Fresnillo plc's Executive Committee

Fresnillo plc's Executive Committee

Fresnillo plc's Executive Committee

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

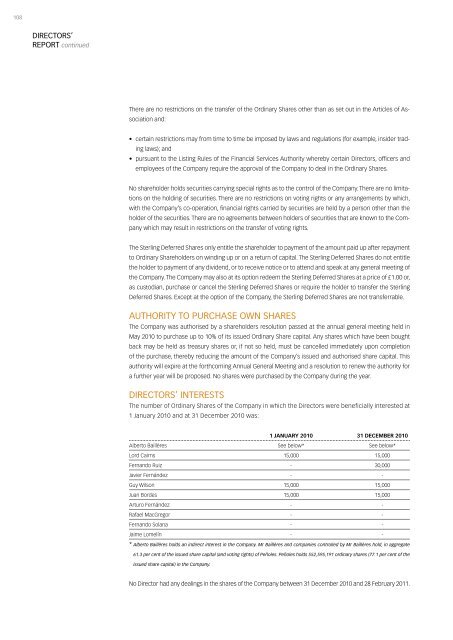

108DIRECTORS’REPORT continuedThere are no restrictions on the transfer of the Ordinary Shares other than as set out in the Articles of Associationand:• certain restrictions may from time to time be imposed by laws and regulations (for example, insider tradinglaws); and• pursuant to the Listing Rules of the Financial Services Authority whereby certain Directors, officers andemployees of the Company require the approval of the Company to deal in the Ordinary Shares.No shareholder holds securities carrying special rights as to the control of the Company. There are no limitationson the holding of securities. There are no restrictions on voting rights or any arrangements by which,with the Company’s co-operation, financial rights carried by securities are held by a person other than theholder of the securities. There are no agreements between holders of securities that are known to the Companywhich may result in restrictions on the transfer of voting rights.The Sterling Deferred Shares only entitle the shareholder to payment of the amount paid up after repaymentto Ordinary Shareholders on winding up or on a return of capital. The Sterling Deferred Shares do not entitlethe holder to payment of any dividend, or to receive notice or to attend and speak at any general meeting ofthe Company. The Company may also at its option redeem the Sterling Deferred Shares at a price of £1.00 or,as custodian, purchase or cancel the Sterling Deferred Shares or require the holder to transfer the SterlingDeferred Shares. Except at the option of the Company, the Sterling Deferred Shares are not transferrable.Authority to Purchase Own SharesThe Company was authorised by a shareholders resolution passed at the annual general meeting held inMay 2010 to purchase up to 10% of its issued Ordinary Share capital. Any shares which have been boughtback may be held as treasury shares or, if not so held, must be cancelled immediately upon completionof the purchase, thereby reducing the amount of the Company’s issued and authorised share capital. Thisauthority will expire at the forthcoming Annual General Meeting and a resolution to renew the authority fora further year will be proposed. No shares were purchased by the Company during the year.Directors’ InterestsThe number of Ordinary Shares of the Company in which the Directors were beneficially interested at1 January 2010 and at 31 December 2010 was:1 January 2010 31 December 2010Alberto Baillères See below* See below*Lord Cairns 15,000 15,000Fernando Ruiz - 30,000Javier Fernández - -Guy Wilson 15,000 15,000Juan Bordes 15,000 15,000Arturo Fernández - -Rafael MacGregor - -Fernando Solana - -Jaime Lomelín - -* Alberto Baillères holds an indirect interest in the Company. Mr Baillères and companies controlled by Mr Baillères hold, in aggregate61.3 per cent of the issued share capital (and voting rights) of Peñoles. Peñoles holds 552,595,191 ordinary shares (77.1 per cent of theissued share capital) in the Company.No Director had any dealings in the shares of the Company between 31 December 2010 and 28 February 2011.