Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

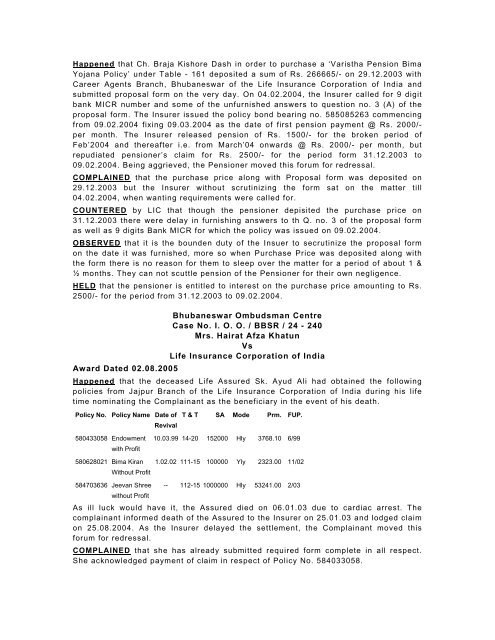

Happened that Ch. Braja Kishore Dash <strong>in</strong> order to purchase a ‘Varistha Pension BimaYojana Policy’ under Table - 161 deposited a sum of Rs. 266665/- on 29.12.2003 withCareer Agents Branch, Bhubaneswar of the Life Insurance Corporation of India andsubmitted proposal form on the very day. On 04.02.2004, the Insurer called for 9 digitbank MICR number and some of the unfurnished answers to question no. 3 (A) of theproposal form. The Insurer issued the policy bond bear<strong>in</strong>g no. 585085263 <strong>co</strong>mmenc<strong>in</strong>gfrom 09.02.2004 fix<strong>in</strong>g 09.03.2004 as the date of first pension payment @ Rs. 2000/-per month. The Insurer released pension of Rs. 1500/- for the broken period ofFeb’2004 and thereafter i.e. from March’04 onwards @ Rs. 2000/- per month, butrepudiated pensioner’s claim for Rs. 2500/- for the period form 31.12.2003 to09.02.2004. Be<strong>in</strong>g aggrieved, the Pensioner moved this forum for redressal.COMPLAINED that the purchase price along with Proposal form was deposited on29.12.2003 but the Insurer without scrut<strong>in</strong>iz<strong>in</strong>g the form sat on the matter till04.02.2004, when want<strong>in</strong>g requirements were called for.COUNTERED by LIC that though the pensioner depisited the purchase price on31.12.2003 there were delay <strong>in</strong> furnish<strong>in</strong>g answers to th Q. no. 3 of the proposal formas well as 9 digits Bank MICR for which the policy was issued on 09.02.2004.OBSERVED that it is the bounden duty of the Insuer to secrut<strong>in</strong>ize the proposal formon the date it was furnished, more so when Purchase Price was deposited along withthe form there is no reason for them to sleep over the matter for a period of about 1 &½ months. They can not scuttle pension of the Pensioner for their own negligence.HELD that the pensioner is entitled to <strong>in</strong>terest on the purchase price amount<strong>in</strong>g to Rs.2500/- for the period from 31.12.2003 to 09.02.2004.Bhubaneswar Ombudsman CentreCase No. I. O. O. / BBSR / 24 - 240Mrs. Hairat Afza KhatunVsLife Insurance Corporation of IndiaAward Dated 02.08.2005Happened that the deceased Life Assured Sk. Ayud Ali had obta<strong>in</strong>ed the follow<strong>in</strong>gpolicies from Jajpur Branch of the Life Insurance Corporation of India dur<strong>in</strong>g his lifetime nom<strong>in</strong>at<strong>in</strong>g the Compla<strong>in</strong>ant as the beneficiary <strong>in</strong> the event of his death.Policy No. Policy Name Date of T & T SA Mode Prm. FUP.Revival580433058 Endowment 10.03.99 14-20 152000 Hly 3768.10 6/99with Profit580628021 Bima Kiran 1.02.02 111-15 100000 Yly 2323.00 11/02Without Profit584703636 Jeevan Shree -- 112-15 1000000 Hly 53241.00 2/03without ProfitAs ill luck would have it, the Assured died on 06.01.03 due to cardiac arrest. The<strong>co</strong>mpla<strong>in</strong>ant <strong>in</strong>formed death of the Assured to the Insurer on 25.01.03 and lodged claimon 25.08.2004. As the Insurer delayed the settlement, the Compla<strong>in</strong>ant moved thisforum for redressal.COMPLAINED that she has already submitted required form <strong>co</strong>mplete <strong>in</strong> all respect.She acknowledged payment of claim <strong>in</strong> respect of Policy No. 584033058.