kimisitu sacco society limited credit policy and procedures manual ...

kimisitu sacco society limited credit policy and procedures manual ...

kimisitu sacco society limited credit policy and procedures manual ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Kimisitu SACCO Society LimitedPREFACEThe purpose of the Kimisitu SACCO Credit Policy <strong>and</strong> Procedures Manual is toprovide guidance in decision-making <strong>and</strong> taking actions within the SACCO forvarious operations <strong>and</strong> activities. The <strong>manual</strong> is intended to:a) Establish <strong>and</strong> implement the objectives of the SACCO as interpreted by the Boardof Directors; <strong>and</strong>b) Govern the operations of the SACCO. This is on the premise that it is anoperational document that is meant to assist members of management teams <strong>and</strong> thestaff in running the SACCO Credit Department smoothly.This Credit Policy <strong>and</strong> Procedures Manual have been developed as a guide towardsproviding a uniform level of underst<strong>and</strong>ing in the interpretation <strong>and</strong> administrationof the <strong>credit</strong> at Kimisitu SACCO Society Limited.In developing this <strong>manual</strong>, the Board of Directors considered that most of the<strong>procedures</strong> described herein are practiced or are to be practiced by the Society in oneway or the other.This <strong>manual</strong> should therefore be carefully studied, as it constitutes an integral part ofthe expectations of the Society sets out the details of the various <strong>procedures</strong> thatshould be followed.Policy <strong>and</strong> Procedures help an organization to:a) Save time by preventing people from having to make the same decision manytimes;b) Prevent <strong>and</strong> help resolve disputes as policies <strong>and</strong> <strong>procedures</strong> lay down firmguidelines that make it easy to decide what does or does not lie within theguideline;c) Encourage faith in the organization as members <strong>and</strong> employees see that theycan rely on the organization to behave consistently hence making them feelsecure about their dealings with the organization; <strong>and</strong>,d) Aid continuity as the organization gradually changes in their make-up, forinstance, even if Board of Directors, members <strong>and</strong> employees leave <strong>and</strong> arereplaced.Credit Administration Policy <strong>and</strong> Procedures ManualPage 4 of 67

Kimisitu SACCO Society Limited1.0 INTRODUCTIONSavings <strong>and</strong> Credit societies meet a need not presently met by other financialinstitutions by allowing members to obtain loans based on Security of their Savings,their incomes, character <strong>and</strong> guarantee by fellow members.To fulfill the above objectives, policies are formulated to guide Savings <strong>and</strong> CreditCo-operative ( SACCO) Societies. Kimisitu SACCO Credit Policy <strong>and</strong> ProceduresManual has been formulated within the legal framework to help members <strong>and</strong>officials of the Society avoid <strong>credit</strong> administration problems.The general objective of <strong>credit</strong> <strong>policy</strong> is to:a) Guide <strong>and</strong> induct new management/employees on what they are expected todob) Provide st<strong>and</strong>ard ways of performing certain activities <strong>and</strong> tasks in <strong>credit</strong>programmec) Eliminate misunderst<strong>and</strong>ing <strong>and</strong> certain errors of omission which may occurin performing specific functionsd) Help in communicating what each person is expected to doe) Help Board of Directors <strong>and</strong> management staff to focus on certain areas ofimportance – Key Result Areas.The specific Objectives of the Policy are to:a) Establish a fair <strong>and</strong> efficient loaning system based on uniform <strong>and</strong> consistent<strong>credit</strong> administrationb) Ensure fairness in loan granting processc) Provide clear basis for dealing with members’ loansd) Ensure that <strong>society</strong> does not get into difficulties through approving loans inexcess of available fundse) Ensure proper utilization of loans granted to membersf) Facilitate loan recoveriesg) Minimize loan defaultingh) Set checks <strong>and</strong> balances in <strong>credit</strong> operationsCredit Administration Policy <strong>and</strong> Procedures ManualPage 6 of 67

Kimisitu SACCO Society Limitedi) Define Committee <strong>and</strong> Staff roles in order to avoid duplication <strong>and</strong> overlap ofduties <strong>and</strong> responsibilitiesFor the Credit system to function there is need to have a Credit Policy <strong>and</strong>Procedures Manual to guide those who are involved in the <strong>credit</strong> granting process.The Credit Committee, Chief Executive Officer, Credit Manager <strong>and</strong> BoardCommittees must follow clear cut set of rules, <strong>procedures</strong> <strong>and</strong> policies. These policiesinclude preconditions for granting loans, the minimum requirement for a member tobe eligible to borrow, maximum loan, types, terms <strong>and</strong> conditions <strong>and</strong> other relevantinformation on the Credit Management Process.1.1 PurposeThe Credit Policy <strong>and</strong> Procedures Manual is intended to provide direction,guidelines, <strong>and</strong> make provisions for proper <strong>and</strong> efficient utilization <strong>and</strong>administration of the Kimisitu SACCO Loan Portfolio. This will ensure that theSociety interests are adequately protected, to ensure equitable distribution of funds,encourage liquidity planning <strong>and</strong> enhance effective communication <strong>and</strong> informationflow between the SACCO <strong>and</strong> its members.The Board of Directors has reviewed the Credit Policy <strong>and</strong> Procedures Manual withthe support of the Enterprise Skills Development Consultants Africa Limited. Thedocument shall become the Loaning Policy for Kimisitu SACCO Society with effectfrom 1 st August, 2012.Due to the rapid growth of Kimisitu SACCO Society <strong>and</strong> the increase in the lo<strong>and</strong>em<strong>and</strong>s for the benefit of the <strong>society</strong> <strong>and</strong> the members in general, the Board ofDirectors found it necessary to redefine the Credit Policy <strong>and</strong> Procedures to make itmore efficient in the provision of services to its members. Since the Society isgrowing <strong>and</strong> many products are being introduced, it was found necessary that theSACCO Credit Policy <strong>and</strong> Procedures are reviewed. Currently, Kimisitu SACCOprovides Back Office Services (BOSA) <strong>and</strong> will in future provide FOSA services.It is expected that, with the increased financial SACCO stability, every member ofKimisitu SACCO Society shall prosper. This <strong>policy</strong> <strong>and</strong> <strong>procedures</strong> shall be reviewedCredit Administration Policy <strong>and</strong> Procedures ManualPage 7 of 67

as may become necessary from time to time.Kimisitu SACCO Society Limited1.2 LegislationAll loans must be made in accordance with the provisions in the CooperativeSocieties Act, Rules, SACCO Act, SACCO Regulations <strong>and</strong> the SACCO By-Laws.1.3 Policy <strong>and</strong> Procedures Manual ViolationAny violation to this Credit Policy <strong>and</strong> Procedures Manual shall be subject todisciplinary action as prescribed by the SACCO Board of Directors.1.4 Policy Approval <strong>and</strong> ReviewThis <strong>policy</strong> takes effect from 1 st August, 2012 <strong>and</strong> will be subject to review annuallyor as may be necessary by the Board of Directors.1.5 DefinitionsUnless otherwise stated in this Policy <strong>and</strong> Procedures Manual the following wordsshall mean:a) Activity: An action, element or decision representing a prescribed step in theprocedure process.b) Board of Directors: Members elected by the Kimisitu Savings <strong>and</strong> CreditCooperative Society Limited at the Annual General Meeting who ultimatelywill be responsible for the <strong>policy</strong> making operations of the Society.c) Credit Committee: A Board Committee appointed by the Board of Directorscomprised of members responsible for the approval of loans within theapproved lending policies as stipulated in this <strong>manual</strong>.d) Chief Executive Officer: An officer hired by the Board of Directorsresponsible for the day to day operations of the SACCO in accordance with therules <strong>and</strong> regulations set by the Board of Directors.e) Credit Manager: This is the officer with delegated authority to consider <strong>and</strong>approve loans within specific limitations as set by the Credit Committee.f) Deposit: means a sum of money paid on terms under which it shall berepaid, with or without interest or premium, <strong>and</strong> either on dem<strong>and</strong> or at atime or in circumstances agreed by or on behalf of the person making the<strong>society</strong> receive it at the risk of the <strong>society</strong> receiving it;Page 8 of 67Credit Administration Policy <strong>and</strong> Procedures Manual

Kimisitu SACCO Society Limitedg) Delinquent Loan: A loan whose repayment terms <strong>and</strong> conditions have beenviolated or a loan granted in violation of the SACCO Loan/ Credit Policy.h) “Equity” is the difference between assets <strong>and</strong> liabilities, or the total ofinstitutional capital <strong>and</strong> other capital accountsi) “Foreclosed assets” means real estate <strong>and</strong> assets of material value that aretransferred to the Society because of non-repayment of a loan.j) Form: A pre-formatted document containing instructions <strong>and</strong> place-holderfor data entry to monitor progress through a particular procedure <strong>and</strong> to ensureproper record-keeping.k) Fixed Deposits: It is Savings by a member whose withdrawal period is fixed.l) Interest Rate: The cost of using moneym) Loan: Any financial transaction or commitment entered into by the SACCOwith a member whereby the other party becomes or could become indebted tothe SACCO.n) Loan Application: A form requiring information used to determine whethera member will be granted a loan.o) Loan Contract: A document that binds the SACCO as lender <strong>and</strong> member asborrower in acknowledgment of a loan granted to the member <strong>and</strong> all subsequentterms <strong>and</strong> conditions associated with the loan.p) Loan Collateral/Security: An asset (any item) of monetary value pledged toensure loan payment <strong>and</strong> may be subject to seizure upon default to offset theindebtedness.q) Management: Refers to the senior staff of the Societyr) Manual: A system of approved <strong>policy</strong> statements <strong>and</strong> corresponding proceduralguidelines <strong>and</strong> supporting forms that direct an organization towards itsoperational goals.s) Market Rate of Interest: A rate of interest determined by the financial marketforces of dem<strong>and</strong> <strong>and</strong> supply <strong>and</strong> is related to the real cost of funds.t) “Member in good st<strong>and</strong>ing” means a member who is current on therepayment of his/her loan payments due to the Society, who is current on makinghis/her required contributions <strong>and</strong> has not in any way acted in a manner which ispotentially damaging to the Society, <strong>and</strong> has fully complied with the policies.Credit Administration Policy <strong>and</strong> Procedures ManualPage 9 of 67

Kimisitu SACCO Society Limitedu) “Minors” shall mean people who are not at least 18 years of age who may notvote or hold office or borrow from the Society.v) Policy: A stated course of action with a defined purpose <strong>and</strong> scope to guidedecision making under a given set of circumstances within the framework ofcorporate objectives, goals <strong>and</strong> management philosophies.w) Procedure: A series of prescribed steps followed in a definite regular orderwhich ensure adherence to the guidelines set forth in the <strong>policy</strong> to which the<strong>procedures</strong> appliesx) “Provision for Loan Losses” is an expense in the income statement to reflectan increase in the probability of losses due to uncollected loansy) Provident Loan: A loan granted to a member for his or her own personalwelfare or for consumption purposes.z) Productive/Business Loan: A loan granted to a member for a use in anincome generating activity (business) intended to earn a return secured by assetsof the said venture <strong>and</strong> its source of repayment is intended to emanate fromrevenue of the said business.aa) “SACCO” means a savings <strong>and</strong> <strong>credit</strong> co-operative <strong>society</strong> registered underthe Co-operative Act <strong>and</strong> licensed under the SACCO Societies Act, 2008.bb) “Society” means “Kimisitu Savings <strong>and</strong> Credit Co-operative Society Limited”.cc) Shares: A member contribution to the Society capitalization subject to reviewby the Board of Directors <strong>and</strong> is not withdrawable.dd) “Share Capital” shall mean members equity in the form of issued <strong>and</strong> fullypaid up shares of common stockee) Savings: Savings by members which can be withdrawn on dem<strong>and</strong> within thenormal working hours as specified by the Society Managementff) Task: A detailed component of an activity specifying required behavior tocomplete the activity.gg) Technical Credit Committee: The Committee constituted by the ChiefExecutive Officer comprising of Management staff such as the Credit Manager,Finance Manager among others for the approval of loans as m<strong>and</strong>ated by theCredit Committee.Credit Administration Policy <strong>and</strong> Procedures ManualPage 10 of 67

2.0 GENERAL POLICY AND PROCEDURESKimisitu SACCO Society Limited2.1 AdministrationA high quality of loan documentation including proper signing authorities,borrowing resolutions shall be instituted <strong>and</strong> maintained. Adequate accountingrecords for a loan shall be required <strong>and</strong> maintained as well as such physical <strong>and</strong>monitoring controls that are necessary to ensure that the loan does not jeopardize orimpair the SACCO financial position.2.2 AuthorityThis Policy <strong>and</strong> Procedures Manual has been approved by the Board of Directors toprovide direction <strong>and</strong> guidelines to the Credit Committee <strong>and</strong> Society staff in order toensure that financial resources are adequately protected, investment in memberloans is of high quality <strong>and</strong> that the Society return on loans is relative to the riskundertaken.2.3 Eligibility for a LoanA member shall be considered for a loan only when he or she fulfils the followingconditions of the <strong>society</strong>:a) Must be above 18 years of age <strong>and</strong> be of sound mindb) Must be a person of high integrity, honest <strong>and</strong> trustworthyc) Must have been a member for a continuous 6 (six) months or as may bedetermined by the loan product. One has to pay the stipulated entrance fees.d) Must have accumulated the prescribed minimum based on multiples (unwithdrawableunless ceases to be a member)e) Must have a set minimum in a Savings/Deposits account or any suchminimum amount as may be set by the Board of Directors from time to timef)Must have no delinquent loang) Committed to save while meeting the loan obligationh) Shall have guarantorsi) Shall not be more than four times non-withdrawable deposit-holding permember or as may be determined by the loan productj)The maximum borrowing by a member shall not exceed 5% of the Society’s totalCredit Administration Policy <strong>and</strong> Procedures ManualPage 11 of 67

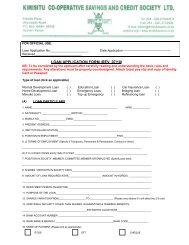

paid up shares/depositsKimisitu SACCO Society Limitedk) Existing members must have a clean past loan repayment recordl)Employees of the Society who wish to apply for a loan under the requirementsset in the <strong>credit</strong> <strong>policy</strong> will be treated as a memberm) All Board of Directors members’ loans should always appear in Board ofDirectors meetings for approval with the absence of the member who hasapplied.n) The loan application must be accompanied by a copy of Identification Card(ID) of the borrowero) Loans will be granted according to the applicant’s qualifications based oncharacter, ability to repay <strong>and</strong> specific compliance with requirements <strong>and</strong>specifications.p) The Society reserves the right to grant or deny a loan despite the formulabased on eligibility2.4. Loan Applicationsa) All loan applications shall be completed in writing on st<strong>and</strong>ard formsprovided by the Society. Verbal applications shall not be entertained. Anapplication fee specified by the Board of Directors shall be paid to the Societyas may be prescribed <strong>and</strong> subject to change from time to time.b) The loan form shall in each case set the amount applied for, the purpose of theloan/advance, terms of repayment <strong>and</strong> security offered.c) The loan/advance application form must be fully completed <strong>and</strong> supported byrelevant supporting documents (such as most recent pay slip, business records<strong>and</strong> current trade license) confirming the applicant’s ability to repay the loancomfortably.d) The loan applications may also be sent by post <strong>and</strong> shall be processedaccordingly.2.5 Loan Processa) Loan applications shall be directed by the applicant <strong>and</strong> during working hoursto the Society offices where the Credit Office will attend to the customer.b) The <strong>society</strong>’s date stamp will be put on the application the same day when it isCredit Administration Policy <strong>and</strong> Procedures ManualPage 12 of 67

eceived <strong>and</strong> processing done in chronological orderKimisitu SACCO Society Limitedc) In the initial discussion, the Credit office shall find out if the prospectiveapplicant meets the requirements, verify the correctness of the informationprovided by the borrower in the application form <strong>and</strong> attachments thereof,<strong>and</strong> number the application form serially <strong>and</strong> enter the application in the loanapplication register.d) If requirements are not met in full, the Credit Office has the prerogative toadvise the customer not to pursue the loan any further.e) If the applicant does not agree with the Credit Officer, the loan applicant hasthe right to contact the Chief Executive Officer, or Finance Manager whotogether with the Credit Manager will enter the final verdict on whether or notthe application should be processed further.f) If requirements are fully met, the Credit Manager can move to the next step,loan assessment <strong>and</strong> analysis.2.6 Assessment <strong>and</strong> Analysisa) The Credit Manager shall in the case of BOSA applicants, make an assessmentof the applicants eligibility based on the salary structure of the member.b) The Credit Manager may where necessary, visit the applicants business,security <strong>and</strong> residence where the relevant demographic, business <strong>and</strong>financial data (as stipulated in the loan application form) are collected.c) The data shall be collected in the form of balance sheet <strong>and</strong> monthly cash flow.Data collected shall be verified (supported by a statement, receipts <strong>and</strong> otherrelevant means) <strong>and</strong> analyzed.d) The visit of the Credit Manager will also include taking of photographs of theSecurity, Business Premises <strong>and</strong> where need arises, the primary applicants infront of his or her business premises or residence.e) As much as possible, the photographs should clearly show the physicalattributes of the person <strong>and</strong> property made available for security. The purposeof the photograph is to enable the Society be able to locate the businesspremises or security if the Credit Manager become unavailable, anotheremployee may use it for identification purpose. During the analysis theapplicant shall be required to declare all existing loan obligations to thePage 13 of 67Credit Administration Policy <strong>and</strong> Procedures Manual

pending further negotiating instead of outright rejection.Kimisitu SACCO Society Limitedm) A loan may also be deferred due to inadequate loaning funds. Action will betaken regarding approval when funds become available.n) When a loan application is denied, the Society shall communicate to theapplicant in writing the reasons for denial of the loan within 14 days.o) If a member is not satisfied with the decision passed by the Credit Committee,they will be required to submit a written appeal to the Board of Directorswithin fourteen days when the decision was passed by the Credit Committee.The decision of the Board of Directors shall be final.p) The Board of Directors shall approve loans for staff <strong>and</strong> Directors.2.9 Purpose of LoanLoans shall be granted for provident <strong>and</strong> productive purposes where repayment willemanate from member’s salary <strong>and</strong> business activities.2.10 Loans to Office Bearers <strong>and</strong> Staffa) Loans to Board members <strong>and</strong> staff shall be approved in the normal loanprocess. This shall however be brought to the attention of the Board ofDirectors provided that such member or employee shall not be present whentheir loan application are being consideredb) All applications for Board members <strong>and</strong> staff loans in excess of deposits shallbe in line with the Credit Policy. The decision of the Board of Directors shallbe final. At least three members of the Board of Directors shall sign theapplication to endorse their decision-approval or otherwise <strong>and</strong> state reasons.c) A Board member who tampers with his/her monthly deposit contribution <strong>and</strong>loan repayment shall be liable for fine as provided for in the By-laws for eachsuch offence committed besides losing his/her position as a committeemember; while an employee who tampers with his/her monthly depositcontribution <strong>and</strong> loan repayment shall face disciplinary action as per section94 of the Cooperative Societies, Cap. 490.2.11 Interest on Loansa) The Board of Directors is empowered by the Society’s By-laws to set <strong>and</strong>Credit Administration Policy <strong>and</strong> Procedures ManualPage 16 of 67

eview loan interest ratesKimisitu SACCO Society Limitedb) The Society will adopt a loan pricing strategy, which will be based on fullsustainability. It will seek to balance institutional sustainability, growth, safety<strong>and</strong> soundness <strong>and</strong> quality of services to membersc) The interest rate on all loans shall be based on market rates to be decided bythe Board of Directors from time to time as dictated by the changes in the baserate. The interest rates will be dynamic <strong>and</strong> competitive.d) The following factors shall be considered when determining interest rates: fullcost of funds, loan risk, inflation, institutional capital building, members’needs <strong>and</strong> market trends. Generally, the <strong>society</strong>’s mark up/margin shall bedetermined by the cost of the fundse) The method of quoting interests shall be decided by the Board of Directorsfrom time to time <strong>and</strong> may vary from one loan product to anotherf) The method of calculating <strong>and</strong> posting interest rates in members’ loanaccounts shall be outlined in the Society’s accounting <strong>procedures</strong> as reviewedfrom time to timeg) The stated interest rates shall exclude legal fees <strong>and</strong> any other direct costrelated to loan processing like collateral valuation2.12 Loan Repayment <strong>and</strong> Recoverya) Loan repayment period shall depend on individual cases in full or byinstallments based on loan agreement <strong>and</strong> contract; which shall takerecognition of the borrower’s current income flow.b) Repayment terms shall clearly show amount relating to the principal loanrepayment <strong>and</strong> interestc) Deductions for loan scheduled for monthly repayments shall commence notlater than the month following that in which the loan was released to thememberd) The members of the Society shall have the obligation to clear their loansborrowed from the <strong>society</strong>, by exercising <strong>credit</strong> discipline so as to maintaingood member-<strong>society</strong> relationship.e) To make good of the borrowed loans, members shall be required to repay theirloans by installments <strong>and</strong> deductions shall be made at source from thePage 17 of 67Credit Administration Policy <strong>and</strong> Procedures Manual

Kimisitu SACCO Society Limitedemployer. Deductions may be effected on the proceeds realized from thebusiness activity, sale of produce through the marketing agent <strong>and</strong> salaries bythe employer. Cash payments shall be accepted by the <strong>society</strong> as another formof loan repaymentf) The member loan repayment plus interest shall not exceed 2/3 of his/her totalproceeds or income at the time of applicationg) A member is free to repay the loan from any other sources besides theindividual’s salary. The Board of Directors may consider these other sourceswhen determining the member’s ability to repay the loan at the time ofgranting provided that the income from other sources is reflected in themember’s savings account in the <strong>society</strong>h) Loan repayment can be made either through check off system, banker’sst<strong>and</strong>ing order or cash payments. Any cash payment done through the bank,bank-pay-in slip should be forwarded to Kimisitu SACCO for receipt <strong>and</strong>recording immediately. It is important to indicate on the pay- in slip thename, personal number of the member <strong>and</strong> purpose of payment.i) Members are advised to ensure timely payment of loan through payroll. If forany reason non-recovery occurs, effort should be made to pay the monthsinstallment through other means e.g. cash, money order etc. Delayedpayments will attract a further penalty on the interest. Members shouldindicate loan type/purpose e.g. emergency, college/school fees etcj) A member’s deposits pledged, as security for another member’s loan shall notbe surrendered to offset his/her outst<strong>and</strong>ing loan unless the former canprovide an alternative security for the loan guaranteedk) The <strong>society</strong> may consider designating an employee to coordinate loanrecovery. If designated, the employee shall work independently from other<strong>credit</strong> activitiesl) Any refinancing of a loan balance, or any request for an extension of time inwhich to pay, shall be agreed to by the Credit Committee only in exceptionalcircumstances. Any extension so granted must be consented to by guarantors<strong>and</strong> shall be treated as though it was a new loan, <strong>and</strong> an extension agreementshall be executed <strong>and</strong> signedCredit Administration Policy <strong>and</strong> Procedures ManualPage 18 of 67

Kimisitu SACCO Society Limitedm) Any loan more than three months overdue may be referred to the guarantorswith a dem<strong>and</strong> notice for them to clear all outst<strong>and</strong>ing loan guaranteed bythem provided that the <strong>society</strong> shall first give written notice of this intentionto the borrower before so actingn) The Supervisory Committee shall monitor the performance of all loans <strong>and</strong> inparticular, the insiders loans (for Board of Directors members, staff, theirrelatives <strong>and</strong> friends) <strong>and</strong> ensure that their repayments are prompt <strong>and</strong>correct.o) The loan repayment periods shall be as follows: Mega Loans ___________up to 60 months Normal Loans ___________up to 48 months Education/School Fees Loans _ up to 12 months Emergency Loans__________ up to 12 months Top Up/Refinancing Loan____ up to 48 monthsNOTE: Loans may be repaid earlier than the agreed term.2.13 Maximum Loana) Loans to any member of the Society shall not exceed 5% of the Society totalassets or as provided for in the Society By-Laws.b) Where there are more applications than funds, the Board of Directors maydecide otherwise on the amount of loan purpose <strong>and</strong> repayment period inorder to maintain adequate liquidity levels in the Society.2.14 Security for Loansa) The Board of Directors or Credit Committee shall ask for such security as itmay consider necessary. The deposits of a member are taken as securityb) Unless the loan applied for is equal to or less than a member’s deposits, itmust be secured by guarantors.c) The total deposits of the borrower <strong>and</strong> guarantors’ commitment must be equalto or more than the loan applied for.d) A member may be granted a loan without guarantor(s) if it does not exceed95% of his/her deposits <strong>and</strong> has not guaranteed any loanCredit Administration Policy <strong>and</strong> Procedures ManualPage 19 of 67

Kimisitu SACCO Society Limitede) No member will be allowed to guarantee more than known capacity asevidenced by the deposits on record at the <strong>society</strong>. The <strong>society</strong> shall maintain aregister to ensure this requirements is not violatedf) All guarantors must be members of the <strong>society</strong> in good st<strong>and</strong>ing <strong>and</strong>acceptable by Credit Committee.g) No member of Board of Directors or any Board committee shall act as anendorser or guarantor, for borrower from the <strong>society</strong>h) A borrower or a guarantor may apply to the Credit Committee for a change ofguarantorsi) The obligation of previous guarantors shall cease upon change of guarantorssubject to the new guarantors being accepted by the <strong>society</strong>. The obligation ofguarantors shall also cease when the loan guaranteed is fully paid, reduced toor less than the borrowers deposits in the <strong>society</strong>. The <strong>society</strong> shall maintain arecord of all guarantors to every loan in each member’s filej) The <strong>society</strong> shall require a borrower who has no check off facility to provideextra security for loan. The priority of such security will be 60% surrendervalue of an insurance <strong>policy</strong>, 50% market value of stock quoted in the stockmarket, 60% value of motor vehicle comprehensively insured, full value oftreasury bonds <strong>and</strong> other negotiable instruments certified by the Board ofDirectorsk) Other security: Mortgage in real estate can be taken as security for a loan notexceeding two thirds of the mortgage value.l) The Credit Committee shall require those applying for loans to produce 100%full security for All Loans. The Society will accept the following as additionalloan security :- Free un-bonded Deposits/savings (Deposits/sav ings less outst<strong>and</strong>ingloans). Consigned free un-bonded Deposits/savings of guarantor Property, business assets, vehicles, farm l<strong>and</strong> <strong>and</strong> any other securityprovided they are valued at the current market rates by professionalvaluers <strong>and</strong> upon presentation of authentic valuation certificates. Group recommendation <strong>and</strong> guaranteeCredit Administration Policy <strong>and</strong> Procedures ManualPage 20 of 67

Kimisitu SACCO Society Limitedm) Log Books Pledged by Third Parties, the <strong>society</strong> will expect the following: Endorsement letters Identification Card (ID) of the owners Certificate of registrations in the case of a registered legal entity Pin Cards for both the endorser <strong>and</strong> the applicant ID cards for both the endorser <strong>and</strong> the applicant. The valuation of the car <strong>and</strong> legal fees shall be paid by the loan applicant. Up to 50% of the surrender value in the case of life insurance cover may beaccepted for loan guarantee.n) The <strong>society</strong> will only accept valuation reports from the AutomobileAssociation of Kenya or any other firms of repute that may be approved by theBoard of Directors, when dealing with motor vehicle log books.o) All security offered must be in place <strong>and</strong> in possession of the Society beforefunds are disbursed.2.15 Loan Disbursementa) Loans will be disbursed when all security documents are completed, signed,acknowledged <strong>and</strong> in place at the Society Office.b) Loan application forms once duly completed shall constitute the loan contract.Loans will be disbursed after approval by the relevant authority subject toavailability of the fundsc) The Society will debit net loan to the member’s loans account in the BackOffice <strong>and</strong> <strong>credit</strong> his/her savings account in the Front Office with the sameamountd) Loans will be disbursed either through cheque to an individual Loanee orSupplier (of inputs services) or <strong>credit</strong>ing the loanee’s Society Savings Accounte) The member can withdraw the money through his or her savings accountthrough the normal proceduref) The <strong>society</strong>, on the request of the borrower, may disburse a loan by makingdirect payments to another organization2.16 Loss of common bonda) Any member, who leaves the common bond (field of membership) as definedPage 21 of 67Credit Administration Policy <strong>and</strong> Procedures Manual

Kimisitu SACCO Society Limitedin the Society’s By-Laws either temporarily or permanently, may be allowed toretain membership provided that such member does not join another Society.Loans granted to such members will not be in excess of security offered. Thissecurity could be the equivalent of the Deposits in the Society savings.b) Any member who loses membership by death where his/her loan claims willhave the balance paid from the Risk Management Fund or any other operatingscheme.c) All doubtful <strong>and</strong> past due loans guaranteed by a member who died will have tobe paid from the Risk Management Fund or by the guarantors.2.17 Loan Delinquencya) The Chief Executive Officer shall at the end of each month prepare a listing ofall loans whose repayment date has been exceeded in the following order: 0-31 days 31-6o days 61-90 days 91-180 days 181 - 365 days 365 days <strong>and</strong> aboveb) The report shall include the following:- Name of borrowers Amount <strong>and</strong> purpose of loan applied for Investigative report <strong>and</strong> analysis Security taken or proposed <strong>and</strong> value Managers recommendations Other loans pending i.e. loans approved but not yet disbursed.c) Such a list shall be presented at all Credit Committee Meetings detailingaction taken to minimize potential loss to the Society.d) The Society will have to levy the interest <strong>and</strong> penalties for the loan defaultede) ALL security pledged or guaranteed shall be realized whenever a loan isdelinquent for more than three months.Credit Administration Policy <strong>and</strong> Procedures ManualPage 22 of 67

Kimisitu SACCO Society Limitedsecured loans approved <strong>and</strong> disbursed by the Manager for formal approval bythe Credit Committee.b) The Society shall produce monthly delinquency report <strong>and</strong> table it to theBoard of Directors. The report shall include the following:- The number of loans in arrears by category (0-3 months, 3-6 months, 6-12 months, <strong>and</strong> over 12 months) The total outst<strong>and</strong>ing principal (unpaid balance) of loans in arrears bycategory The total arrears of all categories in numbers <strong>and</strong> amounts The total ratio of delinquent loans by percentage as it relates to the totalloan portfolio. Action taken on each individual loan to ensure full recoveryc) The Board of Directors shall there upon take action to collect the overdueloansd) A quarterly delinquency report shall be prepared <strong>and</strong> discussed by the Boardof Directors <strong>and</strong> compared with targets to track down the <strong>society</strong>’s overall rateof delinquencye) The Board of Directors shall caution <strong>and</strong> warn any member makingindications of becoming a defaulter <strong>and</strong> the guarantor shall be informedaccordingly. Immediately the loan is defaulted, the Committee shall ensurethat appropriate measures are taken to recover the outst<strong>and</strong>ing loan from theborrower <strong>and</strong> guarantors through all the available machinery including theSociety’s lawyerf) The <strong>society</strong> shall also ascertain that all necessary insurance covers for theloans, in case of the member’s death, are taken. For example a Sinking Fundor Benevolent Fund is established for this purposesg) The <strong>society</strong> shall charge off delinquent loans it considers difficult to collect.This shall be done through the accounting <strong>procedures</strong>. Charged off are notwrite offs. All efforts will be made to recover them <strong>and</strong> proceeds written backin the <strong>society</strong>’s income <strong>and</strong> expenditure account.Credit Administration Policy <strong>and</strong> Procedures ManualPage 25 of 67

Kimisitu SACCO Society Limited2.21.3 Allowance for Doubtful LoansAt the end of each quarter,(after three months), the year- end or any such other timesas the Board of Directors may require, the Chief Executive Officer shall prepare adetailed report of all loans on which the Society anticipates loss of interest <strong>and</strong>/orprincipal.The report shall include the following:-a) Member name <strong>and</strong> addressb) Repayment Termsc) Period in arrears <strong>and</strong> date of last paymentd) Balance of principal <strong>and</strong> interest outst<strong>and</strong>inge) Description of security held including estimated liquidation value <strong>and</strong> sourceof evaluationf) Report on activity on the account since last reportg) Manager’s comments on detailed action being taken to resolveh) Total exposure i.e. loans less cash or security value2.22 Loan Write Offa) The Society shall be required to maintain an allowance of loan losses based onthe Allowance for Doubtful loans report. When all effort to collect the loan hasbeen turned over to the collector or Society lawyer <strong>and</strong> the period hasexceeded 12 months, such loans will be charged off against the allowance forloan loss <strong>and</strong> the same shall be approved by members in a General Meeting.b) The security shall be realized on all savings or Deposits accounts off-settingany amount to be written off shall be applied to the principal sum.c) A record shall be kept of all charged off accounts to be reconciled whenever apayment is received.d) A charge off account may be reactivated upon payment of all interest due <strong>and</strong>reconsidered under new terms <strong>and</strong> conditions as a new loan.e) All charged off loans shall be followed up just as any ordinary loan such thateffort will only cease when the debt has been fully recovered.f) A dividend or bonus will be considered after the Society books have beenCredit Administration Policy <strong>and</strong> Procedures ManualPage 26 of 67

audited <strong>and</strong> the doubtful loans charged off completely.Kimisitu SACCO Society Limited2.23 Risk Management to LoansMembers are encouraged to pay their loans promptly for eligibility to benefits thatwould accrue to the beneficiary in the event of death.a) The cover dem<strong>and</strong>s up to date member’s account.b) Any underpayments within the period will be deducted from the deposits.c) The loan will be fully paid by the appropriate insurance provider in case ofdeath of a member.Credit Administration Policy <strong>and</strong> Procedures ManualPage 27 of 67

2.24 Summary Loan Granting MechanismKimisitu SACCO Society LimitedThe diagram indicates the stages of the loan cycle from granting of the loan up towhen the loan has been fully repaid.Loan ApplicationRegisteredLoan Evaluation/AppraisalLoan Granting/ApprovedLoan RecordedLoan AgreementLoan RejectedLoan DisbursementLoan DeferredOverdueLoan Repayment ScheduleLoan ApprovedLoan ArrearsLoan Repayment As PerScheduled Over a Period ofTimeLoanee MemberLoan DefaultRepayment CompletedCredit Administration Policy <strong>and</strong> Procedures ManualPage 28 of 67

3.0 LOAN PRODUCTS3.1 IntroductionKimisitu SACCO Society LimitedCredit services are intended to enable members to borrow against future savings.Kimisitu SACCO has repackaged <strong>and</strong> introduced the following twelve growthoriented individual loan products that members may obtain at competitive interestrates.The objectives, Eligibility, Mode of loan repayment, Interest <strong>and</strong> other charges <strong>and</strong>Loan security requirements for the various individual growth oriented loan productsare covered in the Credit Policy <strong>and</strong> Procedures Manual.The members <strong>and</strong> clients may obtain either or most of the following loans dependingon their capacity <strong>and</strong> the ability to service the loans. The proposed loan productshave also taken into account the existing Kimisitu SACCO products with a view toensuring harmony in operations.3.2 Normal LoanObjectivesNormal loan is intended to assist the members improve their st<strong>and</strong>ard of livingthrough purchase of l<strong>and</strong>, building of houses <strong>and</strong> any major development project.There are no restrictions as to what purpose it can be put into.EligibilityA member must have;a) At least six months consistent contributions of at least Kshs 3,000 or anagreed amount for members outside payrollb) Pledge of salary from both current <strong>and</strong> future income will be expected from amember who applies for a loan.c) Multiplier is three (3) times the members’ non-withdrawable deposits.d) Maximum normal loan is Kshs. 10,000,000/-or as may be fixed by the Boardfrom time to time.e) Maximum loan shall not exceed 5% of the Society’s deposits.f) Capacity to repayCredit Administration Policy <strong>and</strong> Procedures ManualPage 29 of 67

g) Provide security in form of guarantors or assets to secure the loanKimisitu SACCO Society Limitedh) Notification of the amount qualified for is issued immediately the applicationis certified correct. This enables the member to plan.Mode of loan repaymenta) The repayment period shall be determined by the Board of Directors but in allcases shall not exceed 60 monthsb) Deductions for loan repayments shall commence not later than the monthfollowing that in which the loan was paid to the memberc) A member will be required to repay the loan within the time specified on theloan application form.d) Loans will be repaid from a member’s salary/earning <strong>and</strong> no member shouldbe allowed to suffer total deductions including savings, loan repayment <strong>and</strong>interest in excess of two thirds of his /her monthly basic salary or agreedrepayment schedule. Nothing in the foregoing need prevent any member fromrepaying his/her loan <strong>and</strong> interest in whole or in part, prior to its maturity.e) Basic salary excludes rental house allowance. While a member is allowed torepay the loan from other sources beside the individual salary, under nocircumstances should these sources be taken into account in determining themember’s ability to repay the loan at the time of granting the loanf) For members not in full time employment, they shall be required to showproof that they are capable of repaying the loan by giving a statement of theirincome for the past six months.Interest <strong>and</strong> other chargesa) The interest rate on loan is 12% per annum on reducing basisb) A penalty charge of the loan repayment amount per month shall be levied <strong>and</strong>added to a member’s loan if loan repayment remittances are not received bythe 15th day of the following month.Loan security requirementsa) Loans shall be secured by the member’s savings, other savings in the Society<strong>and</strong>b) At least three (3) or agreed number of guarantorsPage 30 of 67Credit Administration Policy <strong>and</strong> Procedures Manual

Kimisitu SACCO Society Limited3.3 Education/School fees LoanObjectivesThe purpose of the education loan is to provide short-term finance for education ofthe members <strong>and</strong> their dependants in schools, colleges <strong>and</strong> universities. This is whatis commonly known as School fees loan.Eligibilitya) Member must have the ability to repayb) The total of all outst<strong>and</strong>ing loans, including school fees must never exceedthree times members’ deposits.c) Payments may be made direct to the school, on request.d) Need not attach copies of documentary evidencee) Maximum education loan is Kshs. 500,000 per member per year subject to1/3 rule repayable within 12 months.f) Granted within 7 daysMode of Loan RepaymentThe maximum repayment period is 12 months or as may be set by the Board ofDirectors.Interest <strong>and</strong> other chargesa) The interest rate on loan is 1% per month on reducing basisb) A penalty charge of the loan repayment amount per month shall be levied <strong>and</strong>added to a member’s loan if loan repayment remittances are not received bythe 15th day of the following month.Loan Security Requirementsa) Loans shall be secured by the member’s savings in the education scheme,other savings in the Society <strong>and</strong> at least three (3) Society guarantorsb) Applications must be received by close of business every Tuesday to facilitateprocessing for cheques to be ready for dispatch by Friday afternoon.Credit Administration Policy <strong>and</strong> Procedures ManualPage 31 of 67

3.4 Emergency LoanObjectivesKimisitu SACCO Society LimitedThe loan facility is available to members to meet urgent needs such as suddenhospitalization, death of next of kin, natural disasters, fire <strong>and</strong> robbery or any otherspecified causes by the Board of Directors.Eligibilitya) Emergency loan will be considered as a benefit to good members only.b) Shall always be given within a member’s entitlement.c) Loan issued at 3 times the deposits held less any outst<strong>and</strong>ing loansd) A member does not have to produce acceptable <strong>and</strong> satisfactory documentaryproof of the occurrence of the emergency, e.g., valid hospitalization invoice,burial permit, etc.e) A member will receive one emergency loan at a time.f) Emergency loans are disbursed once a weekg) Maximum amount is Kshs 500,000.h) No attachments are required on all emergency cases except copies of ID <strong>and</strong>pay slips.Mode of loan repaymenta) Repayment period is 12 months or lessInterest <strong>and</strong> other chargesa) The interest rate on loan is 1% per month on reducing basis <strong>and</strong> may varydepending on the market conditions,b) A penalty charge of the loan repayment amount per month shall be levied <strong>and</strong>added to a member’s loan if loan repayment remittances are not received bythe 15th day of the following month.Loan security requirementsa) Loans above the exposure limit must be secured by an acceptable securityb) Application forms shall have supporting documents together with current payslip or other acceptable supporting documents.Credit Administration Policy <strong>and</strong> Procedures ManualPage 32 of 67

Kimisitu SACCO Society Limited3.5 Emergency Top Up Loan: One must have an existing emergency loan in order to apply for an emergencyloan top up. Maximum amount is Kshs 300,000 Maximum repayment period is twelve months Granted once a week. One needs to sign an offset agreement 5% interest charged as a one-off payment on the loan balances being offset. Applications MUST be received by the close of business every Tuesday tofacilitate the disbursement of the loans by Friday afternoon.3.6 Refinance Loan/ Top up LoanObjectivesThe loan is provided to a member who already has an existing loan for purposes ofcompleting an existing project or business. This shall be determined bymultiplication of the member’s deposits less all the loans outst<strong>and</strong>ing. The net iswhat is granted to the member as top upEligibilitya) A member must have a running home development or a development loan inorder to qualify for a refinancing loan.b) The outst<strong>and</strong>ing loan(s) <strong>and</strong> a commission will be deducted from the totalloan requested. The request must be done in writing. Commission due onabove may be paid in cash or deducted from the loan requested according tothe member’s wish.c) Multiplier is 3 times the members deposits less the outst<strong>and</strong>ing lo<strong>and</strong>) Capacity to repay.e) Offer security in form of guarantors or assets to secure the loanf) The <strong>society</strong> refinances this loan to members with uncompleted projects whenthere are sufficient funds.g) Member shall pay the full expected loan interest amount i.e. of theoutst<strong>and</strong>ing loan balance in cash.Credit Administration Policy <strong>and</strong> Procedures ManualPage 33 of 67

h) Refinancing loans are granted once a week.Kimisitu SACCO Society LimitedMode of loan repaymenta) Maximum repayment period is eighteen months.b) A letter giving authority for the deduction is m<strong>and</strong>atory. However, memberswho wish to clear their outst<strong>and</strong>ing loans by paying cash <strong>and</strong> applyimmediately for normal loans will be charged 5% of the outst<strong>and</strong>ing normalloans.c) Normal/top-up loans must have to be applied for by 20th of the month <strong>and</strong>will go through due processInterest <strong>and</strong> other chargesa) Commission to be charged to any member who requires a normal loan but isnot able to clear the outst<strong>and</strong>ing loan in cash. The commission of 10% of thetotal loans outst<strong>and</strong>ing or as may be fixed by the Board from time to time ischargeable.b) A penalty charge of 3% of the loan repayment amount per month shall belevied <strong>and</strong> added to a member’s loan if loan repayment remittances are notreceived by the 15th day of the following month.Loan security requirementsa) Loans shall be secured by the member’s savings, other savings in the Society<strong>and</strong> guarantors3.7 Home Development Loan Home development loan are processed within a month from the date ofreceipt of the loan application form. Maximum repayment period is forty eight (48) months. Loan granted is three times the member’s savings less all outst<strong>and</strong>ing loansprovided that one third rule is not violated. The maximum loan granted shall be Kshs 5,000,000. Interest rate is 1% per month on reducing balance.Credit Administration Policy <strong>and</strong> Procedures ManualPage 34 of 67

3.8 Bridging Loans (Mavuko Loan)Kimisitu SACCO Society Limited This loan can be used to clear running emergency, education or refinancingloans. The existing loans must have been repaid for a period of not less than twomonths 5% interest charged as a one-off payment on all loan balances being cleared. Maximum repayment period is 24 months Two thirds rule will apply Granted within 2 weeks. Interest rate is 1% per month on reducing balance3.9 Motor Vehicle Insurance Loan Maximum repayment period is 12 months. Two thirds rule will apply Must be fully guaranteed Interest rate is 1% per month on reducing balance Insurance available with CIC Insurance only Granted once a week Maximum set limit is one year’s premium payable3.10 Masaa Loan Loan to be applied <strong>and</strong> disbursed the same day Must be fully guaranteed It has to be within the three times loan limit Maximum loan amount Kshs. 500,000/- Repayable within 12 months Interest rate is 1.25 % per month on reducing balance Processing fee of 1% (Minimum Kshs. 1,000/- ) of the loan applied to cater forbank <strong>and</strong> administration chargesCredit Administration Policy <strong>and</strong> Procedures ManualPage 35 of 67

4.0 CREDIT PROCEDURES FOR LOAN PRODUCTSKimisitu SACCO Society Limited4.1 Normal Loans When a member brings an application, the Credit Officer will engage the memberin a discussion with the aim of finding out the purpose of the loan being applied<strong>and</strong> advising him /her on when the loan will be granted <strong>and</strong> any otherinformation. The loan applications may also be mailed to the Society. The form will be received in the Credit section <strong>and</strong> he will check if all the relevantattachments have been availed i.e Copy of the ID, two current pay slips. The form should be duly filled <strong>and</strong> signed <strong>and</strong> witnessed If the member is in Management, his loan form should be stamped by Humanresources department. The Credit section will check if the member qualifies for the loan .In particular, heshould check the following:a) The member should qualify under the 2/3 ruleb) The member should have been in the <strong>society</strong> for six monthsc) The loan applied should be 3 times his deposits less any loan outst<strong>and</strong>ing.d) The Loan should be fully guaranteed <strong>and</strong> any other requirement specifiedin the loaning <strong>policy</strong>. The Loan will be keyed into the system <strong>and</strong> the member informed of his loannumber <strong>and</strong> the member shall be informed that the loan will be paid through theFOSA Account <strong>and</strong> all other modes of payment that he can access his loan i.e,ATM withdrawals, EFTs, Bankers Cheques. The Credit Officer will inform the member on how much the member will begranted before he leaves. The Credit Officer will work on the forms <strong>and</strong> forward them to the CreditManager before the end of the following day. The Credit Manager will work on the form within a day after receiving them, Where he finds a variance on the application form he should inform the CreditOfficer <strong>and</strong> call the member to inform him of the changes. The Credit Manager will produce the schedule of the loans approved to be takento the Board of Directors.Credit Administration Policy <strong>and</strong> Procedures ManualPage 36 of 67

Kimisitu SACCO Society LimitedFor loans that have been approved before the Board of Directors approval, theyshould be explained on the Board of Directors reportThe Report <strong>and</strong> the forms should be forwarded to the Credit Committee on aweekly basis.The Credit Manager will attend the Credit Committee meeting where he will statethe loan approved <strong>and</strong> will make the schedule to be taken to the ICT departmentfor recovery on the same day.The Credit Manager will send a text message informing him that his loan hasbeen approved <strong>and</strong> that he should liaise with the Credit department on thevarious modes of payments available.Modes of Payment The Credit Manager will send an official letter that have instructions on paymente.g. EFTs, Bankers Cheque etc. This will also include instructions to pay outst<strong>and</strong>ing liabilities e.g. advances <strong>and</strong>other loans to be cleared4.2 Emergency Loans When a member applies for an Emergency Loan, the Credit Officer will confirmwith the member if the purpose for the loan is valid for an Emergency case. The Credit Officer will key in the application <strong>and</strong> forward it to the Credit Manager The Credit Manager will recommend <strong>and</strong> forward it to the Chief Executive Officer For cases where the Credit Manager differs with the recommendation of theCredit Clerk, he should talk to the member <strong>and</strong> explain to him the basis on whichhe differs with the amount recommended. The Credit Manager will recommend <strong>and</strong> forward it to Management for signingby the Technical Credit Committee. For Emergency cases the Assistant Accountant will key in the amount approved<strong>and</strong> make the payment. After 30 minutes the Credit Officer will check if the cheque for the loan has beenprepared, if not he will inform the Credit Manager immediately.Credit Administration Policy <strong>and</strong> Procedures ManualPage 37 of 67

4.3 Education- School Fees LoansKimisitu SACCO Society Limited When the Credit Officer receives an application for the Education/ school fees, hewill check if the member qualifies as mentioned above <strong>and</strong> in addition check if themember has taken a school fees previously. The Credit Officer will take one day to work on the forms <strong>and</strong> forward them to theCredit Manager All Education /school fees loans should be approved <strong>and</strong> forwarded to theAccounts Department for posting For cases where a member does not qualify or the Credit Manager has madeadjustments on their applications, the Credit Manager will inform the membersimmediately <strong>and</strong> make a report to the Credit Committee. These forms will be processed as they are received <strong>and</strong> forwarded to the TechnicalCredit Committee for approval.4.4 Loan Top-Ups The member will go to the Credit section who will assess his/her eligibility beforeissuing the loans form He will then attach 2 months pay slips <strong>and</strong> process as normal loan <strong>and</strong> then notifythe members within the period Then the form once fully filled will be forwarded to the Credit Manager who willthen verify the attachments <strong>and</strong> certify with a common seal, These forms will be forwarded to the Chief Executive Officer for final authority. Once the loan has been approved, the Assistant Accountant will post in themembers account. The Credit Officer will then notify the member immediately indicating therepayment period <strong>and</strong> any charges levied.4.5 Other Procedures4.5.1 Processing Loans All loans forms <strong>and</strong> other relevant documents moving from loans departmentshould be registered <strong>and</strong> the recipients should sign upon receiving the sameCredit Administration Policy <strong>and</strong> Procedures ManualPage 38 of 67

indicating the date <strong>and</strong> the time.The register will be kept by the Credit ManagerKimisitu SACCO Society Limited4.5.2 Loans Cleared By Advances Loans less than Kshs 100,000 A member intending to clear his/her loan will first go to the Credit section thatwill assess the eligibility within 15 minutes The clearance request form will be forwarded by the member to the CustomerCare who will forward to the Credit Manager within 15 minutes The Credit Manager will then reply to the Credit Manager by 3 pm informing himthat the loan has been cleared or otherwise4.5.3 Loans Cleared By Cash/ChequesThe member will go to the Credit Manager who will advice as follows; For those boosting their deposits, they will be required to wait for 6 months toqualify for another loan They will then be referred to the Accounts section to be given the payment adviceschedule Those who clear by cheques, the Credit section will be required to wait until thecheque is cleared i.e after 14 days This information will be communicated by the Finance Manager through a Memo4.5.4 Loans Appeal This should be done in writing stating the grounds of appeal supportingdocuments. They should be received by the Credit Officer who will attach with the loans formaccompanied with the members file before forwarding to the loans officer. There should also be a letter from the guarantors giving their consent <strong>and</strong>authority with regard to the adjustment if it will be more than what had beenapplied. This should then be forwarded to the Credit Manager immediately The Credit Manager will put his remarks <strong>and</strong> then forward to the next <strong>credit</strong>committee Meeting i.e Thursday All the other <strong>procedures</strong> will then follow.Page 39 of 67Credit Administration Policy <strong>and</strong> Procedures Manual

4.5.5 Savings RefundKimisitu SACCO Society Limited When one wants to withdraw from the <strong>society</strong>, he or she will be referred to theCredit Manager or Marketing Manager to see whether they can be advised on theneed to maintain their membership. This should be done immediately <strong>and</strong> they need to be h<strong>and</strong>led within 5 minutes. The issues to be covered include:o Establish the reason as to why he/she wants to resigno Advice on when to expect their funds i.e 3 days after Board meetingo Advice on the processing fee for those with loans <strong>and</strong> the prescribed sharecapitalo Advice on the different products, services <strong>and</strong> investment opportunitiesavailable If the issue involves a member of staff, call the one mentioned so that the issuecan be addressed in his/her presence If the issues are beyond the staff level <strong>and</strong> one is convinced that the issue can beaddressed further, refer to the Chief Executive Officer or any other official. If one insists on resigning, he/she will be advised on how to write the withdrawalletter He /she will also be advised on the need to replace guarantors He/she will be advised on the maturity date i.e 60 days Withdrawal letters maturing between 1 st <strong>and</strong> 10 th of the month will beconsidered for payment They will be advised on the different modes of payment <strong>and</strong> that they need tospecify clearly For those who send through mailing, the Credit Officer will forward the same tothe Credit Manager who will call the member <strong>and</strong> advise him or her The Credit Officer will make sure that the letter being received is correctly written<strong>and</strong> signed, the guarantors’ signature <strong>and</strong> witness, a copy of ID for the newGuarantor He should also confirm whoever advised the member If everything is in order, he should stamp, register <strong>and</strong> serialize the same The Credit Officer will then replace the Guarantors <strong>and</strong> print the Guarantor cardPage 40 of 67Credit Administration Policy <strong>and</strong> Procedures Manual

indicating both the new <strong>and</strong> oldKimisitu SACCO Society LimitedThe Credit Officer will make remarks on the new card indicating whether the loanhas been cleared or not <strong>and</strong> attach supporting documents for the sameThe Credit Officer will then forward the same in the evening to the CreditManagerThe Credit Manager will then check if all the documents are in orderThe Credit Manager will call registry to request for the files <strong>and</strong> they should beprovided immediately.The Credit Manager will start processing the files that have matured <strong>and</strong> ensurefiles are returned to him on the same day.In case there is an issue arising from the clearance, the Credit Manager willcommunicate to the member within 3 days.The Credit Manager will extract the Deposit refund report <strong>and</strong> the files <strong>and</strong>forward them files to the accounts departmentThe files should be registered as they are taken to accounts department.4.5.6 Clearance The clearance form will be received by the Credit Officer, he will check if themember has replaced the member he has guaranteed He will then advice him to replace the members he has guaranteed. If the member has not guaranteed any one he will originate the clearancesummary sheet <strong>and</strong> call the responsible officer to take it to the relevantdepartments’ i.e ICT, Loans <strong>and</strong> accounts. As the member is waiting for the clearance to be processed, he will call theMarketing Manager who will come to talk to the member After it is signed it will be taken to the Credit Manager who will sign the clearance<strong>and</strong> advice the member accordingly. He will advice the member on the mode of payment if he would wish to continuewith membership, he will also take the contacts of the member <strong>and</strong> forward themto the marketing department. This process will take not more than 30 minutes.Credit Administration Policy <strong>and</strong> Procedures ManualPage 41 of 67

Kimisitu SACCO Society Limited4.5.7 Death Claims The Office will receive notification from the employer Human Resource once in aweek; he will contact the next of kin indicating the will of the <strong>society</strong> to help in thefuneral expenses. He will notify the Chief Executive Officer who will make arrangement for theperson who will go to see the bereaved family within 3 days, where the person isan employee or board member. The representative will inform the bereaved family of the <strong>society</strong>’s help <strong>and</strong>requirements in the death claim The Credit Manager will notify the insurance company (C.I.C or other provider)<strong>and</strong> the next of kin within 3 days <strong>and</strong> copied to the welfare <strong>and</strong> Benevolent Funds. If these documents are not received within one month the Credit Manager willmake a follow up with the next of kin by sending a reminder When all relevant documents are received, the Credit Manager will launch a claimthe following day If he does not receive a payment within 14 days he should launch a complaint inwriting. When paid he will make a provision in the shares refund report <strong>and</strong> inform thenext of kin. Where there is a dispute, all concerned parties will be called to the office toresolve the dispute.4.5.8 Returns to Insurance Loans Processes The Credit Manager will send a list of all the loans approved for that particularmonth on or before 5th of every month. He should do reconciliation with the schedule sent against the control accountbefore 10 of every month. He should make a report <strong>and</strong> make adjustments before 15 of every month4.5.9 Guarantors For a member to qualify as a guarantor one has to have been a member for sixmonths,Page 42 of 67Credit Administration Policy <strong>and</strong> Procedures Manual

Kimisitu SACCO Society LimitedMembers of staff are not allowed to guarantee other members of the <strong>society</strong>.4.5.10 Replacement of Guarantors This will be done on request of the member or when a member is withdrawingfrom membership. The member will be given a irrevocable guarantor form to fill which he will attacha copy of the ID. If a member cannot be able to get a guarantor, an apportionment of the loanhe/she has guaranteed will be calculated <strong>and</strong> will be retained until the loan iscleared.4.5.11 Roles of the Credit Committee The Credit Manager will arrange for the Credit Committee meetings, he willensure the schedules <strong>and</strong> forms are ready. He will also liaise with them wheneverthere are issues to be addressed <strong>and</strong> keep them updated on the loans statusregularly <strong>and</strong> advice them on cash provisions, <strong>and</strong> the loaning <strong>policy</strong>. He should take minutes incase the secretary is absent; the minute should beavailable within 3 days. The Technical Credit Committee should meet at least once a week preferably onThursdays. The Credit Committee should meet at least once a month4.5.12 DefaultersThe Credit Manager will print defaulters list on the first day of the monthHe will check individual accounts <strong>and</strong> produce a report of reasons for non paymentsby 5th of every month. He will then categorize the reports as follows.a) TerminatedThe Credit Manager will write to the member requesting him to inform the office onhow he intends to service the loan <strong>and</strong> inform him on the various modes of payment.The Credit Manager will write these letters within 7 days. He will then write the firstnotice in the following month by 7th. When he sends the 3rd notice he will informAccounts department to pass journals <strong>and</strong> make a schedule to IT for recovery.Credit Administration Policy <strong>and</strong> Procedures ManualPage 43 of 67

Kimisitu SACCO Society Limitedb) DeceasedThe Credit Manager will contact the Insurance company (C.I.C or other provider) toget the loan paid as stipulated in death claims above.c) UnrecoveredExtract list <strong>and</strong> forward to ICT department by 5th of every monthICT department will be expected to give a report on the sameIf the member is not in payroll the procedure for termination will be appliedd) Payroll ClosureCheck against list submitted to ICT. Ensure they feature in the schedule to besubmitted to ICT department.Credit Administration Policy <strong>and</strong> Procedures ManualPage 44 of 67

Kimisitu SACCO Society Limited5.0 FUNCTIONS OF THE CREDIT COMMITTEE AND CREDIT OFFICE5.1 Duties of the Credit CommitteeThe Credit Committee consists of three members of the Board of Directors .ThisCommittee is chosen within seven days of each General Meeting. The Board shallelect its Chairman, Secretary <strong>and</strong> members. It shall hold such meetings as thebusiness of the <strong>society</strong> may require but not less frequently than once a month.Main Dutiesa) Ensure establishment <strong>and</strong> review of appropriate <strong>credit</strong> <strong>policy</strong> consistent withthe relevant provisions of the regulations <strong>and</strong> these bylawsb) Ensure that the problem loan accounts are adequately identified <strong>and</strong> classifiedas prescribed in the regulations.c) Ensure adequate provisions for the potential lossd) Review periodic <strong>credit</strong> <strong>and</strong> loan portfolio reports of the Society beforesubmission of the board.e) Endeavour diligently to assist members to solve their financial problemsf) Observe the loan <strong>policy</strong> <strong>and</strong> the By-Laws when acting on Loan Applications.g) Keep minutes of their meetings <strong>and</strong> detailed reports about their deliberationsfor the consumption of the Board.The Credit committee has therefore a very important function to undertake withinthe Board of Directors of a <strong>society</strong>. They should analyze the lending activity toevaluate the efficiency of the lending process. They are supposed to fulfill theobligations of the <strong>society</strong> faithfully <strong>and</strong> with determination. The <strong>credit</strong> committee isexpected to make detailed reports about their deliberations for the consumption ofother committees <strong>and</strong> the general membership.5.2 Credit OfficeObjectives of the Loans Officea) The main objective of Credit Office is to Lend out loans to members at areasonable rate of interest as set out in the Loans/ Lending/Credit PolicyCredit Administration Policy <strong>and</strong> Procedures ManualPage 45 of 67

Kimisitu SACCO Society Limitedb) After lending the second objective of the Credit Office is to ensure that theloans are recovered as soon as possible so that funds become available forfurther Lending.c) In carrying out the two main objectives, Credit Office shall strive to give thebest services to members in the shortest possible period withoutdiscrimination or favour.d) Credit Manager shall hold interviews with members where need be in order toform a fair opinion of each application where need arises before loans are lentout to members.e) Reports on dem<strong>and</strong> for loans, defaulters, loans staff matters, <strong>credit</strong> committeedeliberations, loans funds requirements <strong>and</strong> any required changes to theBoard through the Chief Executive Officer.Reportinga) Reporting is of various forms <strong>and</strong> the regularity of reporting shall depend onthe type of report.b) Credit Committee minutes shall be reported every time the Credit Committeemeets.c) Staff reports should be on a monthly basis to the Board <strong>and</strong> weekly to theChief Executive Officer.d) Reporting on delinquencies should be on monthly basis.5.3 Duties <strong>and</strong> Work Procedures of the Credit Managera) Receiving Loan forms attached to member files with folio Loan applicationnumber clearly indicated on the member’s file which the Credit Manager shallinitial after acting on the Loan form.b) The Credit Manager has to check the history of the member from Members’file in order to form a fair opinion of granting the applied loan. When goingthrough the file, the Credit Manager will try to underst<strong>and</strong>:- Whether the applicant is the bonafide member who has applied bychecking the details of the copy of Identity card attached to the loanapplication <strong>and</strong> the details of the documents in the file like the namesof the member file number, corresponding ID number in the fileCredit Administration Policy <strong>and</strong> Procedures ManualPage 46 of 67

documentsKimisitu SACCO Society Limited Whether the member has completed the initial six months maturityperiod before applying for a loan If the applicant has applied for previous loans has the member beenpaying regularly Personal address of the member <strong>and</strong> referees incase need arise tocontact the member Creditability of the member - Past payments of loans <strong>and</strong> regularcontributions to the Society should be established. Status nonconvictionshould be considered by confirming that the member is inpayroll incase of common bond members. For non common membersan inquiry <strong>and</strong> preferably personal interview should be undertaken toestablish proper <strong>credit</strong>ability of a member applying for loans Age of the member may be checked either from Identity card or fromthe information in the file in view of considering the repayment periodin regard to retirement age.c) The Credit Manager has to go through all applications in order to satisfyoneself that the form is completed by the applicant in all the space providedfor filling properly <strong>and</strong> with correct information.d) When checking / accessing the form the following major points should beconsidered: What type of loan is applied for <strong>and</strong> if it has all the supportingdocuments <strong>and</strong> details or information required for that particular typeof loan? In case the details <strong>and</strong> information is not complete orinadequate the member-loan applicant should be contacted <strong>and</strong>interviewed or asked to produce the required information ordocuments. The guarantors should be checked to obtain that the loan applied iswell covered by the guarantors incase of common bond members. On open bond <strong>and</strong> retirees the security should be certificates of sharesfor the Society <strong>and</strong> cash deposits in the front office. Other securitiesother than our property should be well charged or be placed in ourCredit Administration Policy <strong>and</strong> Procedures ManualPage 47 of 67

custody until the loan is repaid in full.Kimisitu SACCO Society Limited The part to be filled <strong>and</strong> signed by the establishment office whichconfirms that the member is still on payroll in case of common bondmembers should be noted to have been completed or else the membershould be asked to have the part completed before assessment. Repayment authority should be signed in the form <strong>and</strong> witnessed byanother member.e) The form ought to have been appraised by the Accounts Section thusindicating the status of the member in the Society:- Here the actual share contributions are shown The qualifying amount i.e. multiple of lending times actual sharescontribute or any other factor decided by the board depending on thefinancial capacity of our Society at the time in consideration. If there is any Loan owing, the balance should be given <strong>and</strong>, The difference between the qualifying point <strong>and</strong> the balance of loanindicated.The underlying idea here is that if there is no loan balance then the member shouldhave the maximum qualifying point considered for loan should the member apply forthe same <strong>and</strong> when we consider other factors as payments, repayment period, <strong>and</strong>credibility. If on the other h<strong>and</strong> there is a balance, the qualifying point shall be thedifference between the maximum less the balance of loan.This can only be considered in case of emergency loans.a) A statement of Account indicating share contribution <strong>and</strong> loans taken <strong>and</strong> arebeing repaid or those taken <strong>and</strong> have been completely repaid.b) When it comes to calculating the actual loan amount the member can get, thefollowing has to be considered by the loans officer. What amount the member has applied for. Trends in produce payments The amount of shares the member has applied. The shares times the multiplying factor (shares) shall give thequalifying loan amount.Page 48 of 67Credit Administration Policy <strong>and</strong> Procedures Manual