Landcorp - Crown Ownership Monitoring Unit

Landcorp - Crown Ownership Monitoring Unit

Landcorp - Crown Ownership Monitoring Unit

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

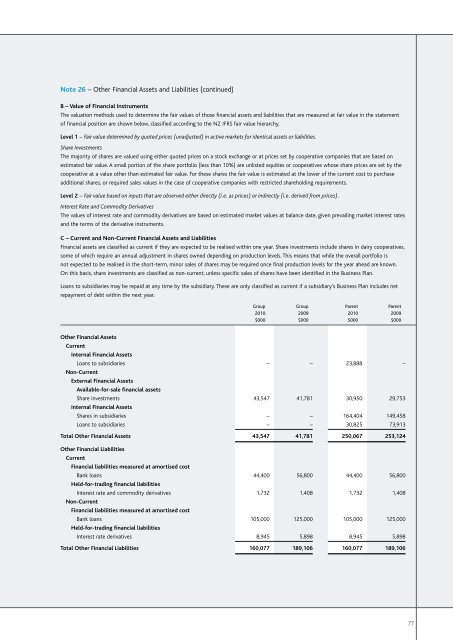

Note 26 – Other Financial Assets and Liabilities (continued)B – Value of Financial InstrumentsThe valuation methods used to determine the fair values of those financial assets and liabilities that are measured at fair value in the statementof financial position are shown below, classified according to the NZ IFRS fair value hierarchy.Level 1 – Fair value determined by quoted prices (unadjusted) in active markets for identical assets or liabilities.Share InvestmentsThe majority of shares are valued using either quoted prices on a stock exchange or at prices set by cooperative companies that are based onestimated fair value. A small portion of the share portfolio (less than 10%) are unlisted equities or cooperatives whose share prices are set by thecooperative at a value other than estimated fair value. For these shares the fair value is estimated at the lower of the current cost to purchaseadditional shares, or required sales values in the case of cooperative companies with restricted shareholding requirements.Level 2 – Fair value based on inputs that are observed either directly (i.e. as prices) or indirectly (i.e. derived from prices).Interest Rate and Commodity DerivativesThe values of interest rate and commodity derivatives are based on estimated market values at balance date, given prevailing market interest ratesand the terms of the derivative instruments.C – Current and Non-Current Financial Assets and LiabilitiesFinancial assets are classified as current if they are expected to be realised within one year. Share investments include shares in dairy cooperatives,some of which require an annual adjustment in shares owned depending on production levels. This means that while the overall portfolio isnot expected to be realised in the short-term, minor sales of shares may be required once final production levels for the year ahead are known.On this basis, share investments are classified as non-current, unless specific sales of shares have been identified in the Business Plan.Loans to subsidiaries may be repaid at any time by the subsidiary. These are only classified as current if a subsidiary’s Business Plan includes netrepayment of debt within the next year.Group Group Parent Parent2010 2009 2010 2009$000 $000 $000 $000Other Financial AssetsCurrentInternal Financial AssetsLoans to subsidiaries – – 23,888 –Non-CurrentExternal Financial AssetsAvailable-for-sale financial assetsShare investments 43,547 41,781 30,950 29,753Internal Financial AssetsShares in subsidiaries – – 164,404 149,458Loans to subsidiaries – – 30,825 73,913Total Other Financial Assets 43,547 41,781 250,067 253,124Other Financial LiabilitiesCurrentFinancial liabilities measured at amortised costBank loans 44,400 56,800 44,400 56,800Held-for-trading financial liabilitiesInterest rate and commodity derivatives 1,732 1,408 1,732 1,408Non-CurrentFinancial liabilities measured at amortised costBank loans 105,000 125,000 105,000 125,000Held-for-trading financial liabilitiesInterest rate derivatives 8,945 5,898 8,945 5,898Total Other Financial Liabilities 160,077 189,106 160,077 189,10677