Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

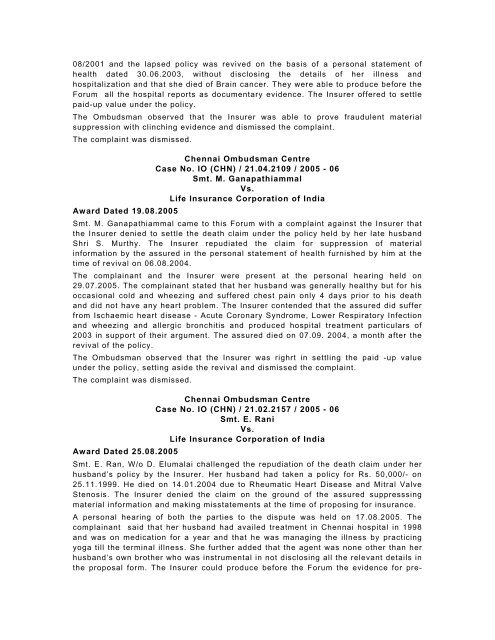

08/2001 and the lapsed policy was revived on the basis of a personal statement ofhealth dated 30.06.2003, without disclos<strong>in</strong>g the details of her illness andhospitalization and that she died of Bra<strong>in</strong> cancer. They were able to produce before theForum all the hospital reports as documentary evidence. The Insurer offered to settlepaid-up value under the policy.The Ombudsman observed that the Insurer was able to prove fraudulent materialsuppression with cl<strong>in</strong>ch<strong>in</strong>g evidence and dismissed the <strong>co</strong>mpla<strong>in</strong>t.The <strong>co</strong>mpla<strong>in</strong>t was dismissed.Chennai Ombudsman CentreCase No. IO (CHN) / 21.04.2109 / 2005 - 06Smt. M. GanapathiammalVs.Life Insurance Corporation of IndiaAward Dated 19.08.2005Smt. M. Ganapathiammal came to this Forum with a <strong>co</strong>mpla<strong>in</strong>t aga<strong>in</strong>st the Insurer thatthe Insurer denied to settle the death claim under the policy held by her late husbandShri S. Murthy. The Insurer repudiated the claim for suppression of material<strong>in</strong>formation by the assured <strong>in</strong> the personal statement of health furnished by him at thetime of revival on 06.08.2004.The <strong>co</strong>mpla<strong>in</strong>ant and the Insurer were present at the personal hear<strong>in</strong>g held on29.07.2005. The <strong>co</strong>mpla<strong>in</strong>ant stated that her husband was generally healthy but for hisoccasional <strong>co</strong>ld and wheez<strong>in</strong>g and suffered chest pa<strong>in</strong> only 4 days prior to his deathand did not have any heart problem. The Insurer <strong>co</strong>ntended that the assured did sufferfrom Ischaemic heart disease - Acute Coronary Syndrome, Lower Respiratory Infectionand wheez<strong>in</strong>g and allergic bronchitis and produced hospital treatment particulars of2003 <strong>in</strong> support of their argument. The assured died on 07.09. 2004, a month after therevival of the policy.The Ombudsman observed that the Insurer was righrt <strong>in</strong> settl<strong>in</strong>g the paid -up valueunder the policy, sett<strong>in</strong>g aside the revival and dismissed the <strong>co</strong>mpla<strong>in</strong>t.The <strong>co</strong>mpla<strong>in</strong>t was dismissed.Chennai Ombudsman CentreCase No. IO (CHN) / 21.02.2157 / 2005 - 06Smt. E. RaniVs.Life Insurance Corporation of IndiaAward Dated 25.08.2005Smt. E. Ran, W/o D. Elumalai challenged the repudiation of the death claim under herhusband’s policy by the Insurer. Her husband had taken a policy for Rs. 50,000/- on25.11.1999. He died on 14.01.2004 due to Rheumatic Heart Disease and Mitral ValveStenosis. The Insurer denied the claim on the ground of the assured suppresss<strong>in</strong>gmaterial <strong>in</strong>formation and mak<strong>in</strong>g misstatements at the time of propos<strong>in</strong>g for <strong>in</strong>surance.A personal hear<strong>in</strong>g of both the parties to the dispute was held on 17.08.2005. The<strong>co</strong>mpla<strong>in</strong>ant said that her husband had availed treatment <strong>in</strong> Chennai hospital <strong>in</strong> 1998and was on medication for a year and that he was manag<strong>in</strong>g the illness by practic<strong>in</strong>gyoga till the term<strong>in</strong>al illness. She further added that the agent was none other than herhusband’s own brother who was <strong>in</strong>strumental <strong>in</strong> not disclos<strong>in</strong>g all the relevant details <strong>in</strong>the proposal form. The Insurer <strong>co</strong>uld produce before the Forum the evidence for pre-