Vehicle Insurance Policy - Gbic.co.in

Vehicle Insurance Policy - Gbic.co.in

Vehicle Insurance Policy - Gbic.co.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

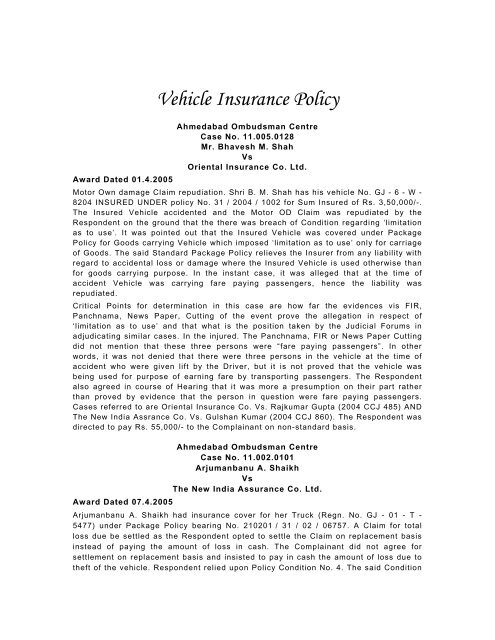

<strong>Vehicle</strong> <strong>Insurance</strong> <strong>Policy</strong>Ahmedabad Ombudsman CentreCase No. 11.005.0128Mr. Bhavesh M. ShahVsOriental <strong>Insurance</strong> Co. Ltd.Award Dated 01.4.2005Motor Own damage Claim repudiation. Shri B. M. Shah has his vehicle No. GJ - 6 - W -8204 INSURED UNDER policy No. 31 / 2004 / 1002 for Sum Insured of Rs. 3,50,000/-.The Insured <strong>Vehicle</strong> accidented and the Motor OD Claim was repudiated by theRespondent on the ground that the there was breach of Condition regard<strong>in</strong>g ‘limitationas to use’. It was po<strong>in</strong>ted out that the Insured <strong>Vehicle</strong> was <strong>co</strong>vered under Package<strong>Policy</strong> for Goods carry<strong>in</strong>g <strong>Vehicle</strong> which imposed ‘limitation as to use’ only for carriageof Goods. The said Standard Package <strong>Policy</strong> relieves the Insurer from any liability withregard to accidental loss or damage where the Insured <strong>Vehicle</strong> is used otherwise thanfor goods carry<strong>in</strong>g purpose. In the <strong>in</strong>stant case, it was alleged that at the time ofaccident <strong>Vehicle</strong> was carry<strong>in</strong>g fare pay<strong>in</strong>g passengers, hence the liability wasrepudiated.Critical Po<strong>in</strong>ts for determ<strong>in</strong>ation <strong>in</strong> this case are how far the evidences vis FIR,Panchnama, News Paper, Cutt<strong>in</strong>g of the event prove the allegation <strong>in</strong> respect of‘limitation as to use’ and that what is the position taken by the Judicial Forums <strong>in</strong>adjudicat<strong>in</strong>g similar cases. In the <strong>in</strong>jured. The Panchnama, FIR or News Paper Cutt<strong>in</strong>gdid not mention that these three persons were “fare pay<strong>in</strong>g passengers”. In otherwords, it was not denied that there were three persons <strong>in</strong> the vehicle at the time ofaccident who were given lift by the Driver, but it is not proved that the vehicle wasbe<strong>in</strong>g used for purpose of earn<strong>in</strong>g fare by transport<strong>in</strong>g passengers. The Respondentalso agreed <strong>in</strong> <strong>co</strong>urse of Hear<strong>in</strong>g that it was more a presumption on their part ratherthan proved by evidence that the person <strong>in</strong> question were fare pay<strong>in</strong>g passengers.Cases referred to are Oriental <strong>Insurance</strong> Co. Vs. Rajkumar Gupta (2004 CCJ 485) ANDThe New India Assrance Co. Vs. Gulshan Kumar (2004 CCJ 860). The Respondent wasdirected to pay Rs. 55,000/- to the Compla<strong>in</strong>ant on non-standard basis.Ahmedabad Ombudsman CentreCase No. 11.002.0101Arjumanbanu A. ShaikhVsThe New India Assurance Co. Ltd.Award Dated 07.4.2005Arjumanbanu A. Shaikh had <strong>in</strong>surance <strong>co</strong>ver for her Truck (Regn. No. GJ - 01 - T -5477) under Package <strong>Policy</strong> bear<strong>in</strong>g No. 210201 / 31 / 02 / 06757. A Claim for totalloss due be settled as the Respondent opted to settle the Claim on replacement basis<strong>in</strong>stead of pay<strong>in</strong>g the amount of loss <strong>in</strong> cash. The Compla<strong>in</strong>ant did not agree forsettlement on replacement basis and <strong>in</strong>sisted to pay <strong>in</strong> cash the amount of loss due totheft of the vehicle. Respondent relied upon <strong>Policy</strong> Condition No. 4. The said Condition

gave them option of repair, re<strong>in</strong>state or replace the vehicle <strong>in</strong>sured or may pay <strong>in</strong> cashthe amount of loss or damage. This was the first Claim that was be<strong>in</strong>g settled on thereplacement basis through this option was operative s<strong>in</strong>ce l<strong>in</strong>g. The Respondent triedto expla<strong>in</strong> that their Head Office had suggested to try this option. At the same time itwas made clear that it was not a Corporate directive but a mere suggestion and thattoo was to be applied to Private Motor Car <strong>Policy</strong>. Subject <strong>Vehicle</strong> be<strong>in</strong>g a Commercial<strong>Vehicle</strong> the replacement option should not desirably be chosen. As there had been nodispute regard<strong>in</strong>g total loss of the Insured <strong>Vehicle</strong>, the settlement on IDV basis for Rs.7,18,500/- (After deduction of Excess of Rs. 1500) became admissible and Respondentwas directed to pay the same.Ahmedabad Ombudsman CentreCase No. 11.004.0089Mr. Gov<strong>in</strong>dbhai J. VadherVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 08.4.2005Mr. Gov<strong>in</strong>dbhai J. Vadher had his Truck No. GJ - 3V - 9767 <strong>in</strong>sured under MotorPackage <strong>Policy</strong> bear<strong>in</strong>g No. 16710 / 02. His Claim for Accident loss to the Insured<strong>Vehicle</strong> was offered to be settled by the Respondent for an amount not acceptable tohim. In this case the Truck overturned on its right side after go<strong>in</strong>g below the roadsidestep area and then dashed with the wall of the bridge caus<strong>in</strong>g severe damages.Spot Survey and F<strong>in</strong>al Survey were done. The F<strong>in</strong>al Survey Report of Mr. Ajay Sharmawas found to be fairly detailed and the Surveyor assessed the loss after scrut<strong>in</strong>y ofBills which worked out to Rs. 2,13,581/-. Salvage was valued at Rs. 8,501/- and SpotSurvey fee of Rs. 920/- was found payable to the Claimant Thus, the net amountpayable on repair basis after deduction of excess worked out as under.Amount fo gross loss assessed : Rs. 2,13,581/-Less Salvage Rs. 8,501/-Add Reimbursement of Spot Survey Rs. 920/-Net Payable Claim Rs. 2,06,000/-Re-<strong>in</strong>spection Report also <strong>co</strong>nfirmed the repairs as permitted. One other Surveyor wasasked to <strong>in</strong>spect the salvage of Eng<strong>in</strong>e Spares. It was judgement over first surveryreport of Mr. Ajay Sharma. This Report <strong>in</strong>ter alia po<strong>in</strong>ted out that Rs. 73,774/- out off<strong>in</strong>al assessment of loss made by Mr. Ajay Sharma was not payable. This prompted theRespondent to offer the Claim amount of Rs. 1,34,913/-. The dispute arose due to these<strong>co</strong>nd <strong>in</strong>spection report by Mr. Vora. The justification of call<strong>in</strong>g this report can be acalled <strong>in</strong> question and its out<strong>co</strong>me should be viewed <strong>in</strong> light of the follow<strong>in</strong>g judicialprecedent. In the case of National <strong>Insurance</strong> Co. Vs. New Patiala Trad<strong>in</strong>g Company(2004 CCJ 537) the Hon’ble State Commission did not f<strong>in</strong>d justification on the part ofthe Insurer <strong>in</strong> appo<strong>in</strong>t<strong>in</strong>g another Surveyor. The Hon’ble National Commission upheldthe position and po<strong>in</strong>ted out <strong>in</strong>ter alia that it is a statute which prescribes theappo<strong>in</strong>tment of Licenced Surveyor and Loss Assessor and prima facie thereforecredence will have to be given to the report of such Approved Surveyors and LossAsssessor. Respondent to pay Rs. 20,600/- to the Compla<strong>in</strong>ant as assessed by Mr.Ajay Sharma.

Ahmedabad Ombudsman CentreCase No. 11.004.0206Shri Sikandarbhai I. GujratiVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 15.4.2005Partial Repudiation under Motor <strong>Vehicle</strong> <strong>Policy</strong>. The Compla<strong>in</strong>ant’s truck met with anAccident. The Respondent had after receiv<strong>in</strong>g an unqualified Discharges Voucher forfull and f<strong>in</strong>al settlement; issued the cheque for payment of Claim. Now the Compla<strong>in</strong>antdesired to raise grievance s<strong>in</strong>ce while pay<strong>in</strong>g the Gross Claim amount; some “Excess”had been re<strong>co</strong>vered. As per the settled law, the Compla<strong>in</strong>ant once hav<strong>in</strong>g accepted theamount <strong>in</strong> full and f<strong>in</strong>al settlement, the matter cannot be normally agitated. S<strong>in</strong>ce theCompla<strong>in</strong>ant <strong>co</strong>uld not prove any fraud, misrepresentation or undue <strong>in</strong>fluence on thepart of the Respondent to get the Discharge Voucher executed; the Compla<strong>in</strong>ant isestopped from reopen<strong>in</strong>g the Claim. The Decision of the Respondent <strong>in</strong> settl<strong>in</strong>g theClaim was upheld with no relief to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 14.003.0106Mr. Prakash L. ParmarVsNational <strong>Insurance</strong> Co. Ltd.Award Dated 18.4.2005The Tata Mobile Car of the Compla<strong>in</strong>ant met with an accident on 13.12.02 and a Claimof Rs. 1,03,005/- was lodged. The Surveyor assessed loss at Rs. 38,993/- as netpayable amount. The Claim was repudiated as there was no endorsement of Certificateof Periodical Inspection (CPI) as per Rule 173 of Gujrat Motor <strong>Vehicle</strong> Rules and it isapplicable to Tata Mobile Car as per amendment No. 172 A of the said Rules, 1989.There was no other <strong>in</strong>firmity <strong>in</strong> the Claim and claim was otherwise genu<strong>in</strong>e as perRespondent. Compla<strong>in</strong>ant <strong>in</strong>formed dur<strong>in</strong>g the Hear<strong>in</strong>g that he was ignorant aboutprovision regard<strong>in</strong>g CPI endorsement <strong>in</strong> RTO Book. He got it done w.e.f. 20.8.03 whenhe was <strong>in</strong>formed by the Surveyor. S<strong>in</strong>ce there was no other deficiency the claimdeserved to be settled on non-standard basis (75 %) <strong>in</strong>stead of repudiat<strong>in</strong>gs <strong>in</strong> total.The breach which is not critical or <strong>co</strong>ntributory to the circumstances which lead toaccident is eligible to be treated as non-standard. Respondent was asked to pay Rs.29,243/- <strong>in</strong> full and f<strong>in</strong>al settlement of the Claim.Ahmedabad Ombudsman CentreCase No. 14.003.0231Ms. Vaishali K. SenVsNational <strong>Insurance</strong> Co. Ltd.Award Dated 25.4.2005Ms. Vaishali K. Sen, owner of the s<strong>co</strong>oter lodged an FIR with the Police Authority thather sooter was stolen on 7.2.03. She had <strong>in</strong>formed Police <strong>in</strong> FIR that s<strong>co</strong>oter wasunlocked and the key was left <strong>in</strong> the vehicle itself. The claim submitted by her wasrepudiated by Respondent on the ground that there was palpable lack of care for the<strong>in</strong>sured property as she kept the vehicle unlocked and left the key <strong>in</strong>side. TheCompla<strong>in</strong>ant affirmed the said <strong>co</strong>ntention to the <strong>in</strong>vestigator appo<strong>in</strong>ted of repudiationwas upheld with no relief to the Compla<strong>in</strong>ant. However, the Respondent appreciated

the high degree of honesty shown by a young girl though it became basis ofrepudiation.Ahmedabad Ombudsman CentreCase No. 11.004.0265Mr. B. N. MakwanaVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 06.5.2005claim lodged under Private Car Package <strong>Policy</strong> declared as “No Claim”. TheRespondent had treated the Claim as non-payable o the ground that the Compla<strong>in</strong>anthad no <strong>in</strong>surable <strong>in</strong>terest <strong>in</strong> the Insured <strong>Vehicle</strong> when the Accident occurred. At thetime of the Claim, the vehicle was <strong>in</strong> the possession of the Compla<strong>in</strong>ant’s friend s<strong>in</strong>cethe same was purchased under Loan Scheme which was yet to be fully repaid. Therewas a letter by the friend of the Compla<strong>in</strong>ant hav<strong>in</strong>g made part payment of the Cost ofthe <strong>Vehicle</strong>. There was no proof of such transaction hav<strong>in</strong>g taken place. Hence theRespondent was directed to pay the Claim as per the assessment of the Surveyor on anet loss basis.Ahmedabad Ombudsman CentreCase No. 11.004.0017Shri Pannalal M. ShethiaVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 30.5.2005<strong>Vehicle</strong> Own Damage Claim - The Compla<strong>in</strong>ant’s <strong>Vehicle</strong> met with an Accident and wasdamaged. The settlement of the Claim was for an amount which was not acceptable bythe Compla<strong>in</strong>ant. The Reports revealed three diferent amounts of the estimated loss.There was no reason to deprive the Compla<strong>in</strong>ant from the highest of the Estimatedvalues. A study of the activity profile of the case made it apparent that the Respondent<strong>co</strong>uld have settled the Claim even on their own terms earlier. Besides re<strong>co</strong>very needsto be done for the Malus (penalty for short payment of premium) Hence, theRespondent was directed to pay the highest of the estimated values less Maluspremium with <strong>in</strong>terest @ 8% per annum for the period of delay <strong>in</strong> full and f<strong>in</strong>alsettlement of the claim.Ahmedabad Ombudsman CentreCase No. 14.002.0110Shri A. D. SolankiVsThe New India Assurance Co. Ltd.Award Dated 20.5.2005Repudiation of Claim due to damage under Private Car <strong>Policy</strong>. The Compla<strong>in</strong>ant’s Carwas damaged. FIR and other Statements given by the witnesses named Mr. Jayantibhaias driv<strong>in</strong>g the vehicle. The Respondent had called for the Orig<strong>in</strong>al LIcence forverification. In reply sworn Affidavits of the Compla<strong>in</strong>ant was received stat<strong>in</strong>g that hehimself was driv<strong>in</strong>g the car and at the time of the accident <strong>in</strong> fright; he had run awayfrom the spot leav<strong>in</strong>g beh<strong>in</strong>d Mr. Jayantibhai to misrepresent the matter <strong>in</strong> the FIR. Tojudiciously deal with the matter, legal processes of summon<strong>in</strong>g the witnesses,exam<strong>in</strong>ation and cross-exam<strong>in</strong>ation, admission of documents, CPC etc. for which the

Institution of Ombudmsman was neither <strong>co</strong>mpetent nor is <strong>in</strong>stitutionally geared up; itwas <strong>in</strong> the <strong>in</strong>terest of fairness and justice; ordered that the Compla<strong>in</strong>ant should pursuehis grievance <strong>in</strong> an appropriate Forum.Ahmedabad Ombudsman CentreCase No. 11.005.0308Shri Pradip B. PatelVsOriental <strong>Insurance</strong> Co. Ltd.Award Dated 09.6.2005Motor Claim not acceptable to Compla<strong>in</strong>ant. The Compla<strong>in</strong>ant’s Car was stolen. TheCompla<strong>in</strong>ant was <strong>in</strong>timated that Rs. 25,000/- balance Claim would be paid only ontransfer of ownership of the vehicle <strong>in</strong> the name of the respondent <strong>in</strong> the R. C. Book.The Compla<strong>in</strong>ant had enquired with the RTO Authorities who had demanded a furtherRs. 20,573/- towards Road Tax s<strong>in</strong>ce the <strong>Vehicle</strong> will have to be transferred to thename of a Company. The Respondent argued that while calculat<strong>in</strong>g the amount of totalloss; the Balance RTO Tax payable on the <strong>Vehicle</strong> was also taken <strong>in</strong>to ac<strong>co</strong>unt. Nows<strong>in</strong>ce the right of subrogation is essential for an Insurer to safeguard its <strong>in</strong>terestsbefore theft claim of an Insured <strong>Vehicle</strong> can be settled; the position taken by theRespondent <strong>in</strong> the subject Claim was upheld with no relief to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 14.003.0338Smt. Sitaben R. DesaiVsNational <strong>Insurance</strong> Co. Ltd.Award Dated 20.6.2005Repudiation of Own Damage Claim under <strong>Vehicle</strong> <strong>Policy</strong>. The Compla<strong>in</strong>ant’s Car metwith an accident. The Claim was repudiated on the ground that the Driver at the time ofthe Accident was not hav<strong>in</strong>g a valid and effective Driv<strong>in</strong>g Licence. The Respondent’s<strong>in</strong>vestigator had brought a letter from the RTO, Ranchi which clearly stated that thesaid Driv<strong>in</strong>g Licence was not issued by them. As such the repudiation of the Claim wasupheld with no relief to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 14.004.0306Mr. Akshay I. PatelVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 20.6.2005Delay <strong>in</strong> settlement of Claim under Motor <strong>Vehicle</strong> <strong>Policy</strong>. The Compla<strong>in</strong>ant’s vehiclewas damaged and the Claim thereof was settled. The Respondent had entrusted thejob of <strong>in</strong>vestigation to a Retired Dy. SP. At the po<strong>in</strong>t of settlement, it was observed thatthe <strong>Vehicle</strong> was <strong>in</strong> fact under Hypothecation Agreement with a Bank while the samewas not mentioned <strong>in</strong> the policy File. Further Investigation was sought for. However, itwas observed that the amount was accepted by the sought for. However, it wasobserved that the amount was accepted by the lesee <strong>in</strong> full and f<strong>in</strong>al satisfaction anddischarge of the Claim. Hence as per precedents <strong>in</strong> law the Compla<strong>in</strong>ant was estopped

from reopen<strong>in</strong>g the issue and the Compla<strong>in</strong>t dismissed without any relief to theCompla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 11.005.0288Mr. Pradip B. PatelVsOriental <strong>Insurance</strong> Co. Ltd.Award Dated 30.6.2005Repudiation of Own Damage Claim under Motor <strong>Vehicle</strong> <strong>Policy</strong>. The Compla<strong>in</strong>ant’s jeephad met with an accident. The Respondent rely<strong>in</strong>g on their Investigator’s Reportrepudiated the Claim on the grounds that the Insured <strong>Vehicle</strong> was ply<strong>in</strong>g for hirerewardat the time of the Accident. The Investigator had mentioned that the passengers<strong>in</strong> the <strong>in</strong>sured vehicle have stated to the Police that they had hired the Jeep and weretravell<strong>in</strong>g as passengers. However, on perusal of the statements given by thepassengers; it had been merely stated that they all boarded the Insured <strong>Vehicle</strong>. Thestatements did never <strong>co</strong>nta<strong>in</strong> any l<strong>in</strong>e to the effect that they were travell<strong>in</strong>g for hire -reward. The Legal Advisor of the Respondent too had remarked that the report of hir<strong>in</strong>gof the subject vehicle was merely an imag<strong>in</strong>ation of the Investigator and that he hadnot <strong>co</strong>llected documents to support this imag<strong>in</strong>ation. S<strong>in</strong>ce Repudiation of a Claimcannot be based on some <strong>in</strong>ference; the Respondent was directed to pay the full Claimamount.Ahmedabad Ombudsman CentreCase No. 11.004.0352Mr. H. D. AroraVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 08.7.2005Claim for accidental loss to Commercial vehicle was rejected on the ground that thedriver was not hold<strong>in</strong>g valid licence duly renewed at the time of driv<strong>in</strong>g the accidentedvehicle. The Compla<strong>in</strong>ant pleaded that vehicle was <strong>in</strong> parked <strong>co</strong>ndition at the time ofaccident. But <strong>in</strong> the claim form Compla<strong>in</strong>ant had mentioned that speed of the vehicle atthe time of vehicle was 20 Kms. per hour. This is <strong>co</strong>ntradictory to parked <strong>co</strong>ndition.Aga<strong>in</strong> the spot Surveyor reported that at the time of accident, the vehicle was be<strong>in</strong>gdriven on surkehj-Gandh<strong>in</strong>agar Road at Cross - Road when a truck dashed with it. This<strong>in</strong>formation was given to him by the Insured at the time of <strong>in</strong>spection. It was thusestablished that vehicle was be<strong>in</strong>g driven by a person not hav<strong>in</strong>g valid licence (<strong>in</strong>validdue to non-renewal). So the Claim is not payable. Repudiation upheld.Ahmedabad Ombudsman CentreCase No. 15.002.0326R. S. SukhadiaVsThe New India Assurance Co. Ltd.Award Dated 18.7.2005Respondent did not grant NCB when renewed the vehicle <strong>in</strong>surance for the period 2003- 04. It was the Compla<strong>in</strong>ant’s plead<strong>in</strong>g that he is eligible for 50 % NCB as the Claim

arose prior to application of New Tariff. Respondent <strong>co</strong>ntended that new Rules for NCBcame to operative from 1.7.2002 on <strong>in</strong>troduction of GR 27, an hence Compla<strong>in</strong>ant is noteligible for NCB. It is observed that as per Clause (b) laid down <strong>in</strong> the GR the NCBprevailed prior to 1.7.2002 will get changed. The Insured will be entitled to an NCBfrom 1.7.2002 onwards till Claims arises, i.e. if no Claim is made or pend<strong>in</strong>g dur<strong>in</strong>g thepreced<strong>in</strong>g full year of <strong>in</strong>surance and it the renewal falls due any time between 1.7.02and 30.6.2003. The clarification issued by the Corporate Technical Deptt. of theRespondent also cross-checked. Respondent’s stand for not grant<strong>in</strong>g NCB upheld.Ahmedabad Ombudsman CentreCase No. 11.002.0188Mr. U. K. KothariVsThe New India Assurance Co. Ltd.Award Dated 18.7.2005Compla<strong>in</strong>ant’s car was <strong>co</strong>vered under Motor <strong>Insurance</strong> <strong>Policy</strong>. The Car accidented on13.10.03. The Accident Claim lodged was rejected as ‘No Claim’ by the Respondent onthe ground of non-<strong>co</strong>mpliance of requirements on the part of Compla<strong>in</strong>ant. Compla<strong>in</strong>antwas asked to submit repair Bills and re-<strong>in</strong>spection Report of the <strong>Vehicle</strong> after repair.The Claim was to be settled on repair basis and not on total loss basis. The loss wasassessed by the Surveyor at Rs. 23,500/- which was less than 75 % of the InsuredDeclared Value Another po<strong>in</strong>t for rejection of the Claim was expiry of fitness certificategiven by the RTO Authority to the <strong>in</strong>sured vehicle. The vehicle should not have ben<strong>in</strong>sured <strong>in</strong> absence of fitness certificate operative on the date of <strong>in</strong>surance. The Insurerhad knowledge of the year of manufacture of the vehicle and about the essentialcertification at the end of 15 years. So the <strong>in</strong>surance accepted by them withoutcertification cannot be the ground for denial of the claim. The claim for Rs. 17,625/-be<strong>in</strong>g 75 % of assessed repair base loss was allowed to the Compla<strong>in</strong>ant.Ahmedabad Ombudsman CentreCase No. 11.004.0129Mr. Janaks<strong>in</strong>h K. ZalaVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 21.7.2005Aga<strong>in</strong>st the amount of Rs. 76,630/- of Motor Own damage claimed by the Compla<strong>in</strong>ant,the Surveyor re<strong>co</strong>mmended Rs 57,000/- for settlement. This amount was paid afterobta<strong>in</strong><strong>in</strong>g <strong>co</strong>nsent of the party to accept the above amount <strong>in</strong> full and f<strong>in</strong>al settlement ofthe Claim. The <strong>co</strong>nsent was unqualified and not obta<strong>in</strong>ed either fraudulently ormisrepresentation or and undue <strong>in</strong>fluence. Supreme Court case ‘United India <strong>Insurance</strong>Co. Ltd., Vs. Ajmere S<strong>in</strong>gh Cotton & General Mills (1999 CCJ 1158 SC) was quoted <strong>in</strong>support of this decision to uphold the decision of the Respondent.Ahmedabad Ombudsman CentreCase No. 11.002.0303V. N. PatelVsThe New India Assurance Co. Ltd.Award Dated 08.8.2005

A Commercial vehicle got accidented on 3.4.2003 <strong>Vehicle</strong> <strong>Policy</strong> was taken by theearlier owner for the period 17.4.2003 to 16.4.2004. <strong>Vehicle</strong> was transferred <strong>in</strong> thename of Purchaser of vehicle who is the Compla<strong>in</strong>ant <strong>in</strong> this case as per RTO Book on17.4.2003. As per GR 17 of India Motor Tariff Liability <strong>co</strong>ver only (and not Motor OwnDamage Cover) gets deemed transferred <strong>in</strong> the name of new owner. Here <strong>in</strong> this case,the Claim for motor disclaim will not be<strong>co</strong>me admissible. The <strong>co</strong>mpla<strong>in</strong>t failed tosucceed.Ahmedabad Ombudsman CentreCase No. 14.002.0413Smt. Vishnubhai J. PatelVsThe New India Assurance Co. Ltd.Award Dated 22.8.2005Repudiation of Motor own Damage Claim. The Compla<strong>in</strong>ant’s claim for reimbursementof <strong>co</strong>st of Broken Glass of his Car was repudiated by the Respondent on the plea that“Gas Kit <strong>co</strong>nnection fitted <strong>in</strong> the <strong>Vehicle</strong> at the material time of Accident without R T OApproval”. It was observed that the Gas - Kit was of RTO Approved type and that theKit was fitted only 2 days before the date of accident. Premiums thereof was also paidto the Respondent. The accident took place when the Car was is <strong>in</strong> parked position.Hence the decision to Repudiate the Claim was set aside and the Respondent wasdirected to pay the full Claim Amount.Ahmedabad Ombudsman CentreCase No. 11.04.0408Mr. Mahim BhattVsCholamandalam Ms General Ins. Co. Ltd.Award Dated 06.9.2005Compla<strong>in</strong>ant’s Three Wheeler classified under transport vehicle met with an accident.Respondent repudiated the claim on the ground that the Driver of the vehicle was noteligible to drive transport vehicles. It is observed from the <strong>co</strong>py of Certificate ofRegistration of the Insured vehicle that the subject vehicle was <strong>in</strong>sured under thecategory of transport vehicle and the Driver at the time of Accident was not hold<strong>in</strong>g aLicence to drive such type of vehicle. Further observed that the Driver was below 20years and he was <strong>in</strong>eligible to get the Driv<strong>in</strong>g Licence to ply transport vehicles underproisions of prevail<strong>in</strong>g Law. Repudiation upheld.Ahmedabad Ombudsman CentreCase No. 11.002.0389Mr. Pramod S. ShahVsThe New India Assurance Co. Ltd.Award Dated 06.9.2005Motor O. D. Claim for damages caused to the Motor Cycle on 6.11.04 by an accident.Respondent repudiated the Claim on the ground that at the material time of accident,the Compla<strong>in</strong>ant was not hold<strong>in</strong>g valid Driv<strong>in</strong>g Licence. Compla<strong>in</strong>ant argued thatthough his Driv<strong>in</strong>g Licence had been expired on 15.9.04, he had submitted renewalapplication with penalty for late renewal to the Designated Authority who hav<strong>in</strong>g

accepted the payment of penalty, and hence, the renewal of licence should have to betaken w.e.f. 15.9.2004 i.e. the date on which the previous Driv<strong>in</strong>g Licence expired.Documents and submissions perused. It is observed that Compla<strong>in</strong>ant’s Driv<strong>in</strong>gLicence had expired on 15.9.2004, and the renewal of Licence was effected w.e.f.9.11.2004 which establishes that at the time of Accident on 6.11.2004, the Compla<strong>in</strong>antwas not hold<strong>in</strong>g valid Driv<strong>in</strong>g Licence. Repudiation upheld.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 11.011.0080Shri Bibhu Prasad PandaVsBajaj Allianz General <strong>Insurance</strong> Co. Ltd.Award Dated 11.4.2005This is a <strong>co</strong>mpla<strong>in</strong>t filed by Shri Bibhu Prasad under Rule 12 (1) (b) of the RPG Rules,1998.The case of the Compla<strong>in</strong>ant is as below :-The Insured - Compla<strong>in</strong>ant had <strong>in</strong>sured his India Car bear<strong>in</strong>g Registration No. OR - 02W - 5088 with Bajaj Allianz General <strong>Insurance</strong> Co. Ltd., Bhubanweswar Branch underCommercial <strong>Vehicle</strong> policy. The vehicle was used on hire basis at the time of accident.The vehicle met with an accident on 28.12.2003. Driver of the vehicle had the Driv<strong>in</strong>gLicence to drive only Light Motor <strong>Vehicle</strong> at the time of a accident.Insurer repudiated the claim as the driver was not authorized to drive the <strong>co</strong>mmercialvehicle / transport vehicle. Hon’ble Ombudsman uphold the repudiation as <strong>co</strong>mpla<strong>in</strong>antadmitted that vehicle was used as taxi at the time of accident. More over, Hon’bleOrissa High Court <strong>in</strong> their judgement M. A. No : 236 of 1996 (O.I.C. - Vs. P. K. Dalai)held that driv<strong>in</strong>g a transport vehicle <strong>in</strong> <strong>co</strong>ntravention of sub section - I of sec - 3 of Actis prohibited.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 14.002.0052Shri Kartik NayakVsNew India Assurance Co. Ltd.Award Dated 18.4.2005This is a <strong>co</strong>mpla<strong>in</strong>ant under Rule 12 (1) (e) of the RPG Rules, 1998.The details of the <strong>co</strong>mpla<strong>in</strong>t is as below :-The Insured - Compla<strong>in</strong>ant Kartik Nayak had <strong>in</strong>sured his Tata truck bear<strong>in</strong>gRegistration No. OR - 09 A / 3875 with New India Assurance Co. Ltd. Bhadrak Branch.The said truck met with a fatal accident on 02.07.2003 result<strong>in</strong>g extensive damage tothe vehicle and death of driver and helper. Survey or has submitted the status reportassess<strong>in</strong>g the loss for Rs. 2,55,000/- <strong>co</strong>nsider<strong>in</strong>g the outwardly visible damages.Insured value of vehicle was for Rs. 375,000/-. Insurer advised the <strong>co</strong>mpla<strong>in</strong>ant todismantle the vehicle as the vehicle was very much repairable as per op<strong>in</strong>ion ofsurveyor. Compla<strong>in</strong>ant requested the <strong>in</strong>surer to settle the claim on total loss basis or <strong>in</strong>cash loss basis as he has no money to repair the vehicle. Insurer <strong>in</strong>sisted on todismantle the vehicle.Dur<strong>in</strong>g Hear<strong>in</strong>g <strong>co</strong>mpla<strong>in</strong>ant submitted the photographs of damaged vehicle whichproved that not only the damage was extensive but beyond repair. The estimate

submitted by <strong>co</strong>mpla<strong>in</strong>ant is double the <strong>in</strong>sured value. Consider<strong>in</strong>g the pecuniaryproblem of <strong>co</strong>mpla<strong>in</strong>ant and extensive damage of vehicle Hon’ble Ombudsman directedthe Insurer to pay Rs. 300,000/- to the <strong>co</strong>mpla<strong>in</strong>ant on total loss basis.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 11.004.0023Mrs. Kiranbala NayakVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 24.5.2005Compla<strong>in</strong>ant’s Ashok Leyland bus bear<strong>in</strong>g No. OR - 02 A - 9097 was <strong>in</strong>sured with theUnited India <strong>Insurance</strong> Co. Ltd., Mancheswar Branch for the period from 01.12.2001 to30.11.2002. The said vehicle met with an accident on 09.06.2002. Insured <strong>co</strong>mpla<strong>in</strong>antlodged a claim for <strong>co</strong>mpensation of Rs. 48,723 f<strong>in</strong>al surveyor assessed the loss anamount of Rs. 12,800/-. Insurer repudiated the claim on the ground that driver ShriBiswanath Sahu had no effective Driv<strong>in</strong>g Licence at the time of accident.The parties was heard on 19th April, 2005.The Compla<strong>in</strong>ant submitted that the she hademployed Shri Sahoo as driver verify<strong>in</strong>g the D/L no : 228 / 2000 issued by R.T.O.,Bhubaneswar. The Insurer submitted that orig<strong>in</strong>al D/L issued by RTO, Balasore videD/L No. : 724 / 91 is a fake one on verification. But subsequent renewal done by RTO,Bhubaneswar was <strong>in</strong> order.<strong>Insurance</strong> Ombudsman directed the <strong>in</strong>surer to pay Rs. 12,800/- on the basis of Apex<strong>co</strong>urt decision on United India <strong>Insurance</strong> Co. Ltd. - Vs. Lehru & Otrhers (2003) 3 SCC388) and National Insurnace Co. Ltd. - Vs. Swaran S<strong>in</strong>gh & others (SLPCC) 9027 of2003.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 14.005.0076Shri Aloke Kumar SahooVsThe New India Assurance Co. Ltd.Award Dated 26.5.2005The Compla<strong>in</strong>ant had <strong>in</strong>sured his Bolero <strong>Vehicle</strong> bear<strong>in</strong>g Registration No. OR - 02 Z -8595 with New India Assurance Co. Ltd. The <strong>Vehicle</strong> met with an accident on15.08.2004. Surveyor of Shri B. K. Mohapatra surveyed the vehicle <strong>in</strong> the garage andadvised the <strong>co</strong>mpla<strong>in</strong>ant to repair the vehicle except the body shell which can berepaired. Repairer wrote to the <strong>co</strong>mpla<strong>in</strong>ant that body shell can not be repaired onlyreplacement can br<strong>in</strong>g back the vehicle to its orig<strong>in</strong>al position. As there is no unanimitybetween the surveyor and repairer regard<strong>in</strong>g the body shell repair<strong>in</strong>g and replacement<strong>co</strong>mpla<strong>in</strong>ant’s claim settlement was delayed.Dur<strong>in</strong>g the Hear<strong>in</strong>g <strong>in</strong>surer agreed to allow the replacement of body shell with adeduction of Rs. 15,000/- towards salvage.Hon’ble Ombudsman directed the Insurer to replace the body shell and reta<strong>in</strong> thesalvage with them.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 11.005.0019

Smt. Santilata AcharyaVsOriental <strong>Insurance</strong> Co. Ltd.Award Dated 08.6.2005Compla<strong>in</strong>ant’s Tata M<strong>in</strong>i bus bear<strong>in</strong>g No OR - 06 C - 9431 was <strong>in</strong>sured with Oriental<strong>Insurance</strong> Co. Ltd., Angul Branch. Dur<strong>in</strong>g the <strong>Policy</strong> Period, the bus met with anaccident on 10.07.2003 due to which <strong>co</strong>nductor of bus died and passengers got <strong>in</strong>jured.The surveyor has assessed the loss for Rs. 45,000/-. Insurer repudiated the claim onthe ground that bus was carry<strong>in</strong>g 80 passengers aga<strong>in</strong>st carry<strong>in</strong>g capacity of 44 anddue to that over load<strong>in</strong>g the accident happened. Dur<strong>in</strong>g the Hear<strong>in</strong>g Compla<strong>in</strong>ant statedthat accident happened due to lost of balance of driver while negotiat<strong>in</strong>g a <strong>co</strong>wsuddenly stray<strong>in</strong>g <strong>in</strong>to the road. Insurer submitted a news paper cutt<strong>in</strong>g of Samaj Oriyadaily which stated that there were 80 passengers on the board at the time of accident.Investigator of <strong>in</strong>surer stated <strong>in</strong> his report that there were 50 to 60 passengers as hecame to know from the local people but he has not furnished the name of the personshe had <strong>co</strong>ntracted no re<strong>co</strong>rded their statements.On verification of R.C. book it is known that but was permitted to carry 44 passengersbut <strong>in</strong>surer <strong>in</strong> his policy stated that bus can carry exceed<strong>in</strong>g 36 passengers but notexceed<strong>in</strong>g 60 passengers.Hon’ble Ombudsman directed the <strong>in</strong>surer to pay Rs. 45,000/- with 6 % <strong>in</strong>terest as the<strong>in</strong>vestigator had stated <strong>in</strong> his report 60 passengers were there at that time which hasbeen permitted by the <strong>in</strong>surer <strong>in</strong> their policy <strong>co</strong>py.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 14.005.0069Shri Basudev DashVsOriental <strong>Insurance</strong> Co. Ltd.Award Dated 14.6.2005Insured <strong>co</strong>mpla<strong>in</strong>ant <strong>in</strong>sured his Tata M<strong>in</strong>i bear<strong>in</strong>g No : OR 02 - AB - 1057 with Oriental<strong>Insurance</strong> Co. Ltd. On 17.07.2004 the vehicle met with an accident near Masthura ofGanjam district. Surveyor assessed the loss for Rs. 48,000/- aga<strong>in</strong>st an estimate of Rs.90,068/-. Insurer repudiated the claim on the ground that driver did not have theeffective driv<strong>in</strong>g licence.Dur<strong>in</strong>g Hear<strong>in</strong>g <strong>in</strong>surer submitted that on verification of D / L of Shri Kedar Behera atAhmedabad RTO who first issued D / L No : 38391 / 77 was fake as 1997 series of D /L was six digit number. There was official letter from the <strong>co</strong>ncerned RTO regard<strong>in</strong>gthis.The Insurer tried to verify the Driv<strong>in</strong>g Licence which was renewed by RTO, Chhatrpurbear<strong>in</strong>g the Licence No. 834 / 81 stands <strong>in</strong> the name of Kedar Behera. RTO,Chhatrapur vide their letter dated 20.09.2004 stated that relevant re<strong>co</strong>rd of said D / Lis torn so, they can not issue a certified <strong>co</strong>py.Insured <strong>co</strong>mpla<strong>in</strong>ant was awarded Rs. 48,000/- along with 6 % <strong>in</strong>terest <strong>in</strong>surer hadsignally failed to prove that D / L No : 38391 / 77 / 834 / 81 issued by RTO Ahmedabadand RTO Chhatrapur is fake.Bhubaneswar Ombudsman Centre

Case No. I. O. O. / B.B.S.R. / 11.002.0015Shri Nikunja Kumar MohantyVsNew India Assurance Co. Ltd.Award Dated 12.7.2005Insured Compla<strong>in</strong>ant <strong>in</strong>sured his Maruti car bear<strong>in</strong>g Registration No. OR - 05 G - 5577which met with an accident on 02.06.2003 at 6.30 P. M. near DAV Square,Bhubaneswar. Though surveyor has assessed the loss for an amount of Rs. 11,100/-but re<strong>co</strong>mmended for repudiation as the damages were old and <strong>in</strong><strong>co</strong>nsistent withnature of accident. Insurer repudiated the claim on the ground that garage owner andmechanic of garage where the vehicle was repaired stated <strong>in</strong> writ<strong>in</strong>g that vehicle wasnot <strong>in</strong> a movable <strong>co</strong>ndition prior to the accident date stated by <strong>co</strong>mpla<strong>in</strong>ant.The parties were heard on 17.3.05, 15.04.05 and 27.07.05. Dur<strong>in</strong>g the hear<strong>in</strong>g <strong>in</strong>surerproduced an affidavit from the mechanic regard<strong>in</strong>g his written statement made earlierbut failed to produce the owner of garage and mechanic physically. The Compla<strong>in</strong>antadmitted the signature of garage owner but disputed on the date and time mentionedby him <strong>in</strong> that written statement.Hon’ble Ombudsman uphold the repudiation as the damaged was caused prior to theeven<strong>in</strong>g of 02.06.03 and <strong>co</strong>mpla<strong>in</strong>ant hav<strong>in</strong>g not <strong>co</strong>me <strong>in</strong> clean hands regard<strong>in</strong>g thedate and time of a accident.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 11.004.0030Shri Shisira Kumar RoutVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 14.7.2005Compla<strong>in</strong>ant’s Tata Truck bear<strong>in</strong>g Registration No. OR - 05 / L - 3155 was <strong>in</strong>sured withUnited India <strong>Insurance</strong> Co. Ltd., Satya Nagar Branch under Motor <strong>Policy</strong> for the periodfrom 27.02.2002 to 26.02.2003. On 3.1.2003 while the Truck was ply<strong>in</strong>g from Kuhuda toSundargarh met with an accident near Chhata Canal bridge. The surveyor hadassessed the loss for Rs 238,000/-. Insurer sat over the file as the signature of the<strong>in</strong>sured is different from the signature appear<strong>in</strong>g <strong>in</strong> R.C. Book and <strong>in</strong> claim form. Dur<strong>in</strong>gthe hear<strong>in</strong>g <strong>in</strong>sured stated that due to fracture <strong>in</strong> his f<strong>in</strong>ger his signature differs and<strong>in</strong>sured was directed to br<strong>in</strong>g the voter identity card and driv<strong>in</strong>g licence for his identityand <strong>in</strong>surer was directed to br<strong>in</strong>g their Development officer who has procured thebus<strong>in</strong>ess.Development officer has identified the <strong>in</strong>sured and <strong>in</strong>sured submitted the photo identitycard and driv<strong>in</strong>g licence which has proved the identity of <strong>in</strong>sured. Hon’ble Ombudsmandirected the <strong>in</strong>surer to pay 238,000/- as assessed by the surveyor.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 14.002.0032Shri Prav<strong>in</strong> Kumar PatelVsNew India Assurance Co. Ltd.Award Dated 08.8.2005

Insured <strong>co</strong>mpla<strong>in</strong>ant Shri Prav<strong>in</strong> Kumar Patel <strong>in</strong>sured his Luna Super bear<strong>in</strong>g No. OR -05 E - 9534 from New India <strong>Insurance</strong> <strong>co</strong>. Ltd. for the period 18.08.98 to 17.08.99.Insured <strong>co</strong>mpla<strong>in</strong>ant’s father while go<strong>in</strong>g <strong>in</strong>side his granite factory kept his vehicle <strong>in</strong>front of the ma<strong>in</strong> gate on 18.08.2003 at 3 p.m. When he returned from the factory on18.08.2003 at 3.30 p.m. he did not found his vehicle and there after lodged an F.I.R.with Jagatpur P.S. Insurer treated the claim as no claim as the <strong>co</strong>mpla<strong>in</strong>ant failed toproduce the required document Subsequently <strong>in</strong>sured submitted the required documentand requested the <strong>in</strong>surer to settled the claim. Insurer delayed the settlement of theclaim. Surveyor assessed the loss for Rs. 10,000/- and stated the <strong>in</strong>cident wasgenu<strong>in</strong>e. Dur<strong>in</strong>g the hear<strong>in</strong>g <strong>in</strong>surer stated that <strong>in</strong>sured suppressed the fact that<strong>in</strong>sured did not disclose the previous <strong>in</strong>surance of that vehicle and theft might haveoccurred dur<strong>in</strong>g un-<strong>in</strong>sured period of vehicle.Honble Ombudsman. Directed the <strong>in</strong>surer to pay Rs. 10,000/- as <strong>in</strong>surer failed to provethat theft took place dur<strong>in</strong>g the gap period of <strong>in</strong>surance. As the <strong>in</strong>sured <strong>co</strong>mpla<strong>in</strong>antpromptly lodged an F.I.R. with the police authorities which has fortified his credibility.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 11.002.0028Shri Bharat SahuVsNew India Assurance Co. Ltd.Award Dated 9.9.2004Insured <strong>co</strong>mpla<strong>in</strong>ant <strong>in</strong>sured his <strong>co</strong>mmander jeep OR - 16 A - 3102 with New IndiaAssurance for the period 01.10.2002 to 30.09.2003 under <strong>co</strong>mmercial vehicle <strong>in</strong>surancepolicy. Insured vehicle met with an accident on 19.04.2003 while ply<strong>in</strong>g from Bamra toDharuadihi. As per the FIR lodged by Gramrakshi Muna S<strong>in</strong>gh was driv<strong>in</strong>g the vehiclewho happened to be the helper of that vehicle. F<strong>in</strong>al policy report submitted by thepolice stated that Ratnakar Nath was driv<strong>in</strong>g the vehicle at the time of accidentac<strong>co</strong>rd<strong>in</strong>gly charge sheet was issued aga<strong>in</strong>st. Mr. Ratnakar Nath. Muna did not havethe valid driv<strong>in</strong>g Licence. Ac<strong>co</strong>rd<strong>in</strong>gly <strong>in</strong>surer repudiated the claim as the Muna S<strong>in</strong>ghwas driv<strong>in</strong>g the vehicle at that time.Muna S<strong>in</strong>gh filed an affidavit that Ratnakar Nath was driv<strong>in</strong>g the vehicle at the materialtime of accident he was the helper of that vehicle. Police authorities re<strong>co</strong>rded thestatement of <strong>in</strong>jured passengers under section 161 of Cr. P. C. and after <strong>in</strong>vestigationcharge sheeted Ratnakar Nath.Dur<strong>in</strong>g hear<strong>in</strong>g <strong>co</strong>mpla<strong>in</strong>ant stated that Ratnakar Nath was the driver, hold<strong>in</strong>g the validD / I at the time of accident driv<strong>in</strong>g the vehicle.<strong>Insurance</strong> Ombudsman directed the <strong>in</strong>surer to settle the claim for an amount of Rs.52,500/- as assessed by the surveyor with<strong>in</strong> fifteen days of receipt of <strong>co</strong>nsent letterfrom the <strong>co</strong>mpla<strong>in</strong>ant.Bhubaneswar Ombudsman CentreCase No. I. O. O. / B.B.S.R. / 14.005.0016Smt. Sushila Ja<strong>in</strong>VsOriental <strong>Insurance</strong> Co. Ltd.Award Dated 09.9.2005Insured <strong>co</strong>mpla<strong>in</strong>ant had obta<strong>in</strong>ed a <strong>co</strong>mprehensive motor policy from Oriental<strong>Insurance</strong> Co. Ltd. to <strong>co</strong>ver her Santro Car. On 17.05.2003 <strong>in</strong>sured car while ply<strong>in</strong>gfrom Pithapur to Dolamundai met with an accident. Insured <strong>co</strong>mpla<strong>in</strong>ant submitted an

estimate of Rs. 30771.58 towards repair<strong>in</strong>g of the vehicle Surveyor <strong>in</strong>spected thevehicle on 25.05.2003 but did not <strong>co</strong>nfirm any th<strong>in</strong>g about repair Insured <strong>co</strong>mpla<strong>in</strong>antwithout repair<strong>in</strong>g the vehicle took away from the garage for her use.Surveyor Shri S. K. Dash submitted his survey report stat<strong>in</strong>g the damages were old and<strong>in</strong><strong>co</strong>nsistent with the nature of accident. Aga<strong>in</strong> that vehicle met with an accident and<strong>in</strong>sured <strong>co</strong>mpla<strong>in</strong>ant lodged the se<strong>co</strong>nd claim for Rs. 52,397/- without mention<strong>in</strong>g thedate and place of accident. Insurer appo<strong>in</strong>ted Shri S. K. Dash and Shri S. K. Panda forJo<strong>in</strong>t survey. Both the surveyors found that damages were old and <strong>in</strong><strong>co</strong>nsistent with thenature of accident. Insurer repudiated the claim on the strength of survey report andInsured <strong>co</strong>mpla<strong>in</strong>ant <strong>co</strong>mmitted the breach of policy <strong>co</strong>ndition by us<strong>in</strong>g the vehiclewithout effect<strong>in</strong>g any repair after the alleged first accident.Dur<strong>in</strong>g the Hear<strong>in</strong>g <strong>in</strong>sured <strong>co</strong>mpla<strong>in</strong>ant’s representative stated that se<strong>co</strong>nd accidenttook place on 13.11.2003 but failed to substantiate with the documentary evidence.Compla<strong>in</strong>ants representative stated that as the car was <strong>in</strong> runn<strong>in</strong>g <strong>co</strong>ndition they tookthe car for their bus<strong>in</strong>ess purposes without effect<strong>in</strong>g any repair.<strong>Insurance</strong> Ombudsman uphold the repudiation and pass nil award as the <strong>co</strong>mpla<strong>in</strong>antviolated the policy <strong>co</strong>ndition by us<strong>in</strong>g the vehicle without repair<strong>in</strong>g it and failedsubstantiate se<strong>co</strong>nd accident.Chandigarh Ombudsman CentreCase No. GIC / 146 / NIC / 11 / 05Shri Hardev S<strong>in</strong>ghVsNational <strong>Insurance</strong> Co. Ltd.Award Dated 13.4.2005FACTS : Shri Hardev S<strong>in</strong>gh got his truck <strong>in</strong>sured from BO Mullahpur for the period6.4.03 to 5.4.04 for sum <strong>in</strong>sured of Rs.3.5 lacs. The vehicle met with an accident on29.7.03. He lodged the FIR and also <strong>in</strong>formed the <strong>in</strong>surer. A surveyor was deputed toassess the loss. He filed the claim on 18.8.2003 which was repudiated as “No Claim” <strong>in</strong>view of false declaration regard<strong>in</strong>g NCB.FINDINGS : The policy was renewed from 6.4.02 to 5.4.03 by BO Ludhiana.Subsequently, when it was renewed by BO Mullanpur NCB @ 45 percent was claimed.The BO Mullanpur sought <strong>co</strong>nfirmation regard<strong>in</strong>g entitlement of NCB from B.OLudhiana vide letter dated 16.5.2003. It was reported on 10.11.2003 that <strong>co</strong>mpla<strong>in</strong>anthad availed of a claim dur<strong>in</strong>g the currency of the previous policy which was notdisclosed at the time of renewal by BO Mullahpur. The claim was repudiated <strong>in</strong> view ofwrong declaration regard<strong>in</strong>g NCB entitlement, as per provisions of GR 27 of IndianMotor Tariff. No proposal form was filled up, as it was a case of renewal and there wasno gap <strong>in</strong> the policy. NCB entitlement was not verified <strong>in</strong> time. A registered letter wassent to the previous <strong>in</strong>sur<strong>in</strong>g office for <strong>co</strong>nfirmation of NCB entitlement, but no replywas received. The report was obta<strong>in</strong>ed after the accident. However, there was noth<strong>in</strong>gon re<strong>co</strong>rd to establish that the <strong>co</strong>mpla<strong>in</strong>ant had claimed NCB @ 45 percent.DECISION : Held that the <strong>in</strong>surer failed to <strong>co</strong>mply with the provisions of GR 27 strictly.NCB entitlement was not verified <strong>in</strong> time. The <strong>in</strong>sured may also be guilty of hav<strong>in</strong>gmade a false verbal statement about NCB entitlement. Ordered that <strong>in</strong> view of lapseson the part of <strong>in</strong>surer as well as the <strong>in</strong>sured, the claim be settled on non-standardbasis by admitt<strong>in</strong>g the liability to the extent of 50 percent.Chandigarh Ombudsman CentreCase No. GIC / 93 / NIC / 14 / 05

Shri Subhash AggarwalVsNational <strong>Insurance</strong> Co. Ltd.Award Dated 21.4.2005FACTS : Sh. Subhash Aggarwal got his s<strong>co</strong>oter bear<strong>in</strong>g registration No. HR 32-8709<strong>in</strong>sured from BO Narwana for the period 30/1/2001 to 29/1/2002 for sum <strong>in</strong>sured of Rs.18,000/-. It met with an accident on 29/1/2002. The Branch Office rejected the claim onthe ground that he did not possess a valid and effective DL on the date of accident. Hesent an attested <strong>co</strong>py of DL <strong>in</strong> December, 2003, but still the claim rema<strong>in</strong>ed unsettled.FINDINGS : The DL was issued by the licenc<strong>in</strong>g authority Hansi on 17.12.1986 fors<strong>co</strong>oter/mc/car/jeep. It was renewed from 18.12.1991 to 16.12.1996 and aga<strong>in</strong> upto16.12.2001. Subsequently he got it renewed from 2.5.2003 to 16.12.2006. For the<strong>in</strong>terven<strong>in</strong>g period from 17.12.2001 to 1.5.2003 dur<strong>in</strong>g which the accident took place,the <strong>co</strong>mpla<strong>in</strong>ant had no valid DL. However, he had duly deposited Rs. 150 as fee forrenewal on 11.12.01 <strong>in</strong> the office of Licens<strong>in</strong>g Authority, Narwana, but the licence wasnot renewed. This was <strong>co</strong>nfirmed by Licenc<strong>in</strong>g Authority, Narwana. The <strong>co</strong>mpla<strong>in</strong>ant<strong>co</strong>ntended that his papers were misplaced <strong>in</strong> the office of Licenc<strong>in</strong>g Authority, Narwanafor which he was not to be blamed. He, therefore, filed another application for renewalof licence with Licenc<strong>in</strong>g Authority, Hansi which had issued the licence orig<strong>in</strong>ally.It was noticed that under Section 15 of MV Act the licencee is required to apply forrenewal with<strong>in</strong> 30 days after the date of expiry. If he does so, the renewal would bedeemed to be effective from the date of expiry of earlier licence. In the <strong>in</strong>stant case the<strong>co</strong>mpla<strong>in</strong>ant applied <strong>in</strong> time.DECISION : Held that the <strong>co</strong>mpla<strong>in</strong>ant was not <strong>in</strong> possession of a valid licence on thedate of accident but as per re<strong>co</strong>rd he had applied for renewal with<strong>in</strong> the prescribedtime. Therefore, he would be deemed to be <strong>in</strong> possession of a valid licence on the dateof accident. The <strong>in</strong>surer was, therefore, directed to settle the claim on merits.Chandigarh Ombudsman CentreCase No. GIC / 123 / UII / 11 / 05Shri Avtar S<strong>in</strong>ghVsUnited India <strong>Insurance</strong> Co. Ltd.Award Dated 27.4.2005FACTS : Sh. Avtar S<strong>in</strong>gh got his Jeep no. PB 53-951 <strong>in</strong>sured for the period 29.12.2002to 28.12.2003 for sum <strong>in</strong>sured of Rs. 1,80,000. The vehicle met with an accident on18.9.2003. The surveyor assessed the loss at Rs. 1,23,000 on repair basis, 1,24,500on total loss basis and 1,02,500 on net of salvage basis. After <strong>in</strong>vestigation, the driv<strong>in</strong>glicence of Sh. Moh<strong>in</strong>der Pal S<strong>in</strong>gh, the driver, was found to be fake. The claim was,ac<strong>co</strong>rd<strong>in</strong>gly, repudiated.FINDINGS : Shri Moh<strong>in</strong>der Pal S<strong>in</strong>gh had earlier served as a driver with the<strong>co</strong>mpla<strong>in</strong>ant from 1998 to 2002. At that time he had a valid licence issued by LAAmritsar. Later he jo<strong>in</strong>ed another <strong>co</strong>mpany <strong>in</strong> U.P and reportedly lost the licenceissued by LA Amritsar. He got another licence through an agent <strong>in</strong> Haldwani. The driverwas aga<strong>in</strong> hired by the <strong>co</strong>mpla<strong>in</strong>ant <strong>in</strong> August, 2003. His licence was, however, notchecked. He presented to the surveyor the licence purported to have been issued byL.A Haldwani, details of which were also given on the claim form signed by the<strong>co</strong>mpla<strong>in</strong>ant. On verification the licence issued by licenc<strong>in</strong>g authority, Amritsar wasfound to be genu<strong>in</strong>e. It was, however, stated that as per provision of Section 6 of the

Motor <strong>Vehicle</strong>s Act, no person <strong>co</strong>uld, while he held a driv<strong>in</strong>g licence for the time be<strong>in</strong>g<strong>in</strong> force, hold another driv<strong>in</strong>g licence.DECISION : The material question <strong>in</strong> so for as the settlement of claim is <strong>co</strong>ncerned iswhether the driver had a valid and effective licence on the date of accident. The<strong>in</strong>sured clarified that driver’s licence was lost which on verification by the <strong>in</strong>surer wasfound to be genu<strong>in</strong>e. He, however, got another licence issued from RTO Haldwaniwhich proved to be fake. Therefore, for all <strong>in</strong>tents and purposes this licence was anullity. Even if it was found to be genu<strong>in</strong>e, the violation of M.V. Act was not materialqua <strong>in</strong>demnification of loss. The <strong>in</strong>sured was not careful enough to have givenparticulars of the genu<strong>in</strong>e licence held by the driver.Held that hav<strong>in</strong>g regard to the facts and circumstances of the case, ends of justicewould be met by settl<strong>in</strong>g the claim on non- standard basis by admitt<strong>in</strong>g liability to theextent of 2/3 rd of the assessed loss.Chandigarh Ombudsman CentreCase No. GIC / 196 / NIC / 11 / 05Shri S. K. MittalVsNational <strong>Insurance</strong> Co. Ltd.Award Dated 24.5.2005FACTS : Shri S.K Mittal filed a <strong>co</strong>mpla<strong>in</strong>t aga<strong>in</strong>st repudiation of accident claim of hiscar which he purchased from Shri Harjit S<strong>in</strong>gh on 9.12.03. Car was got <strong>in</strong>sured by theprevious owner for the period 23.1.03 to 22.1.04. It met with an accident on 10.1.2004.The claim filed by Shri S.K. Mittal was repudiated on the ground that there was no<strong>co</strong>ntract with him. The <strong>co</strong>mpla<strong>in</strong>ant <strong>co</strong>ntended that the claim was repudiated despitethe fact that the previous owner had endorsed on claim form that the claim be paid tohim.FINDINGS : On the date of accident registration as well as <strong>in</strong>surance <strong>co</strong>ver were <strong>in</strong> thename of Shri Harjit S<strong>in</strong>gh. Shri Harjit S<strong>in</strong>gh re<strong>co</strong>rded on the claim form that the claimbe paid to Sh. Mittal, as the car was sold to him. The <strong>in</strong>surer took the plea that as perGR 17 of Motor Tariff, the buyer is required to apply for transfer of policy <strong>in</strong> his namewith<strong>in</strong> 14 days. On receipt of such a request, the underwrit<strong>in</strong>g office works outadditional premium, if any, on ac<strong>co</strong>unt of difference <strong>in</strong> the NCB of previous owner andthereafter the policy is transferred. The <strong>co</strong>ntract <strong>co</strong>mes <strong>in</strong>to effect after the transfer ofpolicy. S<strong>in</strong>ce these formalities were not <strong>co</strong>mpleted by the <strong>co</strong>mpla<strong>in</strong>ant, neither theprevious owner nor the <strong>co</strong>mpla<strong>in</strong>ant had any <strong>in</strong>surable <strong>in</strong>terest.DECISION : Held that <strong>in</strong> the absence of transfer of RC as well as the policy <strong>in</strong> thename of the <strong>co</strong>mpla<strong>in</strong>ant, the <strong>co</strong>mpla<strong>in</strong>ant had no <strong>in</strong>surable <strong>in</strong>terest. He, therefore, hadno locus standi to file the claim as he was not the <strong>in</strong>sured person. The <strong>co</strong>mpla<strong>in</strong>t was,ac<strong>co</strong>rd<strong>in</strong>gly, dismissed.Chandigarh Ombudsman CentreCase No. GIC / 102 / OIC / 11 / 05Shri Jat<strong>in</strong>der KumarVsOriental <strong>Insurance</strong> Co. Ltd.Award Dated 14.7.2005FACTS : Shri Jat<strong>in</strong>der S<strong>in</strong>gh took a Motor Package policy for the period 12.11.03 to11.11.04 for his truck bear<strong>in</strong>g number PB-29-9639. It met with an accident on 31.03.04.The claim filed by him was treated as “No Claim” by DO Pathankot, as NCB declaration

was found to be false. He <strong>co</strong>ntended that he had not given any wrong <strong>in</strong>formationregard<strong>in</strong>g NCB and was prepared to deposit additional premium, if any.FINDINGS : It was noted that 50% NCB was allowed on the basis of allegeddeclaration <strong>in</strong> the proposal form. Compla<strong>in</strong>ant gave <strong>in</strong>timation about accident nearDhariwal on 31.3.04. The <strong>in</strong>surance <strong>co</strong>ver was <strong>in</strong>itially taken by one Shri Gurdev S<strong>in</strong>ghfrom whom the <strong>co</strong>mpla<strong>in</strong>ant had purchased the truck. The <strong>co</strong>mpla<strong>in</strong>ant was not entitledto any NCB as under GR 27 of IMT, NCB follows the fortune of the <strong>in</strong>sured and not thevehicle or the policy. The claim was, ac<strong>co</strong>rd<strong>in</strong>gly, repudiated as benefits under section1 of the policy are forfeited <strong>in</strong> the event of a false declaration. However, NCB wasgranted allegedly by the Development Officer on verbal <strong>co</strong>nfirmation about the<strong>in</strong>sured’s entitlement. The underwrit<strong>in</strong>g office failed to verify the previous <strong>co</strong>vernote.The <strong>in</strong>sured clarified that he had not signed any proposal form. His representative gavethe <strong>co</strong>ver note number for the earlier period and on that basis a fresh <strong>co</strong>ver note wasissued.DECISION : The stand taken by the <strong>in</strong>surer is devoid of any merit. It is a case ofwrongful grant of NCB without follow<strong>in</strong>g procedure or obta<strong>in</strong><strong>in</strong>g declaration from the<strong>in</strong>sured. As the <strong>co</strong>mpla<strong>in</strong>ant purchased a se<strong>co</strong>nd-hand vehicle, only the previous ownerwas entitled to NCB, if any. It was absurd to allow NCB to the <strong>in</strong>sured on the basis of a<strong>co</strong>ver note number of the previous owner. Verification of NCB subsequently wasequally unwarranted, as the <strong>co</strong>mpla<strong>in</strong>ant was not entitled to any NCB. Further,repudiation of claim on the basis of non-existent declaration is untenable. It is simply acase of wrongful grant of NCB, for which <strong>in</strong>sured cannot be held responsible. Held thathav<strong>in</strong>g regard to the totality of circumstances, the claim be settled on non standardbasis by admitt<strong>in</strong>g 70% of liability after re<strong>co</strong>ver<strong>in</strong>g premium to the extent it was paidshort by the <strong>co</strong>mpla<strong>in</strong>ant <strong>in</strong>itially on ac<strong>co</strong>unt of wrongful grant of NCB.Chandigarh Ombudsman CentreCase No. GIC / 59 / NIC / 11 / 05Shri Tej S<strong>in</strong>ghVsNational <strong>Insurance</strong> Co. Ltd.Award Dated 26.7.2005FACTS : Shri Tej S<strong>in</strong>gh purchased TATA Indica bear<strong>in</strong>g No. HR 51 L 3310 <strong>in</strong> an openauction <strong>co</strong>nducted by Excise and Taxation Department, Haryana on 28.8.2003. He gotit <strong>in</strong>sured from BO Faridabad w.e.f 4.9.2003. The vehicle met with an accident on8.3.2004. He got it repaired from Tayal Motors, Faridabad. The surveyor assessed theloss, but the claim was repudiated on the ground that he did not have any <strong>in</strong>surable<strong>in</strong>terest as RC was still <strong>in</strong> the name of Shri Shyam Sunder Bhatia, the previous owner.FINDINGS : While gett<strong>in</strong>g the vehicle <strong>in</strong>sured, the <strong>co</strong>mpla<strong>in</strong>ant had disclosed that hehad applied for transfer of RC <strong>in</strong> his name through Deputy Excise and TaxationCommissioner. The policy was, ac<strong>co</strong>rd<strong>in</strong>gly, issued <strong>in</strong> his name. However, SDMFaridabad refused to transfer RC <strong>in</strong> his name s<strong>in</strong>ce the auctioned vehicle was af<strong>in</strong>anced vehicle and the f<strong>in</strong>ancier held lien on the property. However, at the time ofauction he was <strong>in</strong>formed that the vehicle was unencumbered. He was at his wit’s ends,as the RC was not transferred <strong>in</strong> his name, despite the fact that he had paid theauction money. He, therefore, filed a civil suit <strong>in</strong> the <strong>co</strong>urt of Civil Judge Faridabadpray<strong>in</strong>g that SDM Faridabad be directed to transfer RC <strong>in</strong> his name.DECISION : It is amply established that <strong>co</strong>mpla<strong>in</strong>ant is the rightful owner of vehicle. Itis for the Excise & Taxation Deptt to settle the matter with f<strong>in</strong>ancer hav<strong>in</strong>g re<strong>co</strong>veredfrom the <strong>co</strong>mpla<strong>in</strong>ant the auction money fully. The material question qua the <strong>in</strong>sured is

whether he has any <strong>in</strong>surable <strong>in</strong>terest or not. The vehicle was <strong>in</strong>sured <strong>in</strong> his name. It is<strong>in</strong> his possession and he purchased it <strong>in</strong> open auction <strong>co</strong>nducted by Excise & TaxationDeptt. Transfer / Registration of vehicle is only a means to update the Governmentre<strong>co</strong>rd with regard to ownership. He duly applied for it but the matter is embroiled <strong>in</strong><strong>co</strong>ntroversy with regard to <strong>in</strong>terest of f<strong>in</strong>ancer and will take time for settlement. The<strong>in</strong>surer was fully aware at the time of issue of policy that RC was not <strong>in</strong> the name ofthe proposer, but the <strong>in</strong>surance <strong>co</strong>ver was issued. It is settled law that it is the duty of<strong>in</strong>surer to satisfy itself before issu<strong>in</strong>g the policy that the proposer has an <strong>in</strong>surable<strong>in</strong>terest. In the <strong>in</strong>stant case there is no doubt about purchase of vehicle by the<strong>co</strong>mpla<strong>in</strong>ant through auction and grant of <strong>in</strong>surance <strong>co</strong>ver to him. The <strong>co</strong>mpla<strong>in</strong>ant isbe<strong>in</strong>g held to ransom on the one hand by Excise & Taxation Deptt. which has failed toresolve the matter with the f<strong>in</strong>ancer and on the other by <strong>in</strong>surer by not admitt<strong>in</strong>g theliability. Held that hav<strong>in</strong>g paid the bid money <strong>in</strong> an auction for the vehicle and be<strong>in</strong>g <strong>in</strong>possession of the same, the <strong>co</strong>mpla<strong>in</strong>ant’s <strong>in</strong>surable <strong>in</strong>terest cannot be disputed.Hence, the claim is payable.Chandigarh Ombudsman CentreCase No. GIC / 41 / OIC / 11 / 06Shri Dav<strong>in</strong>der S<strong>in</strong>ghVsOriental <strong>Insurance</strong> Co. Ltd.Award Dated 15.9.2005FACTS : Shri Dav<strong>in</strong>der S<strong>in</strong>gh got his crane <strong>in</strong>sured from BO Karnal for the period30.5.04 to 29.5.05 for sum <strong>in</strong>sured of Rs. 3 lakh. The crane met with an accident andsuffered damage due to overturn<strong>in</strong>g. It was duly surveyed and the <strong>co</strong>mpla<strong>in</strong>ant claimedto have spent Rs. 40,000 on repairs. He submitted bills <strong>in</strong> the branch office. The claimwas, however, filed as ‘No claim’ on the plea that accident on ac<strong>co</strong>unt of overturn<strong>in</strong>gwas not <strong>co</strong>vered under the policy. He <strong>co</strong>ntended that he was not aware of any suchclause or <strong>co</strong>ndition, as <strong>co</strong>py of policy was never furnished to him.FINDINGS : The policy <strong>in</strong> question is a specified perils policy which <strong>co</strong>vers fire,burglary, riot and strike, earthquake, flood, typhoon, damage due to accident anddamage <strong>in</strong> transit but not the risk on ac<strong>co</strong>unt of overturn<strong>in</strong>g of certa<strong>in</strong> specifiedmach<strong>in</strong>ery <strong>in</strong>clud<strong>in</strong>g cranes. Coverage of risk due to overturn<strong>in</strong>g is, however,permissible on payment of additional premium. S<strong>in</strong>ce additional premium was not paid,the repudiation of claim was stated to be <strong>in</strong> order. The <strong>co</strong>mpla<strong>in</strong>ant stated that he wasnot given the option to pay extra premium to <strong>co</strong>ver eventuality of overturn<strong>in</strong>g, nor suchan exclusion was <strong>in</strong>dicated <strong>in</strong> the policy bond.DECISION : Held that there has been serious slip up on the part of underwrit<strong>in</strong>g office.The exclusion was not <strong>in</strong><strong>co</strong>rporated <strong>in</strong> the schedule nor the <strong>in</strong>sured was given theoption to pay extra premium to <strong>co</strong>ver such <strong>co</strong>nt<strong>in</strong>gent loss. Ordered that claim besettled as per loss assessed and additional premium re<strong>co</strong>vered from the <strong>co</strong>mpla<strong>in</strong>antas per rules.Chandigarh Ombudsman CentreCase No. GIC / 76 / OIC / 11 / 06Shri Luv PuriVsOriental <strong>Insurance</strong> Co. Ltd.Award Dated 27.9.2005

FACTS : Shri Luv Puri got his car bear<strong>in</strong>g no. JKR 4333 <strong>in</strong>sured from BO Jammu forthe period 28.5.04 to 27.05.05 for sum <strong>in</strong>sured of Rs. 30,000. While he was travel<strong>in</strong>gfrom Nagrota to Bari Brahmana on 23.8.04, the car met with an accident. The loss wasassessed for Rs. 7084 after deduct<strong>in</strong>g excess clause of Rs. 5000. The RC for thevehicle was renewed by RTO Jammu w.e.f 29.07.02 to 28.07.07 <strong>in</strong><strong>co</strong>rporat<strong>in</strong>g a<strong>co</strong>ndition that vehicle will ply out of Jammu city. The claim was rejected on the groundthat at the time of accident car was ply<strong>in</strong>g <strong>in</strong> municipal area, Jammu, which was notpermitted as per RC.FINDINGS : The <strong>co</strong>mpla<strong>in</strong>ant <strong>co</strong>ntended that there was no restriction <strong>in</strong> the <strong>co</strong>verregard<strong>in</strong>g ply<strong>in</strong>g of car <strong>in</strong> the municipal area, Jammu. In any case, he was go<strong>in</strong>g to BariBrahmana which is a non-municipal area, but he had to pass through Jammu city. Onbehalf of the <strong>in</strong>surer it was stated that s<strong>in</strong>ce the accident had taken place <strong>in</strong> Jammu,the claim was rightly repudiated <strong>in</strong> view of restriction imposed <strong>in</strong> the RC. The perusalof policy <strong>in</strong>dicated that the geographical s<strong>co</strong>pe for vehicle was <strong>in</strong>dicated as India.DECISION : The restriction imposed by RTO Jammu does not make any sense, as thepurpose was not explicit. Be that as it may, <strong>in</strong> so far as the <strong>co</strong>ntract between theparties is <strong>co</strong>ncerned there is no such limitation. Held that repudiation of claim on aflimsy ground was without merit. Ordered that claim be paid as per loss assessed.Chennai Ombudsman CentreCase No. IO (CHN) / 11.8.1346 / 2004 - 05Mrs. RajamVsRoyal Sundaram Alliance <strong>Insurance</strong> Co. Ltd.Award Dated 13.4.2005Mr. Rajenderan, <strong>in</strong>surer his TVS moped for a sum <strong>in</strong>sured of Rs. 16,000/- for the period24.9.2002 to 23.9.2003. for the Owner cum driver, the PA <strong>co</strong>ver was extended for Rs. 1Lac under the Motor <strong>Policy</strong>.On 22.10.2002, the vehicle met with an accident when the <strong>in</strong>sured was driv<strong>in</strong>g thevehicle. It <strong>co</strong>llided with on <strong>co</strong>m<strong>in</strong>g Hero Honda vehicle The accident was reported toSivakanchi Police station and the <strong>in</strong>sured died at the Government Hospital, Chennai on23.10.2002. Based on the Xerox <strong>co</strong>py of the Driv<strong>in</strong>g Licence produced by the<strong>co</strong>mpla<strong>in</strong>ant, the own damage claim was settled for Rs. 1100/- on 8.8.2003 by the<strong>in</strong>surer.However, the <strong>in</strong>surer <strong>in</strong>sisted the orig<strong>in</strong>al driv<strong>in</strong>g licence for verification for settl<strong>in</strong>g theP.A. claim to the legal heirs of the <strong>in</strong>sured. The <strong>co</strong>mpla<strong>in</strong>ant expressed her <strong>in</strong>ability toproduce the Orig<strong>in</strong>al Driv<strong>in</strong>g Licence, as she did not know where it was given by herlate husband.In the meantime, the <strong>in</strong>surer approached the High Court, Chennai by a writ petition andthe Hon’ble S<strong>in</strong>gle judge gave a direction to the Licenc<strong>in</strong>g Authority to <strong>co</strong>nfirm aboutthe validity of the Driv<strong>in</strong>g Licence. As the matter has already be<strong>co</strong>me subjudice, it theDL is proved to be genu<strong>in</strong>e the <strong>in</strong>surer were directed to settle the claim for Rs. 1 lacwith <strong>in</strong>terest and if RTO’s <strong>co</strong>nformation is proved to be otherwise, the <strong>co</strong>mpla<strong>in</strong>ant willhave no remedy. Ac<strong>co</strong>rd<strong>in</strong>gly the case was decided.Chennai Ombudsman CentreCase No. IO (CHN) / 11.02.1399 / 2004 - 05Mrs. A. G. SivaramanVsThe New India Assurance Co. Ltd.

Award Dated 9.5.2005Mrs. A. G. Sivaraman purchased a car from the seller which was <strong>co</strong>vered under thepolicy issued by New India, Chennai. The <strong>Vehicle</strong> has been transferred <strong>in</strong> the name ofthe buyer <strong>in</strong> the R. C. book on 28.06.2004. The <strong>Policy</strong> was transferred <strong>in</strong> the name ofthe purchaser on 7.7.2004. The vehicle met with an accident on 3.7.2004 (before thename transfer was effected <strong>in</strong> <strong>Insurance</strong>) and the <strong>in</strong>surer repudiated the claim that onthe date of the accident the purchaser had no <strong>in</strong>surable <strong>in</strong>terest.It was observed by this forum that the R. C. was changed <strong>in</strong> the name of the purchaseron 28.6.2004 and the policy was transferred with<strong>in</strong> the stipulation of 14 days from thedate of sale, as reflected <strong>in</strong> the R. C. The name transfer was also effected <strong>in</strong> the<strong>Insurance</strong>. Hence, direction was given to the <strong>in</strong>surer to process the claim and settle itwith the purchaser.Chennai Ombudsman CentreCase No. IO (CHN) / 11.05.1427 / 2004 - 05Shri V. GanesanVsThe Oriental <strong>Insurance</strong> Co. Ltd.Award Dated 16.5.2005Shri V. Ganesan <strong>co</strong>mpla<strong>in</strong>ant, <strong>in</strong>sured his vehicle TN 09 AH 3505 Cargo Carrier withOriental <strong>Insurance</strong> Co. Ltd., Chennai for the period 20.8.2004 to 19.8.2005. Thevehicle met with an accident on 30.12.2004, FIR was filed and survey also <strong>co</strong>nducted.The Insurer have repudiated the claim that the driver Mr. Karunanithi is not hav<strong>in</strong>gvalid Badge authorized to drive Goods Carry<strong>in</strong>g. The Insurer also mentioned as per MVAct Badge is one of the basic requirements. The Insured paid advance monies toDriv<strong>in</strong>g School on 13.12.2004 for secur<strong>in</strong>g badge but there was delay <strong>in</strong> remitt<strong>in</strong>g themoney to RTO by the Driv<strong>in</strong>g School. The Insured <strong>co</strong>nfirmed that there is no permit isrequired for the vehicle.On scrut<strong>in</strong>y of the papers it is established that the vehicle was LMV and the driver washold<strong>in</strong>g LMV licence and badge for driv<strong>in</strong>g transport vehicle has been endorsed on18.2.2005. Though the vehicle used for transport<strong>in</strong>g goods, it was admitted positionthat it does not require permit. The Supreme Court held where the vehicle is LMV andno proof to show that there was a permit for the vehicle, LMV licence would suffice andeven transport vehicle endorsement is not necessary. The <strong>co</strong>ntention of the <strong>in</strong>surer isthat there is no badge on the date of accident, but the badge is only as addition on thebasis of Tamil Nadu Motor <strong>Vehicle</strong> Rules with regard to knowledge of language, firstaid, etc., In recent <strong>co</strong>nsumer case the State Commission had held merely for absenceof badge a claim <strong>co</strong>uld not be repudiated when the driver otherwise held a validlicence. Therefore, the <strong>in</strong>surer were directed to process and settle the claim.Chennai Ombudsman CentreCase No. IO (CHN) / 11.03.1408 / 2004 - 05Mr. Parveen KothariVsThe National <strong>Insurance</strong> Co. Ltd.Award Dated 16.5.2005Mr. K. Raja <strong>in</strong>sured his vehicle, Toyota qualis bear<strong>in</strong>g Registration no. TN 04 W 7332with National <strong>Insurance</strong> Co. Ltd., Chennai for a sum <strong>in</strong>sured of Rs. 4,48,000/- for theperiod from 7.8.2002 to 6.8.2003 and sold the vehicle to Mr. Gnana Smabhandam on22.11.2002, who approached the <strong>in</strong>surer on 2.12.2002 for transfer of <strong>in</strong>surance <strong>in</strong> his