7 6 5 4 3 2 1 8 - Elevations Credit Union

7 6 5 4 3 2 1 8 - Elevations Credit Union

7 6 5 4 3 2 1 8 - Elevations Credit Union

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Elevations</strong> <strong>Credit</strong> <strong>Union</strong><br />

Notes to Financial Statements<br />

December 31, 2008 and 2007<br />

developed based on the best information available in the circumstances. In that regard, SFAS 157 establishes a fair<br />

value hierarchy for valuation inputs that gives the highest priority to quoted prices in active markets for identical<br />

assets or liabilities and the lowest priority to unobservable inputs. The fair value hierarchy is as follows:<br />

Level 1: Quoted prices for identical assets or liabilities in active markets that the entity has the ability to access as of<br />

the measurement date.<br />

Level 2: Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or<br />

liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by<br />

observable market data.<br />

Level 3: Significant unobservable inputs that reflect a reporting entity’s own assumptions about the assumptions that<br />

market participants would use in pricing an asset or liability.<br />

A description of the valuation methodologies used for assets and liabilities measured at fair value, as well as the<br />

general classification of such instruments pursuant to the valuation hierarchy, is set forth below.<br />

Investments Available –for- Sale: Where quoted prices are available in an active market, investments are classified<br />

within level 1 of the valuation hierarchy. Level 1 investments would include highly liquid government bonds and<br />

exchange traded equities. If quoted market prices are not available, then fair values are estimated by using pricing<br />

models, quoted prices of securities with similar characteristics, or discounted cash flow. Level 2 investments would<br />

include U.S. agency securities, mortgage backed agency securities, obligations of states and political subdivisions<br />

and certain corporate, asset backed and other securities. In certain cases where there is limited activity or less<br />

transparency around inputs to the valuation, investments are classified within level 3 of the valuation hierarchy.<br />

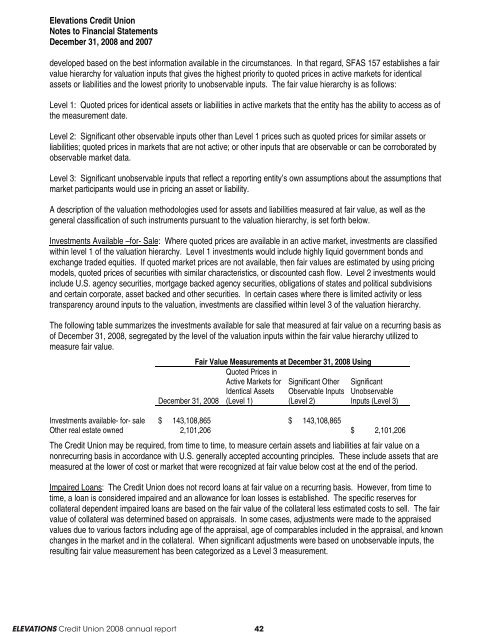

The following table summarizes the investments available for sale that measured at fair value on a recurring basis as<br />

of December 31, 2008, segregated by the level of the valuation inputs within the fair value hierarchy utilized to<br />

measure fair value.<br />

December 31, 2008<br />

ELEVATIONS <strong>Credit</strong> <strong>Union</strong> 2008 annual report 42<br />

Fair Value Measurements at December 31, 2008 Using<br />

Quoted Prices in<br />

Active Markets for<br />

Identical Assets<br />

(Level 1)<br />

Significant Other<br />

Observable Inputs<br />

(Level 2)<br />

Significant<br />

Unobservable<br />

Inputs (Level 3)<br />

Investments available- for- sale $ 143,108,865 $ 143,108,865<br />

Other real estate owned 2,101,206 $ 2,101,206<br />

The <strong>Credit</strong> <strong>Union</strong> may be required, from time to time, to measure certain assets and liabilities at fair value on a<br />

nonrecurring basis in accordance with U.S. generally accepted accounting principles. These include assets that are<br />

measured at the lower of cost or market that were recognized at fair value below cost at the end of the period.<br />

Impaired Loans: The <strong>Credit</strong> <strong>Union</strong> does not record loans at fair value on a recurring basis. However, from time to<br />

time, a loan is considered impaired and an allowance for loan losses is established. The specific reserves for<br />

collateral dependent impaired loans are based on the fair value of the collateral less estimated costs to sell. The fair<br />

value of collateral was determined based on appraisals. In some cases, adjustments were made to the appraised<br />

values due to various factors including age of the appraisal, age of comparables included in the appraisal, and known<br />

changes in the market and in the collateral. When significant adjustments were based on unobservable inputs, the<br />

resulting fair value measurement has been categorized as a Level 3 measurement.