Warren Adams combines conservation and ... - Patagonia Sur

Warren Adams combines conservation and ... - Patagonia Sur

Warren Adams combines conservation and ... - Patagonia Sur

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

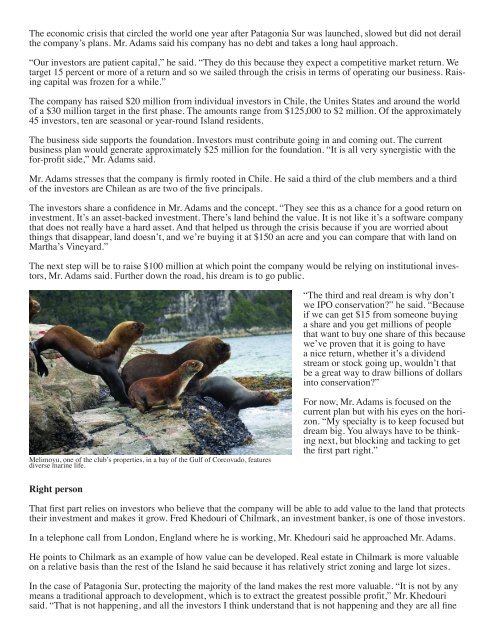

The economic crisis that circled the world one year after <strong>Patagonia</strong> <strong>Sur</strong> was launched, slowed but did not derailthe company’s plans. Mr. <strong>Adams</strong> said his company has no debt <strong>and</strong> takes a long haul approach.“Our investors are patient capital,” he said. “They do this because they expect a competitive market return. Wetarget 15 percent or more of a return <strong>and</strong> so we sailed through the crisis in terms of operating our business. Raisingcapital was frozen for a while.”The company has raised $20 million from individual investors in Chile, the Unites States <strong>and</strong> around the worldof a $30 million target in the first phase. The amounts range from $125,000 to $2 million. Of the approximately45 investors, ten are seasonal or year-round Isl<strong>and</strong> residents.The business side supports the foundation. Investors must contribute going in <strong>and</strong> coming out. The currentbusiness plan would generate approximately $25 million for the foundation. “It is all very synergistic with thefor-profit side,” Mr. <strong>Adams</strong> said.Mr. <strong>Adams</strong> stresses that the company is firmly rooted in Chile. He said a third of the club members <strong>and</strong> a thirdof the investors are Chilean as are two of the five principals.The investors share a confidence in Mr. <strong>Adams</strong> <strong>and</strong> the concept. “They see this as a chance for a good return oninvestment. It’s an asset-backed investment. There’s l<strong>and</strong> behind the value. It is not like it’s a software companythat does not really have a hard asset. And that helped us through the crisis because if you are worried aboutthings that disappear, l<strong>and</strong> doesn’t, <strong>and</strong> we’re buying it at $150 an acre <strong>and</strong> you can compare that with l<strong>and</strong> onMartha’s Vineyard.”The next step will be to raise $100 million at which point the company would be relying on institutional investors,Mr. <strong>Adams</strong> said. Further down the road, his dream is to go public.“The third <strong>and</strong> real dream is why don’twe IPO <strong>conservation</strong>?” he said. “Becauseif we can get $15 from someone buyinga share <strong>and</strong> you get millions of peoplethat want to buy one share of this becausewe’ve proven that it is going to havea nice return, whether it’s a dividendstream or stock going up, wouldn’t thatbe a great way to draw billions of dollarsinto <strong>conservation</strong>?”Melimoyu, one of the club’s properties, in a bay of the Gulf of Corcovado, featuresdiverse marine life.For now, Mr. <strong>Adams</strong> is focused on thecurrent plan but with his eyes on the horizon.“My specialty is to keep focused butdream big. You always have to be thinkingnext, but blocking <strong>and</strong> tacking to getthe first part right.”Right personThat first part relies on investors who believe that the company will be able to add value to the l<strong>and</strong> that protectstheir investment <strong>and</strong> makes it grow. Fred Khedouri of Chilmark, an investment banker, is one of those investors.In a telephone call from London, Engl<strong>and</strong> where he is working, Mr. Khedouri said he approached Mr. <strong>Adams</strong>.He points to Chilmark as an example of how value can be developed. Real estate in Chilmark is more valuableon a relative basis than the rest of the Isl<strong>and</strong> he said because it has relatively strict zoning <strong>and</strong> large lot sizes.In the case of <strong>Patagonia</strong> <strong>Sur</strong>, protecting the majority of the l<strong>and</strong> makes the rest more valuable. “It is not by anymeans a traditional approach to development, which is to extract the greatest possible profit,” Mr. Khedourisaid. “That is not happening, <strong>and</strong> all the investors I think underst<strong>and</strong> that is not happening <strong>and</strong> they are all fine