GMNGC Budget Template - Town of Killington

GMNGC Budget Template - Town of Killington

GMNGC Budget Template - Town of Killington

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

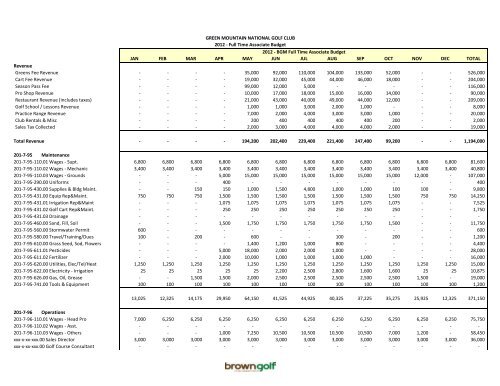

GREEN MOUNTAIN NATIONAL GOLF CLUB2012 - Seasonal Associate <strong>Budget</strong>2012 - Seasonal Associate <strong>Budget</strong>JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTALRevenueGreens Fee Revenue - - - - 35,000 92,000 110,000 104,000 133,000 52,000 - - 526,000Cart Fee Revenue - - - - 19,000 32,000 45,000 44,000 46,000 18,000 - - 204,000Season Pass Fee - - - - 99,000 12,000 5,000 - - - - - 116,000Pro Shop Revenue - - - - 10,000 17,000 18,000 15,000 16,000 14,000 - - 90,000Restaurant Revenue (includes taxes) - - - - 21,000 43,000 40,000 49,000 44,000 12,000 - - 209,000Golf School / Lessons Revenue - - - - 1,000 1,000 3,000 2,000 1,000 - - - 8,000Practice Range Revenue - - - - 7,000 2,000 4,000 3,000 3,000 1,000 - - 20,000Club Rentals & Misc - - - - 200 400 400 400 400 200 - - 2,000Sales Tax Collected - - - - 2,000 3,000 4,000 4,000 4,000 2,000 - - 19,000Total Revenue - - - - 194,200 202,400 229,400 221,400 247,400 99,200 - - 1,194,000201-7-95 Maintenance201-7-95-110.01 Wages - Supt. - - - 6,800 6,800 6,800 6,800 6,800 6,800 6,800 6,800 - 54,400201-7-95-110.02 Wages - Mechanic - - - 3,400 3,400 3,400 3,400 3,400 3,400 3,400 3,400 - 27,200201-7-95-110.03 Wages - Grounds - - - 5,000 15,000 15,000 15,000 15,000 15,000 15,000 12,000 - 107,000201-7-95-290.00 Uniforms - - - 400 - - - - - - - - 400201-7-95-430.00 Supplies & Bldg Maint. - - 150 150 1,000 1,500 4,800 1,000 1,000 100 100 - 9,800201-7-95-431.00 Equip Rep&Maint. 750 750 750 1,500 1,500 1,500 1,500 1,500 1,500 1,500 750 750 14,250201-7-95-431.01 Irrigation Rep&Maint - - - 1,075 1,075 1,075 1,075 1,075 1,075 1,075 - - 7,525201-7-95-431.02 Golf Cart Rep&Maint. - - - 250 250 250 250 250 250 250 - - 1,750201-7-95-431.03 Drainage - - - - - - - - - - - - -201-7-95-460.00 Sand, Fill, Soil - - - 1,500 1,750 1,750 1,750 1,750 1,750 1,500 - - 11,750201-7-95-560.00 Stormwater Permit 600 - - - - - - - - - - - 600201-7-95-580.00 Travel/Training/Dues 100 - 200 - 600 - - 100 - 200 - - 1,200201-7-95-610.00 Grass Seed, Sod, Flowers - - - - 1,400 1,200 1,000 800 - - - - 4,400201-7-95-611.01 Pesticides - - - 5,000 18,000 2,000 2,000 1,000 - - - - 28,000201-7-95-611.02 Fertilizer - - - 2,000 10,000 1,000 1,000 1,000 1,000 - - - 16,000201-7-95-620.00 Utilities, Elec/Tel/Heat 1,250 1,250 1,250 1,250 1,250 1,250 1,250 1,250 1,250 1,250 1,250 1,250 15,000201-7-95-622.00 Electricity - Irrigation 25 25 25 25 25 2,200 2,500 2,800 1,600 1,600 25 25 10,875201-7-95-626.00 Gas, Oil, Grease - - 1,500 1,500 2,000 2,500 2,500 2,500 2,500 2,500 1,500 - 19,000201-7-95-741.00 Tools & Equipment 100 100 100 100 100 100 100 100 100 100 100 100 1,2002,825 2,125 3,975 29,950 64,150 41,525 44,925 40,325 37,225 35,275 25,925 2,125 330,350201-7-96 Operations201-7-96-110.01 Wages - Head Pro - - - 6,250 6,250 6,250 6,250 6,250 6,250 6,250 6,250 - 50,000201-7-96-110.02 Wages - Asst. - - - - - - - - - - - - -201-7-96-110.03 Wages - Others - - - 1,000 7,250 10,500 10,500 10,500 10,500 7,000 1,200 - 58,450xxx-x-xx-xxx.00 Sales Director - - - 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 - 24,000xxx-x-xx-xxx.00 Golf Course Consultant - - - - - - - - - - - - -

GREEN MOUNTAIN NATIONAL GOLF CLUB2012 - Seasonal Associate <strong>Budget</strong>2012 - Seasonal Associate <strong>Budget</strong>JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTAL13,000 - - 10,934 8,103 8,352 21,352 8,352 8,352 13,084 6,949 - 98,476Total Expenses 18,575 6,625 6,125 57,334 120,428 118,492 138,122 121,752 118,712 103,044 57,854 20,875 887,936Net Operating Income (18,575) (6,625) (6,125) (57,334) 73,772 83,908 91,278 99,648 128,688 (3,844) (57,854) (20,875) 306,064Assumptions:1 - Same revenue and expenses as "recommended" budget with the removal <strong>of</strong> all full time staff and related payroll taxes from Dec through Mar. In addition, all FTE'swould pick up their own insurance coverages during the <strong>of</strong>f season.

GREEN MOUNTAIN NATIONAL GOLF CLUB2012 - Seasonal Third Party Managed2012 -Seasonal Third Party ManagedJAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTAL201-7-96-430.00 Clubhouse Sup&Maint. - - - 250 250 250 250 250 - - - - 1,250201-7-96-430.01 Driving Range Bldg - - - - - - - - - - - - -201-7-96-431.00 Clubhouse Rep&Equipment 300 300 300 300 300 300 300 300 300 300 300 300 3,600201-7-96-442.00 Golf Carts Lease - - - - - - - - - - - - -201-7-96-490.00 Sales Tax to St <strong>of</strong> VT - - - - - 2,000 3,000 4,000 4,000 4,000 2,000 - 19,000201-7-96-490.01 Property Taxes - Mendon - 1,550 - - - - - - 1,550 - - - 3,100201-7-96-520.00 Insurance 850 850 850 850 850 850 850 850 850 850 850 850 10,200201-7-96-535.00 Marketing & Promotion - - - 2,000 2,000 2,000 1,500 1,500 1,500 1,500 - - 12,000201-7-96-536.00 Website/Marketing - - - 400 400 400 400 400 400 400 - - 2,800201-7-96-580.00 Travel/Training/Dues - - - - 600 600 600 600 600 600 - - 3,600201-7-96-580.01 Lesson Sharing - - - - 750 750 2,250 1,500 750 - - - 6,000201-7-96-610.00 Ofc Supplies/Postage - - - 400 500 500 500 500 500 400 - - 3,300201-7-96-610.01 Range & Course Supplies - - - 1,000 1,000 500 500 500 250 250 - - 4,000201-7-96-620.00 Clubhouse Utilities & SW 1,600 1,800 1,000 1,000 1,000 2,200 1,800 2,000 2,000 2,500 1,600 1,400 19,900201-7-96-630.00 Cost <strong>of</strong> Goods/Pro Shop - - - - 7,000 11,900 12,600 10,500 11,200 9,800 - - 63,000201-7-96-830.00 Credit Card Discounts - - - - - - - - - - - 15,000 15,0002,750 4,500 2,150 13,033 33,733 44,583 46,883 45,233 46,233 39,433 11,783 17,550 307,864201-7-97 Restaurant201-7-97-110.01 Wages - Rest. Mgr. - - - - 4,625 4,625 4,625 4,625 4,625 4,625 2,325 - 30,075201-7-97-110.02 Wages - Rest. Others - - - - 3,850 3,850 3,850 3,850 3,850 3,850 1,925 - 25,025201-7-97-330.00 Laundry Service - - - - 500 500 500 500 500 500 - - 3,000201-7-97-420.00 Cleaning Bldg - - - - - - - - - - 4,450 - 4,450201-7-97-431.00 Equip Repair & Maint. - - - - 200 200 200 200 200 200 - 1,200201-7-97-490.00 Meals Tax to St <strong>of</strong> VT - - - - - 1,890 3,870 3,600 4,410 3,960 1,080 - 18,810201-7-97-610.00 Operating Supplies - - - - 200 200 200 200 200 200 - - 1,200201-7-97-610.01 Operating Sup. SGSC Check - - - - 300 300 300 300 300 300 - - 1,800201-7-97-630.00 Cost <strong>of</strong> Goods/Rest. - - - - 7,350 15,050 14,000 17,150 15,400 4,200 - - 73,150201-7-97-630.01 Cost <strong>of</strong> Goods SGSC checks - - - - - - - - - - - - -201-7-97-830.00 SGSC Credit Card Discount - - - - - - - - - - - 1,200 1,200- - - - 17,025 26,615 27,545 30,425 29,485 17,835 9,780 1,200 159,910201-7-98 EMPLOYEE BENEFITS201-7-98-210.00 Health Insurance - - - 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 - 16,000201-7-98-220.00 Social Security - - - 1,567 3,458 3,707 3,707 3,707 3,707 3,439 2,443 - 25,736201-7-98-230.00 Retirement - - - - - - - - - - - - -201-7-98-250.00 Golf Unemployment Insuran 5,000 - - 5,000 - - 5,000 - - 5,000 - - 20,000201-7-98-260.00 Worker's Compensation 8,000 - - - - - 8,000 - - - - - 16,000201-7-98-290.00 Uniforms - - - - - - - - - - - - -

GREEN MOUNTAIN NATIONAL GOLF CLUB2012 - Seasonal Third Party Managed2012 -Seasonal Third Party ManagedJAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTAL13,000 - - 8,567 5,458 5,707 18,707 5,707 5,707 10,439 4,443 - 77,736Total Expenses 18,575 6,625 6,125 50,000 118,816 116,880 136,510 120,140 117,100 101,432 50,381 20,875 863,460Net Operating Income (18,575) (6,625) (6,125) (50,000) 75,384 85,520 92,890 101,260 130,300 (2,232) (50,381) (20,875) 330,540Assumptions:1 - management company was hired to oversee operations at $36K annually2 - eliminated sales director position as this would be apart <strong>of</strong> management company's services3 - scaled back head pro and superintendent's wages for a more junior seasonal staff4 - scaled back health insurance options to industry average5 - eliminated retirement contributions as it's not a common benefit in the golf industryAll other revenue and expense line items remain the same. BGM believes the property could see an additional increase to NOI based upon having a veteran managementcompany in place by them implementing proven revenue programs and managing expenses through their relationships, management p hilosophy and skillset.

Green Mountain National Golf Club2011 <strong>Budget</strong> ComparisonSummary2011 BGM Recommended <strong>Budget</strong> 2011 BGM Seasonal <strong>Budget</strong> 2010 ActualOct Nov Dec Oct Nov Dec Oct Nov DecROUNDS 1,400 - - 1,400 - - 1,578 - -AVERAGE PER ROUND 61.96 #DIV/0! #DIV/0! 61.96 #DIV/0! #DIV/0! 62.60 #DIV/0! #DIV/0!COURSE REVENUESDUES 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00INITIATION FEES 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00GREENS FEES 47,500.00 0.00 0.00 47,500.00 0.00 0.00 53,547.00 0.00 0.00CART FEES 15,000.00 0.00 0.00 15,000.00 0.00 0.00 17,828.00 0.00 0.00RANGE 800.00 0.00 0.00 800.00 0.00 0.00 830.00 0.00 0.00OTHER PRO SHOP INCOME 450.00 0.00 0.00 450.00 0.00 0.00 655.00 0.00 0.00OTHER INCOME 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00TOTAL COURSE REVENUES 63,750.00 0.00 0.00 63,750.00 0.00 0.00 72,860.00 0.00 0.0073.49% #DIV/0! #DIV/0! 73.49% #DIV/0! #DIV/0! 73.76% #DIV/0! #DIV/0!MERCHANDISESALES 6,000.00 0.00 0.00 6,000.00 0.00 0.00 14,277.00 0.00 0.00COST OF SALES 2,800.00 0.00 0.00 2,800.00 0.00 0.00 2,822.03 (284.51) 185.18COGS % 46.67% #DIV/0! #DIV/0! 46.67% #DIV/0! #DIV/0! 19.77% #DIV/0! #DIV/0!GROSS PROFIT MERCHANDISE 3,200.00 0.00 0.00 3,200.00 0.00 0.00 11,454.97 284.51 (185.18)FOOD & BEVERAGESALES 17,000.00 0.00 0.00 17,000.00 0.00 0.00 11,643.00 0.00 0.00COST OF SALES 5,000.00 0.00 0.00 5,000.00 0.00 0.00 10,374.53 (582.05) 48.50COGS % 29.41% #DIV/0! #DIV/0! 29.41% #DIV/0! #DIV/0! 89.11% #DIV/0! #DIV/0!OTHER F&B INCOME 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00GROSS PROFIT FOOD & BEVERAGE 12,000.00 0.00 0.00 12,000.00 0.00 0.00 1,268.47 582.05 (48.50)LABORGOLF OPERATIONS LABOR 16,960.30 7,911.27 6,960.70 16,960.30 7,911.27 1,050.00 14,263.42 8,539.84 7,843.87F&B LABOR 8,847.33 3,752.38 0.00 8,847.33 3,752.38 1,050.00 7,136.72 1,504.36 0.00MAINTENANCE LABOR 31,892.36 17,886.35 13,989.30 31,892.36 17,886.35 1,050.00 26,790.79 19,709.52 15,805.69POOL LABOR 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00TENNIS LABOR 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00BUILDING MAINTENANCE LABOR 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00MARKETING LABOR 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00ADMINISTRATIVE LABOR 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00TOTAL LABOR 57,700.00 29,550.00 20,950.00 57,700.00 29,550.00 3,150.00 48,190.93 29,753.72 23,649.56EXPENSESPRO SHOP EXPENSE 20,480.00 4,750.00 15,450.00 20,480.00 4,750.00 15,450.00 9,327.02 (15,211.45) 17,072.24OTHER F&B EXPENSE 7,050.00 3,650.00 1,000.00 7,050.00 3,650.00 1,000.00 5,146.90 6,102.00 1,088.15COURSE MAINTENANCE EXPENSE 12,550.00 5,250.00 3,450.00 12,550.00 5,250.00 3,450.00 9,232.20 8,667.62 4,005.02POOL EXPENSE 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00TENNIS EXPENSE 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00BUILDING MAINTENANCE EXPENSE 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00MARKETING EXPENSE 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00ADMINISTRATIVE EXPENSE 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00TOTAL DEPARTMENTAL EXPENSES 40,080.00 13,650.00 19,900.00 40,080.00 13,650.00 19,900.00 23,706.12 (441.83) 22,165.41TOTAL GROSS REVENUES 86,750.00 0.00 0.00 86,750.00 0.00 0.00 98,780.00 0.00 0.00TOTAL EXPENSES 105,580.00 43,200.00 40,850.00 105,580.00 43,200.00 23,050.00 85,093.61 28,445.33 46,048.65NET OPERATING INCOME (18,830.00) (43,200.00) (40,850.00) (18,830.00) (43,200.00) (23,050.00) 13,686.39 (28,445.33) (46,048.65)-21.71% #DIV/0! #DIV/0! -21.71% #DIV/0! #DIV/0! 13.86% #DIV/0! #DIV/0!

GREEN MOUNTAIN NATIONAL GOLF CLUB2011 - Full Time Associate2011 2011 ActualEST 2011 BGM Full Time AssociatePr<strong>of</strong>orma JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTALRevenueGreens Fee Revenue 500,000 - - - - 27,899 85,364 120,261 115,593 58,000 46,000 - - 453,117Cart Fee Revenue 200,000 - - - - 11,886 35,834 43,395 41,405 22,000 15,000 - - 169,520Season Pass Fee 97,000 - - - - 82,445 12,069 1,252 2,211 - - - - 97,977Pro Shop Revenue 95,000 - - - - 10,717 20,442 17,863 14,997 12,000 6,000 - - 82,019Restaurant Revenue (includes taxes) 205,000 - - - - 15,736 42,592 40,994 33,473 30,000 17,000 - - 179,795Golf School / Lessons Revenue 10,000 - - - - 450 1,606 2,126 2,408 1,000 250 - - 7,840Practice Range Revenue 19,000 - - - - 6,223 2,969 3,469 2,776 1,500 800 - - 17,737Club Rentals & Misc 2,000 - - - - 205 802 545 (322) 500 200 - - 1,930Sales Tax Collected 19,000 - - - - 1,469 3,376 3,905 3,599 3,400 1,500 - - 17,249Total Revenue 1,147,000 - - - - 157,030 205,054 233,810 216,140 128,400 86,750 - - 1,027,184201-7-95 Maintenance201-7-95-110.01 Wages - Supt. 81,200 9,369 3,123 9,369 6,246 6,360 6,246 6,246 9,369 6,250 6,250 6,250 6,250 81,330201-7-95-110.02 Wages - Mechanic 39,585 4,568 1,523 4,568 3,045 3,045 3,045 3,045 4,568 3,050 3,050 3,050 3,050 39,605201-7-95-110.03 Wages - Grounds 124,338 - - - 3,170 20,935 19,249 19,017 22,157 19,000 13,500 5,000 1,000 123,028201-7-95-290.00 Uniforms 2,700 - - - - - - - - - - - - -201-7-95-430.00 Supplies & Bldg Maint. 7,750 131 - 154 167 922 1,414 4,610 1,015 1,000 100 100 100 9,713201-7-95-431.00 Equip Rep&Maint. 21,300 500 999 923 550 3,335 423 1,331 2,373 1,250 1,600 600 300 14,185201-7-95-431.01 Irrigation Rep&Maint 8,000 113 - 445 - 48 - 5,920 500 - 500 200 - 7,727201-7-95-431.02 Golf Cart Rep&Maint. 900 - - - - - - - 334 50 300 - - 684201-7-95-431.03 Drainage 20 - - - - - 20 - - - - - - 20201-7-95-460.00 Sand, Fill, Soil 10,800 - - - - 1,561 1,513 265 5,418 1,500 2,500 500 - 13,257201-7-95-560.00 Stormwater Permit 587 587 - - - - - - - - - - - 587201-7-95-580.00 Travel/Training/Dues 1,350 90 - 170 - - - - 80 - 200 - - 540201-7-95-610.00 Grass Seed, Sod, Flowers 4,500 - - - - 2,924 970 230 2,513 700 - - - 7,337201-7-95-611.01 Pesticides 26,500 - - - - 17,221 5,790 2,250 - 500 2,500 - - 28,261201-7-95-611.02 Fertilizer 27,000 - - - - 15,302 10,444 337 145 1,000 - - - 27,228201-7-95-620.00 Utilities, Elec/Tel/Heat 15,000 655 1,302 2,239 22 1,173 - 1,431 - 1,500 1,250 1,250 1,250 12,072201-7-95-622.00 Electricity - Irrigation 7,500 23 23 24 104 21 - 1,146 2,610 1,600 600 600 600 7,351201-7-95-626.00 Gas, Oil, Grease 28,000 163 889 - 226 1,948 9,946 6,526 7,932 3,300 3,000 2,000 1,200 37,130201-7-95-741.00 Tools & Equipment 900 - - 245 - 178 22 133 17 25 - - - 620407,930 16,199 7,858 18,137 13,530 74,975 59,081 52,488 59,030 40,725 35,350 19,550 13,750 410,673201-7-96 Operations201-7-96-110.01 Wages - Head Pro 76,125 7,671 2,557 17,536 5,114 5,114 5,114 5,114 7,671 5,125 5,125 5,125 5,125 76,393201-7-96-110.02 Wages - Asst. - - - - - - - - - - - - - -201-7-96-110.03 Wages - Others 65,000 - - - 1,078 8,277 10,289 11,989 13,239 11,000 7,000 1,200 - 64,073xxx-x-xx-xxx.00 Golf Course Consultant 6,580 - - - - - - - - - 6,580 - - 6,580201-7-96-430.00 Clubhouse Sup&Maint. 2,000 - - 15 - 470 787 584 45 - 1,000 - - 2,902201-7-96-430.01 Driving Range Bldg - - - - - - - - - - - - - -201-7-96-431.00 Clubhouse Rep&Equipment 7,000 74 357 2,471 2,000 564 2,185 225 (1,948) 400 200 100 50 6,677201-7-96-442.00 Golf Carts Lease - - - - - - - - - - - - - -201-7-96-490.00 Sales Tax to St <strong>of</strong> VT 19,000 82 - - - 38 1,437 3,369 3,904 3,600 3,400 2,100 - 17,930201-7-96-490.01 Property Taxes - Mendon 3,000 - 1,552 - - - - - - 1,600 - - - 3,152201-7-96-520.00 Insurance 11,000 4,614 - - - - - 2,307 - - 2,500 - - 9,421201-7-96-535.00 Marketing & Promotion 10,000 396 - 1,644 167 1,094 3,999 642 480 300 1,500 - - 10,222201-7-96-536.00 Website/Marketing 2,500 - - - - - 439 - - 100 500 - - 1,039201-7-96-580.00 Travel/Training/Dues 5,400 565 - - - - 1,326 - - 1,325 - - - 3,216201-7-96-580.01 Lesson Sharing 7,500 - - - - - 338 1,205 1,594 1,800 1,000 200 - 6,136201-7-96-610.00 Ofc Supplies/Postage 2,200 - 658 - 282 533 345 248 763 550 750 750 - 4,879201-7-96-610.01 Range & Course Supplies 5,000 1,379 - - 327 - 477 311 400 425 250 - - 3,569

GREEN MOUNTAIN NATIONAL GOLF CLUB2011 - Full Time Associate2011 2011 ActualEST 2011 BGM Full Time AssociatePr<strong>of</strong>orma JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTAL201-7-96-620.00 Clubhouse Utilities & SW 15,000 1,568 1,677 743 690 1,054 2,207 1,724 4,713 1,850 2,800 1,600 1,400 22,026201-7-96-630.00 Cost <strong>of</strong> Goods/Pro Shop 65,000 988 752 83 - 19,531 11,305 18,378 5,495 3,250 2,800 62,582201-7-96-830.00 Credit Card Discounts 17,000 - - - - - - - 2,559 - - - 14,000 16,559319,305 17,337 7,553 22,492 9,659 36,675 40,246 46,096 38,916 31,325 35,405 11,075 20,575 317,356201-7-97 Restaurant201-7-97-110.01 Wages - Rest. Mgr. 29,000 - - - - 5,151 4,121 4,121 5,151 4,125 4,125 2,000 - 28,794201-7-97-110.02 Wages - Rest. Others 25,000 - - - - 2,581 4,599 4,302 5,594 4,300 2,200 1,000 - 24,576201-7-97-330.00 Laundry Service 5,000 - - - - 441 267 879 331 400 800 - - 3,117201-7-97-420.00 Cleaning Bldg 4,500 - - - - - - - - - 2,200 2,200 - 4,400201-7-97-431.00 Equip Repair & Maint. 1,000 - - - 45 56 - 56 84 60 450 450 - 1,201201-7-97-490.00 Meals Tax to St <strong>of</strong> VT 19,000 - - - - 45 1,437 3,842 3,832 2,200 3,600 1,000 - 15,956201-7-97-610.00 Operating Supplies 3,600 - 30 250 36 15 - 264 - - - - - 595201-7-97-610.01 Operating Sup. SGSC Check - - - - - - - - - - - - - -201-7-97-630.00 Cost <strong>of</strong> Goods/Rest. 88,000 - - - - 3,070 13,906 10,352 11,710 8,200 3,000 - - 50,238201-7-97-630.01 Cost <strong>of</strong> Goods SGSC checks - - - 1,080 1,452 4,215 6,592 4,506 3,420 2,400 2,000 - - 25,665201-7-97-830.00 SGSC Credit Card Discount - - - - - - - - 364 - - - 1,000 1,364175,100 - 30 1,330 1,533 15,574 30,921 28,321 30,486 21,685 18,375 6,650 1,000 155,906201-7-98 EMPLOYEE BENEFITS201-7-98-210.00 Health Insurance 48,268 3,153 3,133 6,068 8,514 3,133 3,133 3,133 3,915 3,150 3,150 3,150 3,150 46,783201-7-98-220.00 Social Security 33,790 1,638 549 1,646 1,381 3,863 4,147 4,268 5,302 4,200 2,800 1,600 1,200 32,593201-7-98-230.00 Retirement 15,991 1,766 589 2,259 1,177 1,177 1,177 1,180 1,766 1,175 1,175 1,175 1,175 15,793201-7-98-250.00 Golf Unemployment Insuran 20,125 5,000 - 5,196 - - - 5,196 - - 5,200 - - 20,591201-7-98-260.00 Worker's Compensation 14,616 8,232 - - - - - 4,115 - - 4,125 - - 16,472201-7-98-290.00 Uniforms - - - - - - - - - - - - - -132,790 19,789 4,271 15,169 11,072 8,174 8,457 17,893 10,983 8,525 16,450 5,925 5,525 132,232Total Expenses 1,035,125 53,326 19,712 57,128 35,795 135,398 138,706 144,797 139,416 102,260 105,580 43,200 40,850 1,016,167Net Operating Income 111,875 (53,326) (19,712) (57,128) (35,795) 21,632 66,348 89,013 76,724 26,140 (18,830) (43,200) (40,850) 11,017Recommended budget approximates 2010 operations with the exception <strong>of</strong> the following:Removal <strong>of</strong> a $16,618 credit hitting the operations on golf cart lease line

GREEN MOUNTAIN NATIONAL GOLF CLUB2011 - Seasonal Associate2011 2011 Actual EST 2011 BGM Seasonal <strong>Budget</strong>Pr<strong>of</strong>orma JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTALRevenueGreens Fee Revenue 500,000 - - - - 27,899 85,364 120,261 115,593 58,000 46,000 - - 453,117Cart Fee Revenue 200,000 - - - - 11,886 35,834 43,395 41,405 22,000 15,000 - - 169,520Season Pass Fee 97,000 - - - - 82,445 12,069 1,252 2,211 - - - - 97,977Pro Shop Revenue 95,000 - - - - 10,717 20,442 17,863 14,997 12,000 6,000 - - 82,019Restaurant Revenue (includes taxes) 205,000 - - - - 15,736 42,592 40,994 33,473 30,000 17,000 - - 179,795Golf School / Lessons Revenue 10,000 - - - - 450 1,606 2,126 2,408 1,000 250 - - 7,840Practice Range Revenue 19,000 - - - - 6,223 2,969 3,469 2,776 1,500 800 - - 17,737Club Rentals & Misc 2,000 - - - - 205 802 545 (322) 500 200 - - 1,930Sales Tax Collected 19,000 - - - - 1,469 3,376 3,905 3,599 3,400 1,500 - - 17,249Total Revenue 1,147,000 - - - - 157,030 205,054 233,810 216,140 128,400 86,750 - - 1,027,184201-7-95 Maintenance201-7-95-110.01 Wages - Supt. 81,200 9,369 3,123 9,369 6,246 6,360 6,246 6,246 9,369 6,250 6,250 6,250 - 75,080201-7-95-110.02 Wages - Mechanic 39,585 4,568 1,523 4,568 3,045 3,045 3,045 3,045 4,568 3,050 3,050 3,050 - 36,555201-7-95-110.03 Wages - Grounds 124,338 - - - 3,170 20,935 19,249 19,017 22,157 19,000 13,500 5,000 - 122,028201-7-95-290.00 Uniforms 2,700 - - - - - - - - - - - - -201-7-95-430.00 Supplies & Bldg Maint. 7,750 131 - 154 167 922 1,414 4,610 1,015 1,000 100 100 100 9,713201-7-95-431.00 Equip Rep&Maint. 21,300 500 999 923 550 3,335 423 1,331 2,373 1,250 1,600 600 300 14,185201-7-95-431.01 Irrigation Rep&Maint 8,000 113 - 445 - 48 - 5,920 500 - 500 200 - 7,727201-7-95-431.02 Golf Cart Rep&Maint. 900 - - - - - - - 334 50 300 - - 684201-7-95-431.03 Drainage 20 - - - - - 20 - - - - - - 20201-7-95-460.00 Sand, Fill, Soil 10,800 - - - - 1,561 1,513 265 5,418 1,500 2,500 500 - 13,257201-7-95-560.00 Stormwater Permit 587 587 - - - - - - - - - - - 587201-7-95-580.00 Travel/Training/Dues 1,350 90 - 170 - - - - 80 - 200 - - 540201-7-95-610.00 Grass Seed, Sod, Flowers 4,500 - - - - 2,924 970 230 2,513 700 - - - 7,337201-7-95-611.01 Pesticides 26,500 - - - - 17,221 5,790 2,250 - 500 2,500 - - 28,261201-7-95-611.02 Fertilizer 27,000 - - - - 15,302 10,444 337 145 1,000 - - - 27,228201-7-95-620.00 Utilities, Elec/Tel/Heat 15,000 655 1,302 2,239 22 1,173 - 1,431 - 1,500 1,250 1,250 1,250 12,072201-7-95-622.00 Electricity - Irrigation 7,500 23 23 24 104 21 - 1,146 2,610 1,600 600 600 600 7,351201-7-95-626.00 Gas, Oil, Grease 28,000 163 889 - 226 1,948 9,946 6,526 7,932 3,300 3,000 2,000 1,200 37,130201-7-95-741.00 Tools & Equipment 900 - - 245 - 178 22 133 17 25 - - - 620407,930 16,199 7,858 18,137 13,530 74,975 59,081 52,488 59,030 40,725 35,350 19,550 3,450 400,373201-7-96 Operations201-7-96-110.01 Wages - Head Pro 76,125 7,671 2,557 17,536 5,114 5,114 5,114 5,114 7,671 5,125 5,125 5,125 - 71,268201-7-96-110.02 Wages - Asst. - - - - - - - - - - - - - -201-7-96-110.03 Wages - Others 65,000 - - - 1,078 8,277 10,289 11,989 13,239 11,000 7,000 1,200 - 64,073xxx-x-xx-xxx.00 Golf Course Consultant 6,580 - - - - - - - - - 6,580 - - 6,580201-7-96-430.00 Clubhouse Sup&Maint. 2,000 - - 15 - 470 787 584 45 - 1,000 - - 2,902201-7-96-430.01 Driving Range Bldg - - - - - - - - - - - - - -201-7-96-431.00 Clubhouse Rep&Equipment 7,000 74 357 2,471 2,000 564 2,185 225 (1,948) 400 200 100 50 6,677201-7-96-442.00 Golf Carts Lease - - - - - - - - - - - - - -201-7-96-490.00 Sales Tax to St <strong>of</strong> VT 19,000 82 - - - 38 1,437 3,369 3,904 3,600 3,400 2,100 - 17,930201-7-96-490.01 Property Taxes - Mendon 3,000 - 1,552 - - - - - - 1,600 - - - 3,152201-7-96-520.00 Insurance 11,000 4,614 - - - - - 2,307 - - 2,500 - - 9,421201-7-96-535.00 Marketing & Promotion 10,000 396 - 1,644 167 1,094 3,999 642 480 300 1,500 - - 10,222201-7-96-536.00 Website/Marketing 2,500 - - - - - 439 - - 100 500 - - 1,039201-7-96-580.00 Travel/Training/Dues 5,400 565 - - - - 1,326 - - 1,325 - - - 3,216201-7-96-580.01 Lesson Sharing 7,500 - - - - - 338 1,205 1,594 1,800 1,000 200 - 6,136201-7-96-610.00 Ofc Supplies/Postage 2,200 - 658 - 282 533 345 248 763 550 750 750 - 4,879201-7-96-610.01 Range & Course Supplies 5,000 1,379 - - 327 - 477 311 400 425 250 - - 3,569201-7-96-620.00 Clubhouse Utilities & SW 15,000 1,568 1,677 743 690 1,054 2,207 1,724 4,713 1,850 2,800 1,600 1,400 22,026201-7-96-630.00 Cost <strong>of</strong> Goods/Pro Shop 65,000 988 752 83 - 19,531 11,305 18,378 5,495 3,250 2,800 62,582201-7-96-830.00 Credit Card Discounts 17,000 - - - - - - - 2,559 - - - 14,000 16,559319,305 17,337 7,553 22,492 9,659 36,675 40,246 46,096 38,916 31,325 35,405 11,075 15,450 312,231201-7-97 Restaurant201-7-97-110.01 Wages - Rest. Mgr. 29,000 - - - - 5,151 4,121 4,121 5,151 4,125 4,125 2,000 - 28,794

GREEN MOUNTAIN NATIONAL GOLF CLUB2011 - Seasonal Associate2011 2011 Actual EST 2011 BGM Seasonal <strong>Budget</strong>Pr<strong>of</strong>orma JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTAL201-7-97-110.02 Wages - Rest. Others 25,000 - - - - 2,581 4,599 4,302 5,594 4,300 2,200 1,000 - 24,576201-7-97-330.00 Laundry Service 5,000 - - - - 441 267 879 331 400 800 - - 3,117201-7-97-420.00 Cleaning Bldg 4,500 - - - - - - - - - 2,200 2,200 - 4,400201-7-97-431.00 Equip Repair & Maint. 1,000 - - - 45 56 - 56 84 60 450 450 - 1,201201-7-97-490.00 Meals Tax to St <strong>of</strong> VT 19,000 - - - - 45 1,437 3,842 3,832 2,200 3,600 1,000 - 15,956201-7-97-610.00 Operating Supplies 3,600 - 30 250 36 15 - 264 - - - - - 595201-7-97-610.01 Operating Sup. SGSC Check - - - - - - - - - - - - - -201-7-97-630.00 Cost <strong>of</strong> Goods/Rest. 88,000 - - - - 3,070 13,906 10,352 11,710 8,200 3,000 - - 50,238201-7-97-630.01 Cost <strong>of</strong> Goods SGSC checks - - - 1,080 1,452 4,215 6,592 4,506 3,420 2,400 2,000 - - 25,665201-7-97-830.00 SGSC Credit Card Discount - - - - - - - - 364 - - - 1,000 1,364175,100 - 30 1,330 1,533 15,574 30,921 28,321 30,486 21,685 18,375 6,650 1,000 155,906201-7-98 EMPLOYEE BENEFITS201-7-98-210.00 Health Insurance 48,268 3,153 3,133 6,068 8,514 3,133 3,133 3,133 3,915 3,150 3,150 3,150 3,150 46,783201-7-98-220.00 Social Security 33,790 1,638 549 1,646 1,381 3,863 4,147 4,268 5,302 4,200 2,800 1,600 - 31,393201-7-98-230.00 Retirement 15,991 1,766 589 2,259 1,177 1,177 1,177 1,180 1,766 1,175 1,175 1,175 - 14,618201-7-98-250.00 Golf Unemployment Insuran 20,125 5,000 - 5,196 - - - 5,196 - - 5,200 - - 20,591201-7-98-260.00 Worker's Compensation 14,616 8,232 - - - - - 4,115 - - 4,125 - - 16,472201-7-98-290.00 Uniforms - - - - - - - - - - - - - -132,790 19,789 4,271 15,169 11,072 8,174 8,457 17,893 10,983 8,525 16,450 5,925 3,150 129,857Total Expenses 1,035,125 53,326 19,712 57,128 35,795 135,398 138,706 144,797 139,416 102,260 105,580 43,200 23,050 998,367Net Operating Income 111,875 (53,326) (19,712) (57,128) (35,795) 21,632 66,348 89,013 76,724 26,140 (18,830) (43,200) (23,050) 28,817Seasonal budget mirrors BGM's recommended budget with the following changes:Removal <strong>of</strong> the following salary and benefit expenses (social security & retirement) in December 2011:Wages - SuperWages - MechanicWages - Head ProTotal estimated savings in 2011 approximates $17,800. By going seasonal, GMN risks the loss <strong>of</strong> it's full time staff.Historically, seasonal operations benefit with younger, less experienced staff looking to gain experience in the industry. BGM believes the existing staff works well together,provides a solid product and would be difficult to replace continuing to maintain the existing level <strong>of</strong> service GMN is accustom to.BGM noted that GMN's benefits package is better than most in the golf industry. The national averages are listed below, as provided by the National Golf Course OwnersAssociation:Employee Benefits/Policies - the vast majority (87%) <strong>of</strong> responding facilities provided health insurance, down from 90% in 2008. The most popular types <strong>of</strong> plans <strong>of</strong>fered werePreferred Provider Organizations (PPO), Traditional Indemnity and Health Maintenance Organizations (HMO) at 46%, 37% and 34%, respectively.On average, employers paid 80% <strong>of</strong> the health insurance premiums for individual coverage with the remaining 20% paid by the employee.Responding facilities experienced an average increase <strong>of</strong> 11.3% during their most recent health care insurance renewal, similar to the 11.1% reported in 2008. On average,health insurance expenses accounted for 4.1% <strong>of</strong> an organization’s operating budget.Most <strong>of</strong> the respondents (82%) reported taking steps to control the cost <strong>of</strong> providing medical insurance/healthcare to employees within the last year. The most popular stepstaken were increasing the deductible (53%), increasing employee contribution (42%) and changing insurance carriers (34%).The responding facilities reported paying $5,302 in healthcare premiums per staff member during the most recent fiscal year, similar to the $5,337 in 2008.More than half <strong>of</strong> the responding facilities provide a retirement plan. Of those providing a retirement plan, 84% <strong>of</strong>fer a 401(k) plan.

GREEN MOUNTAIN NATIONAL GOLF CLUB2010 Actual2010 ActualJAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTALRevenueGreens Fee Revenue - - - - 35,413 91,961 109,788 104,152 132,507 51,934 - - 525,755Cart Fee Revenue - - - - 18,678 31,729 44,513 44,132 45,883 17,828 - - 202,763Season Pass Fee - - - - 98,552 12,365 5,067 (283) 1,614 - - - 117,315Pro Shop Revenue - - - - 9,533 16,826 18,375 15,228 15,834 14,277 - - 90,073Restaurant Revenue (includes taxes) - - - - 20,992 43,499 39,780 49,431 44,196 11,643 - - 209,541Golf School / Lessons Revenue - - - - 1,325 1,445 2,905 2,099 1,100 265 - - 9,139Practice Range Revenue - - - - 7,317 1,827 3,637 3,141 2,864 830 - - 19,616Club Rentals & Misc - - - - 200 190 535 380 330 390 - - 2,025Sales Tax Collected - - - - 1,741 3,009 3,808 3,816 3,896 1,613 - - 17,883Total Revenue - - - - 193,751 202,851 228,408 222,096 248,224 98,780 - - 1,194,110201-7-95 Maintenance201-7-95-110.01 Wages - Supt. 9,231 6,154 12,308 - 6,154 6,154 6,154 9,231 6,154 6,154 6,154 6,154 80,000201-7-95-110.02 Wages - Mechanic 4,500 3,000 6,000 - 3,000 3,000 3,000 4,500 3,000 3,000 3,000 3,000 39,000201-7-95-110.03 Wages - Grounds - - 10,553 - 15,235 21,692 13,758 28,205 17,818 13,470 5,166 999 126,896201-7-95-290.00 Uniforms - - - - - - - - - - 28 99 127201-7-95-430.00 Supplies & Bldg Maint. - - 684 - 1,278 938 755 1,110 1,045 - (53) 111 5,869201-7-95-431.00 Equip Rep&Maint. 1,929 1,784 7,619 - 1,576 4,047 2,700 1,242 867 1,629 575 301 24,271201-7-95-431.01 Irrigation Rep&Maint 414 - 5,400 - - 4,513 1,778 - - 501 210 5 12,820201-7-95-431.02 Golf Cart Rep&Maint. - - - - 27 - - 327 42 331 - - 727201-7-95-431.03 Drainage - - - - - - - 134 - - - - 134201-7-95-460.00 Sand, Fill, Soil - - - - 4,854 - 730 726 1,418 - 2,559 500 10,786201-7-95-560.00 Stormwater Permit - - - - - - - 2,881 (621) - - - 2,260201-7-95-580.00 Travel/Training/Dues 80 - 250 - 595 - - - - 852 (652) - 1,125201-7-95-610.00 Grass Seed, Sod, Flowers - - - - 915 843 - 450 707 65 - - 2,979201-7-95-611.01 Pesticides - - 3,120 - 18,250 1,652 - 657 481 2,500 - - 26,660201-7-95-611.02 Fertilizer - - 975 - 11,959 - - - 955 170 - - 14,059201-7-95-620.00 Utilities, Elec/Tel/Heat 1,297 576 2,350 - 62 2,407 77 3,516 1,472 235 2,417 1,337 15,745201-7-95-622.00 Electricity - Irrigation 144 - 53 - - 2,143 - 2,878 1,576 - 1,878 - 8,673201-7-95-626.00 Gas, Oil, Grease - 1,246 1,177 - 809 2,575 - 3,118 3,330 2,950 1,697 1,652 18,554201-7-95-741.00 Tools & Equipment 175 - 80 - 151 467 - - - - 9 - 88217,770 12,760 50,568 - 64,866 50,430 28,951 58,974 38,245 31,856 22,988 14,158 391,566

GREEN MOUNTAIN NATIONAL GOLF CLUB2010 Actual2010 ActualJAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTAL201-7-96 Operations201-7-96-110.01 Wages - Head Pro 7,558 5,038 19,679 - 5,038 5,038 5,038 7,558 5,038 5,038 5,038 5,038 75,102201-7-96-110.02 Wages - Asst. - - - - - - - - - - - - -201-7-96-110.03 Wages - Others - - 2,498 - 7,255 12,167 9,210 17,693 11,009 7,007 1,166 - 68,006201-7-96-430.00 Clubhouse Sup&Maint. - - - - 1,274 560 770 - - 657 (3,891) - (630)201-7-96-430.01 Driving Range Bldg - - - - - - - - - - - - -201-7-96-431.00 Clubhouse Rep&Equipment 112 37 1,667 - 55 789 206 209 398 191 97 54 3,814201-7-96-442.00 Golf Carts Lease - - - - - - - - - 70 (16,618) - (16,548)201-7-96-490.00 Sales Tax to St <strong>of</strong> VT - - - - 234 1,506 2,867 3,948 3,804 3,880 1,613 - 17,852201-7-96-490.01 Property Taxes - Mendon - - 1,520 - - - - - 1,552 - - - 3,072201-7-96-520.00 Insurance 5,283 - - - - - 5,284 - - - - - 10,567201-7-96-535.00 Marketing & Promotion 215 430 257 - 930 5,038 999 1,882 289 925 450 - 11,414201-7-96-536.00 Website/Marketing - - 597 - 215 - 393 215 89 - 37 597 2,143201-7-96-580.00 Travel/Training/Dues - - 215 - 260 3,746 - 1,140 1,328 - (185) - 6,504201-7-96-580.01 Lesson Sharing - - - - 326 768 1,084 2,179 1,574 825 199 - 6,954201-7-96-610.00 Ofc Supplies/Postage - - 285 - 525 283 385 43 536 52 1,447 - 3,556201-7-96-610.01 Range & Course Supplies - - - - 720 1,738 405 1,047 427 81 - 149 4,568201-7-96-620.00 Clubhouse Utilities & SW 654 2,033 2,624 - 514 2,183 1,248 1,196 1,883 2,646 1,639 1,332 17,951201-7-96-630.00 Cost <strong>of</strong> Goods/Pro Shop 103 - 3,596 - 17,451 16,080 17,848 12,540 3,233 2,822 (285) 185 73,574201-7-96-830.00 Credit Card Discounts - - - - - - - - - - - 14,940 14,94013,925 7,538 32,939 - 34,797 49,896 45,736 49,649 31,163 24,194 (9,291) 22,296 302,841201-7-97 Restaurant201-7-97-110.01 Wages - Rest. Mgr. - - 2,030 - 4,060 5,075 3,045 6,090 4,060 4,060 1,015 - 29,435201-7-97-110.02 Wages - Rest. Others - - 348 - 1,573 6,715 3,306 7,688 4,506 1,967 78 - 26,181201-7-97-330.00 Laundry Service - - - - 1,265 - 587 597 387 650 - - 3,485201-7-97-420.00 Cleaning Bldg - - - - - - - 630 - - 4,451 - 5,081201-7-97-431.00 Equip Repair & Maint. - - - - - 56 - 191 - 312 575 - 1,134201-7-97-490.00 Meals Tax to St <strong>of</strong> VT 216 - 267 - 293 786 4,883 3,745 4,695 4,185 1,076 - 20,146201-7-97-610.00 Operating Supplies - - 36 - 440 378 342 - - - - - 1,195201-7-97-610.01 Operating Sup. SGSC Check - - - - 950 - 259 888 - - - - 2,097201-7-97-630.00 Cost <strong>of</strong> Goods/Rest. - - 39 - 3,755 9,673 13,086 12,405 19,276 10,375 (5,264) 49 63,393201-7-97-630.01 Cost <strong>of</strong> Goods SGSC checks - - - - 4,035 6,794 4,816 5,592 2,071 - 4,682 - 27,990201-7-97-830.00 SGSC Credit Card Discount - - - - - - - - - - - 1,088 1,088216 - 2,720 - 16,372 29,477 30,324 37,825 34,995 21,548 6,613 1,137 181,226

GREEN MOUNTAIN NATIONAL GOLF CLUB2010 Actual2010 ActualJAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC TOTAL201-7-98 EMPLOYEE BENEFITS201-7-98-210.00 Health Insurance 6,477 3,534 2,126 - 3,772 3,534 3,534 4,838 3,534 3,534 3,892 6,141 44,917201-7-98-220.00 Social Security 1,629 1,086 3,788 - 3,056 4,049 2,967 5,458 4,065 2,801 1,621 1,158 31,677201-7-98-230.00 Retirement 1,740 1,160 2,800 - 1,161 1,165 1,166 1,752 1,160 1,160 1,160 1,160 15,584201-7-98-250.00 Golf Unemployment Insuran 3,896 - - - 3,771 - 3,771 - 3,210 - - - 14,648201-7-98-260.00 Worker's Compensation 6,360 - - - - - 6,360 789 - - - - 13,509201-7-98-290.00 Uniforms - - - - 125 399 - 292 - - 1,462 - 2,27820,102 5,780 8,714 - 11,884 9,147 17,798 13,129 11,969 7,495 8,136 8,458 122,612Total Expenses 52,012 26,078 94,941 - 127,919 138,949 122,809 159,577 116,372 85,094 28,445 46,049 998,245Net Operating Income (52,012) (26,078) (94,941) - 65,832 63,902 105,599 62,519 131,852 13,686 (28,445) (46,049) 195,865The balances above match those provided by the <strong>Town</strong> Office for calendar year 2010