ACT370 - Final Exam, 2008 Questions 1 and 2 relate to the following ...

ACT370 - Final Exam, 2008 Questions 1 and 2 relate to the following ...

ACT370 - Final Exam, 2008 Questions 1 and 2 relate to the following ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

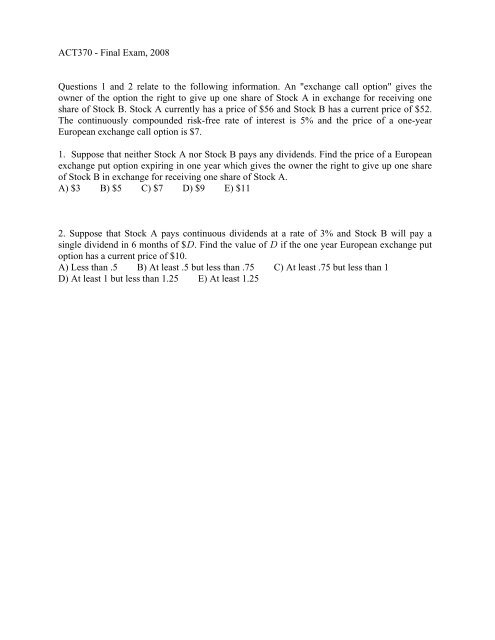

<strong>ACT370</strong> - <strong>Final</strong> <strong>Exam</strong>, <strong>2008</strong><strong>Questions</strong> 1 <strong>and</strong> 2 <strong>relate</strong> <strong>to</strong> <strong>the</strong> <strong>following</strong> information. An "exchange call option" gives <strong>the</strong>owner of <strong>the</strong> option <strong>the</strong> right <strong>to</strong> give up one share of S<strong>to</strong>ck A in exchange for receiving oneshare of S<strong>to</strong>ck B. S<strong>to</strong>ck A currently has a price of $56 <strong>and</strong> S<strong>to</strong>ck B has a current price of $52.The continuously compounded risk-free rate of interest is 5% <strong>and</strong> <strong>the</strong> price of a one-yearEuropean exchange call option is $7.1. Suppose that nei<strong>the</strong>r S<strong>to</strong>ck A nor S<strong>to</strong>ck B pays any dividends. Find <strong>the</strong> price of a Europeanexchange put option expiring in one year which gives <strong>the</strong> owner <strong>the</strong> right <strong>to</strong> give up one shareof S<strong>to</strong>ck B in exchange for receiving one share of S<strong>to</strong>ck A.A) $3 B) $5 C) $7 D) $9 E) $112. Suppose that S<strong>to</strong>ck A pays continuous dividends at a rate of 3% <strong>and</strong> S<strong>to</strong>ck B will pay asingle dividend in 6 months of $ H. Find <strong>the</strong> value of H if <strong>the</strong> one year European exchange pu<strong>to</strong>ption has a current price of $10.A) Less than .5 B) At least .5 but less than .75 C) At least .75 but less than 1D) At least 1 but less than 1.25 E) At least 1.25

3. You are given call option prices of $12 <strong>and</strong> $8 for European options with strike prices of$50 <strong>and</strong> $60, respectively. The options expire at <strong>the</strong> same time <strong>and</strong> are on a non-dividendpaying s<strong>to</strong>ck. According <strong>to</strong> convexity of option prices, how many of <strong>the</strong> <strong>following</strong> prices arefeasible prices for a call option on <strong>the</strong> same s<strong>to</strong>ck <strong>and</strong> expiring at <strong>the</strong> same time with a strikeprice of $53? Feasible means that <strong>the</strong>re are no arbitrage opportunities.I. $10 II. $10.50 III. $11 IV. $11.50A) None B) One C) Two D) Three E) All

<strong>Questions</strong> 4 <strong>and</strong> 5 <strong>relate</strong> <strong>to</strong> <strong>the</strong> <strong>following</strong> information. In a binomial branching model, <strong>the</strong> s<strong>to</strong>ckprice at time 0 is 120. At time 1, <strong>the</strong> s<strong>to</strong>ck price will be ei<strong>the</strong>r 144 or 100. The annual effectiverisk free rate of interest from time 0 <strong>to</strong> time 1 is 3œÞ"! .4. A call option on <strong>the</strong> s<strong>to</strong>ck with exercise price 110 expires at time 1. Find <strong>the</strong> number ofshares of s<strong>to</strong>ck in <strong>the</strong> replicating portfolio at time 0.A) Less than .2 B) At least .2 but less than .4 C) At least .4 but less than .6D) At least .6 but less than .8 E) At least .85. Ano<strong>the</strong>r s<strong>to</strong>ck is available that has a value of 100 at time 0. The s<strong>to</strong>ck price at time 1 is ei<strong>the</strong>rF (when <strong>the</strong> first s<strong>to</strong>ck is 100) or "Þ#F (when <strong>the</strong> first s<strong>to</strong>ck is 144). Find <strong>the</strong> value of F thatresults in no arbitrage opportunities.A) Less than 80 B) At least 80 but less than 85 C) At least 85 but less than 90D) At least 90 but less than 95 E) At least 95

<strong>Questions</strong> 6 <strong>to</strong> 8 <strong>relate</strong> <strong>to</strong> <strong>the</strong> <strong>following</strong> information. A 3-period binomial tree is constructed.The continuously compounded risk-free rate of interest per period is < , <strong>and</strong> you are given that

9. A call option on a non-dividend paying s<strong>to</strong>ck has a strike price of 100 <strong>and</strong> expires in one year.You are given <strong>the</strong> <strong>following</strong>:- current s<strong>to</strong>ck price is 100- current option price is 19.384 based on <strong>the</strong> Black-Scholes option pricing model- continuously compounded risk free interest rate is 8%- <strong>the</strong> call delta is .6554For <strong>the</strong> same s<strong>to</strong>ck, find <strong>the</strong> price of a similar call option with a strike price of 110 using <strong>the</strong>Black-Scholes option pricing model.A) Less than 12 B) At least 12, but less than 13 C) At least 13, but less than 14D) At least 14, but less than 15 E) At least 15

10. A call option on a non-dividend paying s<strong>to</strong>ck has a current price of 60 <strong>and</strong> expires in oneyear. You are given <strong>the</strong> <strong>following</strong>, based on Black-Scholes option pricing:- <strong>the</strong> option > is .018817- <strong>the</strong> volatility of <strong>the</strong> underlying s<strong>to</strong>ck is 5 œÞ%&- <strong>the</strong> option Vega for a .01 change in 5 is .182$"$- ." !Find <strong>the</strong> value of <strong>the</strong> call option ? using Black-Scholes option pricing.A) Less than .50 B) At least .50, but less than .55 C) At least .55, but less than .60D) At least .60, but less than .65 E) At least .65

11. W " , <strong>the</strong> price of a s<strong>to</strong>ck at time 1, has a lognormal distribution under <strong>the</strong> risk neutral measure<strong>and</strong> under <strong>the</strong> physical measure. You are given <strong>the</strong> <strong>following</strong>:- under <strong>the</strong> physical measure IÒ68 W" Ó œ %Þ$*'##( <strong>and</strong> IÒW"Ó œ )&Þ*(#%- under <strong>the</strong> risk neutral measure IÒ68 W"Ó œ %Þ$'*##(.Find IÒW"Ó under <strong>the</strong> risk neutral measure.A) Less than 80 B) At least 80, but less than 81 C) At least 81, but less than 82D) At least 82, but less than 83 E) At least 83

12. You are given <strong>the</strong> <strong>following</strong> information regarding European call options on a non-dividendpaying s<strong>to</strong>ck with a current price of 60 <strong>and</strong> a volatility of 5 œÞ%& . The continuouslycompounded risk free rate is 6%.Call Option 1 Call Option 2Strike Price 62 65Time <strong>to</strong> Expiry (years) .25 .5Option Price 4.9101 6.3348Delta .5133 .5007Gamma .0295 .0209A market maker has a long position in one European put option with strike price 62 expiring in.25 years. The market maker wishes <strong>to</strong> construct a Delta-Gamma hedge using shares of s<strong>to</strong>ck <strong>and</strong>put options with strike price 65 expiring in .5 years. How many shares of s<strong>to</strong>ck are needed in <strong>the</strong>hedging portfolio?A) Short at least 1 share B) Short between 0 <strong>and</strong> 1 shares C) No shares neededD) Long between 0 <strong>and</strong> 1 shares E) Long at least one share

<strong>ACT370</strong>, <strong>2008</strong> <strong>Final</strong> <strong>Exam</strong> Solutions1. According <strong>to</strong> put-call parityTprepaid forward price of asset <strong>to</strong> be receivedœGprepaid forward price of asset be delivered .Therefore T&#œ(&' , so that T œ"" . Answer: EÞ!#&Þ!$2. "! &# H/ œ ( &'/ p H œ Þ'( Þ Answer: B"#GÐ&$ÑGÐ&$Ñ)3. We must have&$&! '!&$p GÐ&$Ñ Ÿ "!Þ)! .Two prices are feasible. Answer: C4. ? œ 0Ð?Ñ0Ð.ÑW ?W .! !$%!"%%"!!œ œ Þ(($ . Answer: D‡ "Þ""!!)"Þ#F: FÐ": Ñ"" "Þ""#!5. : œ œ . For no arbitrage, we must have œ "!! ."%% "!!"#! "#!Solving for F results in F œ *'Þ!$ . Answer: E‡ ‡‡ "Þ!&Þ*6. : œ"Þ"Þ*œ Þ(& .Þ(&Þ#& "The derivative value at node 4 is"Þ!&œ"Þ!&.Þ(&The derivative value at node 5 is"Þ!&.The derivative value at node 2 is Þ(&† " Þ#&† Þ(&"Þ!& "Þ!&œThe derivative value at node 3 is Þ(&†The derivative value at node 1 isÞ(&"Þ!&"Þ!&Þ(&†"Þ!&œÐ"Þ!&Ñ#ÐÞ(&ÑÐ"Þ!&ÑÐÞ(&ÑÐ"Þ#&Ñ ÐÞ(&Ñ#Þ#&†Ð"Þ!&Ñ# Ð"Þ!&Ñ##ÐÞ(&ÑÐ"Þ#&ÑÐ"Þ!&Ñ#œ Þ(#* . Answer: D7. Suppose <strong>the</strong>re are Bunits of <strong>the</strong> option with strike 120 <strong>and</strong> C units of <strong>the</strong> option with strike100. At node 7 <strong>the</strong> combination has value "$Þ"B $$Þ"C œ ".At node 8 <strong>the</strong> combination has value )Þ*C œ " ."Solving for B <strong>and</strong> C results in C œ)Þ*œ Þ""#% (long) units of option with strike 100,<strong>and</strong> B œ Þ#!(' (short) units of option with strike 120. Answer: A

8. The option would not be exercised at any node o<strong>the</strong>r than nodes 4 or 7 since <strong>the</strong> s<strong>to</strong>ck pricewould be less than 100 at any o<strong>the</strong>r node. The prepaid forward price at time 0 is "!! HÐ"Þ!&Ñ. #H #The s<strong>to</strong>ck price at node 4 is Ò"!! ÓÐ"Þ"Ñ H œ "#" Þ!*(&!'H .Ð"Þ!&ÑHÐ"Þ!&ÑThe s<strong>to</strong>ck price at node 7 is Ò"!! ÓÐ"Þ"Ñ œ "$$Þ"! "Þ#!(#&'H .##The option value at node 7 is #$Þ"! "Þ#!(#&'H , <strong>and</strong> <strong>the</strong> option value at node 8 is 0.The exercise value of <strong>the</strong> option at node 4 is "" Þ!*(&!'H .The binomial tree backward induction value of <strong>the</strong> option at node 4 isÐÞ(&ÑÐ#$Þ"!"Þ#!(#&'HÑ"Þ!&œ "'Þ& Þ)'#$#'H .Exercise at node 4 will be optimal if "" Þ!*(&!'H "'Þ& Þ)'#$#'H ,or equivalently, if H (Þ"* ÞAnswer: D$9. ? œ RÐ. " Ñ œ Þ'&&% p ." œ Þ% (from <strong>the</strong> st<strong>and</strong>ard normal table).For <strong>the</strong> option with a strike price of 100, <strong>and</strong> X œ "ß < œ Þ!) , we have

12. The put options have <strong>the</strong> same > as <strong>the</strong> call options, <strong>and</strong> ? T œ ? G " .Þ!#*&The hedging portfolio should be short byÞ!#!* œ "Þ%"" put options with a strike price of 65expiring in .5 years. The ? of <strong>the</strong> long put with strike 62 is Þ&"$$ " œ Þ%)'( .The ? of <strong>the</strong> 1.411 short puts with strike 65 is "Þ%""ÐÞ&!!( "Ñ œ Þ(!%& .To match <strong>the</strong> ? of <strong>the</strong> long put with strike 65, <strong>the</strong> hedging portfolio should go shortÞ(!%& ÐÞ%)'(Ñ œ Þ#"() shares. Answer: B