Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

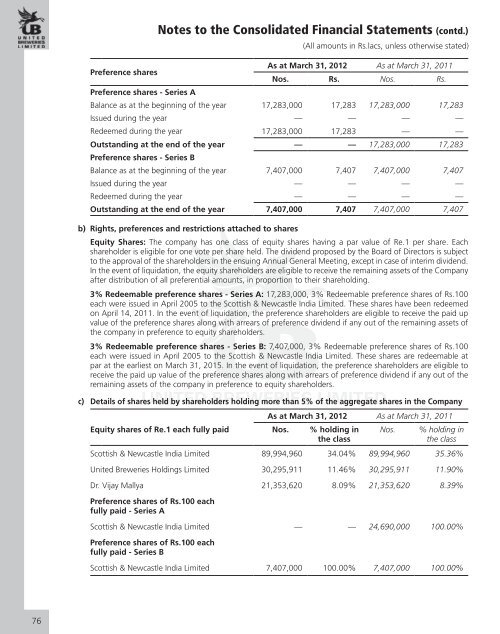

Preference sharesNotes to the Consolidated Financial Statements (contd.)(All amounts in Rs.lacs, unless otherwise stated)As at March 31, <strong>2012</strong> As at March 31, <strong>2011</strong>Nos. Rs. Nos. Rs.Preference shares - Series ABalance as at the beginning of the year 17,283,000 17,283 17,283,000 17,283Issued during the year — — — —Redeemed during the year 17,283,000 17,283 — —Outstanding at the end of the year — — 17,283,000 17,283Preference shares - Series BBalance as at the beginning of the year 7,407,000 7,407 7,407,000 7,407Issued during the year — — — —Redeemed during the year — — — —Outstanding at the end of the year 7,407,000 7,407 7,407,000 7,407b) Rights, preferences and restrictions attached to sharesEquity Shares: The company has one class of equity shares having a par value of Re.1 per share. Eachshareholder is eligible for one vote per share held. The dividend proposed by the Board of Directors is subjectto the approval of the shareholders in the ensuing <strong>Annual</strong> General Meeting, except in case of interim dividend.In the event of liquidation, the equity shareholders are eligible to receive the remaining assets of the Companyafter distribution of all preferential amounts, in proportion to their shareholding.3% Redeemable preference shares - Series A: 17,283,000, 3% Redeemable preference shares of Rs.100each were issued in April 2005 to the Scottish & Newcastle India <strong>Limited</strong>. These shares have been redeemedon April 14, <strong>2011</strong>. In the event of liquidation, the preference shareholders are eligible to receive the paid upvalue of the preference shares along with arrears of preference dividend if any out of the remaining assets ofthe company in preference to equity shareholders.3% Redeemable preference shares - Series B: 7,407,000, 3% Redeemable preference shares of Rs.100each were issued in April 2005 to the Scottish & Newcastle India <strong>Limited</strong>. These shares are redeemable atpar at the earliest on March 31, 2015. In the event of liquidation, the preference shareholders are eligible toreceive the paid up value of the preference shares along with arrears of preference dividend if any out of theremaining assets of the company in preference to equity shareholders.c) Details of shares held by shareholders holding more than 5% of the aggregate shares in the CompanyAs at March 31, <strong>2012</strong> As at March 31, <strong>2011</strong>Equity shares of Re.1 each fully paid Nos. % holding inthe classNos. % holding inthe classScottish & Newcastle India <strong>Limited</strong> 89,994,960 34.04% 89,994,960 35.36%<strong>United</strong> <strong>Breweries</strong> Holdings <strong>Limited</strong> 30,295,911 11.46% 30,295,911 11.90%Dr. Vijay Mallya 21,353,620 8.09% 21,353,620 8.39%Preference shares of Rs.100 eachfully paid - Series AScottish & Newcastle India <strong>Limited</strong> — — 24,690,000 100.00%Preference shares of Rs.100 eachfully paid - Series BScottish & Newcastle India <strong>Limited</strong> 7,407,000 100.00% 7,407,000 100.00%76