Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

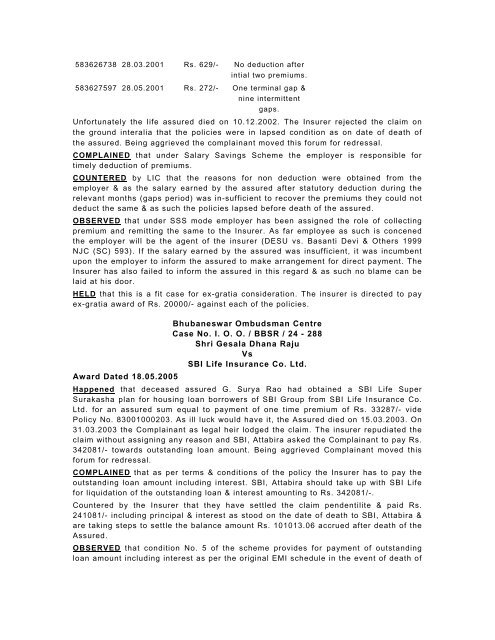

583626738 28.03.2001 Rs. 629/- No deduction after<strong>in</strong>tial two premiums.583627597 28.05.2001 Rs. 272/- One term<strong>in</strong>al gap &n<strong>in</strong>e <strong>in</strong>termittentgaps.Unfortunately the life assured died on 10.12.2002. The Insurer rejected the claim onthe ground <strong>in</strong>teralia that the policies were <strong>in</strong> lapsed <strong>co</strong>ndition as on date of death ofthe assured. Be<strong>in</strong>g aggrieved the <strong>co</strong>mpla<strong>in</strong>ant moved this forum for redressal.COMPLAINED that under Salary Sav<strong>in</strong>gs Scheme the employer is responsible fortimely deduction of premiums.COUNTERED by LIC that the reasons for non deduction were obta<strong>in</strong>ed from theemployer & as the salary earned by the assured after statutory deduction dur<strong>in</strong>g therelevant months (gaps period) was <strong>in</strong>-sufficient to re<strong>co</strong>ver the premiums they <strong>co</strong>uld notdeduct the same & as such the policies lapsed before death of the assured.OBSERVED that under SSS mode employer has been assigned the role of <strong>co</strong>llect<strong>in</strong>gpremium and remitt<strong>in</strong>g the same to the Insurer. As far employee as such is <strong>co</strong>ncenedthe employer will be the agent of the <strong>in</strong>surer (DESU vs. Basanti Devi & Others 1999NJC (SC) 593). If the salary earned by the assured was <strong>in</strong>sufficient, it was <strong>in</strong>cumbentupon the employer to <strong>in</strong>form the assured to make arrangement for direct payment. TheInsurer has also failed to <strong>in</strong>form the assured <strong>in</strong> this regard & as such no blame can belaid at his door.HELD that this is a fit case for ex-gratia <strong>co</strong>nsideration. The <strong>in</strong>surer is directed to payex-gratia award of Rs. 20000/- aga<strong>in</strong>st each of the policies.Bhubaneswar Ombudsman CentreCase No. I. O. O. / BBSR / 24 - 288Shri Gesala Dhana RajuVsSBI Life Insurance Co. Ltd.Award Dated 18.05.2005Happened that deceased assured G. Surya Rao had obta<strong>in</strong>ed a SBI Life SuperSurakasha plan for hous<strong>in</strong>g loan borrowers of SBI Group from SBI Life Insurance Co.Ltd. for an assured sum equal to payment of one time premium of Rs. 33287/- videPolicy No. 83001000203. As ill luck would have it, the Assured died on 15.03.2003. On31.03.2003 the Compla<strong>in</strong>ant as legal heir lodged the claim. The <strong>in</strong>surer repudiated theclaim without assign<strong>in</strong>g any reason and SBI, Attabira asked the Compla<strong>in</strong>ant to pay Rs.342081/- towards outstand<strong>in</strong>g loan amount. Be<strong>in</strong>g aggrieved Compla<strong>in</strong>ant moved thisforum for redressal.COMPLAINED that as per terms & <strong>co</strong>nditions of the policy the Insurer has to pay theoutstand<strong>in</strong>g loan amount <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>terest. SBI, Attabira should take up with SBI Lifefor liquidation of the outstand<strong>in</strong>g loan & <strong>in</strong>terest amount<strong>in</strong>g to Rs. 342081/-.Countered by the Insurer that they have settled the claim pendentilite & paid Rs.241081/- <strong>in</strong>clud<strong>in</strong>g pr<strong>in</strong>cipal & <strong>in</strong>terest as stood on the date of death to SBI, Attabira &are tak<strong>in</strong>g steps to settle the balance amount Rs. 101013.06 accrued after death of theAssured.OBSERVED that <strong>co</strong>ndition No. 5 of the scheme provides for payment of outstand<strong>in</strong>gloan amount <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>terest as per the orig<strong>in</strong>al EMI schedule <strong>in</strong> the event of death of