Energy Assurance Study: Interim Report - Southwest Florida ...

Energy Assurance Study: Interim Report - Southwest Florida ...

Energy Assurance Study: Interim Report - Southwest Florida ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

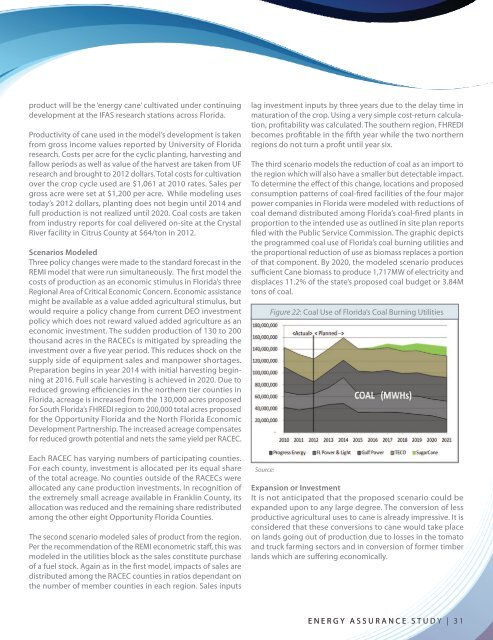

product will be the ‘energy cane’ cultivated under continuingdevelopment at the IFAS research stations across <strong>Florida</strong>.Productivity of cane used in the model’s development is takenfrom gross income values reported by University of <strong>Florida</strong>research. Costs per acre for the cyclic planting, harvesting andfallow periods as well as value of the harvest are taken from UFresearch and brought to 2012 dollars. Total costs for cultivationover the crop cycle used are $1,061 at 2010 rates. Sales pergross acre were set at $1,200 per acre. While modeling usestoday’s 2012 dollars, planting does not begin until 2014 andfull production is not realized until 2020. Coal costs are takenfrom industry reports for coal delivered on-site at the CrystalRiver facility in Citrus County at $64/ton in 2012.Scenarios ModeledThree policy changes were made to the standard forecast in theREMI model that were run simultaneously. The first model thecosts of production as an economic stimulus in <strong>Florida</strong>’s threeRegional Area of Critical Economic Concern. Economic assistancemight be available as a value added agricultural stimulus, butwould require a policy change from current DEO investmentpolicy which does not reward valued added agriculture as aneconomic investment. The sudden production of 130 to 200thousand acres in the RACECs is mitigated by spreading theinvestment over a five year period. This reduces shock on thesupply side of equipment sales and manpower shortages.Preparation begins in year 2014 with initial harvesting beginningat 2016. Full scale harvesting is achieved in 2020. Due toreduced growing efficiencies in the northern tier counties in<strong>Florida</strong>, acreage is increased from the 130,000 acres proposedfor South <strong>Florida</strong>’s FHREDI region to 200,000 total acres proposedfor the Opportunity <strong>Florida</strong> and the North <strong>Florida</strong> EconomicDevelopment Partnership. The increased acreage compensatesfor reduced growth potential and nets the same yield per RACEC.Each RACEC has varying numbers of participating counties.For each county, investment is allocated per its equal shareof the total acreage. No counties outside of the RACECs wereallocated any cane production investments. In recognition ofthe extremely small acreage available in Franklin County, itsallocation was reduced and the remaining share redistributedamong the other eight Opportunity <strong>Florida</strong> Counties.The second scenario modeled sales of product from the region.Per the recommendation of the REMI econometric staff, this wasmodeled in the utilities block as the sales constitute purchaseof a fuel stock. Again as in the first model, impacts of sales aredistributed among the RACEC counties in ratios dependant onthe number of member counties in each region. Sales inputslag investment inputs by three years due to the delay time inmaturation of the crop. Using a very simple cost-return calculation,profitability was calculated. The southern region, FHREDIbecomes profitable in the fifth year while the two northernregions do not turn a profit until year six.The third scenario models the reduction of coal as an import tothe region which will also have a smaller but detectable impact.To determine the effect of this change, locations and proposedconsumption patterns of coal-fired facilities of the four majorpower companies in <strong>Florida</strong> were modeled with reductions ofcoal demand distributed among <strong>Florida</strong>’s coal-fired plants inproportion to the intended use as outlined in site plan reportsfiled with the Public Service Commission. The graphic depictsthe programmed coal use of <strong>Florida</strong>’s coal burning utilities andthe proportional reduction of use as biomass replaces a portionof that component. By 2020, the modeled scenario producessufficient Cane biomass to produce 1,717MW of electricity anddisplaces 11.2% of the state’s proposed coal budget or 3.84Mtons of coal.Source:Figure 22: Coal Use of <strong>Florida</strong>’s Coal Burning UtilitiesExpansion or InvestmentIt is not anticipated that the proposed scenario could beexpanded upon to any large degree. The conversion of lessproductive agricultural uses to cane is already impressive. It isconsidered that these conversions to cane would take placeon lands going out of production due to losses in the tomatoand truck farming sectors and in conversion of former timberlands which are suffering economically.ENERGY ASSURANCE STUDY | 31