7 6 5 4 3 2 1 8 - Elevations Credit Union

7 6 5 4 3 2 1 8 - Elevations Credit Union

7 6 5 4 3 2 1 8 - Elevations Credit Union

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Elevations</strong> <strong>Credit</strong> <strong>Union</strong><br />

Notes to Financial Statements<br />

December 31, 2008 and 2007<br />

As noted in Note 15, the <strong>Credit</strong> <strong>Union</strong> wrote-off its entire $2,708,093 member and permanent capital in Western<br />

Corporate Federal <strong>Credit</strong> <strong>Union</strong> (WesCorp) and its $4,533,101 capital in Sun Corporate <strong>Credit</strong> <strong>Union</strong> (SunCorp) in<br />

2008 based on the March 20, 2009 announcement that the losses at these institutions exceeded the capital in these<br />

organizations. On January 28, 2009, the NCUA Board announced the Temporary Corporate <strong>Credit</strong> <strong>Union</strong> Share<br />

Guarantee Program through September 30, 2011. The NCUSIF guarantee applies to all share amounts above<br />

$250,000, and the NCUSIF insurance coverage applies to all share amounts below $250,000. The net effect is that<br />

during the period of the guarantee the entire share account will be treated by the NCUSIF as if it was insured.<br />

Approximately $62,000,000 of the corporate credit union certificates mature before December 31, 2009 and therefore<br />

are guaranteed. Approximately $5,000,000 of the corporate credit union certificates mature after September 30,<br />

2009 and are therefore not guaranteed.<br />

Certificates are generally non-negotiable and non-transferable, and may incur substantial penalties for withdrawal<br />

prior to maturity.<br />

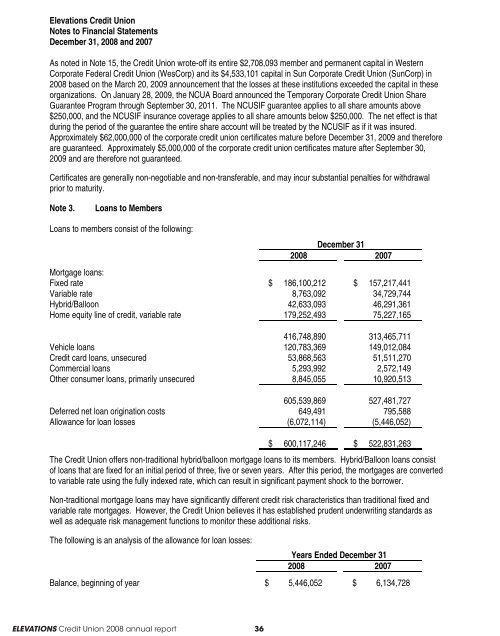

Note 3. Loans to Members<br />

Loans to members consist of the following:<br />

December 31<br />

2008 2007<br />

Mortgage loans:<br />

Fixed rate $ 186,100,212 $ 157,217,441<br />

Variable rate 8,763,092 34,729,744<br />

Hybrid/Balloon 42,633,093 46,291,361<br />

Home equity line of credit, variable rate 179,252,493 75,227,165<br />

416,748,890 313,465,711<br />

Vehicle loans 120,783,369 149,012,084<br />

<strong>Credit</strong> card loans, unsecured 53,868,563 51,511,270<br />

Commercial loans 5,293,992 2,572,149<br />

Other consumer loans, primarily unsecured 8,845,055 10,920,513<br />

605,539,869 527,481,727<br />

Deferred net loan origination costs 649,491 795,588<br />

Allowance for loan losses (6,072,114) (5,446,052)<br />

ELEVATIONS <strong>Credit</strong> <strong>Union</strong> 2008 annual report 36<br />

$ 600,117,246 $ 522,831,263<br />

The <strong>Credit</strong> <strong>Union</strong> offers non-traditional hybrid/balloon mortgage loans to its members. Hybrid/Balloon loans consist<br />

of loans that are fixed for an initial period of three, five or seven years. After this period, the mortgages are converted<br />

to variable rate using the fully indexed rate, which can result in significant payment shock to the borrower.<br />

Non-traditional mortgage loans may have significantly different credit risk characteristics than traditional fixed and<br />

variable rate mortgages. However, the <strong>Credit</strong> <strong>Union</strong> believes it has established prudent underwriting standards as<br />

well as adequate risk management functions to monitor these additional risks.<br />

The following is an analysis of the allowance for loan losses:<br />

Years Ended December 31<br />

2008 2007<br />

Balance, beginning of year $ 5,446,052 $ 6,134,728