Annual Reports - Indraprastha Gas Limited

Annual Reports - Indraprastha Gas Limited

Annual Reports - Indraprastha Gas Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

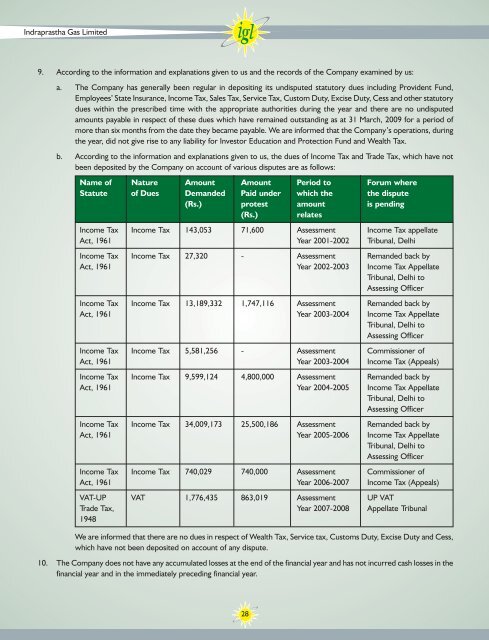

9. According to the information and explanations given to us and the records of the Company examined by us:<br />

a. The Company has generally been regular in depositing its undisputed statutory dues including Provident Fund,<br />

Employees’ State Insurance, Income Tax, Sales Tax, Service Tax, Custom Duty, Excise Duty, Cess and other statutory<br />

dues within the prescribed time with the appropriate authorities during the year and there are no undisputed<br />

amounts payable in respect of these dues which have remained outstanding as at 31 March, 2009 for a period of<br />

more than six months from the date they became payable. We are informed that the Company’s operations, during<br />

the year, did not give rise to any liability for Investor Education and Protection Fund and Wealth Tax.<br />

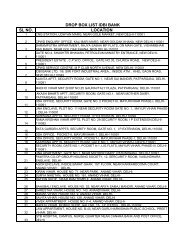

b. According to the information and explanations given to us, the dues of Income Tax and Trade Tax, which have not<br />

been deposited by the Company on account of various disputes are as follows:<br />

Name of Nature Amount Amount Period to Forum where<br />

Statute of Dues Demanded Paid under which the the dispute<br />

(Rs.) protest amount is pending<br />

(Rs.) relates<br />

Income Tax Income Tax 143,053 71,600 Assessment Income Tax appellate<br />

Act, 1961 Year 2001-2002 Tribunal, Delhi<br />

Income Tax Income Tax 27,320 - Assessment Remanded back by<br />

Act, 1961 Year 2002-2003 Income Tax Appellate<br />

Tribunal, Delhi to<br />

Assessing Officer<br />

Income Tax Income Tax 13,189,332 1,747,116 Assessment Remanded back by<br />

Act, 1961 Year 2003-2004 Income Tax Appellate<br />

Tribunal, Delhi to<br />

Assessing Officer<br />

Income Tax Income Tax 5,581,256 - Assessment Commissioner of<br />

Act, 1961 Year 2003-2004 Income Tax (Appeals)<br />

Income Tax Income Tax 9,599,124 4,800,000 Assessment Remanded back by<br />

Act, 1961 Year 2004-2005 Income Tax Appellate<br />

Tribunal, Delhi to<br />

Assessing Officer<br />

Income Tax Income Tax 34,009,173 25,500,186 Assessment Remanded back by<br />

Act, 1961 Year 2005-2006 Income Tax Appellate<br />

Tribunal, Delhi to<br />

Assessing Officer<br />

Income Tax Income Tax 740,029 740,000 Assessment Commissioner of<br />

Act, 1961 Year 2006-2007 Income Tax (Appeals)<br />

VAT-UP VAT 1,776,435 863,019 Assessment UP VAT<br />

Trade Tax, Year 2007-2008 Appellate Tribunal<br />

1948<br />

We are informed that there are no dues in respect of Wealth Tax, Service tax, Customs Duty, Excise Duty and Cess,<br />

which have not been deposited on account of any dispute.<br />

10. The Company does not have any accumulated losses at the end of the financial year and has not incurred cash losses in the<br />

financial year and in the immediately preceding financial year.<br />

28