ANNUAL REPORT 2006 - Triplan AG

ANNUAL REPORT 2006 - Triplan AG

ANNUAL REPORT 2006 - Triplan AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated Notes 45<br />

(2) Property, plant and equipment<br />

The individual items are shown in the statement of changes in fixed assets. Items of property, plant and equipment<br />

are measured at cost less scheduled straight-line depreciation over a useful life of between three and ten<br />

years.<br />

(3) Asset-side deferred taxes<br />

The deferred tax reimbursement claims result from loss carryovers. Due to the uncertainty surrounding the<br />

realization of the deferred taxes, a value adjustment was made to the extent that asset-side deferred taxes<br />

exceed liability-side deferred taxes. Additional explanations result from text number 24.<br />

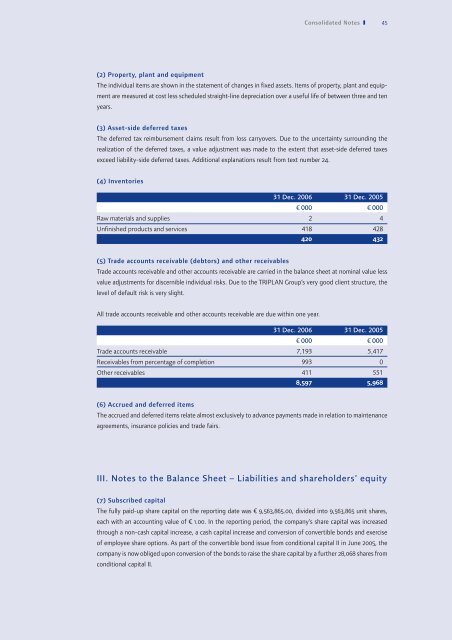

(4) Inventories<br />

31 Dec. <strong>2006</strong> 31 Dec. 2005<br />

¤ 000 ¤ 000<br />

Raw materials and supplies 2 4<br />

Unfinished products and services 418 428<br />

420 432<br />

(5) Trade accounts receivable (debtors) and other receivables<br />

Trade accounts receivable and other accounts receivable are carried in the balance sheet at nominal value less<br />

value adjustments for discernible individual risks. Due to the TRIPLAN Group’s very good client structure, the<br />

level of default risk is very slight.<br />

All trade accounts receivable and other accounts receivable are due within one year.<br />

31 Dec. <strong>2006</strong> 31 Dec. 2005<br />

¤ 000 ¤ 000<br />

Trade accounts receivable 7,193 5,417<br />

Receivables from percentage of completion 993 0<br />

Other receivables 411 551<br />

8,597 5,968<br />

(6) Accrued and deferred items<br />

The accrued and deferred items relate almost exclusively to advance payments made in relation to maintenance<br />

agreements, insurance policies and trade fairs.<br />

III. Notes to the Balance Sheet – Liabilities and shareholders’ equity<br />

(7) Subscribed capital<br />

The fully paid-up share capital on the reporting date was ¤ 9,563,865.00, divided into 9,563,865 unit shares,<br />

each with an accounting value of ¤ 1.00. In the reporting period, the company’s share capital was increased<br />

through a non-cash capital increase, a cash capital increase and conversion of convertible bonds and exercise<br />

of employee share options. As part of the convertible bond issue from conditional capital II in June 2005, the<br />

company is now obliged upon conversion of the bonds to raise the share capital by a further 28,068 shares from<br />

conditional capital II.