Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

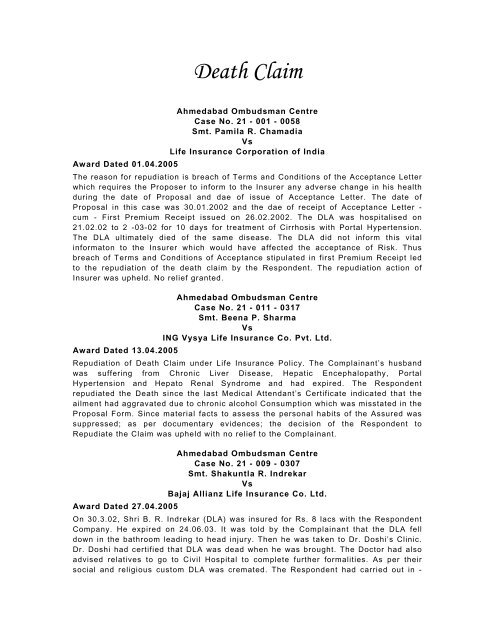

<strong>Death</strong> <strong>Claim</strong>Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0058Smt. Pamila R. ChamadiaVsLife Insurance Corporation of IndiaAward Dated 01.04.2005The reason for repudiation is breach of Terms and Conditions of the Acceptance Letterwhich requires the Proposer to <strong>in</strong>form to the Insurer any adverse change <strong>in</strong> his healthdur<strong>in</strong>g the date of Proposal and dae of issue of Acceptance Letter. The date ofProposal <strong>in</strong> this case was 30.01.2002 and the dae of receipt of Acceptance Letter -cum - First Premium Receipt issued on 26.02.2002. The DLA was hospitalised on21.02.02 to 2 -03-02 for 10 days for treatment of Cirrhosis with Portal Hypertension.The DLA ultimately died of the same disease. The DLA did not <strong>in</strong>form this vital<strong>in</strong>formaton to the Insurer which would have affected the acceptance of Risk. Thusbreach of Terms and Conditions of Acceptance stipulated <strong>in</strong> first Premium Receipt ledto the repudiation of the death claim by the Respondent. The repudiation action ofInsurer was upheld. No relief granted.Ahmedabad Ombudsman CentreCase No. 21 - 011 - 0317Smt. Beena P. SharmaVsING Vysya Life Insurance Co. Pvt. Ltd.Award Dated 13.04.2005Repudiation of <strong>Death</strong> <strong>Claim</strong> under Life Insurance Policy. The Compla<strong>in</strong>ant’s husbandwas suffer<strong>in</strong>g from Chronic Liver Disease, Hepatic Encephalopathy, PortalHypertension and Hepato Renal Syndrome and had expired. The Respondentrepudiated the <strong>Death</strong> s<strong>in</strong>ce the last Medical Attendant’s Certificate <strong>in</strong>dicated that theailment had aggravated due to chronic al<strong>co</strong>hol Consumption which was misstated <strong>in</strong> theProposal Form. S<strong>in</strong>ce material facts to assess the personal habits of the Assured wassuppressed; as per documentary evidences; the decision of the Respondent toRepudiate the <strong>Claim</strong> was upheld with no relief to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 21 - 009 - 0307Smt. Shakuntla R. IndrekarVsBajaj Allianz Life Insurance Co. Ltd.Award Dated 27.04.2005On 30.3.02, Shri B. R. Indrekar (DLA) was <strong>in</strong>sured for Rs. 8 lacs with the RespondentCompany. He expired on 24.06.03. It was told by the Compla<strong>in</strong>ant that the DLA felldown <strong>in</strong> the bathroom lead<strong>in</strong>g to head <strong>in</strong>jury. Then he was taken to Dr. Doshi’s Cl<strong>in</strong>ic.Dr. Doshi had certified that DLA was dead when he was brought. The Doctor had alsoadvised relatives to go to Civil Hospital to <strong>co</strong>mplete further formalities. As per theirsocial and religious custom DLA was cremated. The Respondent had carried out <strong>in</strong> -

house <strong>in</strong>vestigation. The Investigation Report was <strong>in</strong> a well structured format. TheInvestigation Officer <strong>co</strong>ncluded that no specific evidence were <strong>co</strong>llected which can leadto repudiation. As per his re<strong>co</strong>mmendation, the Respondent entrusted <strong>in</strong>vestigation toExternal Investigat<strong>in</strong>g Agency. The External Investigator had tried to <strong>co</strong>llect <strong>co</strong>ncreteevidence. He visited the police Station for verify<strong>in</strong>g prohibition cases. He went toRegistrar of Birth and <strong>Death</strong> to <strong>co</strong>nfirm whether Insured died prior to Proposal date. Healso visited 8 Hospitals and Cl<strong>in</strong>ics to ascerta<strong>in</strong> state of health of DLA. He <strong>co</strong>ntactedDr. Doshi on 01.03.2004 with photograph of DLA. S<strong>in</strong>ce period of nearly 8 months waspassed, the Doctor <strong>co</strong>uld not <strong>co</strong>nfirm identification of the DLA whom was brought deadon 24.06.03 to him. So he reported that identification of DLA <strong>co</strong>uld not be establihsed.And on the basis of f<strong>in</strong>d<strong>in</strong>g of Investigators, the <strong>Claim</strong> was repudiated. It stated that“the cause of death is not established due to non-<strong>co</strong>mpliance of mandatoryrequirements as per Policy <strong>co</strong>nditions. Dur<strong>in</strong>g the <strong>co</strong>urse of Hear<strong>in</strong>g the Compla<strong>in</strong>antproduced notarized affidavits of 10 different persons of em<strong>in</strong>ence of the <strong>co</strong>mmunity<strong>co</strong>nfirm<strong>in</strong>g identification of person. DLA was cremated without Police formalities, it isviolation of Clause - 8 viz. Reports from Police <strong>in</strong> case of accidental / unnatural death”.This will allow the Respondent to deny Accident Benefit but not the basic SumAssured. More than 1 year is passed from <strong>co</strong>mmencement of Risk to death, so suicideclause is also not operative. The Respondent was directed to pay basic Sum Assuredof Rs. 8 lacs and term rider to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0402Smt. Manjulaben V. BhadaniVsLife Insurance Corporation of IndiaAward Dated 20.06.2005Repudiation of <strong>Death</strong> <strong>Claim</strong>. The Compla<strong>in</strong>ant’s husband died due to Cardiac Arrest.The <strong>Claim</strong> was repudiated on grounds that the deceased had suffered from Stroke andHypertension before the date of risk and had taken treatment thereof. The Certificate ofHospital Treatment, Medical Attendant’s Certificate and the Mediclaim Papers all statethat the deceased was a known case of Hypertension with Stroke 2 Years back S<strong>in</strong>cethere was no <strong>in</strong><strong>co</strong>nsistency <strong>in</strong> the sources of the reports and s<strong>in</strong>ce the deceased whiletak<strong>in</strong>g Insurance had not disclosed the material facts, the decision to repudiate the<strong>Claim</strong> was upheld with no relief to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0001Smt. Madhuben H. MayaniVsLife Insurance Corporation of IndiaAward Dated 30.06.2005Repudiation of <strong>Death</strong> <strong>Claim</strong> under Life Insurance Policy. The Compla<strong>in</strong>ant’s husband<strong>co</strong>mmitted suicide by dr<strong>in</strong>k<strong>in</strong>g poison. The Respondent repudiated the <strong>Claim</strong> s<strong>in</strong>ce thedeceased had not mentioned the facts <strong>in</strong> the Personal Form that he was tak<strong>in</strong>gtreatment of Non - <strong>in</strong>sul<strong>in</strong> dependant Diabetes. S<strong>in</strong>ce the said disease had no nexuswith the unnatural cause of death, as per legal precedent <strong>in</strong> similar cases, theRespondent was directed to pay to the Compla<strong>in</strong>ant the Full Sum Assured with <strong>in</strong>terestat 6 %.

Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0183N. A. PatelVsLife Insurance Corporation of IndiaAward Dated 04.07.2005Wife of the Compla<strong>in</strong>ant held a Jeevan Akshay Policy. It was an Annuity Policy (Table146). On her death, Respondent refunded the purchase price only. Compla<strong>in</strong>antdemanded <strong>in</strong>terest, which was turned down by the Respondent. Hear<strong>in</strong>g not held.Documents were sufficient to decide the case. It is observed that the date of<strong>co</strong>mmencement of the Policy be<strong>in</strong>g 27.03.2003 and Mode be<strong>in</strong>g Yearly, the FirstAnnuity Instalment was due on 01.04.2004. But the LA died on 24.02.2004, i.e. beforethe date of First Annuity Instalment payable on 01.04.2004. In this case, the issue tobe ascerta<strong>in</strong>ed was that whether the Nom<strong>in</strong>ee / Beneficiary is entitled to get PurchasePrice only or not. It is observed from the Policy Conditions that no benefit can be thereother than return of Purchase Price on death of Annuitant because, the death tookplace earlier to the due date of First Annuity Instalment. Held that the Compla<strong>in</strong>ant’splead<strong>in</strong>g that the Provisions with regard to <strong>in</strong>terest payment <strong>in</strong> some other PensionPlans are also to be made applicable <strong>in</strong> Table 146, is not acceptable or relevant.Return of Purchase Price upheld without any relief to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 21 - 004 - 0358D. P. AgarwalVsICICI Prudential Life Insurance Co. Ltd.Award Dated 11.07.2005Repudiation of death <strong>Claim</strong> under life Policy for suppression of material fact regard<strong>in</strong>gpersonal health. The Respondent submitted that though the Life Assured suffered fromHypertension, Diabetes and hypothyroidism prior to propos<strong>in</strong>g for <strong>in</strong>surance, it was notmentioned at the proposal stage. This was suppression of material fact which wouldhave effected the underwrit<strong>in</strong>g decision of the respondent. Repudiation was upheldCompla<strong>in</strong>ant failed to succeed.Ahmedabad Ombudsman CentreCase No. 11 - 002 - 0344Mr. V. B. PatelVsThe New India Assurance Co. Ltd.Award Dated 14.07.2005Mediclaim for Cataract treatment rejected as Hospital was not <strong>co</strong>mply<strong>in</strong>g 15 Bedcriteria. However the Hospital was registered by Ahmedabad Municipal Corporations<strong>in</strong>ce 1999. The Respondent argued that the said registration fell short of Registrationas envisaged by them. It was observed her E. N. T. Hospital may not fulfill criteria fornumber of beds meant for General Hospitals. Aga<strong>in</strong> Treat<strong>in</strong>g Doctor is M. S. <strong>in</strong>Ophthalmology. There is no dispute as to the quality of treatment taken which is thema<strong>in</strong> purpose beh<strong>in</strong>d sett<strong>in</strong>g standards of Registration of Hospitals. <strong>Claim</strong> was directedto be paid for Rs. 17395/-.Ahmedabad Ombudsman CentreCase No. 24 - 001 - 0420

Smt. K. M. ShahVsLife Insurance Corporation of IndiaAward Dated 21.07.2005The <strong>co</strong>mpla<strong>in</strong>t relates to the deduction made from <strong>Death</strong> <strong>Claim</strong> proceeds of VarishthaPension Policy. LIC had issued <strong>in</strong>struction that not more than one Policy can be issuedto a person. But this was not done at the outset i.e. with launch<strong>in</strong>g of the Plan but itwas done after few months. Before such <strong>in</strong>structions were issued a policyholder tooktwo separate Policies. Annuity payment started <strong>in</strong> both the Policies as promised. ThePolicyholder died 8 months after start of the annuity. The return of Premium paidbe<strong>co</strong>mes payable subject to deduction of any annuity payable and paid after date ofdeath. But the Respondent re<strong>co</strong>vered the entire amount of all annuity <strong>in</strong>stalment paidunder the se<strong>co</strong>nd Policy. Ac<strong>co</strong>rd<strong>in</strong>g to them Policyholder was not eligible to obta<strong>in</strong>se<strong>co</strong>nd Policy. It was held that Respondent cannot apply the <strong>in</strong>structions withretrospective effect and therefore any Policies issued prior to restrictive <strong>in</strong>structionsshould be eligible to earn annuity. So, re<strong>co</strong>very was not justified and Respondent wasdirected the said amouunt with 8 % <strong>in</strong>terest.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0362Mrs. Wisonta Hanokh ParmarVsLife Insurance Corporation of IndiaAward Dated 22.07.2005The Deceased Life Assured had proposed the <strong>in</strong>surance on 12.03.2002. FPR wasissued on 18.04.2002 with Risk <strong>co</strong>mmenc<strong>in</strong>g on 28.03.2002. <strong>Death</strong> occurred on5.12.2003 by Cancer of Stomach. Respondent pleaded that certificate of Treatmentfrom Dr. Ronak Shah mentioned that the DLA had <strong>co</strong>nsulted Dr. Shah on 16.01.2001for Chest Pa<strong>in</strong> evidently earlier than 12.03.2002 i.e. date of Proposal. It was also notedthat the DLA had been exam<strong>in</strong>ed by Dr. R. L. Kothari on 01.04.2002 <strong>in</strong> OPD forEpigastric Mild Pa<strong>in</strong>. This illness existed s<strong>in</strong>ce 1 ½ month before 01.04.2002 whencalculated back. The Respondent argued that despite there be<strong>in</strong>g past history of illnessof abdom<strong>in</strong>al pa<strong>in</strong> treated by Doctors, the specific questions <strong>in</strong> the proposal form werereplied <strong>in</strong> negative by the DLA. This <strong>co</strong>rrect <strong>in</strong>formation was withhold by the DLA.Aga<strong>in</strong>st this the Compla<strong>in</strong>ant pleaded that he had disclosed <strong>in</strong>formation of UlcerOperation done <strong>in</strong> 1971, and chest - pa<strong>in</strong> and epigastric pa<strong>in</strong> was due to normalacidities <strong>in</strong> the stomach it was held that the suppressed facts regard<strong>in</strong>g history of pa<strong>in</strong><strong>in</strong> abdomen had nexus with cause of death due to Cancer. The Suppression wasmaterial and <strong>in</strong>tentional. The treatment taken dur<strong>in</strong>g date of proposal and date of FPRis also not <strong>in</strong>formed to the Respondent. So the <strong>co</strong>mpla<strong>in</strong>t fails to succeed and theRespondent’s decision to repudiate <strong>Claim</strong> is upheld.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0011K. B. ZalaVsLife Insurance Corporation of IndiaAward Dated 27.07.2005<strong>Death</strong> <strong>Claim</strong> under a Life policy was repudiated on the ground of non-disclosure ofmaterial facts by mak<strong>in</strong>g <strong>in</strong><strong>co</strong>rrect statements regard<strong>in</strong>g his while fill<strong>in</strong>g up the

proposal. Respondent submitted a certificate of treatment from Dr. Milan Dave. It <strong>in</strong>teralia stated that the DLA was his patient on OPD basis whom he had exam<strong>in</strong>ed ondifferent dates from 31.05.2000. Dr. Dave <strong>in</strong>dicated the DLA to be carry<strong>in</strong>g history of<strong>co</strong>ugh, fever, breathlessness and the DLA was diagnosed by him as suffer<strong>in</strong>g fromAllergic Bronchial Asthma. It was also mentioned <strong>in</strong> Certificate that patient wassuffer<strong>in</strong>g “off and on s<strong>in</strong>ce long time” and the history of the ailment was provided by“patient himself to Dr. Dave”. The DLA did not mention anyth<strong>in</strong>g about the aboveailment and treatment taken by him <strong>in</strong> the Proposal form. This <strong>in</strong>formation was materialfor tak<strong>in</strong>g underwrit<strong>in</strong>g decision of the high risk Policy by the DLA. Also the repudiationwas done with<strong>in</strong> 2 years and therefore the case did not get the protections of theennobl<strong>in</strong>g provisions under Section 45 of Insurance Act 1938. Compla<strong>in</strong>t failed tosucceed.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0112P. M. PrajapatiVsLife Insurance Corporation of IndiaAward Dated 29.07.2005Repudiation of Deah <strong>Claim</strong> on the ground tha DLA did not <strong>in</strong>form about the treatmenttaken by him after submission of proposal paper but before date of Acceptance letter.The Respondent pleaded that this was breach of terms and Conditons on which theRisk was accepted. The DLA had taken treatment for burn<strong>in</strong>g sensation dur<strong>in</strong>gur<strong>in</strong>ation suspected to be ur<strong>in</strong>ary tract <strong>in</strong>fection and crystallurea by treat<strong>in</strong>g doctor. TheRenal function test and ur<strong>in</strong>e analysis disclosed absolute normalcy. Only Antibiotictreatment was taken for 5 days and his <strong>co</strong>ndition was certified to be good. The trat<strong>in</strong>gdoctor had never treated him ever before. The DLA was medically exam<strong>in</strong>ed at theproposal stage and Risk was accepted after scrut<strong>in</strong>y of special reports. The DLA diedof drown<strong>in</strong>g. There was no nexus between the alleged non-disclosure of the treatmenttaken dur<strong>in</strong>g submission of proposal and date of Acceptance letter-cum-First Premiumreceipt. The repudiation was set aside and Respondent were directed to pay the <strong>Claim</strong>based on follow<strong>in</strong>g <strong>co</strong>nsideration.1. The <strong>Claim</strong> is free from any other <strong>in</strong>firmity like suppression of material facts <strong>in</strong>Proposal.2. The underwrit<strong>in</strong>g of the Proposal amply demonstrates the screen<strong>in</strong>g of medicaland moral hazard of the Proposer before acceptance.3. While it is true that there was medical <strong>co</strong>nsultation on 24.04.2004, the RenalFunction Test and Ur<strong>in</strong>e Analysis show normal result.4. There had been thus only a formal lack of non-<strong>co</strong>mpliance on the part of the DLAto the Condition stated <strong>in</strong> the FPR.5. <strong>Death</strong> was Accidental hav<strong>in</strong>g obviously no nexus whatsoever with the allegednon-<strong>co</strong>mmunicated medical <strong>co</strong>nsultation.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0067D. P. PatelVsLife Insurance Corporation of IndiaAward Dated 29.07.2005

<strong>Death</strong> claim under LIC Policy repudiated due to gross understatement of age. TheRespondent <strong>co</strong>uld establish the understatement of age with reference to SchoolCertificate of DLA’s son. The material of this evidence also was established byRespondent by expla<strong>in</strong><strong>in</strong>g impact of understatement of age on their decision to acceptor reject the Risk. Repudiation was upheld. Compla<strong>in</strong>t failed to succeed.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0004K. M. BaggaVsLife Insurance Corporation of IndiaAward Dated 8.08.2005The Deceased Life Assured had revived two policies on the strength of Declaration ofgood health which <strong>co</strong>nta<strong>in</strong>ed misstatement and withholdment of material factsregard<strong>in</strong>g illness of Chronic Liver Disease and Hypertension. Therefore the Policieswere repudiated s<strong>in</strong>ce revival. The Respondent <strong>co</strong>uld produce evidence of illnesssuffered by the DLA <strong>in</strong> the form of Certificate of Hospital Treatment given by thetreat<strong>in</strong>g Doctors and then establihsed the rationale for repudiation. The repudiationwas upheld and the Respondent was directed to pay the paid up value of the Policy.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0392Smt. Naynaben R. BrahmbhattVsLife Insurance Corporation of IndiaAward Dated 18.08.2005Repudiation of <strong>Death</strong> <strong>Claim</strong>. The Compla<strong>in</strong>ant’s husband died. The Respondentrepudiated the <strong>Death</strong> <strong>Claim</strong> on the Grounds that it had <strong>in</strong>disputable Proof that thedeceased was us<strong>in</strong>g Al<strong>co</strong>holic dr<strong>in</strong>ks and Tobac<strong>co</strong>. The Respondent relied on theCertificate of the Medical Attendent where<strong>in</strong> the duration of <strong>co</strong>nsumption of dr<strong>in</strong>ks andtobac<strong>co</strong> was illegible. There was no <strong>co</strong>rroborative evidence of the said <strong>in</strong>temperatehabits of the deceased. The <strong>in</strong>-house <strong>in</strong>vestigator also <strong>co</strong>ntradicted the evidence reliedupon by the Repondent. Hence the Respondent was directed to pay the full claimamount to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0137R. K. VachhaniVsLife Insurance Corporation of IndiaAward Dated 29.08.2005Deceased Life Assured proposed for the said <strong>in</strong>surance on 6.11.2003. Proposal wasreceived by Respondent on 07.11.03. Risk <strong>co</strong>mmenced w.e.f. 10.11.03. FPR issued on14.11.03. The DLA had <strong>co</strong>nsulted Dr. Shah, Medical Attendant of DLA on 14.11.03 whohad re<strong>co</strong>rded that the DLA suffered from C. V. Stroke with right hemiplegia one weekbefore. This was evidenced by <strong>Claim</strong> Form-B and a certificate issued by Dr. Shah. TheRespondent pleaded that the DLA was under obligation to <strong>in</strong>form about status of hishealth before acceptance of Risk which he did not do so. Aga<strong>in</strong>, the DLA died on

08.01.04. The re<strong>co</strong>rded cause of death is same as the treatment taken by DLA and hehad <strong>co</strong>nt<strong>in</strong>ued the same ailment till death. So there is strong nexus between the<strong>in</strong>formation withheld and the cause of death. Repudiation is justified. Compla<strong>in</strong>t failedto succeed.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0405U. M. BavsarVsLife Insurance Corporation of IndiaAward Dated 30.08.2005DLA did not mention <strong>in</strong> the proposal for <strong>in</strong>surance the fact of treatment taken by himprior to the date of proposal. Leave taken on medical ground also was not mentioned.The Respondent <strong>co</strong>ntended that this was deliberate mis-statement and <strong>in</strong>disputableproof to establish mistatements were on re<strong>co</strong>rd. In this case claim was repudiated afterelaps<strong>in</strong>g 2 years from date of effect<strong>in</strong>g the Policy Contract. And the death had occurreddue to accident. Intentional fraud had not materialized. There is no nexus between<strong>in</strong>formation withheld and cause of death. Repudiation set aside. Respondent to pay Rs.107350/- to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0421Mr. Pradipkumar RathodVsLife Insurance Corporation of IndiaAward Dated 05.09.2005LA was a Section Officer <strong>in</strong> Government Service. Her Policy lapsed and revived <strong>in</strong>January 2003 based on Declaration of Good Health submitted <strong>in</strong> December 2002. Shedied <strong>in</strong> April 2004 due to Breast Cancer. <strong>Claim</strong> lodged by the Compla<strong>in</strong>ant wasrepudiated on the ground that the DLA made deliberate mis-statements and withheldmaterial <strong>in</strong>formation <strong>in</strong> the DGH, thereby vitiat<strong>in</strong>g the Revival Underwrit<strong>in</strong>g. Documentsperused. It is observed that the DLA’s answer to all queries <strong>in</strong> the DGH was <strong>in</strong> thenegative. At the same time, Certificate issued by Cancer Hospital revealed that theDLA was suffer<strong>in</strong>g from Cancer of Rt. Breast (Lobular Carc<strong>in</strong>oma) s<strong>in</strong>ce June 2002 andshe had also undergone Chemotherapy at that time. Suppression of material<strong>in</strong>formation and mis-statements <strong>co</strong>mmitted by the DLA have been proved. Respondentto pay only the Paid - up Value of Rs. 3333/- which was secured by the Policy on thedate on which the policy lapsed.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0419Smt. Hiraben VankarVsLife Insurance Corporation of IndiaAward Dated 05.09.2005Compla<strong>in</strong>ant’s Husband submitted a Proposal on his life on 09.03.2003. Respondentissued FPR on 18.03.2003. He died on 01.07.2003. Respondent repudiated the claimon the ground that the DLA made <strong>in</strong><strong>co</strong>rrect statement and withheld <strong>co</strong>rrect <strong>in</strong>formationwith respect to his health. Compla<strong>in</strong>ant pleaded that the DLA took Leave for their

Daughter’s marriage and to ensure that the Leave is granted by his Employer, hesubmitted false certificate of sickness. In <strong>co</strong>rroboration of her plead<strong>in</strong>g, she submitted<strong>co</strong>py of an <strong>in</strong>vitation letter purportedly pr<strong>in</strong>ted <strong>in</strong> May 2001. Documents andsubmissions perused. It is observed that there are evidences like COT to establish thatthe DLA was under treatment for acute Pulmonary disease and Chest Pa<strong>in</strong> prior to May2001. However, <strong>in</strong> the Proposal Form, all queries related to health and treatment wasanswered by the DLA <strong>in</strong> negative. Held that where Hospital Certificate and Doctor’sCertificate <strong>co</strong>nfirmed the disease and subsequent Leave obta<strong>in</strong>ed by the DLA,revers<strong>in</strong>g the repudiation merely relay<strong>in</strong>g on an <strong>in</strong>vitation letter, is not justified.Repudiation uphled.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0361Mrs. Savita D. SutharVsLife Insurance Corporation of IndiaAward Dated 07.09.2005Compla<strong>in</strong>ant’s husband held a LIC Policy <strong>co</strong>mmenced from October 1998. He died <strong>in</strong>June 1999. Respondent repudiated the <strong>Claim</strong> on the ground that the DLA understatedhis Age <strong>in</strong> the Proposal Form. The actual date of birth of the DLA was July 1943. But,<strong>in</strong> the Proposal Form, he mentioned the DOB as July 1969. Representative of theCompla<strong>in</strong>ant submitted that the DOB of the DLA as per School Leav<strong>in</strong>g Certificate was1943, but the Agent of the Respondent misdirected the DLA to <strong>co</strong>mmit this error.Documents and submissions perused. It is observed that the DLA was literate who hadpassed SSC <strong>in</strong> 1962 and ac<strong>co</strong>rd<strong>in</strong>g to School Leav<strong>in</strong>g Certificate, his DOB has beenmentioned <strong>in</strong> it as 05.07.1043. Further observed that the Risk <strong>co</strong>vered was underTable-91 and the maximum Age at entry for the said Plan is 50 years. Ground forrepudiation established and upheld the repudiation decision.Ahmedabad Ombudsman CentreCase No. 21 - 001 - 0213S. M. RathodVsLife Insurance Corporation of IndiaAward Dated 30.09.2005<strong>Death</strong> <strong>Claim</strong> under a Life Policy repudiated on the ground of deliberate mis-statementand withholdment of material facts. The <strong>Claim</strong> was repudiated after two years from thedate of Policy. So it attracted only later part of Section 45 of Insurance Act 1938where<strong>in</strong> it is required to be proved that there was deliberate fraud <strong>in</strong> withhold<strong>in</strong>g the<strong>in</strong>formation. Here, <strong>in</strong> this case, the Respondent <strong>co</strong>uld not adduce any evidence <strong>in</strong>support of their <strong>co</strong>ntention regard<strong>in</strong>g DLA’s past treatment. The respondent haddepended only upon the case history noted <strong>in</strong> the treat<strong>in</strong>g hospital. Aga<strong>in</strong>, it was alsonot noted as to who had reported that history. So, it was held that <strong>in</strong>disputableevidence about DLA’s hav<strong>in</strong>g <strong>co</strong>nsulted a medical man did not exist. The repudiationwas set aside. Respondent was directed to pay Rs. 29,000/-.Bhubaneswar Ombudsman CentreCase No. I. O. O. / BBSR / 21 - 144Smt. Pranati MishraVsLife Insurance Corporation of India

Award Dated 05.05.2005Happened that deceased life assured Rab<strong>in</strong>arayan Mishra had obta<strong>in</strong>ed an EndowmentPolicy under Table & Term 14.12 bear<strong>in</strong>g No. 583567973 from Bhubaneswar Branch - Iof LIC of India on 28.05.2000 for an assured sum of Rs. 100000/- under salary sav<strong>in</strong>gsscheme mode of payment nom<strong>in</strong>at<strong>in</strong>g <strong>co</strong>mpla<strong>in</strong>ant as beneficiary <strong>in</strong> evant of his death.Unfortunately the Assured died on 04.08.2002. The <strong>co</strong>mpla<strong>in</strong>ant <strong>in</strong>formed of the deathof the Assured on 07.08.2003 and preferred claim. The Insurer rejected the cliam onthe ground <strong>in</strong>teralia that the policy was under lapsed <strong>co</strong>ndition due to non payment ofpremiums after March’02. Be<strong>in</strong>g aggrieved the <strong>co</strong>mpla<strong>in</strong>ant moved this forum forredressal.COMPLAINED that payment of premium was the responsibility of the employer underSalary Sav<strong>in</strong>gs Scheme.COUNTERED by LIC that premiums were not paid from 4/02 to7/02. On 27-8-2002 the employer (OUAT, Bhubaneswar) remittedRs. 7756/- to wards premium for the due which had been refunded to the <strong>co</strong>mpla<strong>in</strong>anton her request. Due to lapsed status of the policy claim had been repudiated.OBSERVED that mode of <strong>co</strong>llection of premium has been <strong>in</strong>dicated <strong>in</strong> the scheme it -self & the employer has been assigned the role of <strong>co</strong>llect<strong>in</strong>g premium & remitt<strong>in</strong>g thesame to the <strong>in</strong>surer. It is a matter of Common Knowledge that Insurance <strong>co</strong>mpaniesemploy agents. When there is no Insurance Agents as def<strong>in</strong>ed <strong>in</strong> Regulations &Insurance Act, General Pr<strong>in</strong>ciple of Law of Agency as <strong>co</strong>nta<strong>in</strong>ed <strong>in</strong> Indian Contract Act,1872 are to be applied (DESU vs. Basanti Devi & Others 1999 NJC (SC) 563). In the<strong>in</strong>stant case, the <strong>in</strong>surer has not assigned any reasons for delayed payment ofpremiums. In such a case the assured can not be held responsible for delayed paymentof premiums.HELD that the employer as well as the <strong>co</strong>mpla<strong>in</strong>ant had requested for refund of thepremiums due from 4/02 to 7/02 deducted from arrear salary of the deceased andremitted to the <strong>in</strong>surer after death. Had they not requested refund of this amount the<strong>co</strong>mpla<strong>in</strong>ant would have been entitled to the death claim of Rs. 100000/-. This is a fitcase for ex-gratia & Insurer is directed to pay ex-gratia amount ofRs. 30000/- to the <strong>co</strong>mpla<strong>in</strong>ant.Bhubaneswar Ombudsman CentreCase No. I. O. O. / BBSR / 21 - 146Smt. Shantana BhowmikVsLife Insurance Corporation of IndiaAward Dated 06.05.2005Happened that deceased life assured Rajib Bhowmik had obta<strong>in</strong>ed four policiesbear<strong>in</strong>g Nos. 583626396, 583626452, 583626738 & 583627597 from Barbil Branch ofLIC of India for an assured sum of Rs. 50000, Rs. 60000, Rs. 92000 & Rs. 50000respectively. The policies were under Salary Sav<strong>in</strong>gs Scheme the details where of areshown <strong>in</strong> the chart given below.Pol. No. Date of CommAmount of Prem Unpaid Prem583626396 28.03.2001 Rs. 342/- One term<strong>in</strong>al gap &eight <strong>in</strong>termittentgaps583626452 28.03.2001 Rs. 286/- - do -

583626738 28.03.2001 Rs. 629/- No deduction after<strong>in</strong>tial two premiums.583627597 28.05.2001 Rs. 272/- One term<strong>in</strong>al gap &n<strong>in</strong>e <strong>in</strong>termittentgaps.Unfortunately the life assured died on 10.12.2002. The Insurer rejected the claim onthe ground <strong>in</strong>teralia that the policies were <strong>in</strong> lapsed <strong>co</strong>ndition as on date of death ofthe assured. Be<strong>in</strong>g aggrieved the <strong>co</strong>mpla<strong>in</strong>ant moved this forum for redressal.COMPLAINED that under Salary Sav<strong>in</strong>gs Scheme the employer is responsible fortimely deduction of premiums.COUNTERED by LIC that the reasons for non deduction were obta<strong>in</strong>ed from theemployer & as the salary earned by the assured after statutory deduction dur<strong>in</strong>g therelevant months (gaps period) was <strong>in</strong>-sufficient to re<strong>co</strong>ver the premiums they <strong>co</strong>uld notdeduct the same & as such the policies lapsed before death of the assured.OBSERVED that under SSS mode employer has been assigned the role of <strong>co</strong>llect<strong>in</strong>gpremium and remitt<strong>in</strong>g the same to the Insurer. As far employee as such is <strong>co</strong>ncenedthe employer will be the agent of the <strong>in</strong>surer (DESU vs. Basanti Devi & Others 1999NJC (SC) 593). If the salary earned by the assured was <strong>in</strong>sufficient, it was <strong>in</strong>cumbentupon the employer to <strong>in</strong>form the assured to make arrangement for direct payment. TheInsurer has also failed to <strong>in</strong>form the assured <strong>in</strong> this regard & as such no blame can belaid at his door.HELD that this is a fit case for ex-gratia <strong>co</strong>nsideration. The <strong>in</strong>surer is directed to payex-gratia award of Rs. 20000/- aga<strong>in</strong>st each of the policies.Bhubaneswar Ombudsman CentreCase No. I. O. O. / BBSR / 24 - 288Shri Gesala Dhana RajuVsSBI Life Insurance Co. Ltd.Award Dated 18.05.2005Happened that deceased assured G. Surya Rao had obta<strong>in</strong>ed a SBI Life SuperSurakasha plan for hous<strong>in</strong>g loan borrowers of SBI Group from SBI Life Insurance Co.Ltd. for an assured sum equal to payment of one time premium of Rs. 33287/- videPolicy No. 83001000203. As ill luck would have it, the Assured died on 15.03.2003. On31.03.2003 the Compla<strong>in</strong>ant as legal heir lodged the claim. The <strong>in</strong>surer repudiated theclaim without assign<strong>in</strong>g any reason and SBI, Attabira asked the Compla<strong>in</strong>ant to pay Rs.342081/- towards outstand<strong>in</strong>g loan amount. Be<strong>in</strong>g aggrieved Compla<strong>in</strong>ant moved thisforum for redressal.COMPLAINED that as per terms & <strong>co</strong>nditions of the policy the Insurer has to pay theoutstand<strong>in</strong>g loan amount <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>terest. SBI, Attabira should take up with SBI Lifefor liquidation of the outstand<strong>in</strong>g loan & <strong>in</strong>terest amount<strong>in</strong>g to Rs. 342081/-.Countered by the Insurer that they have settled the claim pendentilite & paid Rs.241081/- <strong>in</strong>clud<strong>in</strong>g pr<strong>in</strong>cipal & <strong>in</strong>terest as stood on the date of death to SBI, Attabira &are tak<strong>in</strong>g steps to settle the balance amount Rs. 101013.06 accrued after death of theAssured.OBSERVED that <strong>co</strong>ndition No. 5 of the scheme provides for payment of outstand<strong>in</strong>gloan amount <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>terest as per the orig<strong>in</strong>al EMI schedule <strong>in</strong> the event of death of

the Assured hous<strong>in</strong>g loan borrower due to any cause. The <strong>in</strong>surer is therefore bound torepay the amount as per EMI schedule.HELD that the outstand<strong>in</strong>g loan <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>terest accrued till date of payment as perEMI schedule should be repaid by the <strong>in</strong>surer with<strong>in</strong> 15 days from date of receipt of<strong>co</strong>nsent letter from the <strong>co</strong>mpla<strong>in</strong>ant.Bhubaneswar Ombudsman CentreCase No. I. O. O. / BBSR / 22 - 110Shri Bip<strong>in</strong> Bihari SahuVsLife Insurance Corporation of IndiaAward Dated 23.05.2005Happened that Shri Bip<strong>in</strong> Bihari Sahu had obta<strong>in</strong>ed a policy under T & T 14-20 bear<strong>in</strong>gNo. 580061957 from LIC of India, Berhampur Branch - I on 04.02.87 for an assuredsum of Rs. 25000/- under Mly mode of payment, subsequently <strong>co</strong>nverted to Yly mode.Duplicate policy was issued to him as the orig<strong>in</strong>al was stated to be lost. On28.03.2003, when he visited Berhampur Branch - I to tender his premium due on04.02.2003, the same was not accepted by the Branch on the ground that the Policyhas been surrendered and value paid. As he had neither applied for surrender valuenor received the payment he lodged FIR alleg<strong>in</strong>g fraudulent surrender of the policy atBerhampur Town Police Station vide case no. 69 dtd. 16.05.2003. Be<strong>in</strong>g aggrieved fornon acceptance of premium he moved this forum for redressal.COMPLAINED that there is no reason for the Insurer to mail the S. V. Cheque not <strong>in</strong>the address furnished by him and reflected <strong>in</strong> the policy bond, but <strong>in</strong> the C/o. VikrantBar & restaurant address, whose owner had been charge sheeted by the police for<strong>co</strong>mmmitt<strong>in</strong>g the fraud <strong>in</strong> question.COUNTERED by LIC that pursuant to the surrender application dtd. 02.08.2002surrender was effected on 17.12.2002, after <strong>co</strong>mpletion of all formalities for loss ofduplicate policy bond and S. V. Cheque was mailed <strong>in</strong> the address given by him <strong>in</strong> S.V. application.OBSERVED that the agent did not make over orig<strong>in</strong>al policy bond on the ground that itwas lost for which a duplicate bond was issued to the assured on application. Se<strong>co</strong>ndlythe address given <strong>in</strong> the surrender application is different from the address given <strong>in</strong> thepolicy bond when the assured had not <strong>in</strong>formed any change of address. Thirdly theperson apply<strong>in</strong>g for surrender value produced the orig<strong>in</strong>al policy with a statement thatduplicate was lost. Fourthly advertisement for loss of policy was made <strong>in</strong> a hush - hushmanner <strong>in</strong> a Telugu Daily <strong>in</strong>vit<strong>in</strong>g objections for issuance of duplicate policy bondthough the duplicate bond was issued long before. Fifthly the <strong>in</strong>surer failed to <strong>co</strong>mparethe admitted signatures of the assured with his disputed signatures <strong>in</strong> the surrenderedpapers as it looks different and dist<strong>in</strong>ct to the bare eye.HELD that the fraud was <strong>co</strong>mmitted <strong>in</strong> <strong>co</strong>nnivance with the agent and some of theofficials of the Insurer. The Insurer <strong>in</strong> therefore directed to re<strong>in</strong>state the policyaccept<strong>in</strong>g all arrear premiums due from Feb’o3 waiv<strong>in</strong>g <strong>in</strong>terest.Bhubaneswar Ombudsman CentreCase No. I. O. O. / BBSR / 22 - 164Ch. Braja Kishore DashVsLife Insurance Corporation of IndiaAward Dated 07.07.2005

Happened that Ch. Braja Kishore Dash <strong>in</strong> order to purchase a ‘Varistha Pension BimaYojana Policy’ under Table - 161 deposited a sum of Rs. 266665/- on 29.12.2003 withCareer Agents Branch, Bhubaneswar of the Life Insurance Corporation of India andsubmitted proposal form on the very day. On 04.02.2004, the Insurer called for 9 digitbank MICR number and some of the unfurnished answers to question no. 3 (A) of theproposal form. The Insurer issued the policy bond bear<strong>in</strong>g no. 585085263 <strong>co</strong>mmenc<strong>in</strong>gfrom 09.02.2004 fix<strong>in</strong>g 09.03.2004 as the date of first pension payment @ Rs. 2000/-per month. The Insurer released pension of Rs. 1500/- for the broken period ofFeb’2004 and thereafter i.e. from March’04 onwards @ Rs. 2000/- per month, butrepudiated pensioner’s claim for Rs. 2500/- for the period form 31.12.2003 to09.02.2004. Be<strong>in</strong>g aggrieved, the Pensioner moved this forum for redressal.COMPLAINED that the purchase price along with Proposal form was deposited on29.12.2003 but the Insurer without scrut<strong>in</strong>iz<strong>in</strong>g the form sat on the matter till04.02.2004, when want<strong>in</strong>g requirements were called for.COUNTERED by LIC that though the pensioner depisited the purchase price on31.12.2003 there were delay <strong>in</strong> furnish<strong>in</strong>g answers to th Q. no. 3 of the proposal formas well as 9 digits Bank MICR for which the policy was issued on 09.02.2004.OBSERVED that it is the bounden duty of the Insuer to secrut<strong>in</strong>ize the proposal formon the date it was furnished, more so when Purchase Price was deposited along withthe form there is no reason for them to sleep over the matter for a period of about 1 &½ months. They can not scuttle pension of the Pensioner for their own negligence.HELD that the pensioner is entitled to <strong>in</strong>terest on the purchase price amount<strong>in</strong>g to Rs.2500/- for the period from 31.12.2003 to 09.02.2004.Bhubaneswar Ombudsman CentreCase No. I. O. O. / BBSR / 24 - 240Mrs. Hairat Afza KhatunVsLife Insurance Corporation of IndiaAward Dated 02.08.2005Happened that the deceased Life Assured Sk. Ayud Ali had obta<strong>in</strong>ed the follow<strong>in</strong>gpolicies from Jajpur Branch of the Life Insurance Corporation of India dur<strong>in</strong>g his lifetime nom<strong>in</strong>at<strong>in</strong>g the Compla<strong>in</strong>ant as the beneficiary <strong>in</strong> the event of his death.Policy No. Policy Name Date of T & T SA Mode Prm. FUP.Revival580433058 Endowment 10.03.99 14-20 152000 Hly 3768.10 6/99with Profit580628021 Bima Kiran 1.02.02 111-15 100000 Yly 2323.00 11/02Without Profit584703636 Jeevan Shree -- 112-15 1000000 Hly 53241.00 2/03without ProfitAs ill luck would have it, the Assured died on 06.01.03 due to cardiac arrest. The<strong>co</strong>mpla<strong>in</strong>ant <strong>in</strong>formed death of the Assured to the Insurer on 25.01.03 and lodged claimon 25.08.2004. As the Insurer delayed the settlement, the Compla<strong>in</strong>ant moved thisforum for redressal.COMPLAINED that she has already submitted required form <strong>co</strong>mplete <strong>in</strong> all respect.She acknowledged payment of claim <strong>in</strong> respect of Policy No. 584033058.

COUNTERED by LIC that claim <strong>in</strong> respect of other two policies <strong>co</strong>uld not be settled dueto submission of <strong>in</strong><strong>co</strong>mplete B form and blank B - 1 form and they are also mak<strong>in</strong>g anenquiry <strong>in</strong> to the bonafides of the claim by one of their responsible officers.Held that the claim should be settled with<strong>in</strong> 15days and the Insurer should report<strong>co</strong>mpliance with<strong>in</strong> the said period.Bhubaneswar Ombudsman CentreCase No. I. O. O. / BBSR / 22 - 118Shri Rab<strong>in</strong>arayan PandaVsLife Insurance Corporation of IndiaAward Dated 12.08.2005Happened that Shri R. N. Panda Vill / P. O. Champeswar Dt. Cuttack had obta<strong>in</strong>ed a20 years Money Back Policy uner T & T 75 - 20 bear<strong>in</strong>g No. 580278329 from LIC ofIndia, CAB Cuttack on 01.07.91 for an assured sum of Rs. 25000/- with Hly mode ofpayment of premium @ Rs. 822.50. The policy lapsed as Shri Panda failed to depositthe premium due on 01.01.2003 & 01.07.2003. He paid Rs. 822.50 on 17.07.2003towards unpaid premium which was kept <strong>in</strong> suspense A/c. On 28.10.2003 when he wentto the <strong>co</strong>unter of the issu<strong>in</strong>g branch of the Insurer for payment of the rema<strong>in</strong>deramount, the revival quotation for Rs. 891.50 was handed over to him. It is alleged byhim that he paid Rs. 1714.00 to the cashier at the <strong>co</strong>unter. The cashier took the moneyand issued a receipt for Rs. 1714/- adjust<strong>in</strong>g the previous payment of rs. 822.50 ly<strong>in</strong>g<strong>in</strong> suspense A/c. but did not refund the excess payment of Rs. 891.50. Be<strong>in</strong>g aggrievedhe moved this forum for redressal.COMPLAINED that on 28.10.2003 the cashier issued a receipt for Rs. 1714/- adjust<strong>in</strong>gthe previous payment but kept the excess amount for adjustment of future premiums.He also <strong>co</strong>mpla<strong>in</strong>ed that the fact of payment of Rs. 1714/- can be verified fromdenom<strong>in</strong>ation slip subbmitted by him.COUNTERED by LIC that assured tendered a sum of Rs. 891.50 as per reveivalquotation dtd. 28.10.2003 without submitt<strong>in</strong>g any denom<strong>in</strong>ation slip as no denom<strong>in</strong>ationslip is required <strong>in</strong> a case where revival quotation has been issued.OBSERVED that the revival quotation was issued to the Assured on the date ofpayment. He was required to pay a sum of Rs. 891.50 only. There was no occasion forhim to deposit a sum of Rs.1714/-.Held that the <strong>co</strong>mpla<strong>in</strong>t is an allegation of misappropriation by the cashier of theissu<strong>in</strong>g Branch of the Insurer. The remedy open to the Compla<strong>in</strong>ant is to lodge a FIRwith the Police or Compla<strong>in</strong>t with the C. V. O. of the Insurer The Compla<strong>in</strong>t isdismissed with a Nil award.Chandigarh Ombudsman CentreCase No. LIC / 423 / Ludhiana / Samrala / 21 / 05Shri Ved PrakashVs.Life Insurance Corporation of IndiaAward Dated 12.04.2005FACTS : Ved Prakash filed this <strong>co</strong>mpla<strong>in</strong>t on 28.02.05. He happens to be father of LateDimple Kumar who had taken a policy bear<strong>in</strong>g no. 300023887 for sum assured of Rs.Three lakh on 28.10.02. He died on 27.11.03 reportedly by <strong>co</strong>mmitt<strong>in</strong>g suicide. His

father, be<strong>in</strong>g nom<strong>in</strong>ee, lodged the claim. As suicide was <strong>co</strong>mmitted with<strong>in</strong> one year, theclaim was repudiated under suicide clause of the policy. The <strong>co</strong>mpla<strong>in</strong>ant, however,<strong>co</strong>ntended that the policy was taken on 28.10.02, while his son died on 27.11.03.Therefore, the policy had run more than one year. He <strong>co</strong>ntested the decision of the<strong>in</strong>surer <strong>in</strong>vok<strong>in</strong>g the suicide clause for repudiat<strong>in</strong>g the claim.FINDINGS : The <strong>in</strong>surer <strong>co</strong>ntended that as per the claimant’s statement and thecremation and burial certificate (Form No. 3785), it was a clear case of suicide and notthat of heart attack as stated by the <strong>co</strong>mpla<strong>in</strong>ant. This was further <strong>co</strong>rroborated byenquiries made by the BM, Samrala. Respectables of the area <strong>co</strong>ntacted by him<strong>co</strong>nfirmed that it was case of suicide. S<strong>in</strong>ce suicide had taken place with<strong>in</strong> a year ofissue of the policy, the claim was not payable. The <strong>co</strong>ntention of claimant that he wasmisguided by the BM to show it a case of suicide for expeditious settlement of claim isnot credible as the BM has no motive to misguide the claimant.DECISION : Held that repudiation of claim is based on <strong>co</strong>gent grounds <strong>in</strong>clud<strong>in</strong>gclaimant’s own statement and f<strong>in</strong>d<strong>in</strong>gs <strong>in</strong> an <strong>in</strong>dependent <strong>in</strong>vestigation. The <strong>co</strong>ntentionof the claimant that his son died of heart attack seems to be an after-thought s<strong>in</strong>ce theclaim was otherwise not admissible on ac<strong>co</strong>unt of operation of suicide clause. Hencethe <strong>co</strong>mpla<strong>in</strong>t was dismissed.Chandigarh Ombudsman CentreCase No. LIC / 325 / Karnal / Panchkula / 24 / 05Smt. Asha M<strong>in</strong>ochaVs.Life Insurance Corporation of IndiaAward Dated 28.04.2005FACTS : Dr. J.L. M<strong>in</strong>ocha had taken four s<strong>in</strong>gle premium policies from branch office,Panchkula between 25.05.01 to 16.09.02. He died of liver cancer on 09.03.04 <strong>in</strong> thePGI. Smt. Asha M<strong>in</strong>ocha, his wife, was paid the premium deposited, but sum assuredalong with bonus was decl<strong>in</strong>ed, without any justification. She sought <strong>in</strong>tervention <strong>in</strong>gett<strong>in</strong>g this amount paid to her.FINDINGS : On behalf of <strong>in</strong>surer it was urged that the <strong>in</strong>vestigation had revealed thatwhen DLA was last admitted <strong>in</strong> PGI on 31.12.03, he was reported to be known case ofCAD, Hypertension for past eight years. Enquiry from AIIMS, New Delhi revealed thathe was admitted for <strong>in</strong>sertion of stent <strong>in</strong> 2000. As these are s<strong>in</strong>gle premium policies,<strong>co</strong>mprehensive <strong>in</strong>formation regard<strong>in</strong>g state of health is not sought. The question <strong>in</strong>relation to health reads “Are you at present <strong>in</strong> good health”? Besides, hospitalization ofover week only is required to be disclosed. S<strong>in</strong>ce the DLA was admitted <strong>in</strong> AIIMS onlyfor a day, he was not bound to disclose this. It cannot either be presumed that hav<strong>in</strong>g astent <strong>in</strong>serted, he <strong>co</strong>uld not rema<strong>in</strong> <strong>in</strong> good health subsequently. No specific questionis posed regard<strong>in</strong>g various ailments, unlike the proposal form for other endowmentpolicies. The <strong>co</strong>mpla<strong>in</strong>ant <strong>co</strong>ntended that there is no nexus between the cause of deathand alleged non-disclosure.DECISION : Held that it <strong>co</strong>uld not be established that DLA had deliberately <strong>co</strong>ncealedmaterial <strong>in</strong>formation at the time of purchase of policies. Besides, <strong>co</strong>mpla<strong>in</strong>ant’sassertion regard<strong>in</strong>g lack of nexus between the cause of death and the alleged nondisclosureis not without merit. Held that the claim was payable and ordered that it beadmitted as per rules.Chandigarh Ombudsman Centre

Case No. LIC / 450 / Jalandhar / Garshankar / 21 / 05Smt. Bachni DeviVs.Life Insurance Corporation of IndiaAward Dated 20.05.2005FACTS : Late Shri Jasw<strong>in</strong>der S<strong>in</strong>gh had bought a policy for Sum Assured of Rs. 50,000from BO Garshankar. He was killed <strong>in</strong> a rail accident on 20.09.2003 after hav<strong>in</strong>g paidpremium regularly for two years. The claim filed by his mother/nom<strong>in</strong>ee Bachni Deviwas repudiated on the ground that the policy was <strong>in</strong> lapsed <strong>co</strong>ndition.FINDINGS : Admittedly LA had paid premium for full two years and as the premium dueon 14.07.2003 was not paid with<strong>in</strong> the grace period, the policy lapsed. The claim wasrepudiated by <strong>co</strong>mpetent authority on the plea that policy was <strong>in</strong> a lapsed <strong>co</strong>ndition onthe date of death due to non payment of premium due on 14.07.03. However,guidel<strong>in</strong>es <strong>co</strong>nta<strong>in</strong>ed <strong>in</strong> <strong>Claim</strong>s Manual <strong>in</strong> Chapter 3, Clause 4 deal with relaxation ofdeath claim under policies where premium is paid for full two years and death occursafter expiry of days of grace but with<strong>in</strong> three months of the due date of the first unpaidpremium. Therefore, the case fell under the guidel<strong>in</strong>es.DECISION : Held that full sum assured with vested bonuses be paid subject tore<strong>co</strong>very of the unpaid premiums and the err<strong>in</strong>g officials to be careful <strong>in</strong> future for notsettl<strong>in</strong>g the claim as per guidel<strong>in</strong>es.Chandigarh Ombudsman CentreCase No. LIC / 14 / Karnal / Sirsa / 24 / 06Sh. Harp<strong>in</strong>der S<strong>in</strong>ghVs.Life Insurance Corporation of IndiaAward Dated 14.07.2005FACTS : Smt. Kuldeep Kaur took two policies bear<strong>in</strong>g no. 173545025 and 173545026on 28.05.03, each for sum assured of Rs. 40,000. She died on 05.12.03. Shri Harp<strong>in</strong>derS<strong>in</strong>gh, nom<strong>in</strong>ee, under these policies lodged the claim, which was repudiated on12.08.04. Feel<strong>in</strong>g aggrieved, he filed a <strong>co</strong>mpla<strong>in</strong>t <strong>in</strong> this office.FINDINGS : The <strong>in</strong>vestigations revealed that the DLA had deliberately <strong>co</strong>ncealedmaterial <strong>in</strong>formation regard<strong>in</strong>g her age and occupation. In response to question nos. 2and 4 of the proposal form, she had understated her age to be 44 years, whereas sheas was aged 50 as per form no. 3784 issued by PGI, Chandigarh and her occupationwas shown as a milkmaid. She was not eligible for <strong>in</strong>surance under table and term 14-21 at the age of 50. She fraudulently got herself <strong>in</strong>sured by <strong>in</strong>duc<strong>in</strong>g the <strong>co</strong>rporation toaccept risk under both the policies on the basis of false declarations. This fact wasfurther <strong>co</strong>rroborated by the <strong>in</strong>surer by submitt<strong>in</strong>g election <strong>co</strong>mmission’s ID card andvoters’ list which <strong>in</strong>dicated her age at the time of tak<strong>in</strong>g the policies was 55 and 54years respectively.DECISION : Held that the <strong>co</strong>rroborative evidence established that DLA had understatedher age with a view to get policies for which she was otherwise not eligible. Herdeclaration of age be<strong>in</strong>g false, amounted to <strong>co</strong>ncealment of material fact, therebyrender<strong>in</strong>g the <strong>co</strong>ntract void. Hence the repudiation was valid.Chandigarh Ombudsman CentreCase No. LIC / 115 / Karnal / Pehowa / 24 / 06

Smt. Darshana DhimanVs.Life Insurance Corporation of IndiaAward Dated 19.09.2005FACTS : Late Shri Maya Ram Dhiman husband of Smt. Dharshana Dhiman, took apolicy bear<strong>in</strong>g nos. 172544965 from B.O., Kurukshetra. He died on 07.10.2004. Shefiled the claim papers with the Branch Office on 22.11.04 and made repeated enquiries.She was <strong>in</strong>formed that her papers had been forwarded to IPP Cell, New Delhi. She alsovisited IPP Cell on 07.07.05. She was <strong>in</strong>formed that IPP package <strong>in</strong> respect of herhusband’s policy had not been released. Feel<strong>in</strong>g aggrieved, she filed a <strong>co</strong>mpla<strong>in</strong>t <strong>in</strong>this office on 13.07.2005 which was referred to Sr. D.M., Karnal for <strong>co</strong>mments.FINDINGS : Manager (CRM) <strong>in</strong>formed vide letter dated 31.08.05 that ten annuitycheques dated 18.08.05 and three more cheques dated 01.09. 2005, 01.10.2005 and01.11.2005 have s<strong>in</strong>ce been released.DECISION : Held that there has been delay of seven months <strong>in</strong> issuance of annuitycheques. Further ordered that <strong>in</strong>terest for the period of delay be paid @ 7%.Chandigarh Ombudsman CentreCase No. LIC / 137 / Karnal / Kurukshetra / 24 / 06Smt. Shanti DeviVs.Life Insurance Corporation of IndiaAward Dated 21.09.2005FACTS : Smt. Shanti Devi is the <strong>co</strong>mpla<strong>in</strong>ant <strong>in</strong> this case. Her husband had taken twopolicies bear<strong>in</strong>g nos. 172161093 and 172157792 for sum assured of Rs. 25,000/- andRs. 75,000/- respectively from Branch Office Kurukshetra. He died on 15.02.2005 dueto heart attack. Her claim under policy no. 172161093 was settled after submission ofrequisite claim forms. As advised by the branch officials, she re<strong>in</strong>vested the maturityamount <strong>in</strong> another policy under Future Plus plan. She was further advised that theclaim under se<strong>co</strong>nd policy shall be settled faster if she <strong>in</strong>vested the amount soreceived <strong>in</strong>to yet another fresh policy. She <strong>co</strong>ntended that she was <strong>in</strong> dire need ofmoney and was suffer<strong>in</strong>g because of delay <strong>in</strong> settlement. Her efforts to get the claimsettled had been of no avail.FINDINGS : In the written <strong>co</strong>mments furnished by the Manager (CRM) it was statedthat delay <strong>in</strong> settlement was due to the fact that the case was under <strong>in</strong>vestigation. Itwas revealed that DLA was a known case of diabetes type one, CRF Chronic RenalFailure and had been treated by Dr. Alok Gupta of Gian Bhushan Nurs<strong>in</strong>g Home, Karnalfrom 02.02.05 to 03.02.05. It was further <strong>in</strong>timated that the liability for basic sumassured along with bonuses has been accepted and necessary <strong>in</strong>structions passed onto the BO for paymentDECISION : Held that the <strong>co</strong>ntention of the <strong>in</strong>surer that the claim was under<strong>in</strong>vestigation was a <strong>co</strong>ver-up for delay <strong>in</strong> settlement, which is obvious from the fact thatliability has s<strong>in</strong>ce been admitted. Sr. D.M., Karnal was advised to have the matterlooked <strong>in</strong>to for appropriate <strong>co</strong>rrective action.Chennai Ombudsman CentreCase No. IO (CHN) / 21.07.2589 / 2004 - 05Shri Mookan

Vs.Life Insurance Corporation of IndiaAward Dated 03.05.2005Shri Mookan, father of Late M. Baskar lodged a <strong>co</strong>mpla<strong>in</strong>t aga<strong>in</strong>st L.I.C. of India forrejection of his claim under a policy on the life of his son for a sum of Rs. 50,000/-.The policy <strong>co</strong>mmenced on 15.07.2002. The assured died on 16.07.2003 <strong>in</strong> a roadaccident. The policy was taken under New Janaraksha plan of L.I.C., a special plandesigned for rural people. The m<strong>in</strong>imum age at entry of this policy is 18 years, <strong>in</strong> otherwords, this policy cannot be given to m<strong>in</strong>ors. The Insurer rejected the claim of the<strong>co</strong>mpla<strong>in</strong>ant <strong>co</strong>ntend<strong>in</strong>g that the assured was a m<strong>in</strong>or at the time of propos<strong>in</strong>g and assuch the <strong>co</strong>ntract was void. The <strong>co</strong>mpla<strong>in</strong>ant <strong>co</strong>ntested this decision, giv<strong>in</strong>g rise to thepresent <strong>co</strong>mpla<strong>in</strong>t.This forum called for all the relevant re<strong>co</strong>rds perta<strong>in</strong><strong>in</strong>g to the case and perused. Thepersonal hear<strong>in</strong>g of both the <strong>co</strong>ntend<strong>in</strong>g parties was also arranged. It emerged from thedocumentary evidence and oral submissions that the assured was a m<strong>in</strong>or at the timeof issue of the policy. It came out that the age of the assured was mentioned falsely <strong>in</strong>the proposal as 19 years, which <strong>in</strong>duced the Insurers to <strong>co</strong>nclude that the assured wasa major and hence was eligible for the policy. The Insurers pleaded that after the deathof the assured, they obta<strong>in</strong>ed police report <strong>in</strong> which the age of the assured wasmentioned as 18 years. This prompted them to doubt the age at entry of the assuredand they made further <strong>in</strong>vestigations. Dur<strong>in</strong>g <strong>in</strong>vestigations, it came out that theassured was of 15 years of age. With the help of the <strong>co</strong>mpla<strong>in</strong>ant, the <strong>in</strong>surer obta<strong>in</strong>eda certificate from the school, where the assured studied upto 6th standard andac<strong>co</strong>rd<strong>in</strong>g to the school re<strong>co</strong>rds, the date of birth of the the assured was 09.03.1987.Thus as per this document, the age at entry of the assured was only 15 years. As such,he was not eligible for this <strong>in</strong>surance under New Janaraksha Policy. The Policy,therefore, was void ab-<strong>in</strong>itio not giv<strong>in</strong>g rise to any <strong>co</strong>ntractural obligations there under.S<strong>in</strong>ce the <strong>co</strong>ntract was non-existent, there was no need for any <strong>co</strong>nsideration.This forum, therefore, agreed with the <strong>co</strong>ntention of the <strong>in</strong>surer that noth<strong>in</strong>g waspayable under the policy but directed the <strong>in</strong>surer to refund all the premiums receivedunder the policy with <strong>in</strong>terest to the <strong>co</strong>mpla<strong>in</strong>ant as no <strong>co</strong>nsideration <strong>co</strong>uld be enforcedunder a void <strong>co</strong>ntract.With this direction, the <strong>co</strong>mpla<strong>in</strong>t is disposed off.Chennai Ombudsman CentreCase No. IO (CHN) / 21.01.2011 / 2005 - 06Smt. H. BhuvaneswariVs.Life Insurance Corporation of IndiaAward Dated 23.05.2005Late K. Harikrishnan of Kanchipuram took a policy of life <strong>in</strong>surance on his life for Rs.2,00,000/- and nom<strong>in</strong>ated his wife Smt. H. Bhuvaneswari thereunder. The policy<strong>co</strong>mmenced on 15.08.2001. The assured died on 19.08.2002 due to Chronic MyeloidLeukemia. The claim of the <strong>co</strong>mpla<strong>in</strong>ant was turned down by LIC alleg<strong>in</strong>g materialsupression relat<strong>in</strong>g to the pre-proposal ailments. This was <strong>co</strong>ntested by the<strong>co</strong>mpla<strong>in</strong>ant giv<strong>in</strong>g rise to the present <strong>co</strong>mpla<strong>in</strong>t.All the relevant re<strong>co</strong>rds were called for and perused. A personal hear<strong>in</strong>g of both theparties was arranged. The documentary evidence and the personal depositions

evealed that the assured suffered from Chronic Myeloid Leukemia with symptoms ofthe said ailment for about 5 years. He was treated for this ailment <strong>in</strong> Vijaya HealthCentre, Chennai two months prior to propos<strong>in</strong>g and he was advised to go <strong>in</strong> for BoneMarrow Transplant, He was discharged from the hospital at the request of the assuredwithout <strong>co</strong>nt<strong>in</strong>u<strong>in</strong>g the treatment there. Later on he was admitted to Christian MedicalCollege Hospital, Vellore for treatment of the same ailment, where Bone MarrowTransplant was done. He died <strong>in</strong> the same hospital two months later due to ChronicMyeloid Leukemia, Allegonic Bone Marrow Transplant and CMV Pneumonia andHepatic Come. All these facts were proved Transplant and CMV Pneumonia andHepatic Come. All these facts were proved <strong>co</strong>nclusively by documentary medicalevidence and were also <strong>co</strong>rroborated by the <strong>co</strong>mpla<strong>in</strong>ant dur<strong>in</strong>g the hear<strong>in</strong>g. Thusthere was clear suppression of material <strong>in</strong>formation <strong>in</strong> the proposal vitiat<strong>in</strong>g the very<strong>co</strong>ntract of Insurance.Hence the decision of the Insurer to repudiate the claim under the policy on grounds ofmaterial suppression of vital <strong>in</strong>formation was not <strong>in</strong>terfered with and the repudiationupheld.The Compla<strong>in</strong>t is dismissed.Chennai Ombudsman CentreCase No. IO (CHN) / 21.07.2502 / 2004 - 05Shri V. KumaravelVs.Life Insurance Corporation of IndiaAward Dated 07.06.2005Shri V. Kumaravel of Shen<strong>co</strong>ttah, Tamilnadu preferred the above <strong>co</strong>mpla<strong>in</strong>t agaistL.I.C. of India for repudiat<strong>in</strong>g his claim under the policy on the life of his wife Smt. K.Dhanalakshmi (late) for a sum of Rs. 10,000/-. The policy, which <strong>co</strong>mmenced <strong>in</strong> 01/92,lapsed due to non-payment of premiums due from 01/2000 and was revived on19.03.2001. The assured died on 11.03.2003 due to breast cancer. The Insurerrepudiated the claim plead<strong>in</strong>g non-disclosure of her ailment <strong>in</strong> the personal statementwhile reviv<strong>in</strong>g the policy. The <strong>co</strong>mpla<strong>in</strong>ant, while plead<strong>in</strong>g ignorance on the part of herwife for the non-disclosure, requested sympathetic <strong>co</strong>nsideration of the claim.All the case re<strong>co</strong>rds have been called for and gone through. Personal hear<strong>in</strong>g of theparties was not called for as the sum <strong>in</strong>volved was very small and the <strong>co</strong>mpla<strong>in</strong>antwould have to <strong>co</strong>me from a very far off palce, <strong>in</strong>volv<strong>in</strong>g lot of expenditure. Moreover,There was enough evidence <strong>in</strong> the file to <strong>co</strong>nfirm the assured suffer<strong>in</strong>g from breastcancer and her death was also due to the same reason. However, as a matter ofextreme precaution, further re<strong>co</strong>rds from the treat<strong>in</strong>g hospitals were called for. All themedical evidence <strong>co</strong>llected from Assisi Hospital and Palliative Care Centre, Alleppyand Regional Cancer Centre, Medical College Campus, Thiruvananthapuramestablished that the assured had tumor <strong>in</strong> left breast s<strong>in</strong>ce 1997 and was operatedupon for the same <strong>in</strong> 1998. Biopsy thereafter <strong>co</strong>nfirmed that there was ‘Infiltrat<strong>in</strong>g DuctCarc<strong>in</strong>oma’. She underwent a number of cl<strong>in</strong>ical and diagnostic tests and her ailmentwas <strong>co</strong>nfirmed as ‘Carc<strong>in</strong>oma Breast - Stage IV.’ She had <strong>co</strong>nt<strong>in</strong>uous treatment for thisailment <strong>in</strong> the above said hospitals right from 1997 to the date of her death. The causeof her death was also ‘breast cancer’. Thus there was <strong>in</strong>disputable evidence to proveshe suffered from breast cancer for well over 6 years and was under palliative care andtreatment at the time of revival of the policy. Hence non-disclosure of the same <strong>in</strong> thepersonal statement was a clear fraudulent suppression of material <strong>in</strong>formation, mak<strong>in</strong>g

the revival null and void. The Insurers had offered to settle the paid-up value alongwith accrued bonuses till the time of revival.Study<strong>in</strong>g the entire evidence as detailed above, the <strong>in</strong>surers decision to declare therevival null and void and to settle paid - up vale under the policy was held susta<strong>in</strong>ableand the same was not <strong>in</strong>terfered with. The <strong>co</strong>mpla<strong>in</strong>t is, therefore, dismissed.Chennai Ombudsman CentreCase No. IO (CHN) / 21.01.2572 / 2004 - 05Smt. Renuka RamasamyVs.Life Insurance Corporation of IndiaAward Dated 08.06.2005Smt. Renuka Ramasamy submitted an appeal to this forum challeng<strong>in</strong>g the decision ofL.I.C. of India <strong>in</strong> repudiat<strong>in</strong>g her claim under the policy for Rs. 10,00,000/- on the life ofher husband (late) Shri Ramasamy Pillai. Shri Ramasamy Piallai, who was work<strong>in</strong>g asAddl. Metropolitan Magistrate, took a policy for rs. 10,00,000/- on 15.07.2002. He diedon 28.04.2003 due to hypertensive heart disease. The Insurers refused to honour theclaim, claim<strong>in</strong>g that the assured did not mention <strong>in</strong> the proposal his hypertension, leftventricular failure and also his suffer<strong>in</strong>g from carc<strong>in</strong>oma cheek. The <strong>co</strong>mpla<strong>in</strong>antchallenged the decision of the <strong>in</strong>surer through this <strong>co</strong>mpla<strong>in</strong>t.All the relevant case re<strong>co</strong>rds have been <strong>co</strong>llected and studied <strong>in</strong> depth by this forum. Apersonal hear<strong>in</strong>g of the <strong>co</strong>ntend<strong>in</strong>g parties arranged and their submissions noted. Thedocumentary evidence revealed that the assured, who was <strong>in</strong> the Judiciary ofTamilnadu Govt, worked <strong>in</strong> various places. Dur<strong>in</strong>g his stay <strong>in</strong> Madurai, he <strong>co</strong>ntacted Dr.S. Somasundaram, M. D., of A. R. Hospital, Madurai and got treated by him. The saiddoctor mentioned <strong>in</strong> his case report-cum prescription slips that the assured sufferedfrom Hypertension and Left Ventricular Failure for about 5 years. The medic<strong>in</strong>esprescribed were for treatment of Cardio-vascular system only. The Medical Evidence<strong>co</strong>nta<strong>in</strong>ed <strong>in</strong> the <strong>Claim</strong> Forms of L.I.C. also certified that the assured suffered fromHypertension and Ischeamia and died of the same ailments. This apart, the assuredhad suffered from Carc<strong>in</strong>oma Cheek, for which he received treatment from ApolloSpeciality Hospital, Chennai as an <strong>in</strong>-patient from 07.02.2001 to 15.03.2001. He wason medical leave for this period as certified by Dr. C. N. Rav<strong>in</strong>dran, Senior CivilSurgeon, High Court Dispensary, Chennai. Further he also received reimbursement ofRs. 57,646/-, be<strong>in</strong>g 75% of the <strong>co</strong>st of treatment from the Government of Tamilnadu forhis treatment of cancer <strong>in</strong> Apollo Speciality Hospital, Chennai vide the Order ofRegistrar of High Court, Madras. All these happen<strong>in</strong>gs were well before his propos<strong>in</strong>gfor <strong>in</strong>surance. The <strong>co</strong>mpla<strong>in</strong>ant dur<strong>in</strong>g hear<strong>in</strong>g, while <strong>co</strong>ntend<strong>in</strong>g that she was notaware of her husband’s ailment and hospitalization, quoted, <strong>in</strong> her support, onejudgement <strong>in</strong> the case of Rajendra Kumar Arya vs M/s New India Assurance Co asreported <strong>in</strong> AIR 1992 Calcutta 110. The said judgement was also gone <strong>in</strong>to and thesame perta<strong>in</strong>ed to matters relat<strong>in</strong>g to ‘applicability of arbitration clause <strong>in</strong> the policy’and also about the application of Law of LImitation. Hence the said judgement does notbear any relevance to the present case. S<strong>in</strong>ce there was a clear - cut fraudulentmaterial suppression relat<strong>in</strong>g to very serious ailments the assured suffered from priorto proposal, <strong>in</strong> the proposal, which <strong>in</strong> the f<strong>in</strong>al analysis also happened to be causes ofhis death, it was held that there was a blatant breach of the golden pr<strong>in</strong>ciple of’utmostgood faith’. Hence the repudiation decision of the <strong>in</strong>surers was held to be suta<strong>in</strong>able <strong>in</strong>law and on facts as well. Reliance was placed on the decisions of Hon’ble National

Commission <strong>in</strong> cases L.I.C. of India vs Smt. M<strong>in</strong>u Kalita (III 2002 CPJ 10 N.C.) andL.I.C. of India vs Smt. Gangamma & Anr (III 2002 CPJ 56 NC).The <strong>co</strong>mpla<strong>in</strong>t is,therefore, dismissed.Chennai Ombudsman CentreCase No. IO (CHN) / 21.08.2599 / 2004 - 05Shri V. SelvarasuVs.Life Insurance Corporation of IndiaAward Dated 15.06.2005Shri V. Selvarasu, S/o Shri Veeraraghava Udayar, the life assured, filed a <strong>co</strong>mpla<strong>in</strong>twith this forum question<strong>in</strong>g the decision of L.I.C. of India not to pay the claim amountunder the policy on his father’s life on the plea that he had understated his age <strong>in</strong> theproposal. The policy was taken on 08.06.2000 and the assured died reportedly on21.12.2002. The Insurer’s <strong>co</strong>ntention was that the age of the assured was understated<strong>in</strong> the proposal by about 21 years and the assured was of un<strong>in</strong>surable age at the timeof propos<strong>in</strong>g. This was <strong>co</strong>ntested by the <strong>co</strong>mpla<strong>in</strong>ant.From a careful perusal of all the relevant re<strong>co</strong>rds and a study of the oral submissionsdur<strong>in</strong>g personal hear<strong>in</strong>g, the follow<strong>in</strong>g po<strong>in</strong>ts emerged :1. The assured submitted along with the proposal a horos<strong>co</strong>pe, as per which his ageat the time of propos<strong>in</strong>g was 46 years.2. The policy lapsed and the last premium was paid under the lapsed policy after thedeath of the assured.3. Dur<strong>in</strong>g the <strong>in</strong>vestigation of the <strong>in</strong>surer, it came out that the age of the assuredwas around 70 years.4. The <strong>in</strong>surers <strong>co</strong>llected <strong>co</strong>rroborative age proofs such as Voters’ list and theFamily card of his younger son, as per which the age of the assured <strong>in</strong> the year ofproposal was 67 years.5. The younger son of the assured wrote a letter to this forum that his father wasaged around 75 - 80 years at the time of death.6. The advocate, who came to represent the <strong>co</strong>mpla<strong>in</strong>ant dur<strong>in</strong>g hear<strong>in</strong>g, mentionedthat the <strong>co</strong>mpla<strong>in</strong>ant himself would be around 40 years of age.7. The Family members issued a pr<strong>in</strong>ted card <strong>in</strong> the name of both the sons of thedeceased assured call<strong>in</strong>g the relatives to attend the ‘obsequies’, <strong>in</strong> which thedate of death was mentioned as 05.10.2002. The premium under the lapsed policywas remitted on 08.10.2002.8. The family procured and submitted to this forum a death certificate, as per whichthe date of death was 21.12.2002.Judg<strong>in</strong>g from all the above, this forum decided that the assured grossly understated hisage by 21 years at the time of proposal, which was a clear fraudulentmisrepresentation of material <strong>in</strong>formation. Further it is clear that the <strong>co</strong>rrect date ofdeath was 05.10.2002 as claimed by the family members, whereas the death certificate<strong>co</strong>uld have been manipulated to make it appear that the last premium was paid wellbefore death.Hence this forum upheld the decision of the Insurers to repudiate the claim on thegrounds of fraudulent misrepresentation of <strong>co</strong>rrect age <strong>in</strong> the proposal. The Compla<strong>in</strong>tis, therefore, dismissed. Reliance was placed on the case Ramabai vs L.I.C., Bhopal

as reported <strong>in</strong> AIR 1981 MP 69 (DB) (Courtesy : Pr<strong>in</strong>ciples of Insurance Law, M. N.Sr<strong>in</strong>ivasan - Pages 485, 486).Chennai Ombudsman CentreCase No. IO (CHN) / 21.08.2567 / 2004 - 05Smt. J. VeerammalVs.Life Insurance Corporation of IndiaAward Dated 17.06.2005Shri J. Veerammal brought to the notice of this forum through the above <strong>co</strong>mpla<strong>in</strong>t thatthe claim on her husband’s policy made by her was rejected by L.I.C. of India,Thanjavur Division and pleaded for the <strong>in</strong>tervention of this forum to arrange forpayment of the same. Three policies were taken by the deceased Shri M. JawaharlalNehru <strong>in</strong> 09/2001 and 03/2002. The assured died on 23.06.2004 due to ‘Cardiorespiratoryarrest.’ The <strong>in</strong>surers repudiated the claims on the grounds that the assuredsuppressed <strong>in</strong> the proposals material <strong>in</strong>formation relat<strong>in</strong>g to his suffer<strong>in</strong>g from heartailment <strong>in</strong> the pre-proposal period.The Insurers submitted all the case re<strong>co</strong>rds to this forum. A personal hear<strong>in</strong>g of theparties was also <strong>co</strong>nducted. It was borne out by the evidence thus gathered that theassured, who was an employee <strong>in</strong> Neyveli Lignite Corporation, suffered from CoronaryArtery Disease and Hypertension dur<strong>in</strong>g pre proposal period. There was a reference <strong>in</strong>the N.L.C. Medical book that he was referred to Apollo Hospital <strong>in</strong> 1998. The medicalbook, which was the third one <strong>in</strong> the series talked about his treatment for hypertensionafter 2003 but referred to him as a case of Hypertension and Ischaemic Heart Disease.There was evidence <strong>in</strong> the Apollo Hospital Discharge Summary for the period23.06.2001 to 02.07.2001 that the assured had been, after angiogram, diagnosed as acase of ‘Coronary Artery Disease, Class - II Ang<strong>in</strong>a, S<strong>in</strong>gle Vessel Disease’ etc andangioplasty was done on 29.06.2001. This was two months prior to the first proposal.Later on, <strong>in</strong> January 2002, i.e., 2 months prior to the se<strong>co</strong>nd and third proposals, hewas aga<strong>in</strong> admitted to Apollo Hospital for a review, where he was aga<strong>in</strong> referred to acase of Hypertension and Ischeamic Heart Disease and was treated for his heartailment. This apart, he was also treated for Kidney stones <strong>in</strong> Chennai Kalippa Hospitalprior to proposal.Thus there was enough evidence to prove his pre-proposal illness and his cause ofdeath was clearly relatable to these ailments. But this forum <strong>co</strong>uld not <strong>co</strong>me to the<strong>co</strong>nclusion that there was fraudulent suppression <strong>in</strong> the case of first proposal, thoughthere was suppression, s<strong>in</strong>ce the assured returned two months earlier with improvedheart <strong>co</strong>ndition after angioplasty. But <strong>in</strong> the case of the later two policies, there wasreadmission <strong>in</strong> the same hospital and treatment for the same ailments just two monthsprior to these policies and as such fraudulent material suppression was very muchevident. This forum, therefore, decided that an amount equal to50 % of sum assured under the first policy be given as ex-gratia, whereas therepudiation under the other two later policies be upheld Thus the <strong>co</strong>mpla<strong>in</strong>t is partlyallowed.Chennai Ombudsman CentreCase No. IO (CHN) / 21.04.2095 / 2005 - 06Smt. T. MallikaVs.Life Insurance Corporation of India