Weir Group 2013 Interim Report (PDF, 0.59 MB) - The Weir Group

Weir Group 2013 Interim Report (PDF, 0.59 MB) - The Weir Group

Weir Group 2013 Interim Report (PDF, 0.59 MB) - The Weir Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

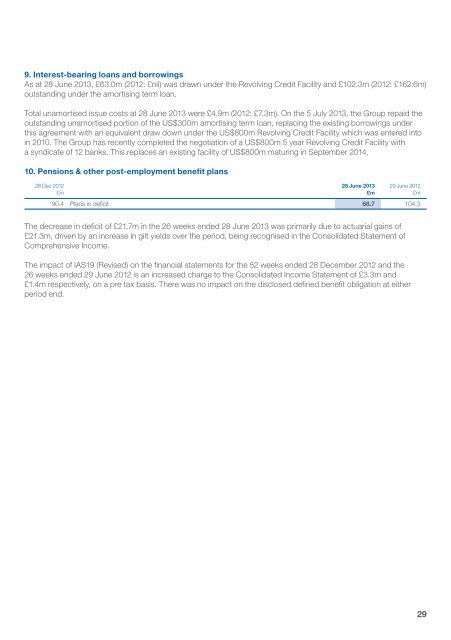

9. Interest-bearing loans and borrowingsAs at 28 June <strong>2013</strong>, £63.0m (2012: £nil) was drawn under the Revolving Credit Facility and £102.3m (2012: £162.6m)outstanding under the amortising term loan.Total unamortised issue costs at 28 June <strong>2013</strong> were £4.9m (2012: £7.3m). On the 5 July <strong>2013</strong>, the <strong>Group</strong> repaid theoutstanding unamortised portion of the US$300m amortising term loan, replacing the existing borrowings underthis agreement with an equivalent draw down under the US$800m Revolving Credit Facility which was entered intoin 2010. <strong>The</strong> <strong>Group</strong> has recently completed the negotiation of a US$800m 5 year Revolving Credit Facility witha syndicate of 12 banks. This replaces an existing facility of US$800m maturing in September 2014.10. Pensions & other post-employment benefit plans28 Dec 2012£m28 June <strong>2013</strong>£m29 June 2012£m90.4 Plans in deficit 68.7 104.3<strong>The</strong> decrease in deficit of £21.7m in the 26 weeks ended 28 June <strong>2013</strong> was primarily due to actuarial gains of£21.3m, driven by an increase in gilt yields over the period, being recognised in the Consolidated Statement ofComprehensive Income.<strong>The</strong> impact of IAS19 (Revised) on the financial statements for the 52 weeks ended 28 December 2012 and the26 weeks ended 29 June 2012 is an increased charge to the Consolidated Income Statement of £3.3m and£1.4m respectively, on a pre tax basis. <strong>The</strong>re was no impact on the disclosed defined benefit obligation at eitherperiod end.29