Checklist for new business

Checklist for new business

Checklist for new business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

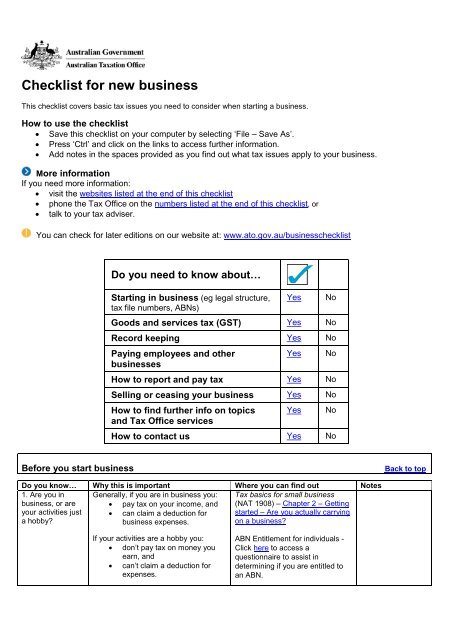

<strong>Checklist</strong> <strong>for</strong> <strong>new</strong> <strong>business</strong>This checklist covers basic tax issues you need to consider when starting a <strong>business</strong>.How to use the checklist• Save this checklist on your computer by selecting ‘File – Save As’.• Press ‘Ctrl’ and click on the links to access further in<strong>for</strong>mation.• Add notes in the spaces provided as you find out what tax issues apply to your <strong>business</strong>.More in<strong>for</strong>mationIf you need more in<strong>for</strong>mation:• visit the websites listed at the end of this checklist• phone the Tax Office on the numbers listed at the end of this checklist, or• talk to your tax adviser.You can check <strong>for</strong> later editions on our website at: www.ato.gov.au/<strong>business</strong>checklistDo you need to know about…Starting in <strong>business</strong> (eg legal structure,tax file numbers, ABNs)YesGoods and services tax (GST) Yes NoRecord keeping Yes NoPaying employees and other<strong>business</strong>esYesHow to report and pay tax Yes NoSelling or ceasing your <strong>business</strong> Yes NoHow to find further info on topicsand Tax Office servicesYesHow to contact us Yes NoNoNoNoBe<strong>for</strong>e you start <strong>business</strong>Back to topDo you know… Why this is important Where you can find out Notes1. Are you in Generally, if you are in <strong>business</strong> you: Tax basics <strong>for</strong> small <strong>business</strong><strong>business</strong>, or are • pay tax on your income, and (NAT 1908) – Chapter 2 – Gettingyour activities justa hobby?• can claim a deduction <strong>for</strong><strong>business</strong> expenses.started – Are you actually carryingon a <strong>business</strong>?If your activities are a hobby you:• don’t pay tax on money youearn, and• can’t claim a deduction <strong>for</strong>expenses.ABN Entitlement <strong>for</strong> individuals -Click here to access aquestionnaire to assist indetermining if you are entitled toan ABN.

CHECKLIST FOR NEW BUSINESS OWNERSDo you know… Why this is important Where you can find out Notes2. Which legalstructure is best<strong>for</strong> your <strong>business</strong>?Sole traders, partnerships, companiesand trusts have different legalobligations and are taxed differently.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 2 – Gettingstarted – Which <strong>business</strong> structureshould you choose?Visit www.<strong>business</strong>.gov.au3. Do you need atax file number?4. Do you need anAustralian<strong>business</strong> number(ABN)?5. Are you runningyour <strong>business</strong> ator from yourhome?6. Are you acontractor orconsultant?Sole traders use their individual tax filenumber <strong>for</strong> their <strong>business</strong>.Partnerships, companies and trustsneed a separate tax file number.It is not compulsory to have an ABN,but your <strong>business</strong> will need an ABN to:• register <strong>for</strong> goods and servicestax (GST) and other <strong>business</strong>tax registrations• deal with other <strong>business</strong>es,and• avoid having amounts withheldfrom payments.Running a <strong>business</strong> at or from yourhome may affect:• what expenses you can claim,and• whether you have to paycapital gains tax when you sellyour home.If the income of your <strong>business</strong> is mainlya result of your personal ef<strong>for</strong>ts orskills:• it may be treated as yourpersonal income <strong>for</strong> taxpurposes• you may not be able to claimcertain deductions, and• if you operate as a partnership,company or trust, you mayhave to withhold amounts fromthe income.Talk to your tax adviser.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 2 – Gettingstarted – Do you need to register<strong>for</strong> a tax file number?Companies, partnerships andtrusts can apply atwww.abr.gov.auTax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 2 – Gettingstarted – Do you need anAustralian <strong>business</strong> number?Apply at www.abr.gov.auABN Entitlement <strong>for</strong> individuals -Click here to access aquestionnaire to assist indetermining if you are entitled toan ABN.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 6 – Somecommon deductions – Whatworking from home expenses canyou claim?Carrying on a <strong>business</strong> at or fromyour home (NAT 10709)Tax basics <strong>for</strong> small <strong>business</strong> –(NAT 1908) – Chapter 7 – Specialrules that might affect your tax –Are you a contractor orconsultant?Alienation of personal servicesincome: contractors andconsultants (NAT 4788)PAGE 2 OF 9

CHECKLIST FOR NEW BUSINESS OWNERSDo you know… Why this is important Where you can find out Notes7. Where can youfind otherin<strong>for</strong>mation aboutwww.<strong>business</strong>.gov.au is a whole-ofgovernmentservice providing essentialgovernment in<strong>for</strong>mation on planning,Visit www.<strong>business</strong>.gov.auVisit www.beca.org.austarting astarting and running a <strong>business</strong>,<strong>business</strong>? including licensing, employment and Check the White pages undergrants.‘Small <strong>business</strong>’.Business Enterprise Centres in someregions can assist <strong>new</strong> <strong>business</strong>operators.Some state governments also runBusiness Development Centres whichcan help you when starting out.PAGE 3 OF 9

CHECKLIST FOR NEW BUSINESS OWNERSRegistering <strong>for</strong> goods and services tax (GST)Back to topDo you know… Why this is important Where you can find out Notes8. How does GSTwork?9. Do you need toregister <strong>for</strong> GST?10. What do youhave to show on atax invoice?If you are registered or required to beregistered <strong>for</strong> GST you:• have to pay one-eleventh ofthe price of your taxablesales to the Tax Office, and• can claim a credit <strong>for</strong> theGST included in the price ofmost <strong>business</strong> purchases.You must register <strong>for</strong> GST if:• your <strong>business</strong> expects annualsales of $50,000 or more, or• you are a taxi operator or hirecar operator.If you are registered <strong>for</strong> GST you haveto show certain details on a taxinvoice.If you are not registered <strong>for</strong> GST youcannot issue tax invoices.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 9 – Goodsand services tax – How does GSTwork?GST <strong>for</strong> small <strong>business</strong> (NAT 3014)GST <strong>for</strong> small <strong>business</strong> (NAT 3014)– Chapter 1 – Register <strong>for</strong> GST –Do you have to register?You can register <strong>for</strong> GST on yourABN application <strong>for</strong>m.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 9 – Goodsand services tax (GST) – What is atax invoice?GST <strong>for</strong> small <strong>business</strong> (NAT 3014)– Chapter 4 – Issue tax invoicesRecord keeping <strong>for</strong> small <strong>business</strong>(NAT 3029) – Chapter 2 – Businessrecords you need to keep –Records relating to income tax andGST (sales and purchase records)PAGE 4 OF 9

CHECKLIST FOR NEW BUSINESS OWNERSSetting up your record keepingDo you know… Why this is important Where you can find out Notes11. What recordsdo you have tokeep, and <strong>for</strong> howlong?Record keeping <strong>for</strong> small <strong>business</strong>(NAT 3029) – Chapter 2 – Businessrecords you need to keepThe tax law requires you to keeprecords <strong>for</strong> five years. These includerecords relating to:• sales and purchases• payments to employees, and• payments to other<strong>business</strong>es.Keeping good records also makes iteasier to manage your <strong>business</strong>.Work out what records you need tokeep by using the record keepingevaluation toolIf you are still unsure, phone13 28 66 to request a free advisoryvisit from a tax officer.12. Can you keepyour recordselectronically?13. Do you need abookkeeper?14. How can youmanage your cashflow?Keeping records electronicallyimproves accuracy and may save youtime.The Tax Office has free electronicrecord keeping software callede-Record.You can also use commercialsoftware packages.Bookkeepers can’t give tax advice, butthey can manage your records.Eligible bookkeepers can also prepareand lodge your activity statements.It’s a good idea to get a bookkeeper toset up your record keeping system.Managing your cash flow is critical tomanaging your <strong>business</strong>. Good cashflow management will help you to payyour bills on time, including your taxbills.Talk to your tax adviser.For in<strong>for</strong>mation about e-Record,visit www.ato.gov.au/erecordThere is a list of commercial recordkeeping packages on our productregister.Your tax adviser may be able torecommend a bookkeeper.Record keeping <strong>for</strong> small <strong>business</strong>(NAT 3029) – Chapter 3 – A basicpaper record keeping system –Managing your cash flowPAGE 5 OF 9

CHECKLIST FOR NEW BUSINESS OWNERSIf you pay employees or other <strong>business</strong>esBack to topDo you know… Why this is important Where you can find out Notes15. Do you haveto withholdamounts frompayments toemployees,directors or other<strong>business</strong>es?If you pay employees, directors or other<strong>business</strong>es, you have to be registered<strong>for</strong> pay as you go (PAYG) withholdingand send withheld amounts to the TaxOffice.You report and pay these amountsusing your activity statement.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 2 – Gettingstarted – Do you need to register<strong>for</strong> PAYG withholding?PAYG withholding <strong>for</strong> small<strong>business</strong> (NAT 8075)You can register <strong>for</strong> PAYG on your16. Are yourworkersemployees orcontractors?You treat employees differently fromcontractors <strong>for</strong> PAYG withholding,fringe benefits tax, and superannuationpurposes.ABN application <strong>for</strong>m.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 10 –Employer essentials – Are yourworkers employees or contractors?PAYG withholding <strong>for</strong> small<strong>business</strong> (NAT 8075) – Chapter 2 –Determine the status of yourworkersIntroduction to fringe benefits tax(NAT 1744)17. Whatsuperannuationsupport must youprovide <strong>for</strong>employees?18. Do you knowabout choice ofsuperannuationfund?19. Do you knowabout salarysacrifice?20. Do you knowabout fringebenefits tax?21. When do youwithhold amountsfrom payments toother<strong>business</strong>es?You have to pay superannuationguarantee <strong>for</strong> most employees andcertain contractors. If you don’t, you willincur extra costs.Eligible employees can choose whichsuperannuation fund they want theirsuperannuation contributions paid into.Your employees may want to pay(sacrifice) part of their salary or wagesinto additional superannuation or otherbenefits.If you provide non-cash benefits to youremployees, such as use of a car, youmay have to pay fringe benefits tax(FBT) and lodge an annual FBT return.Currently you have to withhold 46.5% ofpayments to any <strong>business</strong> that doesn’tquote a valid Australian <strong>business</strong>number (ABN) on a tax invoice or otherdocument, or provide a statementgiving a valid reason <strong>for</strong> not quoting anABN.You report and pay the amount withheldusing your activity statement.Superannuation guarantee – aguide <strong>for</strong> employers (NAT 1987) –Chapter 1 – How thesuperannuation guarantee appliesto youSuperannuation guarantee – aguide <strong>for</strong> employers (NAT 1987)Choice of superannuation fund –guide <strong>for</strong> employers (NAT 13185)Salary sacrifice arrangements <strong>for</strong>employees (NAT 7424)Superannuation guarantee – aguide <strong>for</strong> employers (NAT 1987)Introduction to fringe benefits tax(NAT 1744)Fringe benefits tax <strong>for</strong> small<strong>business</strong> (NAT 8164)PAYG withholding <strong>for</strong> small<strong>business</strong> (NAT 8075) – Chapter 4 –Work out how much to withholdfrom payments – How much towithhold when a <strong>business</strong> doesn’tquote an ABNTo check details of suppliers with avalid ABN, visit the AustralianBusiness register atwww.abr.gov.auPAGE 6 OF 9

CHECKLIST FOR NEW BUSINESS OWNERSHow to report and pay taxBack to topDo you know… Why this is important Where you can find out Notes22. Do you haveto lodge activitystatements?Businesses report their GST and othertaxes on an activity statement.Most <strong>business</strong>es must send an activitystatement and any payment to the TaxOffice every three months. Somesmaller <strong>business</strong>es lodge and pay onlyonce a year and larger <strong>business</strong>es mayhave to lodge and pay every month.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 11 –Reporting and paying tax – ActivitystatementsPAYG withholding <strong>for</strong> small<strong>business</strong> (NAT 8075) – Chapter 5 –Report and pay withheld amountsto the Tax Office23. How do youlodge your activitystatement online?24. Do you haveto lodge anincome taxreturn?25. What are thedue dates <strong>for</strong>lodging activitystatements andtax returns andpaying tax?26. Will you beable to pay yourfirst income taxbill?You can lodge and pay online.The Business Portal is a secure part ofato.gov.au which allows you to:• lodge, revise, view and print activitystatements• update registration details• check <strong>business</strong> tax accounts andrequest refunds and transfers ofcredit accounts• exchange secure messages withthe Tax Office, and• more.You have to lodge an income tax return<strong>for</strong> each year you are in <strong>business</strong> –even if you don’t make a profit or haveany tax to pay.You must lodge and pay by the duedate unless you have made otherarrangements with the Tax Office.If you do not lodge your activitystatement and income tax returns bythe due date, you may incur penaltyand interest charges.The due date <strong>for</strong> lodging your activitystatement is printed on your activitystatement.Income tax returns are generally dueby 31 October each year.You generally don’t pay PAYGinstalments of your income tax untilafter you’ve lodged your first <strong>business</strong>income tax return.This means you may need to putmoney aside to pay your total incometax liability <strong>for</strong> your first year in<strong>business</strong>.See www.ato.gov.au/onlineservicesFor more in<strong>for</strong>mation go towww.ato.gov.au/onlineservicesIncome tax and deductions <strong>for</strong>small <strong>business</strong> (NAT 10710)Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908)Key dates <strong>for</strong> <strong>business</strong>esPhone us on 13 28 66 if you arehaving difficulty paying your tax billson time.Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) - Chapter 12 – Your<strong>business</strong> journey – Are yourbudgeting processes helping youpay your bills and tax on time?PAGE 7 OF 9

CHECKLIST FOR NEW BUSINESS OWNERSSelling or ceasing your <strong>business</strong>Back to topDo you know… Why this is important Where you can find out Notes27. What if youdon’t go aheadwith yourIf you cease carrying on a <strong>business</strong>, orchange the legal structure of your <strong>business</strong>,you may need to:Tax basics <strong>for</strong> small <strong>business</strong>(NAT 1908) – Chapter 12 –Your <strong>business</strong> journey – What<strong>business</strong>, or• cancel your ABN and other registrationsif you stop carrying on yourcease trading?<strong>business</strong>?More in<strong>for</strong>mationInternet• make certain GST adjustments on yourfinal activity statement, and• lodge final tax returns.You must apply to cancel your GSTregistration within 21 days of ceasing tocarry on an enterprise.The easiest way to get more in<strong>for</strong>mation is to visit:PhoneCheck whether your state orterritory government has anyspecial requirements.• www.ato.gov.au to download publications, rulings and other general tax in<strong>for</strong>mation <strong>for</strong> small <strong>business</strong>es• www.abr.gov.au to apply <strong>for</strong> a tax file number (except <strong>for</strong> individuals) and ABN, and register <strong>for</strong> GSTand PAYG withholding• www.ato.gov.au/onlineservices to find out about our range of online services, including the Business Portal• <strong>business</strong>.gov.au <strong>for</strong> easy access to a range of <strong>business</strong> in<strong>for</strong>mation, services and transactions with government.There are links to Tax Office applications to register <strong>for</strong> an ABN and GST, or to apply <strong>for</strong> a tax file number.Phone us on:Fax• 13 28 66 (general <strong>business</strong> enquiries) <strong>for</strong> in<strong>for</strong>mation about most small <strong>business</strong> tax matters, including GST,ABN, pay as you go (PAYG) instalments, amounts withheld from wages, <strong>business</strong> deductions, lodging and payingactivity statements, activity statement accounts, wine equalisation tax, luxury car tax, fringe benefits tax andmatters <strong>for</strong> non-profit organisations• 13 10 20 (superannuation enquiries) <strong>for</strong> in<strong>for</strong>mation about the superannuation guarantee, choice ofsuperannuation fund and the Super Co-contribution• 13 28 61 (personal tax enquiries) <strong>for</strong> in<strong>for</strong>mation about individual income tax and general personal tax enquiries• 1300 720 092 to order Tax Office publications (see below).• Phone 13 28 60 to have in<strong>for</strong>mation faxed to you about a range of tax-related topics.Free seminarsWe run small <strong>business</strong> seminars on a range of topics, including GST, PAYG, activity statements and record keeping.Visit www.ato.gov.au or phone 1300 661 104 to find out whether there is a seminar near you or to make a booking.Other services• If you do not speak English well and want to talk to a tax officer, phone the Translating and Interpreting Serviceon 13 14 50 <strong>for</strong> help with your call.• If you have a hearing or speech impairment and have access to appropriate TTY or modem equipment, phone13 36 77. If you do not have access to TTY or modem equipment, phone the Speech to Speech Relay Service on1300 555 727.PAGE 8 OF 9

CHECKLIST FOR NEW BUSINESS OWNERSHow to have Tax Office publications sent to youOrdering onlineYou can order our booklets, <strong>for</strong>ms and other publications online, by following the links from ‘Booklets and publications’ to‘Online ordering’ on our website at www.ato.gov.au.Ordering by phoneThere are two ways you can do this:1. Using our automated service:• <strong>for</strong> <strong>business</strong>es – 13 72 26 (if you have an ABN), or• <strong>for</strong> individuals – 13 28 65 (if you don’t yet have an ABN).This automated service is available 24 hours a day, 7 days a week. It is <strong>for</strong> people who know the name of the publicationthey want to order and have no other queries.Businesses have to state:• an ABN and the name of a contact person (not the <strong>business</strong> name) – we need this <strong>for</strong> delivery purposes, and• the name of the publication and number of copies required.Individuals have to state:• the name of the publication and number of copies required, and• a name and address <strong>for</strong> delivery purposes.2. Using our publications ordering service on 1300 720 092.An operator-assisted ordering service is available 8.00am to 6.00pm weekdays (closed on weekends and publicholidays).An automated publications service is also available on this number 24 hours a day, 7 days a week <strong>for</strong> people who knowthe name of the publication they want to order and have no other queries.© COMMONWEALTH OF AUSTRALIA 2006This work is copyright. Apart from any use as permitted under the Copyright Act 1968,no part may be reproduced by any process without prior written permission fromthe Commonwealth available from the Attorney-General’s Department. Requestsand enquiries concerning reproduction and rights should be addressed to theCommonwealth Copyright Administration, Copyright Law Branch, Attorney-General’sDepartment, Robert Garran Offices, National Circuit, Barton ACT 2600 or atwww.ag.gov.au/ccaPublished byAustralian Taxation OfficeCanberraJuly 2006PAGE 9 OF 9