GMNGC Budget Template - Town of Killington

GMNGC Budget Template - Town of Killington

GMNGC Budget Template - Town of Killington

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

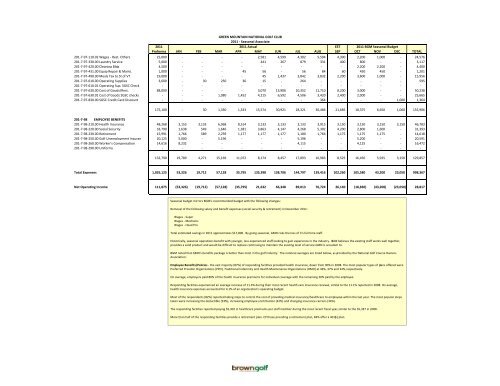

GREEN MOUNTAIN NATIONAL GOLF CLUB2011 - Seasonal Associate2011 2011 Actual EST 2011 BGM Seasonal <strong>Budget</strong>Pr<strong>of</strong>orma JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTAL201-7-97-110.02 Wages - Rest. Others 25,000 - - - - 2,581 4,599 4,302 5,594 4,300 2,200 1,000 - 24,576201-7-97-330.00 Laundry Service 5,000 - - - - 441 267 879 331 400 800 - - 3,117201-7-97-420.00 Cleaning Bldg 4,500 - - - - - - - - - 2,200 2,200 - 4,400201-7-97-431.00 Equip Repair & Maint. 1,000 - - - 45 56 - 56 84 60 450 450 - 1,201201-7-97-490.00 Meals Tax to St <strong>of</strong> VT 19,000 - - - - 45 1,437 3,842 3,832 2,200 3,600 1,000 - 15,956201-7-97-610.00 Operating Supplies 3,600 - 30 250 36 15 - 264 - - - - - 595201-7-97-610.01 Operating Sup. SGSC Check - - - - - - - - - - - - - -201-7-97-630.00 Cost <strong>of</strong> Goods/Rest. 88,000 - - - - 3,070 13,906 10,352 11,710 8,200 3,000 - - 50,238201-7-97-630.01 Cost <strong>of</strong> Goods SGSC checks - - - 1,080 1,452 4,215 6,592 4,506 3,420 2,400 2,000 - - 25,665201-7-97-830.00 SGSC Credit Card Discount - - - - - - - - 364 - - - 1,000 1,364175,100 - 30 1,330 1,533 15,574 30,921 28,321 30,486 21,685 18,375 6,650 1,000 155,906201-7-98 EMPLOYEE BENEFITS201-7-98-210.00 Health Insurance 48,268 3,153 3,133 6,068 8,514 3,133 3,133 3,133 3,915 3,150 3,150 3,150 3,150 46,783201-7-98-220.00 Social Security 33,790 1,638 549 1,646 1,381 3,863 4,147 4,268 5,302 4,200 2,800 1,600 - 31,393201-7-98-230.00 Retirement 15,991 1,766 589 2,259 1,177 1,177 1,177 1,180 1,766 1,175 1,175 1,175 - 14,618201-7-98-250.00 Golf Unemployment Insuran 20,125 5,000 - 5,196 - - - 5,196 - - 5,200 - - 20,591201-7-98-260.00 Worker's Compensation 14,616 8,232 - - - - - 4,115 - - 4,125 - - 16,472201-7-98-290.00 Uniforms - - - - - - - - - - - - - -132,790 19,789 4,271 15,169 11,072 8,174 8,457 17,893 10,983 8,525 16,450 5,925 3,150 129,857Total Expenses 1,035,125 53,326 19,712 57,128 35,795 135,398 138,706 144,797 139,416 102,260 105,580 43,200 23,050 998,367Net Operating Income 111,875 (53,326) (19,712) (57,128) (35,795) 21,632 66,348 89,013 76,724 26,140 (18,830) (43,200) (23,050) 28,817Seasonal budget mirrors BGM's recommended budget with the following changes:Removal <strong>of</strong> the following salary and benefit expenses (social security & retirement) in December 2011:Wages - SuperWages - MechanicWages - Head ProTotal estimated savings in 2011 approximates $17,800. By going seasonal, GMN risks the loss <strong>of</strong> it's full time staff.Historically, seasonal operations benefit with younger, less experienced staff looking to gain experience in the industry. BGM believes the existing staff works well together,provides a solid product and would be difficult to replace continuing to maintain the existing level <strong>of</strong> service GMN is accustom to.BGM noted that GMN's benefits package is better than most in the golf industry. The national averages are listed below, as provided by the National Golf Course OwnersAssociation:Employee Benefits/Policies - the vast majority (87%) <strong>of</strong> responding facilities provided health insurance, down from 90% in 2008. The most popular types <strong>of</strong> plans <strong>of</strong>fered werePreferred Provider Organizations (PPO), Traditional Indemnity and Health Maintenance Organizations (HMO) at 46%, 37% and 34%, respectively.On average, employers paid 80% <strong>of</strong> the health insurance premiums for individual coverage with the remaining 20% paid by the employee.Responding facilities experienced an average increase <strong>of</strong> 11.3% during their most recent health care insurance renewal, similar to the 11.1% reported in 2008. On average,health insurance expenses accounted for 4.1% <strong>of</strong> an organization’s operating budget.Most <strong>of</strong> the respondents (82%) reported taking steps to control the cost <strong>of</strong> providing medical insurance/healthcare to employees within the last year. The most popular stepstaken were increasing the deductible (53%), increasing employee contribution (42%) and changing insurance carriers (34%).The responding facilities reported paying $5,302 in healthcare premiums per staff member during the most recent fiscal year, similar to the $5,337 in 2008.More than half <strong>of</strong> the responding facilities provide a retirement plan. Of those providing a retirement plan, 84% <strong>of</strong>fer a 401(k) plan.