Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

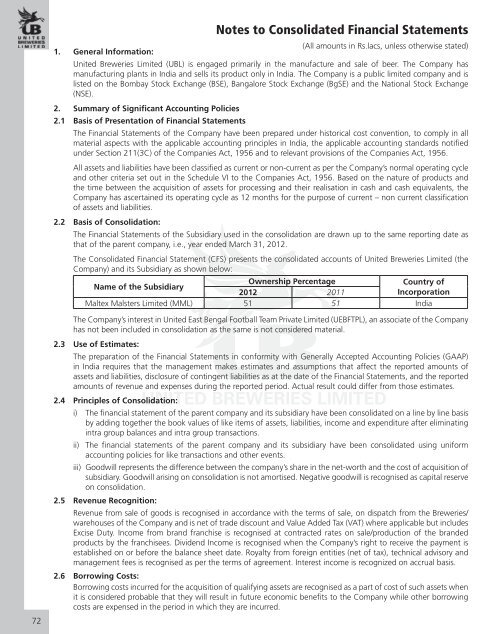

Notes to Consolidated Financial Statements(All amounts in Rs.lacs, unless otherwise stated)1. General Information:<strong>United</strong> <strong>Breweries</strong> <strong>Limited</strong> (UBL) is engaged primarily in the manufacture and sale of beer. The Company hasmanufacturing plants in India and sells its product only in India. The Company is a public limited company and islisted on the Bombay Stock Exchange (BSE), Bangalore Stock Exchange (BgSE) and the National Stock Exchange(NSE).2. Summary of Significant Accounting Policies2.1 Basis of Presentation of Financial StatementsThe Financial Statements of the Company have been prepared under historical cost convention, to comply in allmaterial aspects with the applicable accounting principles in India, the applicable accounting standards notifiedunder Section 211(3C) of the Companies Act, 1956 and to relevant provisions of the Companies Act, 1956.All assets and liabilities have been classified as current or non-current as per the Company’s normal operating cycleand other criteria set out in the Schedule VI to the Companies Act, 1956. Based on the nature of products andthe time between the acquisition of assets for processing and their realisation in cash and cash equivalents, theCompany has ascertained its operating cycle as 12 months for the purpose of current – non current classificationof assets and liabilities.2.2 Basis of Consolidation:The Financial Statements of the Subsidiary used in the consolidation are drawn up to the same reporting date asthat of the parent company, i.e., year ended March 31, <strong>2012</strong>.The Consolidated Financial Statement (CFS) presents the consolidated accounts of <strong>United</strong> <strong>Breweries</strong> <strong>Limited</strong> (theCompany) and its Subsidiary as shown below:Ownership PercentageCountry ofName of the Subsidiary<strong>2012</strong> <strong>2011</strong>IncorporationMaltex Malsters <strong>Limited</strong> (MML) 51 51 India72The Company’s interest in <strong>United</strong> East Bengal Football Team Private <strong>Limited</strong> (UEBFTPL), an associate of the Companyhas not been included in consolidation as the same is not considered material.2.3 Use of Estimates:The preparation of the Financial Statements in conformity with Generally Accepted Accounting Policies (GAAP)in India requires that the management makes estimates and assumptions that affect the reported amounts ofassets and liabilities, disclosure of contingent liabilities as at the date of the Financial Statements, and the reportedamounts of revenue and expenses during the reported period. Actual result could differ from those estimates.2.4 Principles of Consolidation:i) The financial statement of the parent company and its subsidiary have been consolidated on a line by line basisby adding together the book values of like items of assets, liabilities, income and expenditure after eliminatingintra group balances and intra group transactions.ii) The financial statements of the parent company and its subsidiary have been consolidated using uniformaccounting policies for like transactions and other events.iii) Goodwill represents the difference between the company’s share in the net-worth and the cost of acquisition ofsubsidiary. Goodwill arising on consolidation is not amortised. Negative goodwill is recognised as capital reserveon consolidation.2.5 Revenue Recognition:Revenue from sale of goods is recognised in accordance with the terms of sale, on dispatch from the <strong>Breweries</strong>/warehouses of the Company and is net of trade discount and Value Added Tax (VAT) where applicable but includesExcise Duty. Income from brand franchise is recognised at contracted rates on sale/production of the brandedproducts by the franchisees. Dividend Income is recognised when the Company’s right to receive the payment isestablished on or before the balance sheet date. Royalty from foreign entities (net of tax), technical advisory andmanagement fees is recognised as per the terms of agreement. Interest income is recognized on accrual basis.2.6 Borrowing Costs:Borrowing costs incurred for the acquisition of qualifying assets are recognised as a part of cost of such assets whenit is considered probable that they will result in future economic benefits to the Company while other borrowingcosts are expensed in the period in which they are incurred.