PART II : FINANCIAL MANAGEMENT 1. Answer the following ...

PART II : FINANCIAL MANAGEMENT 1. Answer the following ...

PART II : FINANCIAL MANAGEMENT 1. Answer the following ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

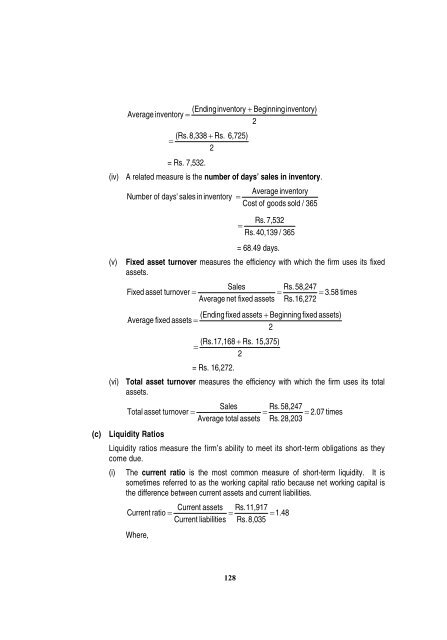

Average inventory<br />

(Endinginventory<br />

�Beginninginventory)<br />

�<br />

2<br />

(Rs. 8,338 �Rs.<br />

6,725)<br />

�<br />

2<br />

= Rs. 7,532.<br />

(iv) A related measure is <strong>the</strong> number of days’ sales in inventory.<br />

Average inventory<br />

Number of days' sales in inventory �<br />

Cost of goods sold / 365<br />

128<br />

Rs. 7,532<br />

�<br />

Rs. 40,139 / 365<br />

= 68.49 days.<br />

(v) Fixed asset turnover measures <strong>the</strong> efficiency with which <strong>the</strong> firm uses its fixed<br />

assets.<br />

Sales Rs. 58,247<br />

Fixed asset turnover �<br />

� �3.58<br />

times<br />

Average net fixed assets Rs. 16,272<br />

Average fixed assets<br />

(Ending fixed assets �Beginning<br />

fixed assets)<br />

�<br />

2<br />

(Rs. 17,168 �Rs.<br />

15,375)<br />

�<br />

2<br />

= Rs. 16,272.<br />

(vi) Total asset turnover measures <strong>the</strong> efficiency with which <strong>the</strong> firm uses its total<br />

assets.<br />

Sales Rs. 58,247<br />

Total asset turnover �<br />

� �2.07<br />

times<br />

Average total assets Rs. 28,203<br />

(c) Liquidity Ratios<br />

Liquidity ratios measure <strong>the</strong> firm’s ability to meet its short-term obligations as <strong>the</strong>y<br />

come due.<br />

(i) The current ratio is <strong>the</strong> most common measure of short-term liquidity. It is<br />

sometimes referred to as <strong>the</strong> working capital ratio because net working capital is<br />

<strong>the</strong> difference between current assets and current liabilities.<br />

Current assets Rs. 11,917<br />

Current ratio �<br />

� �<strong>1.</strong>48<br />

Current liabilities<br />

Rs. 8,035<br />

Where,