PART II : FINANCIAL MANAGEMENT 1. Answer the following ...

PART II : FINANCIAL MANAGEMENT 1. Answer the following ...

PART II : FINANCIAL MANAGEMENT 1. Answer the following ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

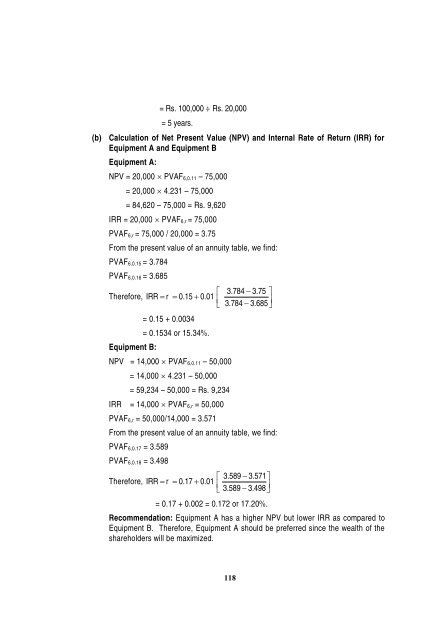

= Rs. 100,000 ÷ Rs. 20,000<br />

= 5 years.<br />

(b) Calculation of Net Present Value (NPV) and Internal Rate of Return (IRR) for<br />

Equipment A and Equipment B<br />

Equipment A:<br />

NPV = 20,000 � PVAF6,0.11 – 75,000<br />

= 20,000 � 4.231 – 75,000<br />

= 84,620 – 75,000 = Rs. 9,620<br />

IRR = 20,000 � PVAF6,r = 75,000<br />

PVAF6,r = 75,000 / 20,000 = 3.75<br />

From <strong>the</strong> present value of an annuity table, we find:<br />

PVAF6,0.15 = 3.784<br />

PVAF6,0.16 = 3.685<br />

� 3.784 �3.75<br />

�<br />

Therefore, IRR �r<br />

�0.15<br />

�0.01<br />

�<br />

�<br />

�3.784<br />

�3.685�<br />

Equipment B:<br />

= 0.15 + 0.0034<br />

= 0.1534 or 15.34%.<br />

NPV = 14,000 � PVAF6,0.11 – 50,000<br />

= 14,000 � 4.231 – 50,000<br />

= 59,234 – 50,000 = Rs. 9,234<br />

IRR = 14,000 � PVAF6,r = 50,000<br />

PVAF6,r = 50,000/14,000 = 3.571<br />

From <strong>the</strong> present value of an annuity table, we find:<br />

PVAF6,0.17 = 3.589<br />

PVAF6,0.18 = 3.498<br />

�3.589<br />

�3.571�<br />

Therefore, IRR �r<br />

�0.17<br />

�0.01<br />

� �<br />

�3.589<br />

�3.498�<br />

= 0.17 + 0.002 = 0.172 or 17.20%.<br />

Recommendation: Equipment A has a higher NPV but lower IRR as compared to<br />

Equipment B. Therefore, Equipment A should be preferred since <strong>the</strong> wealth of <strong>the</strong><br />

shareholders will be maximized.<br />

118