Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

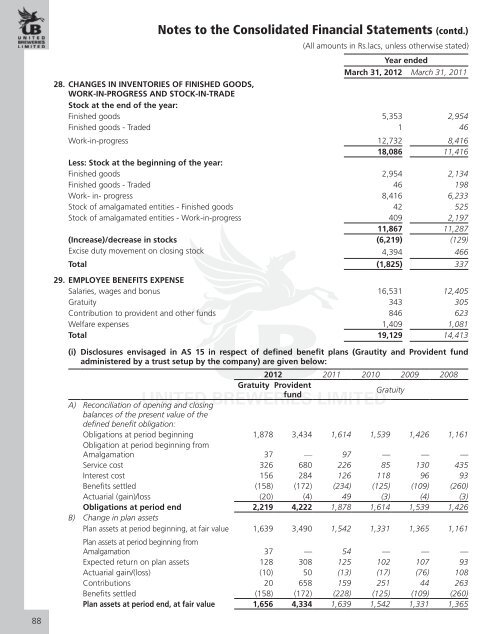

Notes to the Consolidated Financial Statements (contd.)(All amounts in Rs.lacs, unless otherwise stated)Year endedMarch 31, <strong>2012</strong> March 31, <strong>2011</strong>28. CHANGES IN INVENTORIES OF FINISHED GOODS,WORK-IN-PROGRESS AND STOCK-IN-TRADEStock at the end of the year:Finished goods 5,353 2,954Finished goods - Traded 1 46Work-in-progress 12,732 8,41618,086 11,416Less: Stock at the beginning of the year:Finished goods 2,954 2,134Finished goods - Traded 46 198Work- in- progress 8,416 6,233Stock of amalgamated entities - Finished goods 42 525Stock of amalgamated entities - Work-in-progress 409 2,19711,867 11,287(Increase)/decrease in stocks (6,219) (129)Excise duty movement on closing stock 4,394 466Total (1,825) 33729. EMPLOYEE BENEFITS EXPENSESalaries, wages and bonus 16,531 12,405Gratuity 343 305Contribution to provident and other funds 846 623Welfare expenses 1,409 1,081Total 19,129 14,413(i) Disclosures envisaged in AS 15 in respect of defined benefit plans (Grautity and Provident fundadministered by a trust setup by the company) are given below:<strong>2012</strong> <strong>2011</strong> 2010 2009 2008Gratuity ProvidentfundGratuityA) Reconciliation of opening and closingbalances of the present value of thedefined benefit obligation:Obligations at period beginning 1,878 3,434 1,614 1,539 1,426 1,161Obligation at period beginning fromAmalgamation 37 — 97 — — —Service cost 326 680 226 85 130 435Interest cost 156 284 126 118 96 93Benefits settled (158) (172) (234) (125) (109) (260)Actuarial (gain)/loss (20) (4) 49 (3) (4) (3)Obligations at period end 2,219 4,222 1,878 1,614 1,539 1,426B) Change in plan assetsPlan assets at period beginning, at fair value 1,639 3,490 1,542 1,331 1,365 1,161Plan assets at period beginning fromAmalgamation 37 — 54 — — —Expected return on plan assets 128 308 125 102 107 93Actuarial gain/(loss) (10) 50 (13) (17) (76) 108Contributions 20 658 159 251 44 263Benefits settled (158) (172) (228) (125) (109) (260)Plan assets at period end, at fair value 1,656 4,334 1,639 1,542 1,331 1,36588