Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

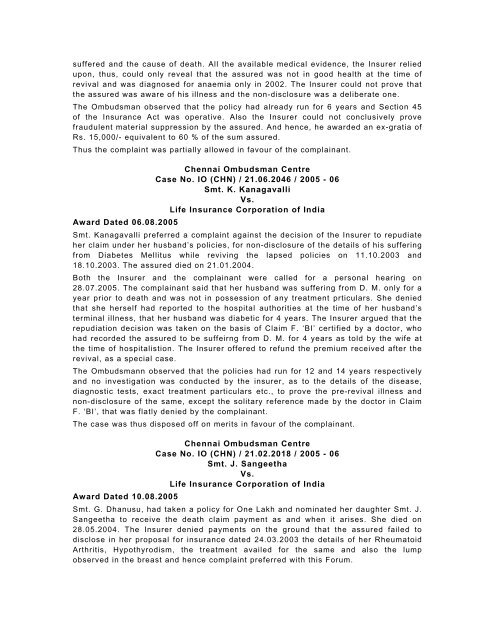

suffered and the cause of death. All the available medical evidence, the Insurer reliedupon, thus, <strong>co</strong>uld only reveal that the assured was not <strong>in</strong> good health at the time ofrevival and was diagnosed for anaemia only <strong>in</strong> 2002. The Insurer <strong>co</strong>uld not prove thatthe assured was aware of his illness and the non-disclosure was a deliberate one.The Ombudsman observed that the policy had already run for 6 years and Section 45of the Insurance Act was operative. Also the Insurer <strong>co</strong>uld not <strong>co</strong>nclusively provefraudulent material suppression by the assured. And hence, he awarded an ex-gratia ofRs. 15,000/- equivalent to 60 % of the sum assured.Thus the <strong>co</strong>mpla<strong>in</strong>t was partially allowed <strong>in</strong> favour of the <strong>co</strong>mpla<strong>in</strong>ant.Chennai Ombudsman CentreCase No. IO (CHN) / 21.06.2046 / 2005 - 06Smt. K. KanagavalliVs.Life Insurance Corporation of IndiaAward Dated 06.08.2005Smt. Kanagavalli preferred a <strong>co</strong>mpla<strong>in</strong>t aga<strong>in</strong>st the decision of the Insurer to repudiateher claim under her husband’s policies, for non-disclosure of the details of his suffer<strong>in</strong>gfrom Diabetes Mellitus while reviv<strong>in</strong>g the lapsed policies on 11.10.2003 and18.10.2003. The assured died on 21.01.2004.Both the Insurer and the <strong>co</strong>mpla<strong>in</strong>ant were called for a personal hear<strong>in</strong>g on28.07.2005. The <strong>co</strong>mpla<strong>in</strong>ant said that her husband was suffer<strong>in</strong>g from D. M. only for ayear prior to death and was not <strong>in</strong> possession of any treatment prticulars. She deniedthat she herself had reported to the hospital authorities at the time of her husband’sterm<strong>in</strong>al illness, that her husband was diabetic for 4 years. The Insurer argued that therepudiation decision was taken on the basis of <strong>Claim</strong> F. ‘BI’ certified by a doctor, whohad re<strong>co</strong>rded the assured to be suffeirng from D. M. for 4 years as told by the wife atthe time of hospitalistion. The Insurer offered to refund the premium received after therevival, as a special case.The Ombudsmann observed that the policies had run for 12 and 14 years respectivelyand no <strong>in</strong>vestigation was <strong>co</strong>nducted by the <strong>in</strong>surer, as to the details of the disease,diagnostic tests, exact treatment particulars etc., to prove the pre-revival illness andnon-disclosure of the same, except the solitary reference made by the doctor <strong>in</strong> <strong>Claim</strong>F. ‘BI’, that was flatly denied by the <strong>co</strong>mpla<strong>in</strong>ant.The case was thus disposed off on merits <strong>in</strong> favour of the <strong>co</strong>mpla<strong>in</strong>ant.Chennai Ombudsman CentreCase No. IO (CHN) / 21.02.2018 / 2005 - 06Smt. J. SangeethaVs.Life Insurance Corporation of IndiaAward Dated 10.08.2005Smt. G. Dhanusu, had taken a policy for One Lakh and nom<strong>in</strong>ated her daughter Smt. J.Sangeetha to receive the death claim payment as and when it arises. She died on28.05.2004. The Insurer denied payments on the ground that the assured failed todisclose <strong>in</strong> her proposal for <strong>in</strong>surance dated 24.03.2003 the details of her RheumatoidArthritis, Hypothyrodism, the treatment availed for the same and also the lumpobserved <strong>in</strong> the breast and hence <strong>co</strong>mpla<strong>in</strong>t preferred with this Forum.