Loan Form-JULY 2009.pdf - Kimisitu Sacco

Loan Form-JULY 2009.pdf - Kimisitu Sacco

Loan Form-JULY 2009.pdf - Kimisitu Sacco

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

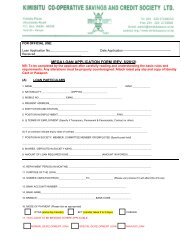

FOR OFFICIAL USE:<strong>Loan</strong> Application No.______________________Received___________________________Date ApplicationLOAN APPLICATION FORM (REV. 6/09)(To be completed after carefully reading and understanding all the paragraphs)Type of loan (tick as applicable)Normal Development <strong>Loan</strong> ( ) Education <strong>Loan</strong> ( ) Motor vehicle INS <strong>Loan</strong> ( )Home Development <strong>Loan</strong> ( ) Emergency <strong>Loan</strong> ( ) Bridging loan ( )Refinance <strong>Loan</strong> ( ) Top-up Emergency(A)LOAN PARTICULARS1.NAME______________________________________________________________M/NO._____________2. NATIONALITY______________________ID/PP.NO.__________________MOBILE NO.___________________3. PRESENT ADDRESS__________________________________EMAIL___________________________________4. INSTITUTION AND STATION____________________________________________________________________5. POSITION IN EMPLOYMENT___________________________________________P/NO.____________________6. (i) TERMS OF EMPLOYMENT (Specify if Temporary, Permanent & Pensionable, Contract or other)_______________________________________________________________________________________(ii) If on contract indicate expiry date of contract _____________________________________________________7. POSITION IN SOCIETY: MEMBER, COMMITTEE MEMBER OR EMPLOYEE (Specify post held)______________________________________________________________________________________________8. SHARES / DEPOSITS IN SOCIETY KSHS__________________________________________________________9. AMOUNT OF LOAN REQUIRED KSHS________________________ (AMOUNT IN WORDS)_______________________________________________________________________________________________________________10. REPAYMENT PERIOD (IN MONTHS) ____________________________________________________________11. PURPOSE OF THE LOAN_____________________________________________________________________12. ADDITIONAL SECURITY OTHER THAN SHARES, GUARANTORS & TERMINAL BENEFITS_______________________________________________ESTIMATED VALUE KSHS_________________________

(B)BASIC RULES & REQUIREMENTSI understand that rules applicable to this application are listed below and the loans will be granted inaccordance with these rules which are:1. A member must have contributed and been active for a minimum period of six months and have aminimum deposit holding/savings of Kshs 12,0002. Any category of outstanding loan must be cleared before a new loan of the same category isprovided.3. No member will be permitted to suffer total deductions including savings, loan repayment and interestin excess of two-thirds of his/her basic salary.4. A one off interest of 5 % shall be charged on loans to be bridged or topped up.5. Members shall not have more than eight loans simultaneously.6. New loans will be given subject to the previous loan being regularly paid.7. Total loans granted or owed to the society shall not exceed three times a member’s deposit savingsand in all cases repayable within a period not exceeding 48 months but subject to the maximum of5% of the Society share capital and reserves, and availability of funds.8. Emergency and Education loans will only be granted with a maximum repayment period of 12months.9. Refinance of Development loans will only be granted with a maximum repayment period of 18months.10. In case of any default in repayment the entire balance of this loan will immediately become due andpayable at the discretion of the Management Committee and all deposits owned by the member andany interest due to the member will be offset against the balance owed. The member will be liable forany costs incurred in collection of the loan balance and accumulated interest. Any remaining balancewill be deducted from the member's salary and / or terminal benefits.11. The loan must be guaranteed by a minimum of three (3) guarantors who must be members of theSociety. The total deposits of the borrower and those of the guarantors must be equal to or more thanthe loan applied for.12. Savings contribution paid in cash or cheque outside the check-off system shall remain in the Societyfor at least six months to be considered for lending purposes.13. The loan application form must be completed and supported with the most recent pay slip (certified bythe employer's payroll officer), copy of national identity card/ passport and any other relevantsupporting documents.14. The cheque for the loan approved will be issued net of the insurance premium.15. An application for a loan shall only be considered when the authorized loan application form is used.16. No member shall guarantee more than eight loans at any one given time.17. No member may withdraw his deposits unless all loans are repaid and all loans guaranteed by himare cleared or replacement guarantors sought for the same.18. Guarantors’ loan and deposits must be up-to-date to be eligible.(C) DECLARATION:I hereby declare that the foregoing particulars are true to the best of my knowledge and belief, and agree toabide by the by-laws of the Society, the loan policy and any other variations in respect to items 10-11 above. Ihereby authorize the employer to make the necessary deductions to be made from my salary as repaymentfor this loan. If I should leave employment before completion of repayment, I authorize any Society debts tobe recovered from my terminal benefits and from the deposits in the society owned by me.Signature_____________________________________ Date________________________________Witnessed by:(Name ______________________________________________ (One Must be a member)(Institution)_________________________________M/No________________________(Signature)______________________________________Date______________________________Page 2 of 4

AUTHORITY TO DEDUC T OB LIGATI ONS FROM TERMI NAL BENEFITSIn the event of my leaving employment with ..........................................., (herein after referred toas the organization)I, ________________________authorize the organization, to first apply my terminalpayments to offset, as far as possible, any outstanding obligations to <strong>Kimisitu</strong> Cooperative Savings andCredit Society Ltd, before paying the balance, if any, to me. I hereby agree to release and hold harmless theorganization, its trustees, officers, employees, agents, administrators, successors and assigns, against anyand all claims, causes of action and judgments, damages, losses, costs, expenses and demands whatsoever,arising out of or in connection with my participation in the <strong>Kimisitu</strong> Savings and Credit CooperativeSociety, including any deductions from my salary authorized by me as borrower or guarantor.Dated ……………………………………………………………………………………….………….Name of the Employee …….………………..……………….……………………………..……………Signature of Employee …………………………………………………………………….……………..CONFIRMATIONBY THE EMPLOYERThe applicant is employed by………………………………………………………of(Address)………………….………………………………….and subject to the authority given above by the said employee, I will deductany obligations due as advised by <strong>Kimisitu</strong> Co-operative Savings and Credit Society Ltd,from the employee’sterminal benefits.Signed on behalf of employer,Name…………………………………………………………………………………………..Signature& Rubber stamp……………………………………………………………………………Page 4 of 4