- Page 1: SRS LIMITEDRED HERRING PROSPECTUSJu

- Page 4 and 5: SRS LimitedTermDescriptionEPSEarnin

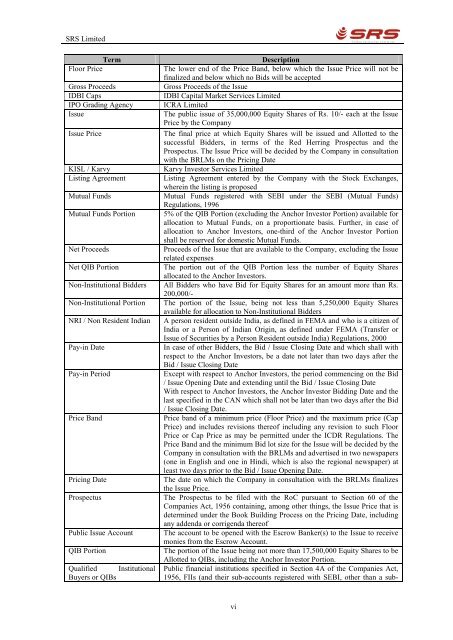

- Page 7: SRS LimitedTermBid / Issue PeriodDe

- Page 11 and 12: SRS LimitedTechnical and Industry-R

- Page 13 and 14: SRS LimitedFORWARD LOOKING STATEMEN

- Page 15 and 16: SRS Limitedb. Proceedings initiated

- Page 17 and 18: SRS LimitedAny delay or failure in

- Page 19 and 20: SRS LimitedS.No.Pending license Cur

- Page 21 and 22: SRS LimitedFurthermore, the governm

- Page 23 and 24: SRS Limited15. Any defect in the ti

- Page 25 and 26: SRS Limited23. The Company is raisi

- Page 27 and 28: SRS Limited32. There is no guarante

- Page 29 and 30: SRS Limited43. The Company is depen

- Page 31 and 32: SRS Limited52. In the cash & carry

- Page 33 and 34: SRS Limited60. Instability in India

- Page 35 and 36: SRS LimitedPROMINENT NOTES1. The ne

- Page 37 and 38: SRS LimitedSECTION III - INTRODUCTI

- Page 39 and 40: SRS LimitedSUMMARY OF BUSINESSSRS L

- Page 41 and 42: SRS LimitedSUMMARY OF CONSOLIDATED

- Page 43 and 44: SRS LimitedSUMMARY OF STANDALONE AS

- Page 45 and 46: SRS LimitedSUMMARY OF STANDALONE CA

- Page 47 and 48: SRS LimitedGENERAL INFORMATIONINCOR

- Page 49 and 50: SRS LimitedIDBI Capital Market Serv

- Page 51 and 52: SRS LimitedDeputy Company Secretary

- Page 53 and 54: SRS LimitedAppraisal EntityThe obje

- Page 55 and 56: SRS Limitedalso inform the same to

- Page 57 and 58: SRS LimitedCAPITAL STRUCTUREThe Equ

- Page 59 and 60:

SRS LimitedDate ofAllotmentand Date

- Page 61 and 62:

SRS LimitedDate ofAllotmentand Date

- Page 63 and 64:

SRS LimitedName ofPromotersDate ofA

- Page 65 and 66:

SRS Limited6. Details of transactio

- Page 67 and 68:

SRS LimitedSr.NoName22. BTL Industr

- Page 69 and 70:

SRS Limitedvalue, the issue price a

- Page 71 and 72:

SRS LimitedCategorycodeCategory ofs

- Page 73 and 74:

SRS Limited14. The Issue is being m

- Page 75 and 76:

SRS LimitedThe objects of this Publ

- Page 77 and 78:

SRS LimitedSr. Asset Classification

- Page 79 and 80:

SRS Limited2. Setting up of Food Co

- Page 81 and 82:

SRS LimitedParticularOriginal Sched

- Page 83 and 84:

SRS LimitedParticularFixtures and O

- Page 85 and 86:

SRS LimitedSr. Particulars Details

- Page 87 and 88:

SRS LimitedImplementation Schedule

- Page 89 and 90:

SRS LimitedBASIS FOR ISSUE PRICEInv

- Page 91 and 92:

SRS LimitedComparison of Accounting

- Page 93 and 94:

SRS LimitedANNEXURE TO STATEMENT OF

- Page 95 and 96:

SRS Limited5. As per the provisions

- Page 97 and 98:

SRS Limited3. Securities Transactio

- Page 99 and 100:

SRS LimitedE. BENEFITS AVAILABLE TO

- Page 101 and 102:

SRS LimitedGrowth drivers for the f

- Page 103 and 104:

SRS LimitedComfortable seatingExcel

- Page 105 and 106:

SRS LimitedThe high costs of produc

- Page 107 and 108:

SRS LimitedIn India, FBJs operate a

- Page 109 and 110:

SRS LimitedBranding drives revenues

- Page 111 and 112:

SRS Limitedfeature offered by this

- Page 113 and 114:

SRS LimitedWide assortment across v

- Page 115 and 116:

SRS Limiteda) Increase in the nucle

- Page 117 and 118:

SRS LimitedWith branded jewellery g

- Page 119 and 120:

SRS Limitedc) Growing market for lu

- Page 121 and 122:

SRS LimitedBUSINESS OVERVIEWSRS Lim

- Page 123 and 124:

SRS LimitedUnderstanding of ‘valu

- Page 125 and 126:

SRS LimitedCity (State) Location Ye

- Page 127 and 128:

SRS LimitedBusiness ModelBusiness M

- Page 129 and 130:

SRS LimitedAverage Ticket Price (in

- Page 131 and 132:

SRS LimitedOperations & Maintenance

- Page 133 and 134:

SRS LimitedList of Existing food &

- Page 135 and 136:

SRS LimitedMenu Engineering Impleme

- Page 137 and 138:

SRS LimitedStore Layout and Ambienc

- Page 139 and 140:

SRS Limitedgoods from small and med

- Page 141 and 142:

SRS Limited• Melting- Under this

- Page 143 and 144:

SRS LimitedBusiness Division/ Categ

- Page 145 and 146:

SRS LimitedSr.No.Location of Proper

- Page 147 and 148:

SRS Limited8. Company shall have no

- Page 149 and 150:

SRS LimitedState Specific Cinema Re

- Page 151 and 152:

SRS LimitedEach State Government an

- Page 153 and 154:

SRS LimitedThe Consumer Protection

- Page 155 and 156:

SRS Limitedacts in relation to orig

- Page 157 and 158:

SRS LimitedThe Motor Vehicles Act,

- Page 159 and 160:

SRS LimitedSr.ParticularsDate of Bo

- Page 161 and 162:

SRS Limited8. To act as a generator

- Page 163 and 164:

SRS Limited26. To carry on the busi

- Page 165 and 166:

SRS Limited5. Mr. Sunil Jindal6. Mr

- Page 167 and 168:

SRS Limited4) In the event the Comp

- Page 169 and 170:

SRS LimitedMANAGEMENTBOARD OF DIREC

- Page 171 and 172:

SRS LimitedName, Father’sName, Ag

- Page 173 and 174:

SRS LimitedName, Father’sName, Ag

- Page 175 and 176:

SRS LimitedMr. Shiv Mohan Gupta, ag

- Page 177 and 178:

SRS LimitedName Mr. Raju Bansal Mr.

- Page 179 and 180:

SRS LimitedCorporate GovernanceProv

- Page 181 and 182:

SRS LimitedThe role of the said com

- Page 183 and 184:

SRS LimitedManagement Organisation

- Page 185 and 186:

SRS LimitedBrief Profile of Key Man

- Page 187 and 188:

SRS LimitedChanges in the Key Manag

- Page 189 and 190:

SRS LimitedMr. Bishan Bansal aged 4

- Page 191 and 192:

SRS LimitedSr. No. ParticularsNo. o

- Page 193 and 194:

SRS LimitedNet Worth 307.05 306.92

- Page 195 and 196:

SRS LimitedSr. NameEquity Sharehold

- Page 197 and 198:

SRS LimitedCategoryCode(f)(g)(h)Cat

- Page 199 and 200:

SRS LimitedCategoryCodeCategory ofS

- Page 201 and 202:

SRS LimitedParticulars For the year

- Page 203 and 204:

SRS Limited(Rs. in mn.)Particulars

- Page 205 and 206:

SRS Limited18. Mrs. Toshi Devi Bans

- Page 207 and 208:

SRS Limited10. Mr. Dinesh Kumar 2,5

- Page 209 and 210:

SRS LimitedS. No. Particulars No. o

- Page 211 and 212:

SRS LimitedSr. No. Particulars No.

- Page 213 and 214:

SRS LimitedSr. No. Particulars No.

- Page 215 and 216:

SRS LimitedSr. No. Particulars No.

- Page 217 and 218:

SRS Limited20) SRS Events and Media

- Page 219 and 220:

SRS LimitedDetails of shareholding

- Page 221 and 222:

SRS Limited3. Mr. Rajesh ManglaDeta

- Page 223 and 224:

SRS Limited27) SRS Buildcon Private

- Page 225 and 226:

SRS Limited29) SRS Entertainment Li

- Page 227 and 228:

SRS LimitedDetails of shareholding

- Page 229 and 230:

SRS LimitedSr.No.ParticularsNo. of

- Page 231 and 232:

SRS LimitedDetail of the Board of D

- Page 233 and 234:

SRS LimitedDIVIDEND POLICYDividends

- Page 235 and 236:

SRS LimitedDirectors relating to Co

- Page 237 and 238:

SRS LimitedCONSOLIDATED SUMMARY STA

- Page 239 and 240:

SRS LimitedAnnexure-IVSIGNIFICANT A

- Page 241 and 242:

SRS LimitedGoods held for Resale ar

- Page 243 and 244:

SRS LimitedD. Notes on adjustments

- Page 245 and 246:

SRS Limited5. a) During the Financi

- Page 247 and 248:

SRS Limitedb) Total contingent rent

- Page 249 and 250:

SRS LimitedSalary increase (taking

- Page 251 and 252:

SRS LimitedProfit before taxes 569.

- Page 253 and 254:

SRS LimitedS.No.Name of the Party N

- Page 255 and 256:

SRS LimitedNotes:a) Long term debt

- Page 257 and 258:

SRS Limitedattract 2% p.a.charges o

- Page 259 and 260:

SRS LimitedHDFCBank Ltd-VehicleLoan

- Page 261 and 262:

SRS LimitedAnnexure - XSTATEMENT OF

- Page 263 and 264:

SRS LimitedCONSOLIDATED STATEMENT S

- Page 265 and 266:

SRS Limitedc. there are no extraord

- Page 267 and 268:

SRS LimitedAnnexure-IISTANDALONE SU

- Page 269 and 270:

SRS LimitedAnnexure-IVSIGNIFICANT A

- Page 271 and 272:

SRS LimitedDeferred Tax Assets are

- Page 273 and 274:

SRS Limited7. Provision of Income T

- Page 275 and 276:

SRS Limited4. Sales includes Entert

- Page 277 and 278:

SRS Limitedb) Total contingent rent

- Page 279 and 280:

SRS LimitedThe principal assumption

- Page 281 and 282:

SRS LimitedParticulars For the year

- Page 283 and 284:

SRS Limited2. Computation of net pr

- Page 285 and 286:

SRS LimitedParticularUnits ofMeasur

- Page 287 and 288:

SRS LimitedParticularsUnit ofMeasur

- Page 289 and 290:

SRS LimitedBTL Industries Ltd. (w.e

- Page 291 and 292:

SRS LimitedS.No.Name of the Party N

- Page 293 and 294:

SRS Limitediv) Net Worth (Rs.) = Eq

- Page 295 and 296:

SRS LimitedAnnexure-VIIISTANDALONE

- Page 297 and 298:

SRS LimitedLenderLoanDocumentationL

- Page 299 and 300:

SRS LimitedLenderState Bankof Patia

- Page 301 and 302:

SRS LimitedSecurity Clause for Secu

- Page 303 and 304:

SRS LimitedAnnexure-XIIISTATEMENT O

- Page 305 and 306:

SRS LimitedFINANCIAL INDEBTEDNESSTh

- Page 307 and 308:

SRS LimitedSr. No. Particulars Amou

- Page 309 and 310:

SRS Limited1.2 Term Loan - SBIThe C

- Page 311 and 312:

SRS LimitedBanker.Security Primary

- Page 313 and 314:

SRS LimitedNegative CovenantsThe do

- Page 315 and 316:

SRS LimitedNature of LoanTerms of R

- Page 317 and 318:

SRS Limited8. The Company shall not

- Page 319 and 320:

SRS Limited1.9 Working Capital Faci

- Page 321 and 322:

SRS LimitedNature of LoanWorking Ca

- Page 323 and 324:

SRS LimitedOther important terms an

- Page 325 and 326:

SRS LimitedNature of LoanLetter of

- Page 327 and 328:

SRS LimitedNegative CovenantsThe do

- Page 329 and 330:

SRS LimitedNature of LoanLetter of

- Page 331 and 332:

SRS Limited11. The Company shall no

- Page 333 and 334:

SRS LimitedNature of LoanMarginRate

- Page 335 and 336:

SRS LimitedNature of LoanTenureTerm

- Page 337 and 338:

SRS LimitedAs per restated audited

- Page 339 and 340:

SRS LimitedDemand for the jewellery

- Page 341 and 342:

SRS Limitedtrading transaction, it

- Page 343 and 344:

SRS LimitedEarning Per ShareEarning

- Page 345 and 346:

SRS LimitedCOMPARISON OF THE FINANC

- Page 347 and 348:

SRS LimitedProfit after Tax and Ext

- Page 349 and 350:

SRS LimitedTotal ExpenditureTotal e

- Page 351 and 352:

SRS LimitedNet Profit before Tax an

- Page 353 and 354:

SRS LimitedAssetsThe fixed assets i

- Page 355 and 356:

SRS Limited5. New Product or Busine

- Page 357 and 358:

SRS LimitedI (B). Litigations invol

- Page 359 and 360:

SRS LimitedI (D). Litigations invol

- Page 361 and 362:

SRS LimitedII. LITIGATIONS AGAINST

- Page 363 and 364:

SRS Limited4. Case No. Consumer Com

- Page 365 and 366:

SRS Limited(ii)M/s. SRS Finance Lim

- Page 367 and 368:

SRS LimitedNature of Case /Brief Fa

- Page 369 and 370:

SRS LimitedDefendant / AccusedName

- Page 371 and 372:

SRS LimitedIX. CASES FILED BY THE C

- Page 373 and 374:

SRS Limitedprospective effect.The n

- Page 375 and 376:

SRS Limited7. Case No. Suit No. 39

- Page 377 and 378:

SRS LimitedPlaintiff / ComplainantM

- Page 379 and 380:

SRS LimitedPlaintiff / ComplainantM

- Page 381 and 382:

SRS LimitedPlaintiff / ComplainantM

- Page 383 and 384:

SRS LimitedPlaintiff / ComplainantM

- Page 385 and 386:

SRS LimitedPlaintiff / ComplainantM

- Page 387 and 388:

SRS LimitedPlaintiff / ComplainantM

- Page 389 and 390:

SRS Limited6. M/s. SRS Real Infrast

- Page 391 and 392:

SRS LimitedSRS Housing Finance Limi

- Page 393 and 394:

SRS LimitedLicences / Approval Obta

- Page 395 and 396:

SRS LimitedSr.No.Nature ofRegistrat

- Page 397 and 398:

SRS LimitedSr.No.Nature ofRegistrat

- Page 399 and 400:

SRS LimitedSr.No.Nature ofRegistrat

- Page 401 and 402:

SRS LimitedSr.No.Nature ofRegistrat

- Page 403 and 404:

SRS LimitedSr.No.Nature ofRegistrat

- Page 405 and 406:

SRS LimitedSr.No.Nature ofRegistrat

- Page 407 and 408:

SRS LimitedSr.No.Nature ofRegistrat

- Page 409 and 410:

SRS Limited11. Omaxe Celebration Ma

- Page 411 and 412:

SRS Limited3. SRS 7 Dayz Restaurant

- Page 413 and 414:

SRS LimitedSr.No.Nature ofRegistrat

- Page 415 and 416:

SRS LimitedSr.No.Nature ofRegistrat

- Page 417 and 418:

SRS Limited16. Punjabi Haandi, West

- Page 419 and 420:

SRS LimitedSr.No.Nature ofRegistrat

- Page 421 and 422:

SRS LimitedSr.No.Nature ofRegistrat

- Page 423 and 424:

SRS LimitedSr.No.Nature ofRegistrat

- Page 425 and 426:

SRS LimitedSr.No.Nature ofRegistrat

- Page 427 and 428:

SRS Limited15. SRS Value Bazar, Gro

- Page 429 and 430:

SRS Limited18. SRS Value Bazar, Bye

- Page 431 and 432:

SRS Limited21. SRS Value Bazaar, 1s

- Page 433 and 434:

SRS Limited24. SRS Value Bazaar - R

- Page 435 and 436:

SRS Limited3. SRS Jewells, City Cen

- Page 437 and 438:

SRS LimitedOTHER OFFICES1. 202, New

- Page 439 and 440:

SRS LimitedSr.No.Name ofTrademark4

- Page 441 and 442:

SRS LimitedSr.No.Name ofTrademarkAp

- Page 443 and 444:

SRS LimitedSr.No.Name ofTrademarkAp

- Page 445 and 446:

SRS Limited*The said applications a

- Page 447 and 448:

SRS LimitedAuthority for the IssueO

- Page 449 and 450:

SRS Limited• Monetary Assets comp

- Page 451 and 452:

SRS LimitedRELEASED BY THE SAID BAN

- Page 453 and 454:

SRS LimitedTransfer RestrictionsThe

- Page 455 and 456:

SRS LimitedExpert OpinionExcept for

- Page 457 and 458:

SRS Limitedhave made any capital is

- Page 459 and 460:

SRS LimitedSECTION VII - ISSUE RELA

- Page 461 and 462:

SRS LimitedParticulars QIBs # Non-I

- Page 463 and 464:

SRS LimitedThe Company may consider

- Page 465 and 466:

SRS LimitedFor a detailed descripti

- Page 467 and 468:

SRS LimitedISSUE PROCEDUREThis sect

- Page 469 and 470:

SRS Limitedlaw relating to trusts/s

- Page 471 and 472:

SRS LimitedIn addition to the above

- Page 473 and 474:

SRS Limitede) For Non-Institutional

- Page 475 and 476:

SRS LimitedMethod and Process of Bi

- Page 477 and 478:

SRS LimitedBidder’s Depository Ac

- Page 479 and 480:

SRS Limitedat the centre where the

- Page 481 and 482:

SRS LimitedSyndicate and the SCSBs,

- Page 483 and 484:

SRS Limitedthe Syndicate or the Des

- Page 485 and 486:

SRS LimitedPre- Issue Advertisement

- Page 487 and 488:

SRS Limited(i) In the event Mutual

- Page 489 and 490:

SRS LimitedType ofQIBbiddersEquitys

- Page 491 and 492:

SRS LimitedImpersonationAttention o

- Page 493 and 494:

SRS LimitedLetters of Allotment or

- Page 495 and 496:

SRS LimitedSECTION VIII: MAIN PROVI

- Page 497 and 498:

SRS Limitedfull or part of any prop

- Page 499 and 500:

SRS Limitedc. The provisions of the

- Page 501 and 502:

SRS Limited36. Before registering a

- Page 503 and 504:

SRS LimitedALTERATION OF CAPITAL49.

- Page 505 and 506:

SRS Limited63. At every General Mee

- Page 507 and 508:

SRS Limited115. The Company in Gene

- Page 509 and 510:

SRS LimitedINDEMNITY AND RESPONSIBI

- Page 511 and 512:

13. In-principle listing approval f

- Page 516 and 517:

SRS LIMITEDIssue DetailsSRS Limited

- Page 518 and 519:

ICRA Grading PerspectiveSRS Limited

- Page 520 and 521:

ICRA Grading PerspectiveSRS Limited

- Page 522 and 523:

ICRA Grading PerspectiveSRS Limited

- Page 524:

ICRA Grading PerspectiveSRS Limited