity claim was paid by cheque dated 08.12.06 fora sum of Rs. 1,92,915/- (<strong>in</strong>clud<strong>in</strong>g penal <strong>in</strong>terest of Rs. 4,958).Decision :The absence of the <strong>co</strong>mpla<strong>in</strong>ant at the time of hear<strong>in</strong>g <strong>in</strong>dicateed that she must havereceived the payment and does not have any more grievances. S<strong>in</strong>ce the grievancewas satisfactorily redressed, no <strong>in</strong>terference was called for.Mumbai Ombudsman CentreCase No. : LI-251 of 2006-2007Shri Narayan Bhaskar JoshiV/s.Life Insurance Corporation of IndiaAward Dated : 18.12.2006Shri Narayan Bhaskar Joshi took policy no. 17614973 from Life Insurance Corporationof India, Bombay Divisional Office for Rs. 10,000 with effect from 23.12.1970 underplan 14 for a term of 34 years through his proposal dated 23.12.1970. The policy wasorig<strong>in</strong>ally taken on yearly mode of premium and later <strong>co</strong>nverted to SSS policy. Thepolicy matured on 23.12.2004 and LIC settled the claim for Rs. 26,434 aga<strong>in</strong>st theamount of Rs. 34,409.30. They stated that the f<strong>in</strong>al additional bonus of Rs. 6800 wasnot payable to him s<strong>in</strong>ce as per the policy terms and <strong>co</strong>nditions f<strong>in</strong>al additional bonuswas payable only <strong>in</strong> case of <strong>in</strong>force policies. Not gett<strong>in</strong>g favourable reply from SSSDivision, Shri Joshi approached this Forum with his <strong>co</strong>mpla<strong>in</strong>t seek<strong>in</strong>g justice. Afterperusal of the re<strong>co</strong>rds parties to the dispute were called for hear<strong>in</strong>gThe documents on re<strong>co</strong>rd have been gone through. It is noted that LIC has not<strong>in</strong>formed the policyholder anytime regard<strong>in</strong>g non-receipt of gap premiums or for revivalof the policy, but adjusted the subsequent premiums as and when received leav<strong>in</strong>g theold gaps. Even at the time of send<strong>in</strong>g the maturity <strong>in</strong>timation he was not specifically<strong>in</strong>formed about the 14 gap premiums and get necessary certificate from the Employer.It is observed and admitted that they had not <strong>in</strong>formed about the gaps anytime <strong>in</strong>writ<strong>in</strong>g. However he was orally asked to br<strong>in</strong>g the certificate from the Employer. Even<strong>in</strong> the letter dated 17.12.2004 the unpaid premium was shown as ‘0’ and no reason for

deduction of Rs 7973.30 from the claim amount of Rs.34,409 was given, but gave thedetails and reasons thereof on tak<strong>in</strong>g up the matter. The gap premium was perta<strong>in</strong><strong>in</strong>gto the period 12/99 to 7/2001, but premium for the month 2/2000 to 5/2000, 7/2000,2/2001 and 8/2001 to 9/2004 were received and adjusted by LIC. How the subsequentpremiums were adjusted when the premium for earlier months were not received andadjusted was unexpla<strong>in</strong>ed by LIC. Even when the maturity <strong>in</strong>timation was sent <strong>in</strong>steadof send<strong>in</strong>g a detailed letter, LIC chose to send a stereotype letter without specifically<strong>in</strong>form<strong>in</strong>g about the gap premium and ask<strong>in</strong>g him to obta<strong>in</strong> a certificate from hisEmployer. After gett<strong>in</strong>g the maturity <strong>in</strong>timation the Compla<strong>in</strong>ant had not made s<strong>in</strong>cereefforts to get a certificate from his Employer for hav<strong>in</strong>g deducted the said premia fromhis salary. Instead, he chose to write to them only on 4.1.2006, nearly after one yearand that too <strong>in</strong>stead of ask<strong>in</strong>g for a certificate, he asked them to make good the losssuffered by him and thereafter no rem<strong>in</strong>ders were sent to them. Even on the date ofhear<strong>in</strong>g he <strong>co</strong>uld not produce such a certificate for claim<strong>in</strong>g the full maturity proceeds.In view of the above analysis, I do not f<strong>in</strong>d any justifiable reason to deny the maturityclaim benefits to the policyholder except the gap premium amount, for whichpolicyholder has not made any s<strong>in</strong>cere attempt to get a certificate from the employerare to be deducted from the maturity proceeds.Life Insurance Corporation of India is hereby directed to treat the policy <strong>in</strong> force till thedate of <strong>Maturity</strong> and settle the balance maturity benefits under policy no. 17614973 toShri Narayan Bhaskar Joshi alongwith F<strong>in</strong>al Additional Bonus after deduct<strong>in</strong>g the gappremium amount. The case is disposed of ac<strong>co</strong>rd<strong>in</strong>gly.