7 6 5 4 3 2 1 8 - Elevations Credit Union

7 6 5 4 3 2 1 8 - Elevations Credit Union

7 6 5 4 3 2 1 8 - Elevations Credit Union

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Elevations</strong> <strong>Credit</strong> <strong>Union</strong><br />

Notes to Financial Statements<br />

December 31, 2008 and 2007<br />

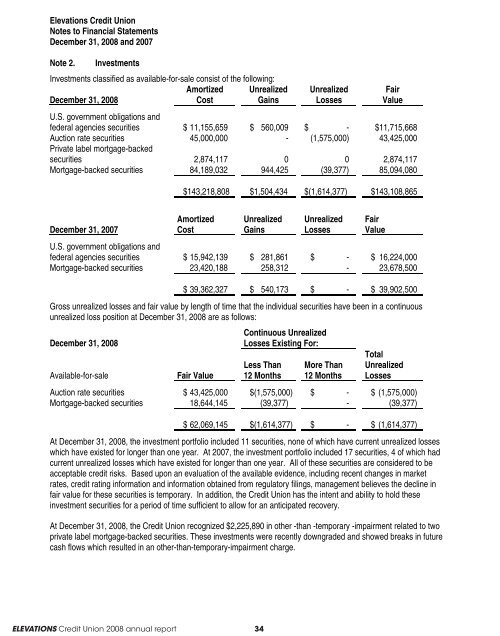

Note 2. Investments<br />

Investments classified as available-for-sale consist of the following:<br />

Amortized Unrealized Unrealized Fair<br />

December 31, 2008 Cost Gains Losses Value<br />

U.S. government obligations and<br />

federal agencies securities $ 11,155,659 $ 560,009 $ - $11,715,668<br />

Auction rate securities 45,000,000 - (1,575,000) 43,425,000<br />

Private label mortgage-backed<br />

securities 2,874,117 0 0 2,874,117<br />

Mortgage-backed securities 84,189,032 944,425 (39,377) 85,094,080<br />

ELEVATIONS <strong>Credit</strong> <strong>Union</strong> 2008 annual report 34<br />

$143,218,808 $1,504,434 $(1,614,377) $143,108,865<br />

Amortized Unrealized Unrealized Fair<br />

December 31, 2007 Cost Gains Losses Value<br />

U.S. government obligations and<br />

federal agencies securities $ 15,942,139 $ 281,861 $ - $ 16,224,000<br />

Mortgage-backed securities 23,420,188 258,312 - 23,678,500<br />

$ 39,362,327 $ 540,173 $ - $ 39,902,500<br />

Gross unrealized losses and fair value by length of time that the individual securities have been in a continuous<br />

unrealized loss position at December 31, 2008 are as follows:<br />

December 31, 2008<br />

Available-for-sale Fair Value<br />

Continuous Unrealized<br />

Losses Existing For:<br />

Less Than<br />

12 Months<br />

More Than<br />

12 Months<br />

Total<br />

Unrealized<br />

Losses<br />

Auction rate securities $ 43,425,000 $(1,575,000) $ - $ (1,575,000)<br />

Mortgage-backed securities 18,644,145 (39,377) - (39,377)<br />

$ 62,069,145 $(1,614,377) $ - $ (1,614,377)<br />

At December 31, 2008, the investment portfolio included 11 securities, none of which have current unrealized losses<br />

which have existed for longer than one year. At 2007, the investment portfolio included 17 securities, 4 of which had<br />

current unrealized losses which have existed for longer than one year. All of these securities are considered to be<br />

acceptable credit risks. Based upon an evaluation of the available evidence, including recent changes in market<br />

rates, credit rating information and information obtained from regulatory filings, management believes the decline in<br />

fair value for these securities is temporary. In addition, the <strong>Credit</strong> <strong>Union</strong> has the intent and ability to hold these<br />

investment securities for a period of time sufficient to allow for an anticipated recovery.<br />

At December 31, 2008, the <strong>Credit</strong> <strong>Union</strong> recognized $2,225,890 in other -than -temporary -impairment related to two<br />

private label mortgage-backed securities. These investments were recently downgraded and showed breaks in future<br />

cash flows which resulted in an other-than-temporary-impairment charge.