Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

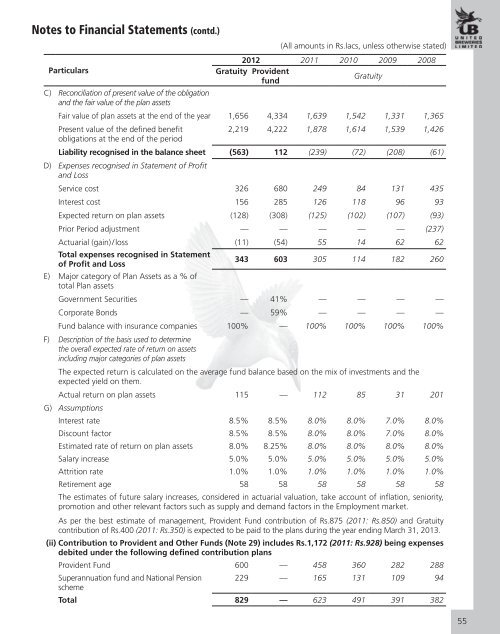

Notes to Financial Statements (contd.)Particulars(All amounts in Rs.lacs, unless otherwise stated)<strong>2012</strong> <strong>2011</strong> 2010 2009 2008Gratuity ProvidentGratuityfundC) Reconciliation of present value of the obligationand the fair value of the plan assetsFair value of plan assets at the end of the year 1,656 4,334 1,639 1,542 1,331 1,365Present value of the defined benefit2,219 4,222 1,878 1,614 1,539 1,426obligations at the end of the periodLiability recognised in the balance sheet (563) 112 (239) (72) (208) (61)D) Expenses recognised in Statement of Profitand LossService cost 326 680 249 84 131 435Interest cost 156 285 126 118 96 93Expected return on plan assets (128) (308) (125) (102) (107) (93)Prior Period adjustment — — — — — (237)Actuarial (gain)/ loss (11) (54) 55 14 62 62Total expenses recognised in Statementof Profit and Loss343 603 305 114 182 260E) Major category of Plan Assets as a % oftotal Plan assetsGovernment Securities — 41% — — — —Corporate Bonds — 59% — — — —Fund balance with insurance companies 100% — 100% 100% 100% 100%F) Description of the basis used to determinethe overall expected rate of return on assetsincluding major categories of plan assetsThe expected return is calculated on the average fund balance based on the mix of investments and theexpected yield on them.Actual return on plan assets 115 — 112 85 31 201G) AssumptionsInterest rate 8.5% 8.5% 8.0% 8.0% 7.0% 8.0%Discount factor 8.5% 8.5% 8.0% 8.0% 7.0% 8.0%Estimated rate of return on plan assets 8.0% 8.25% 8.0% 8.0% 8.0% 8.0%Salary increase 5.0% 5.0% 5.0% 5.0% 5.0% 5.0%Attrition rate 1.0% 1.0% 1.0% 1.0% 1.0% 1.0%Retirement age 58 58 58 58 58 58The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority,promotion and other relevant factors such as supply and demand factors in the Employment market.As per the best estimate of management, Provident Fund contribution of Rs.875 (<strong>2011</strong>: Rs.850) and Gratuitycontribution of Rs.400 (<strong>2011</strong>: Rs.350) is expected to be paid to the plans during the year ending March 31, 2013.(ii) Contribution to Provident and Other Funds (Note 29) includes Rs.1,172 (<strong>2011</strong>: Rs.928) being expensesdebited under the following defined contribution plansProvident Fund 600 — 458 360 282 288Superannuation fund and National Pension 229 — 165 131 109 94schemeTotal 829 — 623 491 391 38255