AnnuAl report 2007 - Raiffeisen Landesbank Tirol

AnnuAl report 2007 - Raiffeisen Landesbank Tirol

AnnuAl report 2007 - Raiffeisen Landesbank Tirol

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGAnnual<strong>report</strong><strong>2007</strong>

0Contents

ContentspageForeword of the Board of Managing Directors 05Foreword of the Chairman of the Supervisory Board 07The <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG 08Management <strong>report</strong> 13Annual financial statements 25RLB offices 43Imprint 43

0Introduction

0Foreword of the Board of Managing DirectorsLadies and Gentlemen,Despite difficult framework conditionsfor the loan business, <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG can look backon an extremely successful <strong>2007</strong>.A significant increase in operatingincome, a sideways movement inoperating expenses, and a positivedevelopment in credit risk provisionsonce again led to a very satisfactoryresult.At the same time, we were able tofurther increase the quality of our customerrelations. For instance, thanksto proficient consulting and innovativeproduct solutions, we secured a sustainableadded value for our customers.Furthermore, we managed tofurther consolidate our thematic leadershipon the Tyrol banking market.<strong>Raiffeisen</strong>-<strong>Landesbank</strong> stands forproximity, above all personal proximity.This is why we opened our 17 thbranch in <strong>2007</strong>. We are pleased tonow be able to offer expert consultingand comprehensive banking services– as in other regions – in the Pradldistrict of Innsbruck.The pleasing development of ourbusiness is largely down to our committedand superbly trained employees.They are our key competitiveadvantage and ensure our long-termsuccess.<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGassumes responsibility for Tyrol asa place to live. Our long-standing traditionof funding social programmes,art, culture, education, science,churches and sport is firmly anchoredin our company. We feel we havea duty to these values in the future,too, not just to maximising profits.As the <strong>Raiffeisen</strong> Banking Group Tyrol– comprised of 82 <strong>Raiffeisen</strong> banksand <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG –we are by far the largest and highest-performancebanking group inthe province of Tyrol, and together weare writing a success story. Thanksto close cooperation in this organisation,in particular, we were also able tocement this position in <strong>2007</strong>. In turn,this guarantees the independence ofthe Tyrolean <strong>Raiffeisen</strong> banks and theability to supply the entire local populationand economy with customerorientedbanking products.We would like to thank our customers,partners, owners and employeesfor their confidence in us, and welook forward to successfully workingtogether in 2008.Reinhard Mayr Hans Unterdorfer Gobert Sternbach Hannes Schmid

0Overview of the Board of Managing Directorsand Supervisory BoardThe <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGBoard of Managing DirectorDr Hannes SchmidSpokesmanReinhard Reinhard MayrMemberOlaf Gobert SternbachMemberDr Hans UnterdorferMemberThe <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGBoard of Managing DirectorPeter GreidererChairmanDirector, <strong>Raiffeisen</strong>bank WörglKufsteinJosef GraberDeputy ChairmanDirector, <strong>Raiffeisen</strong> Regional BankHall in <strong>Tirol</strong>lAndreas MantlDeputy ChairmanDirector, <strong>Raiffeisen</strong>bank WipptalPeter-Roman BachlerDirector, <strong>Raiffeisen</strong>bank KitzbühelBerthold BlassnigDirector, <strong>Raiffeisen</strong>bankDefereggentalJohannes GomigDirector, <strong>Raiffeisen</strong>bank ReutteEngineer, Alfred GreilFarmer, DölsachHerbert JehleDirector, <strong>Raiffeisen</strong>bank PaznaunMeinhard MayrDirector, <strong>Raiffeisen</strong> District BankSchwazDr Manfred OppererLawyerOlaf Gallus ReinstadlerDirector, <strong>Raiffeisen</strong>bank PitztalEmployees’ committee delegatesAgathe Astner, Sistrans*Olaf Stefan Bodner, AldransDoris Clementi, Innsbruck**Gerhard Elentner, Mils*Olaf Heinz Hofer, Lienz*Werner Kerber, Hall**Johannes Kröll, Innsbruck*Olaf Roman Sautner, Jenbach**Erika Zingerle, InnsbruckDr Markus Zorn, Rum*** up to 13.04.<strong>2007</strong>** from 13.04.<strong>2007</strong>State CommissionersCourt CounsellorDr Michael Manhard(Federal Finance Ministry, Vienna)Otto Schabl(Federal Finance Ministry, Vienna)

0Foreword of theChairman of the Supervisory Board<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG,the flagship of the <strong>Raiffeisen</strong> BankingGroup Tyrol, further consolidatedits market position as Tyrol’s leadingfinancial service provider in <strong>2007</strong>.Thanks to risk- and earnings-orientedgrowth based on a clear strategy, anoutstanding result was achieved onceagain.The <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGBoard of Managing Directors systematicallymaintained the course ofcustomer orientation and aligned thewhole company even more closelywith the wishes and requirements ofits customers. It was possible to pushahead with and conclude importantforward-looking projects. At this point,I would like to particularly highlight theprofessional implementation of thenew legal framework conditions fromBasel II and MiFID.<strong>2007</strong> has once again shown, ina difficult environment with increasingcompetition, that the strength of thealliance with the Tyrolean <strong>Raiffeisen</strong>banks has an essential part to play inresponding to common challenges ofthe future. This organisation enablesus to be thematic leaders, marketleaders and great innovators, bothnow and in the long-term future.The intensive cooperation betweenthe Supervisory Board and the Boardof Managing Directors was continuedconstructively and productively againthis year, to the common benefit of the<strong>Raiffeisen</strong> Banking Group Tyrol andRLB <strong>Tirol</strong> AG as its top institute. Forthis I would like to heartily thank all ofthose involved, the entire Board ofManaging Directors, all managementpersonnel, functionaries and employees.Dir. Business ExecutivePeter GreidererSupervisory Board Chairman

0<strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG

0<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGA modern but traditional service provider<strong>Raiffeisen</strong> stands for expertise andreliability in all financial matters. The<strong>Raiffeisen</strong> financial organisations havea tradition which stretches back morethan a century and is founded uponthe ideas of Friedrich Wilhelm <strong>Raiffeisen</strong>.With these principles, he laidthe cornerstone for a unique successstory and a cross-border, world-encompassingform of enterprise.<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG is thetop institute of the <strong>Raiffeisen</strong> BankingGroup Tyrol, which is also morethan 99 per cent owned by Tyrolean<strong>Raiffeisen</strong> banks, and it represents byfar the largest and highest-performancebanking group in the provinceof Tyrol in its alliance with the Tyrolean<strong>Raiffeisen</strong> banks.<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG isa modern universal bank and offersits customers tailor-made, forwardlookingsolutions and proficient consulting.Numerous special <strong>Raiffeisen</strong>companies make a decisive additionalcontribution by supplying expertknowledge and attractive productsand services.RLB <strong>Tirol</strong> AG offers the Tyroleanraiffeisen banks competitive productsolutions and professional services.Real-life partnerships, mutual esteem,professionalism and a sense ofresponsibility are benchmarks for ouractivities.Successful cooperation in an allianceOne of the <strong>Raiffeisen</strong> tenets is helpingeach other out where the strengthof the individual is not enough. Theprinciple serves as a foundation forthe <strong>Raiffeisen</strong> Banking Group, whichrepresents Austria’s largest bankinggroup, with a market share of over38 per cent and the country’s densestbranch network.Close cooperation within the grouphas also been the key to the successof the <strong>Raiffeisen</strong> Banking Group Tyrol,and it remains so to this day. It is thiscooperation which brings about themaximum benefit from synergiesand allows the market to be workedon actively and systematically. Thecustomers benefit from this throughinnovative product solutions and thegreatest proficiency in consulting.Furthermore, the <strong>Raiffeisen</strong> organisationis active in almost all key sectorsof the Austrian economy in the form ofinvestments, and therefore constitutesa comprehensive network. <strong>Raiffeisen</strong>customers can call upon this network,and they value the advantages whichcome with it.

10Clear direction“If you don’t know which port you’reaiming for, no wind will be the rightone.” (Seneca)The vision of <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG is both a foundation for itslong-term orientation and a yardstickfor all actions and activities.We are Tyrol’s leading financialservice provider, and we guaranteesustainable added value for customersand <strong>Raiffeisen</strong> banks throughoutstanding performance.An awareness of responsibility, mutualesteem and professionalism form thebenchmarks for our partnerships.➜ We offer our customers individualsolutions.➜ Committed employees and theirdevelopment ensure that we remaina step ahead.➜ Our innovative activities as anorganisation guarantee marketleadership and independence.➜ We assume responsibility for Tyrolas a place to live.From vision to successOur medium-term strategy was determinedon the basis of the companyvision and a business model gearedconsistently towards our customers.The division into five strategicbusiness areas (retail and businesscustomers, private banking, corporatecustomers, own business and <strong>Raiffeisen</strong>banks) enables us to respondto the specific needs of individualcustomer groups.Because this strategy places thecustomers at its centre, it becomespossible to orient all the processesin the company towards its customers.Furthermore, the strategy is thefoundation for targeted initial trainingand further training, and ensures thecompany’s economic success.In this way, the customers profit fromproficient consulting geared towardstheir individual needs, from tailormadesolutions, innovative productsand quick handling. This brings aboutsustainable added value.Business model of<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGSBAPrivate andbusinesscustomersSBAPrivate bankingSBAcorporatecustomersSBAown businessSBA<strong>Raiffeisen</strong> banksInternal service functions

11<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGProfitable partnershipA partnership put into active practiceunites RLB <strong>Tirol</strong> AG with its customers.The focus here is on discretion,professionalism and short decisionroutes in order to offer the customersthe best support in realising theirplans and goals. Our personal customersupport, targeted response toindividual requirements and outstandingproduct quality are particularlynoteworthy.<strong>Raiffeisen</strong> stands for proximity. Thepersonal proximity provided by ourconsultants plays a central role in this.But we also place great value in beinglocal. This is why RLB is constantlyoptimising its bank branch network inthe Tyrol districts of Innsbruck, Innsbruck-Land,Imst and Lienz.Offering the best support to customersin every phase of life and everyfinancial challenge is a founding principleof RLB <strong>Tirol</strong> AG. To achieve this,we have specialists with attractive solutionson hand who respond specificallyto particular needs and developtailor-made offers. This allows privaterequests to be fulfilled or entrepreneurialplans to be made into reality.RLB <strong>Tirol</strong> AG offers particular serviceswhich go beyond the range of classicbanking. These include special bankingservices, interesting lecture seriesand the use of the comprehensiveRaffeisen network. The sustainableadded value which results from thisincreases trust and forms the basisfor a long-term, profitable partnershipbetween RLB <strong>Tirol</strong> AG and its customers.The key to successAs a service provider, our success isreflected above all in the satisfactionof our customers. Benchmarks forthis satisfaction are proficient consulting,market-tailored product solutions,quick handling and dealing with complaintsprofessionally. Our employeestake on a central role in all theseareas. They are the most importantpoint of contact to customers and thekey to success.The employees of <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG stand out thanks toa great degree of expertise and socialskills, as well as above-average commitment.This competitive advantageprovides the guarantee of being ableto quickly respond to the needs ofthe customers, to new challengesand arising market opportunities. Thisensures that <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG remains a step ahead.A requirement for this is regular, highlyfocused human resources development.This is why professional, methodicaland personal development ofour employees has been anchored inour strategy as an essential companygoal. Some important instrumentsfor <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG’sprofessional personnel managementare job descriptions, income brackets,and managing with performanceagreements which are linked toa performance-related pay scheme.Furthermore, RLB <strong>Tirol</strong> AG placesgreat value in the satisfaction andwell-being of its employees. A keyrole in this is played by the companysports association and the company’sown gym which is available to all employees.Together, <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG employees were ableto achieve excellent results in skiingraces, golf and football tournamentsand other competitions.

12Responsibility for Tyrol as a place to liveRLB <strong>Tirol</strong> AG traditionally regards socialengagement and responsibility forTyrol as a place to live as a duty whichis assumed actively and with pleasure.Due to our strong local roots, theresidents of Tyrol occupy a specialplace in the heart of the company.The top institute of the Tyrolean <strong>Raiffeisen</strong>Banking Group is pleased tosupport social initiatives and facilitiessuch as Caritas, Aktion Leben and the“Red-Nosed Clown Doctors”. We alsosupport numerous smaller initiatives.For example, as part of a campaignin connection with World Savings Day<strong>2007</strong>, we aided the “Nestwärme” associationin installing new equipmentin its headquarters.In addition, there is a long traditionof supporting art and culture at RLB<strong>Tirol</strong> AG. We began building up anart collection in Innsbruck as far backas the early 1960s, and were one ofthe first banking institutes in Austriato do so. Since 1997 there has beena dedicated space for exhibitions inthe Adamgasse branch in Innsbruckcalled the RLB Art Bridge (Kunstbrücke).Three exhibitions have beenpresented here each year – showcasinga spectrum from young Tyroleansto renowned international artists.RLB <strong>Tirol</strong> AG has enjoyed successfulpartnerships for many years withthe Innsbruck Ancient Music Festival,the Tyrolean Festival, and the NewOrleans Festival.Together with the Tyrolean <strong>Raiffeisen</strong>banks, RLB <strong>Tirol</strong> AG is amongst thelargest sponsors of grass-roots andtop-level sport in Tyrol. Numerousclubs and individual sportspeoplewear the crossed horse gable symbolof their sponsor on their clothing withpride.

Management<strong>report</strong>13

14Overall economic developmentContinuing strong global economicgrowth<strong>2007</strong> will go down in the history booksas a year of strong, yet not untroubledeconomic growth. After a pleasingfirst six months, the economic situationbegan to weaken in the secondhalf of the year, triggered by the propertycrisis in America. The dynamicgrowth of the emerging countries,above all China and India, was able tocushion the weak economic situationin the West to an extent, and providedthe world economy with substantialsupport. In turn, global GDP exhibitedan increase of more than 5 per cent.Raw materials’ prices on the riseAs a consequence of the continuedstrong economic growth in Asian, thedemand for energy and raw materialswas correspondingly high. There wasno stopping the crude oil price, whichonly just fell short of the 100-dollarmark per barrel in <strong>2007</strong>. Gold establisheditself as a crisis currency and,at a price of USD 845.40 per ounce atthe start of November, only remainednarrowly under its all-time high of1980. The growing world population,the changing eating habits in Asia andthe increasing use of wheat, corn,sugar and soya for fuel and energyproduction led to clear price increasesin agricultural raw materials.Volatile stock marketsInvestors experienced a constant rollercoasterride on the stock markets.Positive economic data and pleasingcompany profits proved a catalyst fora good start to <strong>2007</strong>. Emerging worriesregarding the US economy anda slide on the Chinese stock marketcaused setbacks in March before thestock indexes, aided by increasinglyoptimistic economic growth forecasts,were in some cases able to reachnew all-time highs. After the crisison the US mortgage credit marketcaused drastic stock price losses,the interest rate cut by the AmericanFederal Reserve (FED) in Septemberalong with the plucky intervention ofthe central banks eased the tensiononce more and brought about risingshare prices. The increase did notlast long before reverting to a downwardtrend once more. This was inrespect of a further need for depreciationamongst numerous financialinstitutes, coupled with fears over theconsequences of the crisis on the USeconomy. A countermovement set inmotion towards the end of the yearwith the prospect of further interestrate cuts in the USA.

15Management <strong>report</strong>Asia the big winnerAfter a year of large fluctuations,the American and Japanese stockexchanges finally closed with a lossagainst the Euro. The weak US dollarand Yen led to a result of -6.36 percent for the S&P 500, and of -15.67percent for the Nikkei, in <strong>2007</strong>. Onceagain, this confirmed that monitoringthe currency markets plays an importantrole in investment. The majority ofthe European stock markets exhibiteda sideways movement below the line.Not even the ATX, with a plus of just1.11 per cent could repeat its successof the previous year. The strongeconomic growth and healthy influx offoreign capital led to clear increaseson the Asian stock markets. At thevery head of this field was China,where the stock markets, fuelledby economic growth of over 11 percent, were able to show rapid priceincreases. However, the Indian marketalso exhibited a plus of almost 50 percent for the year.Central banks activeThe European Central Bank increasedits key interest rate twice in the firsthalf of <strong>2007</strong> to reach the current levelof 4 per cent. The returns on Europeangovernment bonds also roseto 4.7 per cent thanks to positiveeconomic data. Despite inflation risks,the American Federal Reserve wasforced by the mortgage crisis to relaxits interest rate policy. It cut its interestrates three times in Septemberby a total of 100 basis points to 4.25per cent. The investors’ rush for safegovernment securities brought theten-year American bond to a low of3.8 per cent in November.Guarantee products remainin demandThe marginal increase in interestrates in the bond markets resulted ininvestors retaining their lively interestin guarantee products with opportunitiesfor attractive returns. Moreover,the demand for shares, certificatesand investment funds continued toshow an upward trend. The extensiveliquidity available continued to seekalternative attractive possibilities forinvestment, and largely flowed intothe aforementioned possibilities.Austria’s economyThe dynamism in the Austrian economyremained equally high in <strong>2007</strong>.According to interim figures, real GDProse by 3.3 per cent. Exports againrepresented the driving force of theAustrian economy, with a growthrate of 6.4 per cent, whilst consumerdemand proved rather cautious,rising by 1.6 per cent. The excellenteconomic situation revealed clearpositive effects on the labour market.With increased employment of 1.9per cent, Austria exhibited dynamismon its labour market, the likes of whichhad not been seen since 1991. At4.3 per cent, the unemployment ratestood even lower than its level duringthe economic boom at the turn of thecentury.In summary, it can be said that theAustrian economy found itself ina phase of prosperity in the past year,the high point of which may alreadyhave past, however, in keeping withthe European trend. Nevertheless,despite all the turbulence, 2008 isexpected to bring a growth rate overthe 2 per cent mark.

16Business development<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG canlook back on a successful <strong>2007</strong>. Therisk- and earnings-oriented approachwas systematically maintained. Thisled to a significant increase in operatingincome alongside a very positivedevelopment in credit risk provisions.The company was able to keep operatingexpenses at the same level asthe previous year. This resulted in thebest result in the history of <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG.Total assets in EUR mill.31.12.2000 31.12.2001 31.12.2002 31.12.2003 31.12.2004 31.12.2005 31.12.2006 31.12.<strong>2007</strong>4,151 4,651 4,922 5,120 5,086 4,882 4,758 5,047* Deviations in the figures after the decimal point can occur in the sub-totals due to rounding.Employment of funds/assets structure31.12.<strong>2007</strong> 31.12.2006 Changeeur mill. eur mill. eur mill.Loans to banks 2,337.67 46.3% 2,104.98 44.2% 232.69 11.1%Loans to customers 2,093.09 41.5% 2,082.68 43.8% 10.41 0.5%Securities 293.00 5.8% 250.67 5.3% 42.33 16.9%Investments including sharesin affiliated companies 170.76 3.4% 165.98 3.5% 4.78 2.9%Other assets 152.85 3.0% 153.86 3.2% -1.01 -0.7%Total assets 5,047.37 100.0% 4,758.18 100.0% 289.19 6.1%The increase on the assets side of6.1 per cent, or EUR 289.19 million,to EUR 5,047.37 million, wasprimarily due to an increase in theloans to banks and in the securitiesin the company’s own possession.The loans to banks rose by 11.1 percent, or EUR 232.69 million, to EUR2,337.67 million, and the securitiesrose by 16.9 per cent, or EUR 42.33million, to EUR 293 million. The loansto customers also rose by 0.5 percent, or EUR 10.41 million, to EUR2,093 million, and the investments includingshares in affiliated companiesby 2.9 per cent, or EUR 4.78 million,to EUR 170.76 million. There wasa slight reduction in the other assetsitem of 0.7 per cent, or EUR 1.01 million,to EUR 152.85 million.

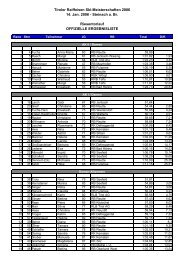

17Management <strong>report</strong>Loans to customers at year-end <strong>2007</strong> showed the following breakdown:Branch comparisonOver<strong>2007</strong> <strong>2007</strong> 2006 Change Total loansthou. EURthou. EURAgriculture, forestryand co-operatives 25,547 25,211 1.3% 1.2%Transport 125,306 129,683 -3.4% .0%Commerce 392,215 344,103 14.0% 18.7%Industry 87,409 102,396 -14.6% 4.2%Employed, private persons 484,292 521,459 -7.1% 23.1%Tourism, leisure industry 325,520 352,147 -7.6% 15.6%Public bodiesand social security institutions 59,482 4,704 -8.1% 2.8%Freelancers, self-employed 2,190 7,771 -8.2% 3.0%Retail 123,312 117,860 4.6% 5.9%Other (housing associationsand other non-banks) 407,819 357,351 14.1% 19.5%Total 2,093,092 2,082,684 0.5% 100.0%In <strong>2007</strong>, <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG was able to further enhance its risk-bearing capacity.Equity (according to § 23 of the Austrian Banking Act)31.12.<strong>2007</strong> 31.12.2006 Changethou. EUR thou. EUR thou. EURSubscribed capital 80,000 80,000Liability reserve 3,760 2,260Uncommitted reserves 165,161 155,237Intangible assets -50 -381CORE CAPITAL 308,871 297,116 11,755 4.0%Supplementary capital 12,397 18,600Secondary capital 2,080 3,120SUPPLEMENTARY EQUITY 14,477 21,720 -7,243 -33.3%EQUITY prior to deductions 323,348 318,836 4,512 1.4%Deduction (§23 (13) Austrian Banking Act) -2,502 -2,502ACTUAL EQUITY 320,846 316,334 4,512 1.4%Equity ratio pursuant to § 22 (1)of the Austrian Banking Act (>8%) 11.28% 11.74%During the year under review, <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG equityrose by 1.4 per cent, or EUR 4.51million, to EUR 320.85 million. Theequity ratio totals 11.74 per cent andtherefore still stands well above themandatory equity quota of 8 per centpursuant to § 22 Section 1 of the AustrianBanking Act.

18Source of funds/capital structure31.12.<strong>2007</strong> 31.12.2006 Changeeur mill. eur mill. eur mill.Liabilitiesto banks 2,559.47 50.7% 2,690.56 56.5% -131.09 -4.9%Giro deposits 16.19 12.2% 523.18 11.0% 93.01 17.8%Savings deposits 537.43 10.6% 503.38 10.6% 34.05 6.8%Certificated liabilities 901.38 17.9% 625.23 13.1% 276.15 44.2%Equity 308.92 6.1% 297.83 6.3% 11.09 3.7%Other liabilities 123.98 2.5% 118.00 2.5% 5.98 5.1%Total capital 5,047.37 100.0% 4,758.18 100.0% 289.19 6.1%On the liabilities side, the increase intotal assets can be traced primarilyto a significant rise in certificated liabilitiesand giro deposits. It was possibleto raise certificated liabilities by 44.2per cent, or EUR 276.15 million, toEUR 901.38 million, and giro depositsby 17.8 per cent, or EUR 93.01 million,to EUR 616.19 million. Savingsdeposits rose by 6.8 per cent, or EUR34.05 million, to EUR 537.43 million,equity by 3.7 per cent, or EUR 11.09million, to EUR 308.92 million, andother liabilities by 5.1 per cent, or EUR5.98 million, to EUR 123.98 million.Liabilities to banks fell by 4.9 percent, or EUR 131.09 million, to EUR2,559.47 million.Income situation<strong>2007</strong> 2006 Changeeur mill. eur mill. eur mill.Net interest income 44.76 40.31 4.45 11.0%Income fromsecuritiesand investments 12.93 11.33 1.60 14.1%Income from commission 30.29 28.04 2.25 8.0%Income/expenses fromfinancial business 2.71 2.43 0.28 11.5%Other operating income 10.59 13.50 -2.91 -21.6%OPERATING INCOME 101.27 95.61 5.66 5.9%Personnel expenses -39.98 -38.38 1.60 4.2%Other adminstrative expenses(cost of materials) -20.62 -19.58 1.04 5.3%Provisionsfor assets -4.43 -5.67 -1.25 -22.0%Other operating expenses -1.02 -2.48 -1.46 -58.8%OPERATING EXPENSES -66.04 -66.11 -0.06 -0.1%OPERATING RESULT 35.23 29.50 5.72 19.4%Balance from reversals/allocations from and tothe provisions for loans -13.80 -17.39 -3.59 -20.6%Balance from reversals/allocations from and to the provisionsor securities and investments -3.88 3.76 -7.64 -203.4%Result from ordinarybusiness activities 17.55 15.87 1.67 10.5%

19Income situationThe development of operating incomein <strong>2007</strong> was pleasing. It was possibleto raise it from 5.9 per cent, or EUR5.66 million, to EUR 101.27 million.The net interest income increased by11.0 per cent, or EUR 4.45 million, toEUR 44.76 million, the income fromcommission by 8.0 per cent, or EUR2.25 million, to EUR 30.29 million,and the income from securities andinvestments by 14.1 per cent, or EUR1.6 million, to EUR 12.93 million. Thedevelopment of the income/expensesfrom financial business was equallypositive. Here, an increase of 11.5per cent, or EUR 0.28 million, to EUR2.71 million, was achieved. The otheroperating income decreased, dueto special effects in 2006, by 21.6per cent, or EUR 2.91 million, to EUR10.59 million.Operating expenses were kept atthe level of the previous year, and itwas even possible to reduce themslightly, by 0.1 per cent, or EUR 0.06,to EUR 66.04 million. There was aslight development in personnel costsand other administrative expenses.Personnel expenses increased by 4.2per cent, or EUR 1.6 million, to EUR39.98 million, and other administrativeexpenses by 5.3 per cent, or EUR1.04 million, to EUR 20.62 million.The other expense items showed anextremely positive picture. Provisionsfor assets fell by 22 per cent, or EUR1.25 million, to EUR 4.43 million, andother operating expenses decreasedby 58.8 per cent, or EUR 1.46 million,to EUR 1.02 million.Despite the systematic pursuit of ourprovision-oriented value adjustmentpolicy, the balance from provisionsfor loans and to certain securities andallocation to contingent liabilities, andincome from reversals of provisionsfor loans and to certain securities andreversals of contingent liabilities wascut by 20.6 per cent, or EUR 3.59million, to EUR 13.80 million. Thebalance of provisions for securitieswhich are valued as financial assetsand provisions for investments andshares in affiliated companies, againstincome from the reversal of securitieswhich are valued as financial assetsand of investments and shares in affiliatedcompanies increased by 203.4per cent, or EUR 7.64 million, to EUR3.88 million. This development canbe attributed to the difficult frameworkconditions, in particular in the secondhalf of <strong>2007</strong>.The result from ordinary businessactivities for the year under reviewwas up by 10.5 per cent, or EUR 1.67million, at EUR 17.55 million.Management <strong>report</strong>BranchesAs of 31 December <strong>2007</strong>, <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG wasrepresented in the market territoryby 21 branches, three of which areself service. The employees at ourbranches look after more than 65,000private and corporate customers.In order to further consolidate thepersonal proximity to our customers,a new branch was opened in <strong>2007</strong> inthe Pradl district of Innsbruck.Human resourcesDuring the <strong>2007</strong> financial year, <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG had anaverage of 520.8 employees (499white-collar and 21.8 blue-collar). Thisrepresented a slight increase of 2.5per cent over 2006.

20Risk <strong>report</strong>Modern risk managementActive risk management is a major<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG priorityand secures long-term success.In line with mandatory requirements(Austrian Banking Act and BaselII), RLB <strong>Tirol</strong> AG has set itself theobjective of guaranteeing the profitabilityand security of the bank in theinterests of the customers and ownersby using up-to-date methods andcorresponding risk management andcontrolling systems.Risk policy principlesThe foundations of our risk managementpolicy are provided by theBoard of Managing Directors, whichare regularly reviewed and modifiedwhere necessary:➜➜➜The Board of Managing Directorsand the entire workforce feelan obligation to the risk policyprinciples and make their dailydecisions in line with these directives.In cases of unclear risk or doubtsregarding methodology, the principleof prudence is employed.As a rule, the introduction of newbusiness areas or products ispreceded by a full analysis of thespecial business risks involved(product launch process).Risk management principlesOur risk management approach isbased on the following principles:➜➜➜The Board of Managing Directorsbears overall responsibilityfor risk management supervisionwithin <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG. The Supervisory Boardexamines our risk policy at regularintervals.The management of loan, market,liquidity and operational riskstakes place as a coordinatedprocess on all the relevant levelsof the bank.The risk committee prepares andrecommends the risk strategy,risk capital allocation and thecorresponding limitation of theallocated risk capital for the entirebank (risk-bearing capacity),the types of risk and the strategicbusiness fields.Risk management organisationRisk management is organised ina manner that prevents conflictsof interest on both a personal andorganisational level (separation ofmarket/market monitoring). The assignmentsand the organisationalprocedures involved in the measurementand surveillance of risks, thelimit structure and the action to betaken should limits be exceeded, areundertaken by financing and marketrisk management and are presentedin the relevant <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG manuals.Credit riskCredit risk is defined in the case ofcounterparts, banks, investments,countries and concentrations.Loan allocations, i.e. targeted acceptanceof risks, number amongstthe major core business areas of<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG.Therefore, the financing managementorganisational unit supports the operativeunits in the checking, measurementand control of the creditrisk, as well as the management ofthe problem involvement. Variousanalyses of the existing risk profilerepresent a fixed element in financingmanagement <strong>report</strong>ing. Closing date<strong>report</strong>s and forecasts are prepared inthe course of a monthly risk committeemeeting.In line with the principle of proportionality,risk evaluation and controlmethods have been developed andimplemented. The differing risk contentof the loan activities is allocateddifferentiated treatment in the correspondingcalculations. On the basis ofmandatory, supervisory requirementsand recommendations, as well asbusiness management advantages,RLB <strong>Tirol</strong> AG has set itself the task ofcontinually developing and improvingthe risk management process.➜

21Management <strong>report</strong>The risk situation of a borrower isconsidered in two dimensions bymeans of an in-house rating system.This involves an ongoing assessmentof the economic situation on the onehand, and the evaluation and checkingof hedging for risk reduction onthe other. A comprehensive, activerisk management control process,which is further supplemented byaggregation, control, monitoring andchecking, is therefore assured.The related tasks and organisationalprocedures, as well as the credit riskstrategy approved by the Board, areclearly described in the <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG credit manual,and they have been communicatedto all personnel entrusted with thecompletion of business, and are alsoavailable online. This ensures that inevery individual case, risks are onlyassumed that correspond to our riskpolicy. In addition, in line with theprinciple of commercial prudence,sufficient provisions are formed forexisting risks.Market riskMarket risks originate from interestrate changes and the currency andexchange rate risks derived from securities,interest and foreign exchangeitems. Market risks occur in both retailand non-retail business.<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGuses a combination of various riskmeasurement dimensions (sensitivity,value at risk) with regard to economiccapital, in order to control market risksand set corresponding limits.Market risk is managed in the Treasury,in which all items are systematicallycollated and then appropriatelyendowed. In addition to loan business,<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong>AG’s own business numbers amongits core activities.The market risk management organisationalunit supports the Treasury inthe pre- and post-control of marketrisks. The identification, measurement,aggregation and monitoringof the market risks (limit) and <strong>report</strong>ingconstitute the main assignmentsof market risk management. Marketrisks are <strong>report</strong>ed to the Boardof Managing Directors during themonthly risk committee meetings andappropriate control measures areproposed.Liquidity riskThe refinancing of loans at matchingmaturities is highly significant at<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG. Thisstrategy is supplemented on an operativelevel by the appropriate liquiditygap limits. Marketing risk managementchecks to see that these limitsare adhered to. Sufficient provisionsof short- and long-term liquidity forpossible bottlenecks are included ina separate liquidity plan and are regularlydiscussed by the risk committee.The assignments and organisationalprocedures relating to the managementof market and liquidity risk areclearly described in the <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG Treasury RuleBook.Operational riskRLB <strong>Tirol</strong> AG understands operationalrisk as the risk that losses could beincurred due to system, process oremployee error, or as a consequenceof external events. At present, theequity requirement for operational riskis determined according to the basicindicator method.<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG hasinitiated organisational and computertechnology measures in this risk segment.Limit systems, competence allocation,a risk-adequate internal controlsystem, as well as regular checks byInternal Auditing, guarantee a highstandard of security.➜

22➜Risk-bearing capacityWithin the scope of overall bank riskcontrol at <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG, the available risk-bearingpotential (income, equity and hiddenreserves) of the bank are balancedagainst all major risks, which aredetermined using the latest methodsand appropriate systems.The annually planned risk-bearingcapacity represents the limit for theoverall bank risk, whereby existing risklimits are taken into account as wellas the actual measured risk.All information of relevance to riskis incorporated into the monthlyrisk-bearing capacity analysis. Thiscompares the overall bank risk withthe available risk coverage in orderto ensure that, in the highly unlikelycase of an extreme situation, sufficientcapital would be available.The predominant factors in <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG risk managementare credit and market risks, asthe focus of bank business is on retailand corporate customers and treasurybusiness.The market risk derived from tradingand bankbooks is calculated usingthe value at risk parameter. whilecredit and investment risk is analysedin the project phase using the value atrisk approach.As well as market-related risks,operational risks are registered andcalculated within the scope of overallbank management in order to obtaina risk presentation, on the one hand,and to accommodate the developmentsrelating to Basel II on the other.This analysis is therefore the startingpoint for risk policy in the form of alimitation on the extent of risk activitiesto a level acceptable to the bank,with the aim of securing its continuedproblem-free existence and the appropriateexploitation of its incomepotential.Securing depositsSolidarity Association of the Tyrol<strong>Raiffeisen</strong> monetary organisationTogether with <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG, the Raffeisen banks of the<strong>Raiffeisen</strong> Banking Group Tyrol haveset up a solidarity association whichensures, through appropriate measures,that association members whichhave run into economic difficultiesreceive help.<strong>Raiffeisen</strong> Customer GuaranteeCollective for AustriaThis collective, which is formed by the<strong>Raiffeisen</strong> banks, <strong>Raiffeisen</strong> provincialbanks and the <strong>Raiffeisen</strong> CentralBank, provides a mutual guaranteeon all customer deposits and ownissues, irrespective of the amount.The customer guarantee system isorganised on a two-level basis: atprovincial level, on the one hand, andin the Federal Guarantee Collective onthe other. The Customer GuaranteeCollective thus ensures security forthe customers over and above themandatory deposit security.Deposit security institutions of theRaffeisen Banking Group AustriaVia <strong>Raiffeisen</strong>-Einlagensicherung <strong>Tirol</strong>reg. Gen. mbH, the member institutesof the <strong>Raiffeisen</strong> Banking GroupTyrol are together a member of theAustrian <strong>Raiffeisen</strong>-Einlagensicherungreg. Gen. mbH. This deposit securitycooperative represents the liable institutionfor the entire Raffeisen BankingGroup in accordance with §§ 93, 93aand 93b of the Austrian CommercialCode.For the purpose of deposit security, anappropriate early-warning system hasbeen implemented in the RaffeisenBanking Group Austria, which carriesout continuous analyses and observationsof income and risk developmenton the part of all member institutes,based on a comprehensive regulatory<strong>report</strong>ing system.

23Management <strong>report</strong>Outlook 2008In 2008, <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong>AG will continue to systematicallypursue its policy of risk- and earningsorientedgrowth. The company’s declaredaim in doing so is to optimiseoperative results within the frameworkof the agreed risk policy.After having specifically aligned ourcompany with our customers, andmade decisive improvements to theprocesses, it is now a case of furtherconsolidating our market positionin the various business fields. To doso, as well as tapping the existingcustomer potential, we are placingemphasis on a targeted acquisition ofnew customers.In the strategic business field of retailand business customers, we willcontinue our investment offensive andadjust the bank branches to the newwishes and needs of our customers.In 2008 there will be a focus on innovativeproduct solutions and the useof new sales channels. This is howwe will succeed in building upon theproximity we have to our customers.In the strategic business field of corporatecustomers, we are focusingon increasing the quality of customerrelationships. Thanks to proficientconsulting, providing tailor-made solutions,and a large degree of flexibility,we offer our customers sustainableadded value. In addition, our declaredaim is to convince new customers ofour high performance.In the strategic business field of privatebanking it is particularly importantto us to intensify customer relationshipsmore, and use the availablepotential even more effectively. Gainingnew customers is also of greatimportance here.In 2008, we will support our drive fornew customers by further optimisingour handling and support processes.Once again, we expect to improveour productivity in this area. We willsystematically pursue and furtherintensify the targeted support anddevelopment of our employees on thebasis of our 2010 personnel developmentconcept. For we are firmlyconvinced that committed and welltrainedemployees ensure that ourcompany stays a step ahead.In 2008, we will also work intensivelyon a new strategic orientation of <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG up to theyear 2012. In this way, we are settingour course for a successful future.We will anchor the new strategy in allbusiness fields, and systematicallyimplement it starting from 2009.In the association of the <strong>Raiffeisen</strong>Banking Group Tyrol, we aim toprovide new, innovative product solutions,and thus further consolidate ourthematic leadership. Even closer cooperationand continuing to work ona shared strategic orientation shouldallow us to profit even better fromthe existing synergies. In this way,we make an important contributiontowards ensuring our leading positionon the market and the independenceof the Tyrolean Raffeisen banks.We look forward to a successful2008.Board of Managing Directors <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGHannes Schmid reinhard Mayr Gobert Sternbach Hans Unterdorfer

Annual financialstatements25

26Balance as at 31 December <strong>2007</strong> - assets31.12.<strong>2007</strong> 31.12.2006eur eur thou. EUR thou. EUR1. Cash on hand, balances at central banksand postal giro offices 22,827,929.23 23,9322. Public sector debt issues and billsof exchange eligible for refinancingat the Austrian Central Bank:a) Public sector debt issues andsimilar securities ,778,347.18 10,689b) Bills of exchange eligible for efinancingat the Austrian Central Bank 0.00 6,778,347.18 0 10,6893. Loans to banks:a) Payable on demand 463,428,646.03 458,335b) Other loans 1,874,243,274.25 2,337,671,920.28 1,646,644 2,104,9794. Loans to banks: 2,093,092,495.38 2,082,6855. Bonds and other fixed interestsecurities:a) From public sector issuers 0.00 0b) From other issuers 184,124,544.82 184,124,544.82 108,648 108,648thereof: own bonds (0.00) (0)6. Bonds and other fixed interestnon-fixed interest securities 102,096,848.69 131,3327. Investments 149,048,803.51 144,699thereof: in banks (136,849,778.31) (127,574)8. Shares in affiliated companies 21,714,570.93 21,286thereof: in banks (0.00) (0)9. Intangiblefixed assets 49,985.35 38110. Tangible assets 51,074,522.01 54,103thereof:real estate buildings whichare used by the banks (24,356,713.42) (24,933)11. Own shares or interests and sharesin companies where a controllingor majority holding is held 0.00 0thereof: nominal value (0.00) (0)12. Other assets 76,672,634.36 73,87113. Subscribed capital,which has been demanded but not yet paid 0.00 014. Accruals and deferred income 2,220,060.28 1,573thereof: deferred taxes in accordance with § 198section 10 of the Austrian Commercial bank code (0.00) (0)TOTAL assets 5,047,372,662.02 4,758,178

27Annual financial statementsBalance as at 31 December <strong>2007</strong> - liabilities1. Liabilities to banks:31.12.<strong>2007</strong> 31.12.2006eur eur thou. EUR thou. EURa) Payable on demand 1,037,159,629.50 1,004,233b) With an agreed term or period of notice 1,522,314,081.62 2,559,473,711.12 1,686,327 2,690,5602. Liabilities to banks:a) a) Savings deposits 537,428,524.87 503,379thereof:aa) Payable on demand (0.00) (0)ab) With an agreed term or period of notice (537,428,524.87) (503,379)b) Other liabilities 16,190,788.00 1,153,619,312.87 523,167 1,026,546thereof:ba) Payable on demand (349,743,360.49) (307,522)bb) With an agreed term or period of notice (266,447,427.51) (215,645)3. Certificated liabilities:a) Bonds issued 0.00 0b) Other certificated liabilities 901,382,556.19 901,382,556.19 625,231 625,2314. Other assets 32,575,170.72 31,7315. Accruals and deferred income 885,029.20 9376. Provisions:a) Provisions for severance payments 8,355,207.17 8,159a) Provisions for pensions 22,854,070.65 23,406c) Provisions for taxes 0.00 0d) Others 15,658,761.40 46,868,039.22 11,258 42,8236.A Funds for general bank risks 0.00 07. Other assets 5,243,338.08 5,2438. Supplementary capital 32,803,945.21 32,8049. Subscribed capital 80,000,000.00 80,00010. Capital reserves:a) Committed ,967,800.00 ,968b) Uncommitted 0.00 66,967,800.00 0 66,96811. Revenue reserves:a) Legal reserves 8,000,000.00 8,000b) Reserves according to articles of association 0.00 0c) Other reserves 82,580,375.68 90,580,375.68 72,556 80,556thereof:Committed reserves (11,641,930.57) (11,642)Reserves (§23 Section 6, Austrian Banking Act) (0.00) (0)12. Reserves (§23 Section 6, Austrian Banking Act) 3,760,000.00 2,26013. Profit for the year 5,600,931.91 4,80614. Untaxed reserves:a) Valuation reserve due tospecial depreciation 7,612,451.82 7,713b) Other untaxed reserves 0.00 7,612,451.82 0 7,713thereof:ba) Investment grants from public funding (0.00) (0)bb) IA (§10, Austrian Income Tax Act 1988) (0.00) (0)bc)bd) IA (§12, Austrian Income Tax Act 1988) (0.00) (0)TOTAL liabilities 5,047,372,662.02 4,758,178

28Items below the bottom line:Balance as at 31.12.<strong>2007</strong> Balance as at 31.12.06eur eur thou. EUR thou. EURASSETS:1. Foreign assets 08,819,760.53 424,865LIABILITIES:1. Foreign assets 156,630,455.85 146,702thereof:a) Acceptedand endorsedbillssold (0.00) (0)b) Liabilities fromindemnity agreementsand guarantees (156,504,276.48) (146,678)2. Credit risks 257,994,890.72 210,815thereof: Liabilitiesfrom repo business (0.00) (0)3. Liabilitiesfrom trust business 0.00 04. Reserves pursuantto § 23 Section 6 14 320,845,524.81 316,334thereof: Deductible equity pursuantto § 23 Section 14, Item 7 (0.00) (0)5. Required equity pursuantto § 22 Section 1 227,818,287.02 216,704thereof: Equity pursuant to § 22,Section 1, Items 1 and 4 (227,580,287.02) (215,622)6. Foreign assets 364,117,746.15 421,7057. Hybrid capital pursuant to § 24 Section 2,Items 5 and 6 0.00 0

29Annual financial statementsProfit and loss calculation <strong>2007</strong><strong>2007</strong> 2006eur eur thou. EUR thou. EUR1. Interest and interest-related income 193,665,602.92 148,387thereof:From fixed interest securities (10,283,283.31) (5,889)2. Interest and interest-related income 148,903,583.18 108,077I. Net interest income 44,762,019.74 40,3103. Income from securitiesand investmentsa) Income from shares,otherstock rights andnon-fixed interest securities 3,062,784.97 2,788b) Income from investments 8,157,641.67 7,530c) Income from sharesin affiliated companies 1,709,144.42 12,929,571.06 1,017 11,3354. Income from commission 39,818,639.74 37,2435. Expenses on commission 9,533,264.45 9,2056. Income/expensesfrom financial business 2,705,672.08 2,4267. Other operating income 10,588,863.86 13,501II. Operating income 101,271,502.03 95,6108. General administrativeexpensesa) Personnel expenses 39,977,358.37 38,377thereof:aa) Wages and salaries (26,432,793.15) (24,145)ab) Expenses for legallyrequiredsocial securitycontributions andpayroll taxes (6,786,339.32) (6,617)ac) Other social expenses (2,107,529.98) (2,422)ad) Expenses for pension schemesand support (2,573,542.98) (2,617)ae) Allocations to the provisionsfor pensions (904,249.58) (1,538)af) Allocations to the provisionsfor severance paymentsto employee pensionfunds (1,172,903.36) (1,038)b) Other administrativeexpenses (material costs) 20,618,050.11 60,595,408.48 19,578 57,9559. Provisions for assetscontained in the assetside Items 9 and 10 4,426,877.15 5,67210. Other operatingexpenses 1,021,303.86 2,480III. Operating expenses ,043,589.49 ,107IV. Operating result 35,227,912.54 29,503

30Profit and loss calculation <strong>2007</strong> - Page 2<strong>2007</strong> 2006eur eur thou. EUR thou. EURIV. Operating result Carry forward 35,227,912.54 Carry forward 29,50311./12. Balance from reversalsfrom the provisionsfor loans andcertain securitiesand the provision forcontingent liabilitiesand loan risks,and allocationsand certain securitiesand the provision for contingentliabilities and loan risks. -13,798,460.55 -17,38613./14. Balance from reversalsfrom the provisionsfor securities whichare <strong>report</strong>ed as financialassets as well asinvestments and sharesin affiliated companies,and allocations to theprovisions for securitieswhich are <strong>report</strong>edas financial assets as well asinvestments and sharesin affiliated companies -3,883,748.11 3,756V. Result from ordinary business activities 17,545,703.88 15,87315. Extraordinary income 0,00 0thereof: Withdrawalsfrom the fund for general bank risks (0,00) (0)16. Extraordinary income 0,00 0thereof: Allocations to the fundfor general bank risks (0,00) (0)17. Extraordinary result(sub-total fromItems 15 and 16) 0,00 018. Taxes on incomeand earnings -169,117.09 -76719. Other taxes unless <strong>report</strong>edunder Item 18 -357,845.90 -703VI. Net profit 17,018,740.89 14,40320. Movements in the reserves -11,423,856.05 -9,603thereof:Allocation to the legal reserve (1,500,000.00) (390)Reversal from the legal reserve (0.00) (0)VII. Net income 5,594,884.84 4,80021. Profit brought forward ,047.07 VIII. Profit for the year 5,600,931.91 4,806

31AppendixAnnual financial statementsAccounting andvaluation principlesGeneral principlesThe annual financial statements weredrawn up in line with the principlesof orderly accounting, as well as thegenerally accepted standard thata true and fair view of the assets,financial position and profitability ofthe company be provided. The principleof completeness was observedduring the preparation of the annualfinancial statements.The principle of individual valuationwas observed during the valuationof the various assets and debts andthe going concern principle was assumed.The due diligence principle was observedand only those profits realisedon the balance sheet date were<strong>report</strong>ed. All recognisable risks andimpending losses were taken intoaccount.Currency translationThe currencies of the member statesin the Currency Union were <strong>report</strong>edat a fixed translation rate.In accordance with § 58 Section 1 ofthe Austrian Banking Act, amountsin foreign currencies are translatedaccording to the ECB reference rates,except where published at meanexchange rates (RZB fixing).Currency forward transactions aretranslated at the forward rate on thebalance sheet date in accordancewith § 58 Section 2 of the AustrianBanking Act.SecuritiesFixed interest securities in the fixedassets were valued according to themoderated lower of cost or marketprinciple in accordance with § 56Section 2 of the Austrian Banking Act.Other securities in the fixed assetswere valued according to the strictlower of cost or market principle.Securities serving as cover stock fortrust funds were regarded as fixed assetsand valued according to the strictlower of cost or market method pursuantto § 2 Section 3 of the AustrianTrust Fund Security Act.Trading stock and current assets werevalued according to the strict lower ofcost or market method in accordancewith § 207 of the Austrian CommercialCode. Current asset securitiesemployed as cover for own issueswere valued according to the marketvalue. The securities derived fromown issues contained in the currentassets were <strong>report</strong>ed at redemptionvalue.Loans, contingent liabilities andcredit risksIndividual value adjustments andprovisions were made for recognisablerisks in the case of borrowers.Additional charges are recognised asincome in the year of the loanallocation.InvestmentsInvestments were valued at historiccost of acquisition. Extraordinarydepreciation was undertaken wherea permanent loss of value seemedprobable as a consequence of the reducedequity and/or reduced incomederived from continuing losses.➜

32➜Tangible and intangible assetsThe valuation of tangible assets tookplace at the historic cost of acquisitionor production less planned depreciationin accordance with § 55 Section 1of the Austrian Banking Act, in combinationwith § 204 of the AustrianCommercial Code.Additions made in the first half of theyear were fully depreciated, whilethose in the second half were <strong>report</strong>edat half the depreciation for theyear.Low value assets were fully written-offin the year of purchase.The life expectancy used as a basisfor planned depreciation amountedto 5 – 67 years for immovable assets,3 – 20 years for movables and 4 – 15years for intangibles.Extraordinary depreciation was completedwhere a lasting value loss wasprobable.Provisions for pensionsThe provisions for pensions werecalculated according to recognisedactuarial principles using the Pagler &Pagler tables (AVÖ 1999) and the partialvalue method at an interest rateof 4 per cent for entitlements. A retirementage of 62 for women and 62for men was employed, whereby thetransitional conditions of the SocialLaw Amendment Act <strong>2007</strong> weretaken into consideration. A deductionfor fluctuations was not undertaken.Monetary value adjustments wereaccounted for by the use of the realinterest rate.Provisions for severance paymentsand similar obligationsThe obligations relating to severancepayments on the balance sheet datewere calculated according to actuarialmathematical principles using aninterest rate of 4 per cent and assuminga retirement age of 60 for womenand 65 for men. The provision for theobligations relating to long-servicepayments was calculated accordingto actuarial mathematical principlesin a manner analogous to thatemployed for severance payments.A deduction for fluctuations was notundertaken. Monetary value adjustmentswere accounted for by the useof the real interest rate.Other provisionsIn line with the due diligence principle,the other provisions covered all risksrecognisable upon the preparation ofthe balance sheet, as well as certainliabilities for which the amount wasnonetheless uncertain, to an amountdeemed necessary pursuant to reasonablecommercial judgement.LiabilitiesLiabilities are <strong>report</strong>ed at the nominalor higher redemption value.Note on the publication mediain accordance with § 26 of theAustrian Banking ActIn accordance with § 26 of the AustrianBanking Act, banks have to publishinformation on their organisationalstructure, their risk management andtheir risk capital situation at least onceper year. For <strong>Raiffeisen</strong>-<strong>Landesbank</strong><strong>Tirol</strong> AG, this information is publishedin the appendix to the annual financialstatements (data which changesannually), or in the case of generaldetails, on the internet site of RLB <strong>Tirol</strong>AG (www.rlb-tirol.at).

33Annual financial statementsNotes to the balance sheetPeriods to maturityThe loans to banks not payable on demand have the following periods to maturity:Remaining period to maturity 31.12.<strong>2007</strong> previous year (in thou. EUR)Up to 3 months 1,421,501,912 1,353,553More than 3 months and up to 1 year 276,244,369 88,648More than 1 year and up to 5 years 31,783,674 7,800More than 5 years 144,713,319 136,643The payables to non-banks not payable on demand have the following periods to maturity:Remaining period to maturity 31.12.<strong>2007</strong> previous year (in thou. EUR)Up to 3 months 155,388,810 152,545More than 3 months and up to 1 year 250,888,944 202,774More than 1 year and up to 5 years 497,596,794 469,429More than 5 years 973,074,792 1,036,563The undertakings to banks not payable on demand have the following periods to maturity:Remaining period to maturity 31.12.<strong>2007</strong> previous year (in thou. EUR)Up to 3 months 1,093,815,196 1,263,262More than 3 months and up to 1 year 125,170,654 132,357More than 1 year and up to 5 years 143,212,482 78,409More than 5 years 158,143,087 212,299The undertakings to non-banks not payable on demand have the following periods to maturity:Remaining period to maturity 31.12.<strong>2007</strong> previous year (in thou. EUR)Up to 3 months 202,946,957 206,732More than 3 months and up to 1 year 317,721,868 252,891More than 1 year and up to 5 years 112,603,964 144,140More than 5 years 170,603,163 115,261Own bonds and other fixed asset securities amounting to EUR 23,668,463will mature in <strong>2007</strong>.

34SecuritiesThe securities admissible for stock exchange listing contained in the asset side Items 5 and 6 are divided into listed andnon-listed securities as follows:Designation listed unlistedBonds and other fixed interest securities 7,135,475 175,187,538Shares and other non-fixed interest securities 16,657,000 9,514,726The securities admissible for stock exchange listing contained in the asset side Items 5 and 6 are divided up according tothe type of valuation as follows:Valued asnot valued asDesignation fixed assets fixed assetsBonds and other fixed interest securities 176,073,218 ,249,794Shares and other non-fixed interest securities 23,641,400 2,530,326The listed securities serve long-term investment. The securities not valued as fixed assets were acquired for the purpose ofsecurity trading. RLB <strong>Tirol</strong> maintains a large securities account book which currently contains securities with a volume of upto EUR 10,000 k.In line with §56 Section 2 of the Austrian Banking Act, the difference between the carrying value and the lower redemptionvalue in the bonds and other fixed interest securities <strong>report</strong>ed under the asset-side Items 2a and 5b amounted toEUR 104,909 (previous year: EUR 50 k).In line with § 56 Section 2 of the Austrian Banking Act, the difference between the cost of acquisition and the higher marketprice of the securities <strong>report</strong>ed under the asset-side Items 2a, 5 and 6 amounted to EUR 571,821.22 (previous year:EUR 91 k).

35Annual financial statementsSupplementary informationThe balance sheet contains the following foreign currency items translated into euros:Assetsliabilities1,685,460,291 935,387,362The following derivative financial instruments are present on the balance sheet date (in thou. EUR):trading positive NegativeCategory and type Bank book book Total market value market valueCurrency forward transactions dependent on interestOTC products:Interest rate swaps 2,100,251 0 2,100,251 15,649 41,325Interest rate options - purchase 70,361 0 70,361 700 0Interest rate options - sale 77,574 0 77,574 0 277Currency forward transactions dependent on foreign currenciesOTC products:Forward exchange transactions 22,729 0 22,729 552 509Currency/interest rate swaps 885,950 0 885,950 22,779 3,352As at 31.12.<strong>2007</strong>, securities with a nominal value of EUR 4,995,300 serve as cover stock for trust funds of EUR 2,574,984.In addition, a trading deposit of EUR 800.000 was deposited at the OeKB for Xetra Vienna, and of EUR 4,000,000 atDeutsche Börse Clearing AG for Xetra Frankfurt. Sureties of EUR 81,833,876 were provided to <strong>Raiffeisen</strong> Zentralbank ÖsterreichAG for the ECB tender procedure. Securities of EUR 6,522,584 were deposited for handling securities transactions,as well as securities of EUR 363,364 for options transactions. In addition, EUR 30,556,730 was deposited as sureties forliabilities to banks, and EUR 10,000,000 for GSA/supply of cash. Loans of EUR 3,716,050 were ceded to ÖsterreichischeKontrollbank AG, and of EUR 55,260,088 to the European Investment Bank.Write-ups within the meaning of § 208 Section 2 of the Austrian Banking Act were omitted for reasons of tax law.

36Notes to the profitand loss calculationAllocations to subordinated liabilitiesDuring the year under review, allocations to subordinated liabilities of EUR 243.427 (previous year: EUR 203 k) were made.Other operating incomeThe other operating income shown in the profit and loss calculation under Item 7 contain the following items of considerableamounts:Item designation<strong>2007</strong> (in EUR) Previous year (in thou. EUR)Sector services 2,729,370 2,715Computer centre income 2,549,062 2,475Rental 1,547,380 1,836Reimbursement of costs for ELBA 1,366,973 1,395Other informationInformation on employeesIn the financial year <strong>2007</strong> (2006), an average of 499.0 (486.0) white-collar and 21.8 (22.2) blue-collar staff were employed.Cash advances, loans and contingent claims to members of the Board of Managing Directors and Supervisory Board.The cash advances, loans and contingent claims to members of the Board of Managing Directors and Supervisory Boardare distributed as follows:BodyAmount as at 31.12.<strong>2007</strong> Previous year (in thou. EUR)Board of Managing Directors 529,029 1,083Supervisory Board 523,771 495The loans to members of the Board of Managing Directors and Supervisory Board are issued according to the usual contractconditions for the sector. EUR 571 k has been repaid in the current financial year.Allocations to severance payments and pensionsThe amounts for severance payments and pensions for members of the Board of Managing Directors, management personneland other employees in the financial year <strong>2007</strong> are distributed as follows:Group<strong>2007</strong> (in EUR) Previous year (in thou. EUR)Board of Managing Directors and management personnel 1,758,058 2,501Other employees 2,424,769 3,126

37Annual financial statementsAllocations for emoluments and remunerations of the Board of Managing Directors and the Supervisory BoardThe emoluments issued to members of the Board of Managing Directors and the Supervisory Board in the financial year<strong>2007</strong> are distributed as follows:Body <strong>2007</strong> (in EUR) Previous year (in EUR 1000)Board of Managing Directors 1,272,674 1,164Supervisory Board 106,052 106The total emoluments of former managing directors and their surviving dependants amount to 529,749 (previous year:EUR 589 k).Valuation reserveStatus as atStatus as atAsset-side items 1.1.<strong>2007</strong> Addition Reversal Transfer 31.12.<strong>2007</strong>7. Investments 3,826,975 0 0 0 3,826.975thereof: to banks 3,244,708 0 0 0 3,244,70810. Tangible assets 3,885,621 0 100,144 0 3,785,477thereof: real estate and buildingswhich are used by the bank 1,534,769 0 9,358 -15,574 1,509,837Final totals 7,712,596 0 100,144 0 7,612,452

38Assets analysisHistoric cost of acquisition/Asset items production 1.1. Additions Disposals2.a) Public sector debt issues and similar securities 9,203,454 0 2,495,7923.b) Other loans to banks 14,606,341 0 3,419,280Bonds and other fixed interest securitiesa) Public sector issuers 0 0 0b) Other issuers 105,529,597 80,035,100 7,527,072thereof: own bonds6. Shares and other non-fixed interest securities 128,006,348 36,625,086 64,960,1597. Investments 146,160,147 9,308,294 4,571,437thereof: to banks 127,573,7788. Shares in affiliated companies 21,320,821 428,750 00thereof: to banks9. Intangible fixed assets 18,210,973 2,160 96,74310. Tangible assets 129,971,704 1,576,881 3,378,220thereof: real estate and buildingswhich are used by the bank 41,429,912 16,365 25,351Final totals 573,009,386 127,976,271 86,448,703

39Annual financial statementstrans- Historic cost of acquisition/ Cumulative Carrying value Carrying value Depreciationfers production 31.12. depreciation 31.12. 01.01. in FY0 ,707,662 0 79 6,707,583 9,203,414 391,597,009 12,784,070 0 1,775 12,782,295 14,588,212 00 0 0 0 0 0 0-1,597,009 176,440,616 0 367,398 176,073,218 105,042,640 40,2590 99,671,275 0 2,682,365 96,988,910 127,148,473 2,057,0420 150,897,004 0 1,848,201 149,048,803 144,698,459 846,556127,573,778 0 0 127,573,778 127,573,778 00 21,749,571 0 35,000 21,714,571 21,285,8210 18,116,390 0 18,066,405 49,985 380,829 333,0040 128,170,364 0 77,095,842 51,074,523 54.081,389 3,986,1930 42,020,925 0 17,664,212 24,356,713 24,933,348 1,167,7810 14,536,953 0 100,097,065 514,439,888 476,429,237 7,263,093These annual financial statements were compiled on 19.02.2008For the Board of Managing DirectorsHannes Schmid reinhard Mayr Gobert Sternbach Hans UnterdorferSpokesman Member Member Member

40Audit certificateSince there are no objections to beraised, the full/German-languagefinancial statements of <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG as at 31December <strong>2007</strong> were allocated thefollowing unqualified audit certificate inaccordance with § 274, Section 1 ofthe Austrian Company Code:I examined the annual financial statementsof <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong>AG, domiciled at Adamgasse 1-7,A-6020 Innsbruck for the financialyear from 1 January 2006 to 31 December2006 taking into considerationthe accounting. The accounting,presentation and content of thesefinancial statements, as well as themanagement <strong>report</strong>, comply withAustrian commercial law and the supplementarystipulations contained inthe company articles are the responsibilityof the legal representatives ofthe company. My responsibility is toexpress an opinion on these financialstatements based on my audit anda statement concerning the correspondenceof the management <strong>report</strong>with the financial statements.My audit was conducted in accordancewith the applicable Austrianlegal regulations and professionalstandards. These standards requirethat the audit be planned and performedin such a manner that reasonableassurance can be obtained asto whether the financial statementsare free of material misstatement andwhether an opinion can be expressedconcerning the correspondence ofthe management <strong>report</strong> with thefinancial statements. During the audit,knowledge concerning the businessactivities and economic and legalbackground of the company, as wellas the expectations concerning possibleerrors, were taken into account.The audit includes an examination,largely on a test basis, of evidencesupporting the amounts and disclosuresin the financial statements. Theaudit also includes the assessmentof the accounting principles used andsignificant estimates made by thelegal representatives of the company,as well as the evaluation of the overallfinancial statement presentation. I believethat my audit provides a reasonablebasis for my opinion.The results of my audit gave noreason for objection. On the basisof the knowledge gained during theaudit, in my judgement the financialstatements comply with the legalregulations in Austria, as well asthe supplementary stipulations inthe company articles and presenta true and fair view of the assets andfinancial position of the company asat 31 December <strong>2007</strong>, as well as theearnings of the company for the financialyear from 1 January <strong>2007</strong> to 31December <strong>2007</strong> in accordance withAustrian accounting regulations. Themanagement <strong>report</strong> corresponds withthe financial statements.Innsbruck, 19 February 2008AuditorOlaf FuchsAssociation auditor

41Annual financial statementsProposal for the distribution of profitsin accordance with § 126 of theAustrian Stock Corporation ActA net profit for the year <strong>2007</strong> ofEUR 5,600,931.91 was <strong>report</strong>ed.The Board of Managing Directorsproposes that for the year <strong>2007</strong>, adividend of EUR 70 per share be paidon the share capital of EUR 80,000shares, and that the remainder becarried forward to a new account.Hannes Schmid reinhard Mayr Gobert Sternbach Hans UnterdorferSpokesman Member Member MemberReport of the Supervisory BoardDuring the <strong>2007</strong> financial year, atits meetings the Supervisory Boardcarried out the duties allocated to itby law and the articles of associationand was regularly informed concerningimportant business matters andthe development of the bank by theBoard of Managing Directors.The Supervisory Board examined theannual financial statements and foundthat these conformed with the correctlymaintained accounts and balancesheet. The management <strong>report</strong>provided by the Board of ManagingDirectors corresponds to the annualfinancial statements. These examinationsgave no cause for objections.In addition, the Supervisory Boardconcurs with the proposal of theBoard of Managing Directorsregarding the distribution of netprofits.Peter GreidererSupervisory Board Chairman

42Info

43InfoRLB officesHeadquarters6021 InnsbruckAdamgasse 1-7, Postfach 543,AustriaPhone: +43 512 5305-0Fax Austria: +43 512 5305-2011Fax abroad: +43 512 5305-3730S.W.I.F.T.-Code: RZTI AT 22Email: rlb.adamgasse@rlb-tirol.atInternet: www.rlb-tirol.atBranchesEast Innsbruck regionAldrans branchDorf 34, 6071 Aldrans, AustriaAmras branchPhilippine-Welser-Straße 51, AustriaIgls branchHilberstraße 24, 6080 Igls, AustriaPradl branchAmraser Straße 76Patsch self-service branchDorfstraße 22, 6082 Patsch, AustriaEllbögen self-service branchPeter 31, 6082 Ellbögen, AustriaCentral Innsbruck regionAdamgasse branchAdamgasse 1-7Rathaus self-service branchMaria-Theresien-Straße 18Wilten branchAndreas-Hofer-Straße 6die junge RLBSüdtiroler Platz 8West Innsbruck regionFürstenweg branchFürstenweg 20Hötting branchHöttinger Gasse 32Marktplatz branchInnrain 6–8Universal RLBUniversitätsstraße 15aImst regionImst branchStadtplatz 9-10, 6460 Imst, AustriaNassereith branchKarl-Mayr-Straße 116a,6465 Nassereith, AustriaTarrenz branchTrujegasse 1, 6464 Tarrenz, AustriaLienz regionLienz branchJohannesplatz 4, 9900 Lienz, AustriaOberlienz self-service branchNr. 31, 9900 Oberlienz, AustriaTristach branchLavanter Straße 6, 9900 Tristach,AustriaAinet self-service branchNo. 90, 9951 Ainet, AustriaZirl regionZirl branchBühelstraße 1, 6170 Zirl, AustriaDistrict branchesFreie Berufe district branchBürgerstraße 2, 6020 Innsbruck,AustriaJungholz district branchNo. 20, 6691 Jungholz, AustriaImprintResponsible for the content:<strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AGAdamgasse 1-7, 6020 Innsbruck,AustriaEditing:RLB Marketing division,Michael Weiß Thomas WassDesign:Andreas Ederwww.spread-communications.atPortrait photos:www.fotowerk.atAuthor of the success stories:Bernhard AichnerArchive photos:RLB <strong>Tirol</strong> AG,Christian Forcher, www.fotoforcher.atSpecial thanks goes to GregorBloéb, Peter Habeler, Evelyn Haim-Swarovski, Alexander Nußbaumer,Alexander and Angela Pointner,Michael Seeber, Sarah Louise Wilson.All rights reserved © 2008 <strong>Raiffeisen</strong>-<strong>Landesbank</strong> <strong>Tirol</strong> AG