What Is FSA Debit Card Substantiation? - HealthSCOPE Benefits

What Is FSA Debit Card Substantiation? - HealthSCOPE Benefits

What Is FSA Debit Card Substantiation? - HealthSCOPE Benefits

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

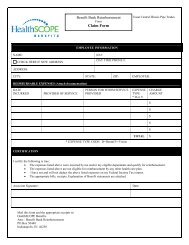

<strong>Substantiation</strong> method 2: Point-of-sale auto-substantiation. In this case, the merchant where apurchase is being made has an inventory control system in place that identifies whether or not eachproduct in the merchant’s inventory is eligible for reimbursement from an <strong>FSA</strong>. (Such an inventory-controlsystem is called an Inventory Information Approval System, or “IIAS”.) When you use your <strong>FSA</strong> debit cardat a merchant who has an IIAS in place, your card will not be usable for products that are not marked as<strong>FSA</strong>-eligible in the merchant’s system. For example, if you purchase a bottle of aspirin and a gallon of icecream from a large discount retailer with an IIAS in place, the cash register will allow you to pay for theportion of your purchase that represents the aspirin with your <strong>FSA</strong> debit card, and then you will have topay for the ice cream by some other means. When you use your <strong>FSA</strong> debit card at such a merchant, nofurther action is necessary on your part, because the merchant has already verified that what youpurchased was an eligible expense. For further discussion and information on point-of-sale autosubstantiation,please see the section below entitled “WHAT CHANGES ARE COMING?”<strong>Substantiation</strong> method 3: Submit receipts after the fact. In all caseswhere your <strong>FSA</strong> debit-card purchase cannot be automatically substantiatedat the time of the transaction, you will be required to submit a detailed receiptto <strong>HealthSCOPE</strong> <strong>Benefits</strong> so that we can verify that the product or servicepurchased was an eligible expense. (Again, please keep in mind that byreminding you to submit receipts, we are helping you abide by Federal taxregulations.) It is important to note that in order to qualify as adequate substantiation,the receipt must explicitly identify the product or service that waspurchased, along with the date of service if the card was used to pay for aservice such as a medical or dental procedure. Therefore, when usingyour <strong>FSA</strong> debit card, always ask for an itemized receipt listing thedetails of what was paid for. A simple Visa receipt or other genericdocument that simply says “Pharmacy” or “Services Rendered” will not qualify as acceptable substantiation.WHAT CHANGES ARE COMING?Before discussing upcoming changes in the Federal substantiation requirements, it would be helpful toprovide some history on the subject. Prior to 2008, the only automatic substantiation that was widelyavailable for <strong>FSA</strong> debit cards was copay aggregation, which was described inthe previous section. The IRS and <strong>FSA</strong> administrators were concerned that<strong>FSA</strong> debit cards were frequently being used for non-eligible expenses, whichled to adverse consequences for flex participants, employers offering flexiblespending plans, and administrators who were responsible for recovering theincorrectly-distributed funds on behalf of the flexible spending plan.In an effort to streamline the process for everyone involved, the IRS mandatedthat effective January 1, 2008, all merchants who wished to be able toaccept <strong>FSA</strong> debit cards would have to install an Inventory InformationApproval System (IIAS) so that <strong>FSA</strong> debit card purchases could be substantiated at point of sale. Thereasoning was that if the card could not be used for ineligible merchandise at the time of purchase, therewould be a drastic reduction in improper <strong>FSA</strong> plan usage, which would benefit all parties in the process:namely, the flex plan participants, the <strong>FSA</strong> administrators, and the employers offering the flex plans.Pharmacies were granted a grace period of one extra year to implement their systems, so their effectivedate was extended to January 1, 2009.