PINEWOOD THE CASE FOR EXPANSION - Pinewood Studios

PINEWOOD THE CASE FOR EXPANSION - Pinewood Studios

PINEWOOD THE CASE FOR EXPANSION - Pinewood Studios

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

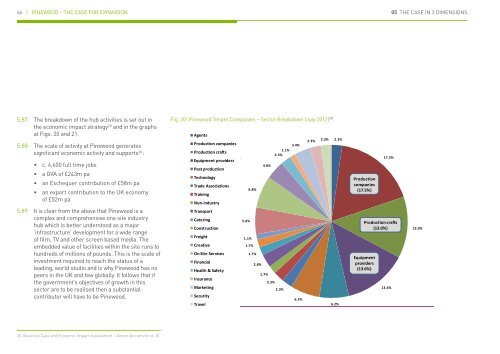

66 | <strong>PINEWOOD</strong> – <strong>THE</strong> <strong>CASE</strong> <strong>FOR</strong> <strong>EXPANSION</strong> 05 <strong>THE</strong> <strong>CASE</strong> IN 3 DIMENSIONS 05 <strong>THE</strong> <strong>CASE</strong> IN 3 DIMENSIONS<strong>PINEWOOD</strong> – <strong>THE</strong> <strong>CASE</strong> <strong>FOR</strong> <strong>EXPANSION</strong> | 675.87 The breakdown of the hub activities is set out inthe economic impact strategy 20 and in the graphsat Figs. 20 and 21.5.88 The scale of activity at <strong>Pinewood</strong> generatessignificant economic activity and supports 20 :• c. 4,600 full time jobs• a GVA of £243m pa• an Exchequer contribution of £58m pa• an export contribution to the UK economyof £52m pa5.89 It is clear from the above that <strong>Pinewood</strong> is acomplex and comprehensive one site industryhub which is better understood as a major‘infrastructure’ development for a wide rangeof film, TV and other screen based media. Theembedded value of facilities within the site runs tohundreds of millions of pounds. This is the scale ofinvestment required to reach the status of aleading, world studio and is why <strong>Pinewood</strong> has nopeers in the UK and few globally. It follows that ifthe government’s objectives of growth in thissector are to be realised then a substantialcontributor will have to be <strong>Pinewood</strong>.Fig. 20: <strong>Pinewood</strong> Tenant Companies – Sector Breakdown (July 2012) 20 .2.3%2.3%3.4%Agents1.1%2.3%2.3%2.3% 2.3%Production companies3.4%Production Agents1.1%crafts4.0%2.3%Production companiesEquipment providersProduction crafts4.0%Post productionEquipment providersTechnology Post production6.8%Trade Technology Associations6.8%Trade AssociationsTrainingTrainingNon-industryNon-industryTransportTransportCatering CateringConstruction ConstructionFreightFreightCreativeCreativeOn Site ServicesOn Site Financial ServicesFinancial Health & SafetyInsuranceHealth & SafetyMarketingInsuranceSecurityMarketing TravelSecurityTravel5.6%1.1%1.1%1.7%1.7%1.7%1.7%2.8%2.8% 1.7%2.3%1.7%2.3%2.3%2.3%6.2%6.2%2.3%5.6%17.5%Productioncompanies5.6%Productioncompanies (17.5%)(17.5%)Equipmentproviders(13.6%)5.6%Equipmentproviders(13.6%)13.6%7.4%17.5%13.6%11.1%7.4%5.6%On-siteservices7.4%Production crafts Production crafts Financial (18.5%)(13.0%) (13.0%)13.0% (11.1%)13.0%5.6%Creative(11.1%)18.5%5.6%3.7%11.1%Fig 21: <strong>Pinewood</strong> Support Tenant Companies – Sector Breakdown (July 2012) 21TransportCateringConstructionFreightCreativeOn Site ServicesFinancialHealth & SafetyInsuranceMarketingNon-industrySecurityTravel5.6%5.6%5.6%7.4%7.4%11.1%7.4%Financial(11.1%)5.6%On-siteservices(18.5%)5.6%Creative(11.1%)18.5%5.6%3.7%11.1%4. Operation of UK film tax relief5.90 Tax credits play an important role in the financing of films. Since 2006,the UK Government has made available the latest tax relief for films becauseTransportit recognises the importance of the industry to the economy. Between 2006/07Catering and 2010/11, 100 tax credit claims (valued at £390 million) were made by filmsConstruction with budgets greater than £20 million.5.91 Freight The UK government has announced a draft legislation for the finance bill 2013,Creativewhich offers tax breaks to drama, comedy and documentary TV production withproduction budgets over £1m per hour (qualifying programmes must be at leastOn 30 Site minutes Services long.) It also includes tax breaks for animation and video gamesFinancial with production budgets of over £1m. The draft legislation is expected to beagreed in April 2013 subject to a period of consultation. When operationalHealth & Safetythis incentive is expected to be worth c. £350m per year as a result ofInsurance high-end television scripted production relocating to the UK.5.92MarketingThe Government has confirmed its commitment to the maintenance andNon-industry expansion of UK film tax relief.Security “I want to make it crystal clear that we intend to maintain film tax creditTravel which is worth over £100 million each year to British film [activity].”Ed Vaizey, Minister for Culture, Media & Sport, November 20106.2%6.2%20. Business Case and Economic Impact Assessment – Amion (document no. 5) 21. Business Case and Economic Impact Assessment – Amion (document no. 5)