Supporting Carers Of Other People's Children - Australian Foster ...

Supporting Carers Of Other People's Children - Australian Foster ...

Supporting Carers Of Other People's Children - Australian Foster ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

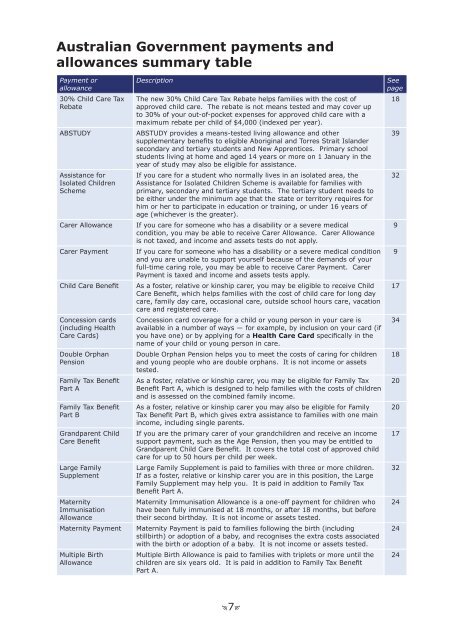

<strong>Australian</strong> Government payments andallowances summary tablePayment orallowance30% Child Care TaxRebateABSTUDYAssistance forIsolated <strong>Children</strong>SchemeCarer AllowanceCarer PaymentChild Care BenefitConcession cards(including HealthCare Cards)Double OrphanPensionFamily Tax BenefitPart AFamily Tax BenefitPart BGrandparent ChildCare BenefitLarge FamilySupplementMaternityImmunisationAllowanceMaternity PaymentMultiple BirthAllowanceDescriptionThe new 30% Child Care Tax Rebate helps families with the cost ofapproved child care. The rebate is not means tested and may cover upto 30% of your out-of-pocket expenses for approved child care with amaximum rebate per child of $4,000 (indexed per year).ABSTUDY provides a means-tested living allowance and othersupplementary benefits to eligible Aboriginal and Torres Strait Islandersecondary and tertiary students and New Apprentices. Primary schoolstudents living at home and aged 14 years or more on 1 January in theyear of study may also be eligible for assistance.If you care for a student who normally lives in an isolated area, theAssistance for Isolated <strong>Children</strong> Scheme is available for families withprimary, secondary and tertiary students. The tertiary student needs tobe either under the minimum age that the state or territory requires forhim or her to participate in education or training, or under 16 years ofage (whichever is the greater).If you care for someone who has a disability or a severe medicalcondition, you may be able to receive Carer Allowance. Carer Allowanceis not taxed, and income and assets tests do not apply.If you care for someone who has a disability or a severe medical conditionand you are unable to support yourself because of the demands of yourfull-time caring role, you may be able to receive Carer Payment. CarerPayment is taxed and income and assets tests apply.As a foster, relative or kinship carer, you may be eligible to receive ChildCare Benefit, which helps families with the cost of child care for long daycare, family day care, occasional care, outside school hours care, vacationcare and registered care.Concession card coverage for a child or young person in your care isavailable in a number of ways ― for example, by inclusion on your card (ifyou have one) or by applying for a Health Care Card specifically in thename of your child or young person in care.Double Orphan Pension helps you to meet the costs of caring for childrenand young people who are double orphans. It is not income or assetstested.As a foster, relative or kinship carer, you may be eligible for Family TaxBenefit Part A, which is designed to help families with the costs of childrenand is assessed on the combined family income.As a foster, relative or kinship carer you may also be eligible for FamilyTax Benefit Part B, which gives extra assistance to families with one mainincome, including single parents.If you are the primary carer of your grandchildren and receive an incomesupport payment, such as the Age Pension, then you may be entitled toGrandparent Child Care Benefit. It covers the total cost of approved childcare for up to 50 hours per child per week.Large Family Supplement is paid to families with three or more children.If as a foster, relative or kinship carer you are in this position, the LargeFamily Supplement may help you. It is paid in addition to Family TaxBenefit Part A.Maternity Immunisation Allowance is a one-off payment for children whohave been fully immunised at 18 months, or after 18 months, but beforetheir second birthday. It is not income or assets tested.Maternity Payment is paid to families following the birth (includingstillbirth) or adoption of a baby, and recognises the extra costs associatedwith the birth or adoption of a baby. It is not income or assets tested.Multiple Birth Allowance is paid to families with triplets or more until thechildren are six years old. It is paid in addition to Family Tax BenefitPart A.Seepage18393299173418202017322424247