Checklist for new business

Checklist for new business

Checklist for new business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

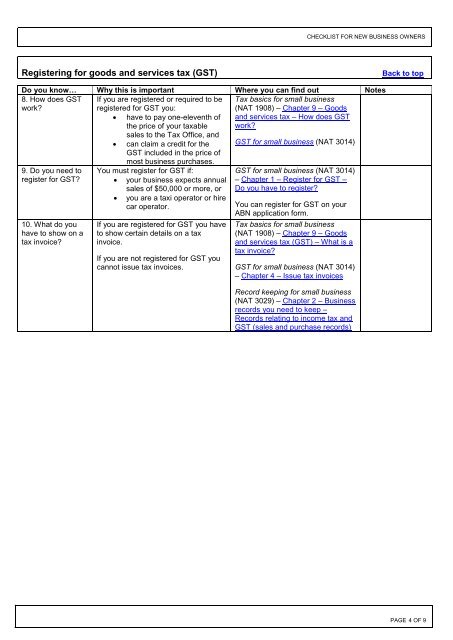

CHECKLIST FOR NEW BUSINESS OWNERSRegistering <strong>for</strong> goods and services tax (GST)Back to topDo you know… Why this is important Where you can find out Notes8. How does GSTwork?9. Do you need toregister <strong>for</strong> GST?10. What do youhave to show on atax invoice?If you are registered or required to beregistered <strong>for</strong> GST you:• have to pay one-eleventh ofthe price of your taxablesales to the Tax Office, and• can claim a credit <strong>for</strong> theGST included in the price ofmost <strong>business</strong> purchases.You must register <strong>for</strong> GST if:• your <strong>business</strong> expects annualsales of $50,000 or more, or• you are a taxi operator or hirecar operator.If you are registered <strong>for</strong> GST you haveto show certain details on a taxinvoice.If you are not registered <strong>for</strong> GST youcannot issue tax invoices.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 9 – Goodsand services tax – How does GSTwork?GST <strong>for</strong> small <strong>business</strong> (NAT 3014)GST <strong>for</strong> small <strong>business</strong> (NAT 3014)– Chapter 1 – Register <strong>for</strong> GST –Do you have to register?You can register <strong>for</strong> GST on yourABN application <strong>for</strong>m.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 9 – Goodsand services tax (GST) – What is atax invoice?GST <strong>for</strong> small <strong>business</strong> (NAT 3014)– Chapter 4 – Issue tax invoicesRecord keeping <strong>for</strong> small <strong>business</strong>(NAT 3029) – Chapter 2 – Businessrecords you need to keep –Records relating to income tax andGST (sales and purchase records)PAGE 4 OF 9