What Is FSA Debit Card Substantiation? - HealthSCOPE Benefits

What Is FSA Debit Card Substantiation? - HealthSCOPE Benefits

What Is FSA Debit Card Substantiation? - HealthSCOPE Benefits

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

As the administrator for your flexible spending account (<strong>FSA</strong>), <strong>HealthSCOPE</strong> <strong>Benefits</strong>believes that providing you with information about the administration of your account isvery important. In keeping with this philosophy, we have sent this mailing to you in orderto better explain the substantiation process around your <strong>FSA</strong> debit card. Please read theenclosed correspondence carefully and save it for future reference. Note that the lastpage of this packet is a “Questions and Answers” document that addresses some of thecommon concerns around the <strong>FSA</strong> debit card substantiation process.If you have any questions about the contents of this letter or about your flex account ingeneral, we encourage you to contact us toll-free at (877) 385-8775, or by e-mail atflex.services@healthscopebenefits.com.Sincerely,Your <strong>HealthSCOPE</strong> Flex Services TeamWHAT IS SUBSTANTIATION?Internal Revenue Service (IRS) regulations require that all purchases madefrom your health or limited-purpose (dental/vision) <strong>FSA</strong> be for products andservices that are on the IRS’s eligible-expenses list. The process of verifyingthat a purchase made from a flexible-spending account was for an eligibleexpense is known as substantiation. <strong>Substantiation</strong> is extremely important,because failure to properly substantiate all reimbursements made from yourflexible spending account places you in violation of Federal law and createsnegative tax consequences for you, and it can also cause your employer’s <strong>FSA</strong>plan to no longer qualify as a pre-tax benefit. As your <strong>FSA</strong> administrator,<strong>HealthSCOPE</strong> <strong>Benefits</strong> is responsible for assisting you with substantiatingpurchases made with your debit card.There are three ways for <strong>FSA</strong> debit-card purchases to be substantiated. These are described below.<strong>Substantiation</strong> method 1: Copay aggregation. With this method, the computer system that is used toadminister the flexible spending accounts is programmed with the copayment amounts for your medical,prescription, dental, and/or vision plan(s), whichever of these are applicable to your type of <strong>FSA</strong>. Then,when you use your <strong>FSA</strong> debit card at a location with the appropriate merchant category code, the logic inthe system will automatically substantiate a purchase that is an even multiple (up to five) of your plan’scopayment amount. For example, suppose that your dental plan has a $20 office copay for a visit to thedentist. If you swipe your card for exactly $20 at the dentist’s office, the system will assume that it was foryour plan copayment and will automatically substantiate the transaction. If you take both of your children tothe dentist on the same day and they charge you $40, that transaction will automatically substantiate aswell since it is exactly twice your plan’s copayment amount. IRS regulations permit us as your plan administratorto set up your <strong>FSA</strong> debit card to automatically substantiate purchases in this way.

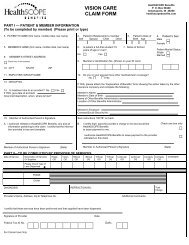

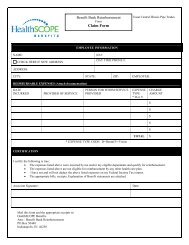

<strong>Substantiation</strong> method 2: Point-of-sale auto-substantiation. In this case, the merchant where apurchase is being made has an inventory control system in place that identifies whether or not eachproduct in the merchant’s inventory is eligible for reimbursement from an <strong>FSA</strong>. (Such an inventory-controlsystem is called an Inventory Information Approval System, or “IIAS”.) When you use your <strong>FSA</strong> debit cardat a merchant who has an IIAS in place, your card will not be usable for products that are not marked as<strong>FSA</strong>-eligible in the merchant’s system. For example, if you purchase a bottle of aspirin and a gallon of icecream from a large discount retailer with an IIAS in place, the cash register will allow you to pay for theportion of your purchase that represents the aspirin with your <strong>FSA</strong> debit card, and then you will have topay for the ice cream by some other means. When you use your <strong>FSA</strong> debit card at such a merchant, nofurther action is necessary on your part, because the merchant has already verified that what youpurchased was an eligible expense. For further discussion and information on point-of-sale autosubstantiation,please see the section below entitled “WHAT CHANGES ARE COMING?”<strong>Substantiation</strong> method 3: Submit receipts after the fact. In all caseswhere your <strong>FSA</strong> debit-card purchase cannot be automatically substantiatedat the time of the transaction, you will be required to submit a detailed receiptto <strong>HealthSCOPE</strong> <strong>Benefits</strong> so that we can verify that the product or servicepurchased was an eligible expense. (Again, please keep in mind that byreminding you to submit receipts, we are helping you abide by Federal taxregulations.) It is important to note that in order to qualify as adequate substantiation,the receipt must explicitly identify the product or service that waspurchased, along with the date of service if the card was used to pay for aservice such as a medical or dental procedure. Therefore, when usingyour <strong>FSA</strong> debit card, always ask for an itemized receipt listing thedetails of what was paid for. A simple Visa receipt or other genericdocument that simply says “Pharmacy” or “Services Rendered” will not qualify as acceptable substantiation.WHAT CHANGES ARE COMING?Before discussing upcoming changes in the Federal substantiation requirements, it would be helpful toprovide some history on the subject. Prior to 2008, the only automatic substantiation that was widelyavailable for <strong>FSA</strong> debit cards was copay aggregation, which was described inthe previous section. The IRS and <strong>FSA</strong> administrators were concerned that<strong>FSA</strong> debit cards were frequently being used for non-eligible expenses, whichled to adverse consequences for flex participants, employers offering flexiblespending plans, and administrators who were responsible for recovering theincorrectly-distributed funds on behalf of the flexible spending plan.In an effort to streamline the process for everyone involved, the IRS mandatedthat effective January 1, 2008, all merchants who wished to be able toaccept <strong>FSA</strong> debit cards would have to install an Inventory InformationApproval System (IIAS) so that <strong>FSA</strong> debit card purchases could be substantiated at point of sale. Thereasoning was that if the card could not be used for ineligible merchandise at the time of purchase, therewould be a drastic reduction in improper <strong>FSA</strong> plan usage, which would benefit all parties in the process:namely, the flex plan participants, the <strong>FSA</strong> administrators, and the employers offering the flex plans.Pharmacies were granted a grace period of one extra year to implement their systems, so their effectivedate was extended to January 1, 2009.

Due to this change in the regulations, on January 1, 2008, all merchants except for pharmacies andmerchants with 90% or more of their revenue coming from <strong>FSA</strong>-eligible products and services were requiredto have an IIAS in place or be unable to accept <strong>FSA</strong> debit cards. Beginning on that date, large retailers suchas Wal-Mart and Target were able to continue accepting <strong>FSA</strong> debit cards because their inventory controlsystems made it so that <strong>FSA</strong> debit cards could only be used for flex-eligible merchandise. Other nonpharmacyretailers who did not implement an IIAS were no longer able to accept <strong>FSA</strong> debit cards at all.Late in 2008, pharmacies were granted a further six-month grace period to July 1, 2009, to implement anIIAS or apply for the “90% rule exemption”. It appears that the grace period is not going to be extended anyfurther. Therefore, effective July 1, 2009, pharmacies that have not implemented an IIAS or appliedfor an exemption will no longer be able to accept <strong>FSA</strong> debit cards. This means that if you areaccustomed to using your <strong>FSA</strong> debit card at your local pharmacy, there is a possibility that your cardwill no longer work at that pharmacy on July 1, 2009. If your debit card no longer works at your localpharmacy on July 1, <strong>HealthSCOPE</strong> <strong>Benefits</strong> is unable to change anything in our system’s configuration toforce the card to be accepted there. In order for the card to work, the pharmacy will need to eitherimplement an IIAS or apply for a 90% rule exemption.More details on which merchants are confirmed to have an IIAS in place, as well as what merchants need todo to be able to accept <strong>FSA</strong> debit cards, can be found on the website for The Special Interest Group for IIASStandards, located at http://www.sig-is.org.HOW CAN HEALTHSCOPE AND I WORK TOGETHER TO SUBSTANTIATEMY TRANSACTIONS?After the new requirements are implemented on July 1, 2009, all <strong>FSA</strong> debit card transactions should automaticallysubstantiate, with two exceptions: (1) transactions with service providers such as doctors’ officesand dentists’ offices, and (2) transactions with vendors who have claimed the 90% rule exemption (whichmeans that 90% of the merchant’s products sold during the previous year were <strong>FSA</strong>-eligible; some mailorderprescription services fall into this second category). Oncethe new merchant requirements are in place, <strong>HealthSCOPE</strong>intends to enhance its receipt reminder and acceptance process.In cases where <strong>HealthSCOPE</strong> requires a receipt in order to substantiatea transaction you have made using your <strong>FSA</strong> debit card,you will receive a system-generated e-mail requesting a receipt ifyou have an e-mail address in our system, otherwise you willreceive a printed letter by traditional mail. This initial reminderwill be generated three days after your transaction. Ten daysafter the original transaction, you will receive a second reminder.Seventeen days after the original transaction, you will receive athird reminder advising you that in one more week, <strong>HealthSCOPE</strong>will begin holding all manual reimbursements from your accountuntil either (1) we receive substantiation of the original debit card transaction in question, (2) we receivesubstantiation for an equal value of other qualifying purchases made during the plan year, or (3) youreimburse the dollar amount of the transaction to the flex plan.If you have an e-mail address loaded in our system, you will receive this third reminder both by e-mail andstandard mail to ensure that possible problems with your e-mail service have not prevented you fromreceiving receipt reminders. If we do not receive items (1), (2), or (3) within forty-five days of the originaltransaction, your debit card will be deactivated until appropriate substantiation is received. Again, pleasekeep in mind that one of <strong>HealthSCOPE</strong>’s primary responsibilities is to assist you and your employer withusing your flex plan in compliance with Federal law, so these processes are not an intentionalinconvenience.

Your receipt requests will include a bar-coded page that can be used as a fax cover sheet for your receipts.You can fax a copy of your receipts, using the bar-coded cover sheet as the first page, to the toll-freenumber on the receipt reminder, or you can mail copies of the receipts to the address indicated on thereminder. (If you choose the standard mail option, please only send copies of your receipts rather than theoriginals, as your receipts will not be returned to you.) Important note: If you fax your receipts to<strong>HealthSCOPE</strong>, please fax each debit card transaction’s substantiation separately, rather than including allcover sheets and receipts in a single fax. This will ensure that all of your transactions are substantiated inthe timeliest fashion possible.Important reminder: Save your debit-card receipts!One final note on receipts: Please do not submit receipts for debit cardtransactions to <strong>HealthSCOPE</strong> <strong>Benefits</strong> until you receive a request, but pleasesave the receipts for all of your <strong>FSA</strong> debit card transactions in case you needto provide them during a future tax audit.CONCLUSIONThe <strong>FSA</strong> debit card substantiation process can be confusing at first, but withproper understanding of the process and the reasons why it is required, itbecomes straightforward and does not significantly diminish the convenience of the <strong>FSA</strong> debit card.<strong>HealthSCOPE</strong> <strong>Benefits</strong> is pleased to be your <strong>FSA</strong> administrator, and we will gladly assist you with anyquestions or concerns you have regarding your flexible spending account. We encourage you to pleasecontact us toll-free at (877) 385-8775, or by e-mail at flex.services@healthscopebenefits.com.