7 6 5 4 3 2 1 8 - Elevations Credit Union

7 6 5 4 3 2 1 8 - Elevations Credit Union

7 6 5 4 3 2 1 8 - Elevations Credit Union

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Elevations</strong> <strong>Credit</strong> <strong>Union</strong><br />

Notes to Financial Statements<br />

December 31, 2008 and 2007<br />

ELEVATIONS <strong>Credit</strong> <strong>Union</strong> 2008 annual report 44<br />

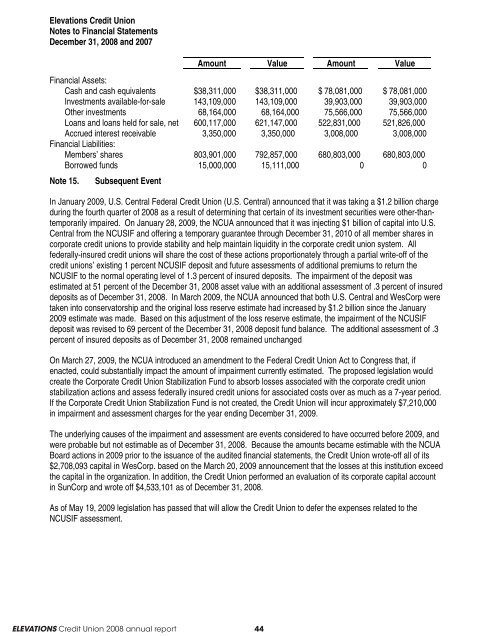

Amount Value Amount Value<br />

Financial Assets:<br />

Cash and cash equivalents $38,311,000 $38,311,000 $ 78,081,000 $ 78,081,000<br />

Investments available-for-sale 143,109,000 143,109,000 39,903,000 39,903,000<br />

Other investments 68,164,000 68,164,000 75,566,000 75,566,000<br />

Loans and loans held for sale, net 600,117,000 621,147,000 522,831,000 521,826,000<br />

Accrued interest receivable 3,350,000 3,350,000 3,008,000 3,008,000<br />

Financial Liabilities:<br />

Members’ shares 803,901,000 792,857,000 680,803,000 680,803,000<br />

Borrowed funds 15,000,000 15,111,000 0 0<br />

Note 15. Subsequent Event<br />

In January 2009, U.S. Central Federal <strong>Credit</strong> <strong>Union</strong> (U.S. Central) announced that it was taking a $1.2 billion charge<br />

during the fourth quarter of 2008 as a result of determining that certain of its investment securities were other-thantemporarily<br />

impaired. On January 28, 2009, the NCUA announced that it was injecting $1 billion of capital into U.S.<br />

Central from the NCUSIF and offering a temporary guarantee through December 31, 2010 of all member shares in<br />

corporate credit unions to provide stability and help maintain liquidity in the corporate credit union system. All<br />

federally-insured credit unions will share the cost of these actions proportionately through a partial write-off of the<br />

credit unions’ existing 1 percent NCUSIF deposit and future assessments of additional premiums to return the<br />

NCUSIF to the normal operating level of 1.3 percent of insured deposits. The impairment of the deposit was<br />

estimated at 51 percent of the December 31, 2008 asset value with an additional assessment of .3 percent of insured<br />

deposits as of December 31, 2008. In March 2009, the NCUA announced that both U.S. Central and WesCorp were<br />

taken into conservatorship and the original loss reserve estimate had increased by $1.2 billion since the January<br />

2009 estimate was made. Based on this adjustment of the loss reserve estimate, the impairment of the NCUSIF<br />

deposit was revised to 69 percent of the December 31, 2008 deposit fund balance. The additional assessment of .3<br />

percent of insured deposits as of December 31, 2008 remained unchanged<br />

On March 27, 2009, the NCUA introduced an amendment to the Federal <strong>Credit</strong> <strong>Union</strong> Act to Congress that, if<br />

enacted, could substantially impact the amount of impairment currently estimated. The proposed legislation would<br />

create the Corporate <strong>Credit</strong> <strong>Union</strong> Stabilization Fund to absorb losses associated with the corporate credit union<br />

stabilization actions and assess federally insured credit unions for associated costs over as much as a 7-year period.<br />

If the Corporate <strong>Credit</strong> <strong>Union</strong> Stabilization Fund is not created, the <strong>Credit</strong> <strong>Union</strong> will incur approximately $7,210,000<br />

in impairment and assessment charges for the year ending December 31, 2009.<br />

The underlying causes of the impairment and assessment are events considered to have occurred before 2009, and<br />

were probable but not estimable as of December 31, 2008. Because the amounts became estimable with the NCUA<br />

Board actions in 2009 prior to the issuance of the audited financial statements, the <strong>Credit</strong> <strong>Union</strong> wrote-off all of its<br />

$2,708,093 capital in WesCorp. based on the March 20, 2009 announcement that the losses at this institution exceed<br />

the capital in the organization. In addition, the <strong>Credit</strong> <strong>Union</strong> performed an evaluation of its corporate capital account<br />

in SunCorp and wrote off $4,533,101 as of December 31, 2008.<br />

As of May 19, 2009 legislation has passed that will allow the <strong>Credit</strong> <strong>Union</strong> to defer the expenses related to the<br />

NCUSIF assessment.