Landcorp - Crown Ownership Monitoring Unit

Landcorp - Crown Ownership Monitoring Unit

Landcorp - Crown Ownership Monitoring Unit

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

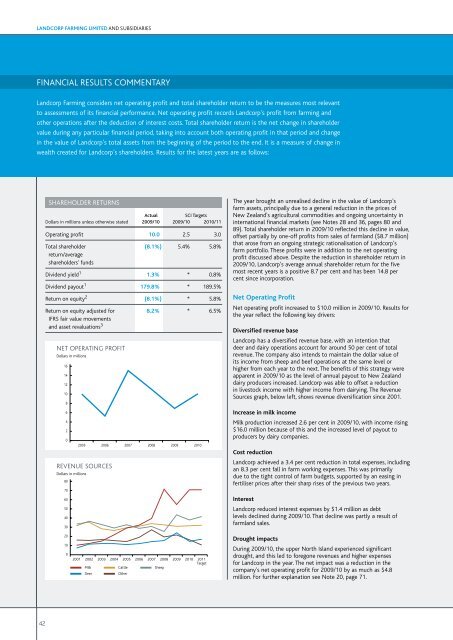

LANDCORP FARMING LIMITED AND SUBSIDIARIESFINANCIAL RESULTS COMMENTARY<strong>Landcorp</strong> Farming considers net operating profit and total shareholder return to be the measures most relevantto assessments of its financial performance. Net operating profit records <strong>Landcorp</strong>’s profit from farming andother operations after the deduction of interest costs. Total shareholder return is the net change in shareholdervalue during any particular financial period, taking into account both operating profit in that period and changein the value of <strong>Landcorp</strong>’s total assets from the beginning of the period to the end. It is a measure of change inwealth created for <strong>Landcorp</strong>’s shareholders. Results for the latest years are as follows:SHAREHOLDER RETURNSActualSCI TargetsDollars in millions unless otherwise stated 2009/10 2009/10 2010/11Operating profit 10.0 2.5 3.0Total shareholder (8.1%) 5.4% 5.8%return/averageshareholders’ fundsDividend yield 1 1.3% * 0.8%Dividend payout 1 179.8% * 189.5%Return on equity 2 (8.1%) * 5.8%Return on equity adjusted for 8.2% * 6.5%IFRS fair value movementsand asset revaluations 3NET OPERATING PROFITDollars in millions1614121086420REVENUE SOURCESDollars in millions8070605040302005 2006 2007 2008 2009 2010The year brought an unrealised decline in the value of <strong>Landcorp</strong>’sfarm assets, principally due to a general reduction in the prices ofNew Zealand's agricultural commodities and ongoing uncertainty ininternational financial markets (see Notes 28 and 36, pages 80 and89). Total shareholder return in 2009/10 reflected this decline in value,offset partially by one-off profits from sales of farmland ($8.7 million)that arose from an ongoing strategic rationalisation of <strong>Landcorp</strong>’sfarm portfolio. These profits were in addition to the net operatingprofit discussed above. Despite the reduction in shareholder return in2009/10, <strong>Landcorp</strong>’s average annual shareholder return for the fivemost recent years is a positive 8.7 per cent and has been 14.8 percent since incorporation.Net Operating ProfitNet operating profit increased to $10.0 million in 2009/10. Results forthe year reflect the following key drivers:Diversified revenue base<strong>Landcorp</strong> has a diversified revenue base, with an intention thatdeer and dairy operations account for around 50 per cent of totalrevenue. The company also intends to maintain the dollar value ofits income from sheep and beef operations at the same level orhigher from each year to the next. The benefits of this strategy wereapparent in 2009/10 as the level of annual payout to New Zealanddairy producers increased. <strong>Landcorp</strong> was able to offset a reductionin livestock income with higher income from dairying. The RevenueSources graph, below left, shows revenue diversification since 2001.Increase in milk incomeMilk production increased 2.6 per cent in 2009/10, with income rising$16.0 million because of this and the increased level of payout toproducers by dairy companies.Cost reduction<strong>Landcorp</strong> achieved a 3.4 per cent reduction in total expenses, includingan 8.3 per cent fall in farm working expenses. This was primarilydue to the tight control of farm budgets, supported by an easing infertiliser prices after their sharp rises of the previous two years.Interest<strong>Landcorp</strong> reduced interest expenses by $1.4 million as debtlevels declined during 2009/10. That decline was partly a result offarmland sales.201002001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011TargetMilk Cattle SheepDeerOtherDrought impactsDuring 2009/10, the upper North Island experienced significantdrought, and this led to foregone revenues and higher expensesfor <strong>Landcorp</strong> in the year. The net impact was a reduction in thecompany's net operating profit for 2009/10 by as much as $4.8million. For further explanation see Note 20, page 71.42