Chemical Week

Chemical Week

Chemical Week

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

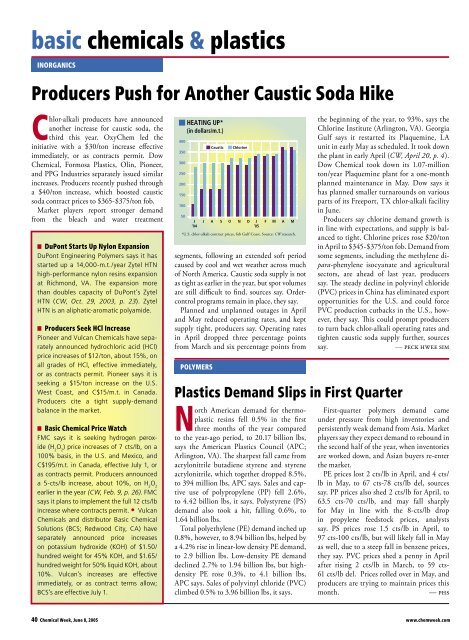

asic chemicals & plasticsINORGANICSProducers Push for Another Caustic Soda HikeChlor-alkali producers have announcedanother increase for caustic soda, thethird this year. OxyChem led theinitiative with a $30/ton increase effectiveimmediately, or as contracts permit. Dow<strong>Chemical</strong>, Formosa Plastics, Olin, Pioneer,and PPG Industries separately issued similarincreases. Producers recently pushed througha $40/ton increase, which boosted causticsoda contract prices to $365-$375/ton fob.Market players report stronger demandfrom the bleach and water treatment■ DuPont Starts Up Nylon ExpansionDuPont Engineering Polymers says it hasstarted up a 14,000-m.t./year Zytel HTNhigh-performance nylon resins expansionat Richmond, VA. The expansion morethan doubles capacity of DuPont’s ZytelHTN (CW, Oct. 29, 2003, p. 23). ZytelHTN is an aliphatic-aromatic polyamide.■ Producers Seek HCl IncreasePioneer and Vulcan <strong>Chemical</strong>s have separatelyannounced hydrochloric acid (HCl)price increases of $12/ton, about 15%, onall grades of HCl, effective immediately,or as contracts permit. Pioneer says it isseeking a $15/ton increase on the U.S.West Coast, and C$15/m.t. in Canada.Producers cite a tight supply-demandbalance in the market.■ Basic <strong>Chemical</strong> Price WatchFMC says it is seeking hydrogen peroxide(H 2O 2) price increases of 7 cts/lb, on a100% basis, in the U.S. and Mexico, andC$195/m.t. in Canada, effective July 1, oras contracts permit. Producers announceda 5-cts/lb increase, about 10%, on H 2O 2earlier in the year (CW, Feb. 9, p. 26). FMCsays it plans to implement the full 12 cts/lbincrease where contracts permit. • Vulcan<strong>Chemical</strong>s and distributor Basic <strong>Chemical</strong>Solutions (BCS; Redwood City, CA) haveseparately announced price increaseson potassium hydroxide (KOH) of $1.50/hundred weight for 45% KOH, and $1.65/hundred weight for 50% liquid KOH, about10%. Vulcan’s increases are effectiveimmediately, or as contract terms allow;BCS’s are effective July 1.40035030025020015010050HEATING UP*(in dollars/m.t.)J’04*U.S. chlor-alkali contract prices, fob Gulf Coast. Source: CW research.segments, following an extended soft periodcaused by cool and wet weather across muchof North America. Caustic soda supply is notas tight as earlier in the year, but spot volumesare still difficult to find, sources say. Ordercontrolprograms remain in place, they say.Planned and unplanned outages in Apriland May reduced operating rates, and keptsupply tight, producers say. Operating ratesin April dropped three percentage pointsfrom March and six percentage points fromPOLYMERSCausticChlorineJ A S O N D J’05F M A Mthe beginning of the year, to 93%, says theChlorine Institute (Arlington, VA). GeorgiaGulf says it restarted its Plaquemine, LAunit in early May as scheduled. It took downthe plant in early April (CW, April 20, p. 4).Dow <strong>Chemical</strong> took down its 1.07-millionton/year Plaquemine plant for a one-monthplanned maintenance in May. Dow says ithas planned smaller turnarounds on variousparts of its Freeport, TX chlor-alkali facilityin June.Producers say chlorine demand growth isin line with expectations, and supply is balancedto tight. Chlorine prices rose $20/tonin April to $345-$375/ton fob. Demand fromsome segments, including the methylene dipara-phenyleneisocyanate and agriculturalsectors, are ahead of last year, producerssay. The steady decline in polyvinyl chloride(PVC) prices in China has eliminated exportopportunities for the U.S. and could forcePVC production cutbacks in the U.S., however,they say. This could prompt producersto turn back chlor-alkali operating rates andtighten caustic soda supply further, sourcessay.— PECK HWEE SIMPlastics Demand Slips in First QuarterNorth American demand for thermoplasticresins fell 0.5% in the firstthree months of the year comparedto the year-ago period, to 20.17 billion lbs,says the American Plastics Council (APC;Arlington, VA). The sharpest fall came fromacrylonitrile butadiene styrene and styreneacrylonitrile, which together dropped 8.5%,to 394 million lbs, APC says. Sales and captiveuse of polypropylene (PP) fell 2.6%,to 4.42 billion lbs, it says. Polystyrene (PS)demand also took a hit, falling 0.6%, to1.64 billion lbs.Total polyethylene (PE) demand inched up0.8%, however, to 8.94 billion lbs, helped bya 4.2% rise in linear-low density PE demand,to 2.9 billion lbs. Low-density PE demanddeclined 2.7% to 1.94 billion lbs, but highdensityPE rose 0.3%, to 4.1 billion lbs,APC says. Sales of polyvinyl chloride (PVC)climbed 0.5% to 3.96 billion lbs, it says.First-quarter polymers demand cameunder pressure from high inventories andpersistently weak demand from Asia. Marketplayers say they expect demand to rebound inthe second half of the year, when inventoriesare worked down, and Asian buyers re-enterthe market.PE prices lost 2 cts/lb in April, and 4 cts/lb in May, to 67 cts-78 cts/lb del, sourcessay. PP prices also shed 2 cts/lb for April, to63.5 cts-70 cts/lb, and may fall sharplyfor May in line with the 8-cts/lb dropin propylene feedstock prices, analystssay. PS prices rose 1.5 cts/lb in April, to97 cts-100 cts/lb, but will likely fall in Mayas well, due to a steep fall in benzene prices,they say. PVC prices shed a penny in Aprilafter rising 2 cts/lb in March, to 59 cts-61 cts/lb del. Prices rolled over in May, andproducers are trying to maintain prices thismonth.— PHS40 <strong>Chemical</strong> <strong>Week</strong>, June 8, 2005www.chemweek.com