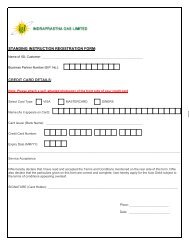

Annual Reports - Indraprastha Gas Limited

Annual Reports - Indraprastha Gas Limited

Annual Reports - Indraprastha Gas Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2.12 Taxation<br />

Income tax expense comprises current tax, deferred tax and fringe benefit tax. Current Tax and Fringe Benefit Tax<br />

is amount of tax for the period determined in accordance with the Income-tax Act, 1961. Deferred Tax charge or<br />

credit reflects the tax effects of timing differences between accounting income and taxable income for the period.<br />

The deferred tax charge or credit and the corresponding deferred tax liability or deferred tax asset are recognized<br />

using the tax rates that have been enacted or substantially enacted by the Balance Sheet date. Deferred tax assets<br />

are recognized only to the extent there is reasonable certainty of realisation in the future. Such assets are reviewed<br />

at each balance sheet date to reassess realisation. Where there are unabsorbed depreciation and carry forward<br />

losses under tax laws, deferred tax assets are recognized only if there is virtual certainty supported by convincing<br />

evidence that such deferred tax assets can be realised in future.<br />

2.13 Earnings per share<br />

Basic earning per share is computed using the weighted average number of equity shares outstanding during the<br />

year. Diluted earning per share is computed using the weighted average number of equity and dilutive equity equivalent<br />

shares outstanding during the year, except where the results would be anti dilutive.<br />

2.14 Contingencies<br />

A provision is recognized in the financial statements where there exists a present obligation as a result of a past<br />

event, the amount of which can be reliably estimated, and it is probable that an outflow of resources would be<br />

necessitated in order to settle the obligation. Contingent liability is a possible obligation that arises from past events<br />

and the existence of which will be confirmed only by the occurrence or non-occurrence of one or more uncertain<br />

future events, not wholly within the control of the enterprise, or is a present obligation that arises from past events<br />

but is not recognized because either it is not probable that an outflow of resources embodying economic benefits<br />

will be required to settle the obligation, or a reliable estimate of the amount of the obligation cannot be made.<br />

2.15 Deposits with Government Agencies, Local Authorities and Other Electricity Companies<br />

Deposits given to Government agencies, local authorities and other electricity companies which are perennial in<br />

nature are charged to revenue in the year of payment.<br />

3. Contingent liabilities<br />

3.1 Income Tax cases<br />

In respect of Assessment Year 2001-02 to Assessment Year 2006-07, the department disallowed certain claims made<br />

or set offs availed by the Company. This resulted into adjustments to past carried forward losses aggregating Rs<br />

29,448,913 (previous year Rs. 29,448,913) and demands raised aggregating Rs. 63,289,287 (Previous year Rs.<br />

56,968,002) against which Company has deposited Rs. 32,858,902 (Previous Year Rs. 22,118,716) under protest.<br />

The Company has filed appeals against the above which are pending at various stages.<br />

3.2 UP Trade Tax Cases<br />

The Commercial Tax department of Uttar Pradesh has raised the demand towards UP Trade Tax for the Assessment<br />

year 2007-08 amounting to Rs. 1,776,435 (Previous year Rs. 1,776,435) against which Rs. 863,019 (Previous Year Rs.<br />

863,019) has been deposited and a Bank Guarantee of Rs. 914,000 is issued in favour of the department. The<br />

Company has filed appeals against the above demand with Tribunal, Commercial Taxes, Noida.<br />

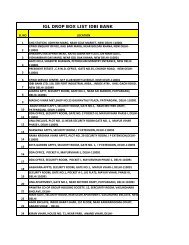

3.3 Bank Guarantees<br />

The Company’s total liability towards un-expired Bank Guarantees is Rs.494,809,876 (Previous year Rs. 219,175,559).<br />

3.4 Service charges<br />

During the year the Company has received a demand of Rs. 43,745,684 towards service charges on purchase of<br />

natural gas for the period 1 July, 2008 to 31 March, 2009 The Company is of the view that the amount is not payable<br />

and is disputing the demand made by the supplier and hence no provision has been made in the books of accounts<br />

for this amount.<br />

46