Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

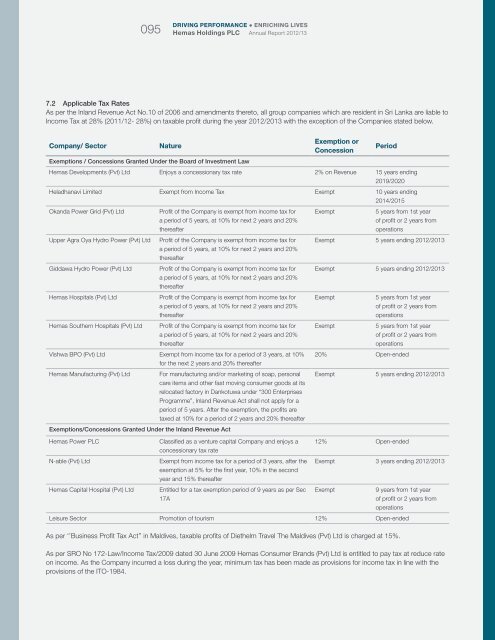

DRIVING PERFORMANCE ● ENRICHING LIVES095 <strong>Hemas</strong> <strong>Holdings</strong> PLC Annual Report 2012/137.2 Applicable Tax RatesAs per the Inland Revenue Act No.10 of 2006 and amendments thereto, all group companies which are resident in Sri Lanka are liable toIncome Tax at 28% (2011/12- 28%) on taxable profit during the year 2012/2013 with the exception of the Companies stated below.Company/ SectorNatureExemption orConcessionPeriodExemptions / Concessions Granted Under the Board of Investment Law<strong>Hemas</strong> Developments (Pvt) <strong>Ltd</strong> Enjoys a concessionary tax rate 2% on Revenue 15 years ending2019/2020Heladhanavi Limited Exempt from Income Tax Exempt 10 years ending2014/2015Okanda Power Grid (Pvt) <strong>Ltd</strong>Profit of the Company is exempt from income tax fora period of 5 years, at 10% for next 2 years and 20%thereafterExempt5 years from 1st yearof profit or 2 years fromoperationsUpper Agra Oya Hydro Power (Pvt) <strong>Ltd</strong> Profit of the Company is exempt from income tax for Exempt 5 years ending 2012/2013a period of 5 years, at 10% for next 2 years and 20%thereafterGiddawa Hydro Power (Pvt) <strong>Ltd</strong> Profit of the Company is exempt from income tax for Exempt 5 years ending 2012/2013a period of 5 years, at 10% for next 2 years and 20%thereafter<strong>Hemas</strong> Hospitals (Pvt) <strong>Ltd</strong>Profit of the Company is exempt from income tax fora period of 5 years, at 10% for next 2 years and 20%thereafterExempt5 years from 1st yearof profit or 2 years fromoperations<strong>Hemas</strong> Southern Hospitals (Pvt) <strong>Ltd</strong> Profit of the Company is exempt from income tax fora period of 5 years, at 10% for next 2 years and 20%thereafterExempt5 years from 1st yearof profit or 2 years fromoperationsVishwa BPO (Pvt) <strong>Ltd</strong> Exempt from income tax for a period of 3 years, at 10% 20% Open-endedfor the next 2 years and 20% thereafter<strong>Hemas</strong> Manufacturing (Pvt) <strong>Ltd</strong> For manufacturing and/or marketing of soap, personal Exempt 5 years ending 2012/2013care items and other fast moving consumer goods at itsrelocated factory in Dankotuwa under “300 EnterprisesProgramme”, Inland Revenue Act shall not apply for aperiod of 5 years. After the exemption, the profits aretaxed at 10% for a period of 2 years and 20% thereafterExemptions/Concessions Granted Under the Inland Revenue Act<strong>Hemas</strong> Power PLCClassified as a venture capital Company and enjoys a 12% Open-endedconcessionary tax rateN-able (Pvt) <strong>Ltd</strong>Exempt from income tax for a period of 3 years, after the Exempt 3 years ending 2012/2013exemption at 5% for the first year, 10% in the secondyear and 15% thereafter<strong>Hemas</strong> Capital Hospital (Pvt) <strong>Ltd</strong> Entitled for a tax exemption period of 9 years as per Sec17AExempt9 years from 1st yearof profit or 2 years fromoperationsLeisure Sector Promotion of tourism 12% Open-endedAs per ‘’Business Profit Tax Act’’ in Maldives, taxable profits of Diethelm Travel The Maldives (Pvt) <strong>Ltd</strong> is charged at 15%.As per SRO No 172-Law/Income Tax/2009 dated 30 June 2009 <strong>Hemas</strong> Consumer Brands (Pvt) <strong>Ltd</strong> is entitled to pay tax at reduce rateon income. As the Company incurred a loss during the year, minimum tax has been made as provisions for income tax in line with theprovisions of the ITO-1984.